Construction Credit

Financing for construction: find out how to do it!

Do you want to build a property, but don't have the full amount to invest right now? See how you can achieve this with construction financing!

Advertisement

Find out how to finance your work and have your property ready!

Nowadays, many Brazilians want to invest in construction, but this venture can prove to be very expensive. To make it a reality, it is possible to obtain financing for construction.

This type of financing is different from real estate financing, which many people use to purchase a ready-made property. Using construction financing, it is possible to finance up to 80% of construction and make payments within 35 years.

It is offered by banks and financial institutions, each of which has its own rules regarding payment time and financing amount. However, it shows a better option for those looking to build a property.

In the following post, you will learn more about this type of financing, how it works and how you can get yours through Caixa!

Is it possible to finance construction?

Most Brazilians are already well accustomed to real estate financing. From there, it is possible to finance the amount to purchase a ready-made property or carry out renovations.

However, when it comes to building a property, this type of financing may not cover the project. Therefore, anyone who wants to build needs to look for other ways to obtain credit.

One of them is providing financing for construction. Even though it is not as well known as real estate financing, it is the best option for those who want to build from scratch.

What is construction financing and how does it work?

Financing for property construction is a line of credit that several banks offer. From there, it is possible to finance up to 80% of the construction value, without counting labor.

Payment can extend over a period of 35 years, which is longer than real estate financing allows.

To be able to finance a construction, it is necessary to research the banks and financial institutions that offer this line of credit.

Caixa Econômica Federal, for example, offers this type of financing. From there, you can even use your FGTS resources for payment.

But, regardless of the institution, it is necessary to meet some basic requirements to gain access to the credit line, such as:

- Have a clean name;

- Be of legal age or have emancipation;

- Be a native Brazilian or have a permanent visa;

- Have the ability to make payment.

Furthermore, the value of the installments must not exceed 30% of your monthly income. To obtain financing, your land must also have the necessary structure to carry out the construction.

How does construction financing on your own land work?

If you meet the requirements listed above, you can continue applying for financing! If you already have your own land and only need resources for construction, you can follow the steps below to make the request.

Choose the institution and simulate credit

The first step is to carry out the credit simulation to obtain financing. From there, you will have a better idea of what the interest rates and installment amounts will be.

Before carrying out the simulation, the bank or financial institution will carry out a credit analysis.

This step is necessary because it is from the analysis that they can check whether you can use your FGTS or participate in a government program to obtain financing.

Separate the documents

With the simulation done, you will be able to separate all the necessary documentation to request the credit amount. To do this, you will need to have the following documents on hand:

- Identification document (RG or CNH);

- Proof of marital status;

- Document of your dependents;

- Proof of residence;

- Income tax declaration;

- Proof of income.

In addition to these, the institution may request other additional documents to analyze. These documents could be the building permit, floor plan, or construction schedule.

When making the request, the institution will communicate to you all the necessary documents. Until you receive your approval and sign the contract, it is essential to keep your income, marital status and other information intact.

Contract signing

With your credit analysis approved, the institution will send you a document showing all the details of the financing. There you will find the down payment, the total financing, the installments to be paid, among other data.

From there, it will be possible to sign the contract. At that time, the bank or financial institution will confirm that all your documentation is correct before releasing the credit.

Once everything is in place, you can sign the contract online or physically. At this point, it is important to read the contract and check that all information is as agreed.

Which bank provides land and construction financing?

To obtain construction financing, it is important to carry out the entire process with a reliable bank. Currently, there are 3 well-known banks on the market that offer this line of credit to the public.

Caixa Econômica Federal

At Caixa, you can finance construction through a letter of credit. With this bank, it is possible to finance up to R$100 thousand, which can be paid in up to 18 years.

Here, you can use your FGTS for payment, in addition to being able to participate in government programs, such as Casa Verde and Amarela.

Bradesco Bank

Bradesco is also able to offer financing for construction. With it, you can finance up to 70% of the amount you need, which can be paid in up to 10 years. In this bank, the value of the installments cannot exceed 20% of your income.

Itau bank

Finally, it is possible to obtain financing from Banco Itaú. With it, you can finance up to 82% of construction, with the minimum amount for financing being R$133,334.00.

However, to finance construction from it, the value of the installments must not exceed 35% of your income.

How does the Caixa construction loan work?

When it comes to financing, the institution that most comes to consumers' minds is Caixa. After all, it is from there that you can easily access your FGTS balance to make the payment, in addition to being able to use government programs.

When financing through Caixa, the amount borrowed is guaranteed by the property to be built. This way, you don't run the risk of losing your other assets.

To take out a construction loan, you will need to go through the same steps as for any financing. First you do a simulation and send the documentation for credit analysis.

With the credit approved, Caixa will analyze the engineering of the property to be built. If everything is ok, the financing for construction will be approved and you can continue signing the contract and then paying the installments.

In addition, Caixa also works with specific financing only for the purchase of construction materials. From there, you can use the Construcard Caixa Card.

With it, you can buy the material at Caixa partner stores and pay for it within 240 months. If you want to know more about this card, check out the post below!

How to request Construcard

See how you can request this Caixa card to finance construction materials!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

3 reliable self-employed loan options

If you are looking for a loan, how about knowing the best loan options for a reliable self-employed person? Read and check!

Keep Reading

uConecte personal loan: what it is and how it works

With the uConecte personal loan, you only start paying after 45 days and the installments are fixed. Check out more benefits here!

Keep Reading

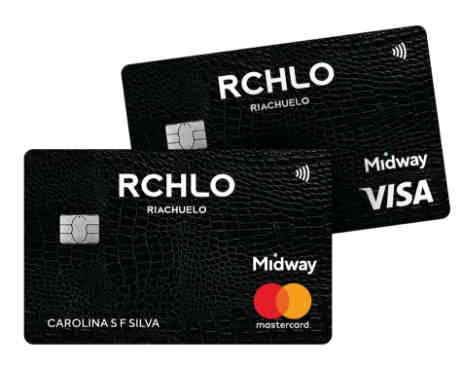

All the benefits of the Riachuelo card

The Riachuelo card has been growing more and more in the country, but are its advantages really good?

Keep ReadingYou may also like

Caixa Platinum Card or Caixa Gold Card: which one to choose?

Be it the Caixa Platina card or the Caixa Gold card, both are two different financial products, but offer exclusive advantages for their customers. Here you will find out the difference between them and which is the best card. Check out!

Keep Reading

How to apply for the Decolar Santander Visa Gold Card

Do you want a card to earn miles points for every dollar spent, with international coverage, but an annuity that fits in your pocket? So, find out how to apply for Decolar Santander Gold.

Keep Reading

How to prepare your card for Black Friday 2020

Learn how to prepare your credit card for Black Friday 2020. Find out how to release your credit limit to take advantage of the deals!

Keep Reading