Tips

How to stop paying overdue bills

If you want to learn how to stop paying late bills and change your financial life, check out these tips we have for you right now!

Advertisement

overdue bills

Many people suffer from various overdue bills. The economic reality of the country undoubtedly contributes to all of this. Brazilians are having to deal with a new difficulty every day.

Thus, seeking alternatives to reverse this situation is essential. Thus, it is possible to get out of the red and start investing in your own projects. However, this is a task that requires a lot of research and effort.

To help you, we prepared this complete guide. Here, you will know how to get rid of overdue bills. Find out how some attitudes can bring you closer to achieving your financial autonomy.

How to stop paying overdue bills

This is a difficult plan for someone who is already in debt. Now, without a doubt, there are interesting alternatives to reach this level. So, first of all, you need to be aware of your financial status. Only then is it possible to make a decision.

Later on, you will find infallible tips to get rid of this situation. Soon, you will see that there are some elements that are always repeating themselves. To get rid of delays, it is necessary to prevent them.

Find out how to keep your bills up to date

The keyword is organization. You need to know all your debts right away. It will not be possible to pay everything on time if you don't even remember what you owe. So make a complete outline of your finances.

In the beginning, if you are already in debt, getting organized will not be easy. However, do not be discouraged. Keep in mind that the end result is always worth all the effort.

5 tips to start your financial control

There are some ways to start financial planning, including apps that can help you with this process! Check out the unmissable tips that we have separated for you.

Why is it important not to pay overdue bills?

Ever heard the term snowball? When you have overdue bills, you enter a chaotic universe. Then you will always be in debt and you can say goodbye to peace of mind. Being in debt affects all aspects of your life, both personal and professional.

So let's go to the consequences of finding yourself in this situation. Realize that they are exactly the reasons for trying to get rid of this status.

1- Emotional stress

Imagine knowing that you are in debt and not thinking of any efficient solution to get out of it. The stress and anxiety this causes is absurd. So you are tired all the time, looking for possibilities.

2- No credibility

No one trusts someone who is in debt. This is especially true when talking about banks and financial institutions. Thus, getting a line of credit is much more complicated than usual.

3- No prospect of the future

When you're stuck in something, you can't move on, right? In the case of debt, the logic is the same. That way, there's no way to think about future projects if your present is in complete chaos.

What happens if you get overdue bills?

Apart from what has already been mentioned above, you cannot grow financially. So there will always be a problem to solve.

So, forget about that dream of having a better life. However, calm down. We will give you practical solutions to not have more overdue bills. With them, everything will be lighter, believe me.

Tips for not paying overdue bills

Many people believe that after delaying an account, it is no longer possible to reverse the situation. However, they couldn't be more wrong. There are yes alternatives that can help you get out of that snowball.

Of course, not all work the same for everyone. After all, everyone has their own reality. So it was with that in mind that we brought several options. That way, all you have to do is pick the ones you think might have the most effect.

Note that the tips below are outlined almost as a step by step. Even so, this is not a problem if you only want to use some of them. So, check it out.

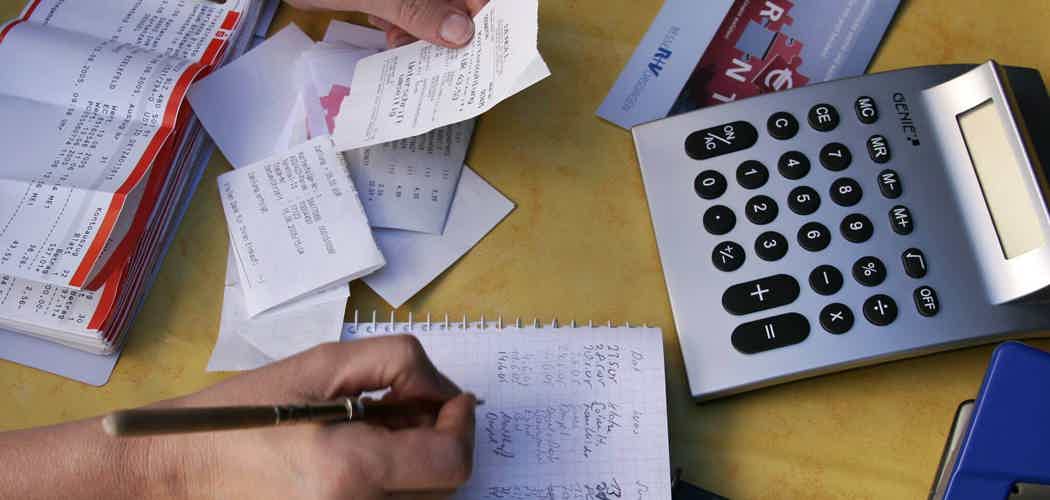

Create a financial plan

The first thing you need to understand is that without planning nothing goes forward. It doesn't matter if you are already in debt or looking to avoid this scenario. Organization is a determining factor in your financial success. You can search, no one successful reached this status working with a mess.

So, take this step very seriously. One thing you can do is list all of your debts. So, take those debts that are recurring, like IPVA. Register each of them that compromise your monthly income.

Thus, with the date in sight, it is easier to reserve the money you need. Also, it helps you not to be caught off guard. Believe me, this is one of the worst things that can happen.

Of course, that and not having the money to pay for the necessary. That way, as much as it may seem complicated at first, don't give up on planning. Think that if you are not used to a task, it is obvious that it will be more difficult.

However, time solves this problem easily. Further ahead, you will learn about some tools that will make this process faster and more interesting.

Renegotiate old debts

you know those overdue bills that are very old and you still haven't been able to pay? You can deal with them in a more practical way. So, follow these 3 steps below and see how solving this type of problem is possible.

1- All your calculations must be realistic

Put all your income on paper. Hence, subtract the essential expenses and see which of the superfluous ones can be cut. You need to do this before contacting the bank. That's because the latter will launch you a proposal.

Thus, if you do not know your financial reality, you cannot sign any agreement. In fact, you can, but it will be harmed in the end.

2- Study the contract

Take your debt agreement and read it. See if there are any irregularities. Believe me, the chances of finding something wrong are higher than you might think.

So, if this happens, do not hesitate to report it to consumer protection bodies. That way, you might be able to improve payment terms.

3- Contact the bank

Now, let's say you didn't find any flaws in your old contract. Therefore, it is time to contact the bank. When explaining your situation, they will launch you a proposal. It should come with better discharge conditions.

However, he doesn't think he needs to sign the new agreement right away, quite the contrary. The ideal is that you ask for a deadline to analyze it calmly. Still, if you find it feasible, come up with a counterproposal.

So understand that this is not the time to be shy. Only in this way can you get better and more efficient solutions for your pocket.

Create a grocery shopping list

A great Brazilian custom is not to make a list to go shopping at home. The supermarket is full of options. That way, if you're not aware of what you need to buy, it's gone. So, you will end up getting lost and spending more than you should.

So, before you leave the house, look through your entire stock of groceries. Then make a list of everything that's missing. In addition, you can list the products in order of priority. So, if you have a ceiling to spend, it's easier not to exceed it.

Now comes the hard part, don't give in to temptation. As said, there you will find a variety of things. So, try to be as faithful to your list as possible.

However, do not overdo it. The tip is to make you save and not deprive yourself of essential things. Remember that, when in doubt, balance is always the best solution. In short, be aware of what you can consume.

Also, some financial experts say making one purchase a month is a mistake. That's because you'll end up buying unnecessary or leftover stuff. Therefore, they advise that each week, the supply of groceries is renewed. So, you only buy what you are going to use and avoid waste.

Beware of overdue credit card bills

This is one of the major causes of indebtedness and overdue bills. The credit card is seen as a villain by many people. In fact, he can indeed play that role. However, this is not a rule. The danger with the card is that you can use more than you have available. That is, it is possible to pass that limit.

So when that happens, you have to deal with interest on top of interest. There you have another snowball. Therefore, it is important to understand that you can use this tool. In this case, only planning is required.

Many people claim that it is advantageous because you don't need to carry money. This is indeed true. On the other hand, some professionals bring another interesting view. They claim that when you have cash in hand, it's easier to be in control.

That's because you are aware that he is leaving when buying something. In the case of the card, this feeling does not happen. Thus, to use the latter there is a useful tip, do not pay in installments.

Only buy what you can afford right away. This is especially true for those who are already in arrears. Also, always respect your limit. However, if you think you can't do that, there's no way.

Put that tool to rest. When you're free of old debts, who knows, maybe you'll use it again?

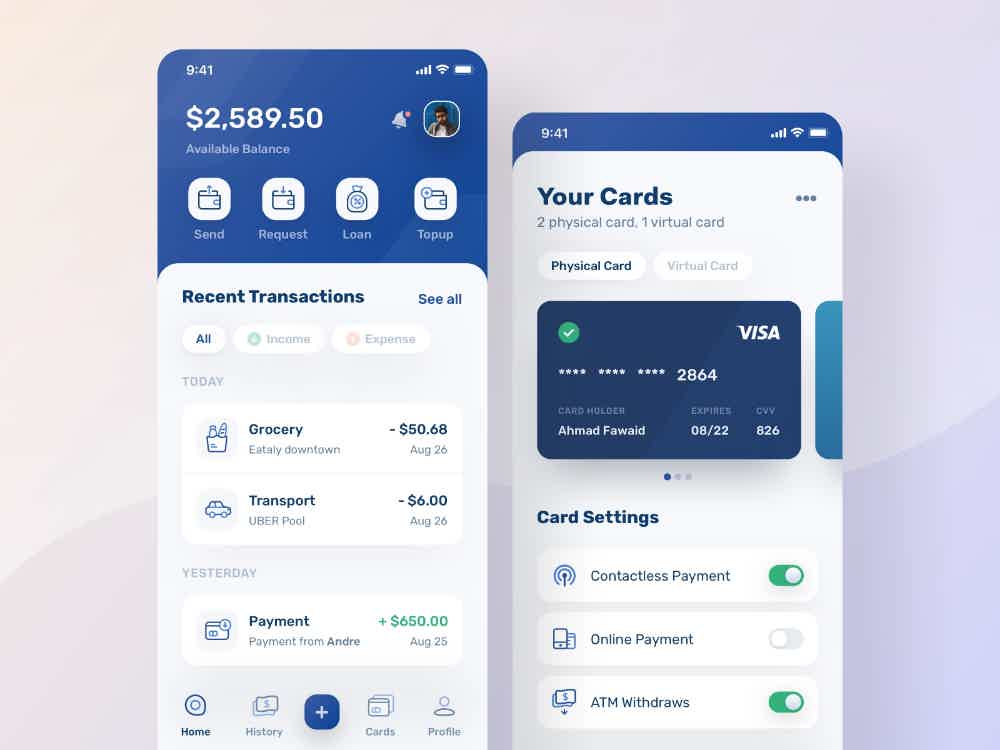

Create an expense spreadsheet or use an app not to pay overdue bills

Remember we talked about planning above? Now it's time to learn about some tools that will help you put it into practice. So, the spreadsheet is undoubtedly the most classic option.

Still, there are several ready-made templates on the internet, so you don't even have to create a new one. However, some apps are pretty interesting too, check out some of them.

1- Finance

This is a complete tool. With it, you register all your financial transactions in a simple way. In addition, it is possible to register your installment accounts. That way, you don't forget the date of any of them. So, once the payment is made, just download the app. He himself will update your balance.

2- Paid bill

An ideal application for those who have overdue bills. Boleto Pago recalculates the amount of your debt. Thus, it is based on the interest rate value and maturity time. However, that's not all. It notifies you of bills that are approaching their payment date.

3- Furniture

An efficient and simple way to manage your entire financial life. Also, Mobills provides you with specific charts and reports. This way, you can analyze in depth how your finances are going. Finally, he sends you emails reminding you of the payments that must be made.

4- Money Lover

He also plays this accountability role. However, he has a difference. Money Lover lets you use your contact list to generate a file with creditors and debtors. Still, it is ideal for those who enjoy traveling. That's because it has a currency converter.

Put accounts on automatic debit

This is a way to not delay your bills. However, she requires a lot of care. So, if you are in debt, you better take it easy with this tip. Therefore, it is not recommended to put everything on automatic debit. That's because at the end of the month you may run out of money.

So, an alternative is to go step by step. Register accounts that are essential first. Water, electricity, health plan and internet are good examples. At the same time, put the other tips in this article into practice. That's because they will help you get organized.

So, when you are able to resolve your financial situation, then you can leave everything on automatic debit. With this, you guarantee that nothing else will be delayed. Of course, always making sure your money is enough.

Direct debit is a very interesting tool. That way, he's good at helping you take control of spending. With care, it's really worth using.

Pay essential bills first

Remember automatic debit. Always give priority to what is fundamental to your quality of life. Without it, you won't even be able to get rid of other debts. Take the list of debts and set goals to resolve the most important ones.

Once that's done, the rest gets easier. Okay, now you know very well how not to pay more overdue bills. Now it is your turn. Use the tips in this article and go in search of improving your financial life.

What is the role of credit in your financial life?

Credit is a financial product that can make a difference in your life. In our article, you will learn about the types and how to use them in a healthy way.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What is the best credit card in Brazil?

Find out which is the best credit card in Brazil and be surprised by the differentials, benefits and features. Check it out and learn more!

Keep Reading

Afinz Card or BMG Card: which is better?

Are you in doubt between the Afinz card or the BMG card? Both have international coverage and great rewards programs. Learn more here!

Keep Reading

5 loan options now on account 2021

It has become much easier to get a loan now on the account. So check out our top 5 list and apply for credit today!

Keep ReadingYou may also like

Chinese index funds soar on B3

After the Chinese government announced support for the stability of local assets, its three main Index Funds listed on the Brazilian stock exchange experienced impressive increases. Learn more here.

Keep Reading

Nu Ultraviolet funds: how to invest?

The Nu Ultravioleta funds arrived to revolutionize the world of investments. So, with just R$ 100.00 you can start investing and diversifying your asset portfolio. So, check out its main features below and transform your financial life!

Keep Reading

Why Use Streaming Services: Amazon Prime Pricing

Amazon Prime is one of the best priced streaming services in the market today. But, did you know that it offers much more than Prime Video? Check out all the subscription benefits here and find out why it's worth becoming Prime today!

Keep Reading