Cards

Cloned credit card: what to do?

Learn in this post what you should do if you have a cloned credit card. Also check out tips to prevent this from happening again.

Advertisement

How to protect yourself against card cloning

If your credit card has been cloned, it means that someone has stolen your CPF, as well as the card's number and security code, through a fake bank or store link or by inserting malicious software into the browser you use to access the internet.

Although experts say that “cloning” is no longer the correct term, because it was coined at a time when magnetic stripe cards were more common, the word is still in use. But what really matters is that the theft of banking information is a reality that needs to be combated.

Don't click on unknown links, keep your antivirus up to date, don't post photos of your card on social media, and change your passwords frequently. These are some of the ways to avoid this scam. However, if your card has been cloned, we'll teach you what you should do to avoid other problems.

So, continue reading and find out what to do in this situation.

Are magnetic stripe cards more susceptible to fraud?

In the past, most cards had a magnetic stripe, the line on the back of the card that contained security information. Today, this type of card still exists, but those with a chip are the most widely used.

Magnetic stripe cards work like this: you need to swipe the stripe through the machine and then sign a receipt. You don't need a password. For greater security, it is recommended that the seller checks the signature on the receipt against the one on the card and that the user enters the CVV, the famous 3 or 4-digit security code found on the back of the card.

Striped cards leave a lot of data exposed, which is why it is easier to have your credit card cloned. But striped cards are now a thing of the past. Proof of this is that Mastercard announced in August of this year that it will retire them. The operator expects that from 2024 onwards no striped cards will be issued.

Now, if the card with a strip makes life easier for fraudsters, the technology of chip cards makes it more difficult. The explanation is that the microprocessor, which is the chip, stores data and converts it into data that is difficult to process. Since this card requires a password, the chip verifies this information and authorizes the transaction.

With all this, you might think that a chip card is impossible to clone. Well, although it is more difficult, a chip card can be cloned. So, you can never be too careful when it comes to protecting your card.

Why are cards cloned during online purchases?

The internet is the perfect setting for criminals to clone cards. This is because more and more people are opting for the convenience of using online stores.

Proof of this is that in the first quarter of 2021, 78.5 million purchases were made online, according to a report by Neo Trust, a tool that issues reports on commercial transactions with real data.

The ease of buying online combined with some people's carelessness comes at a price: for every 6 Brazilians, 1 had their credit card cloned, according to research by Dfndr, the largest cybersecurity laboratory in Latin America.

With so many people buying online, more data is exposed. And the methods of data theft are sophisticated, involving the replacement of real bank and store websites with fake pages created by scammers.

Data leak: be careful with your CPF

Your data is very important and you need to take care of it. Learn how to protect your CPF and prevent data leaks on the internet.

What to do if you discover that your card has been cloned?

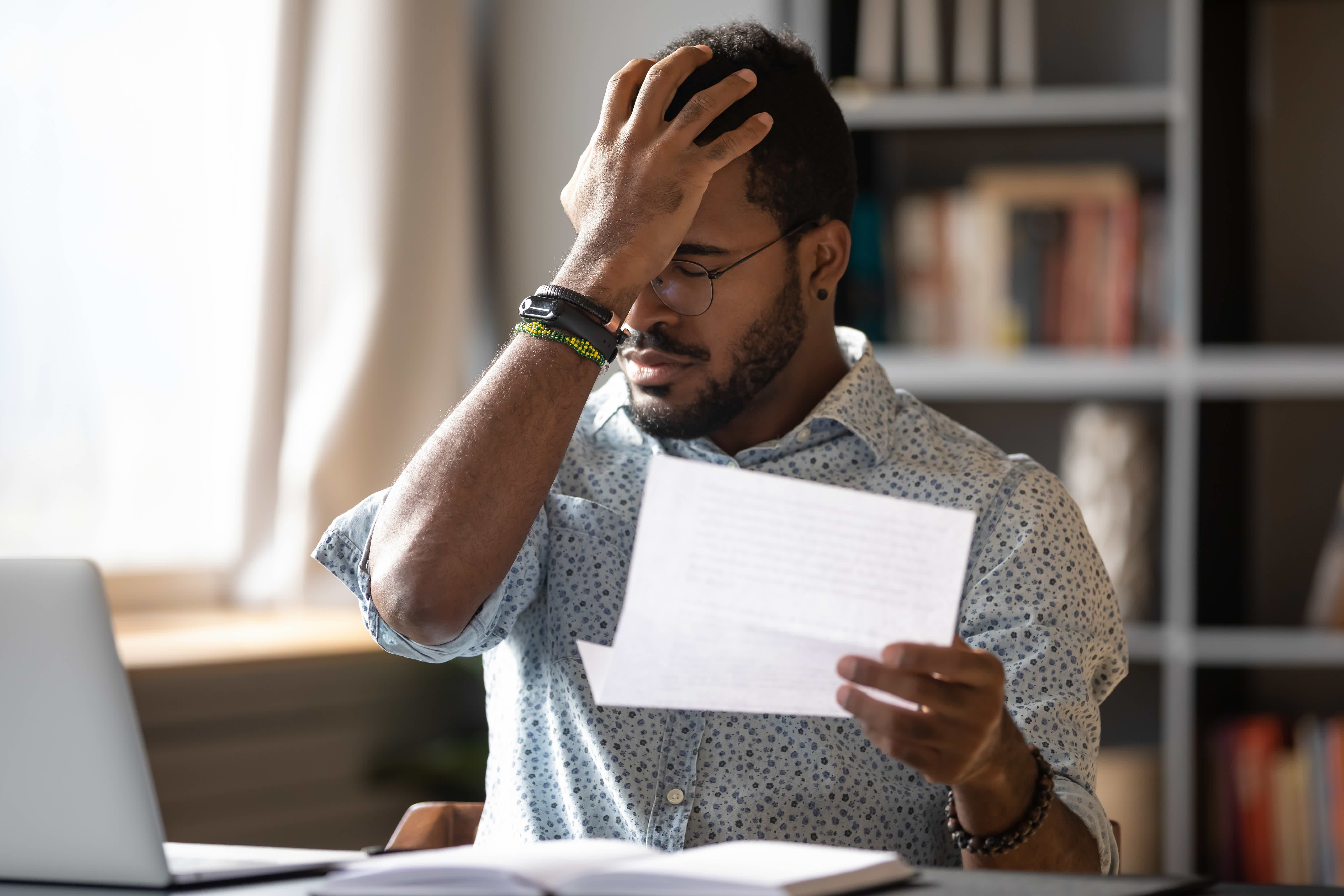

When you look at your credit card statement, you get an unpleasant surprise: several purchases that you don't recognize. Your first reaction is despair, but it's important to keep your cool and take the necessary measures. Here's what you should do.

Analyze charges

Edson Ortega, Vice President of the Visa Risk area in Brazil, advises that you map the stores where you made purchases and the dates. Once you verify that the transactions described in the card history were not actually made by you, then you can move on to the next step.

Police Report

We know this is a nuisance, but it is extremely important that you go to a police station to file a police report. This will inform you that you are unaware of the transactions and that future card usage cannot be credited to you. The police report will also allow you to create a data alert with Serasa.

Data Alert

On the “Ajuda Serasa” website, you can create a Document Alert. This alert is a warning to institutions accredited by the credit protection agency that items have been lost, stolen or robbed.

You can create a Temporary Alert lasting 30 business days for documents and 3 business days for checks. You can also create a Permanent Alert that is valid for up to 5 years.

Request card blocking

Contact your card issuer. Report that your card has been used improperly and request that it be blocked. The company will investigate and, if fraud is proven, the bank is obliged to refund the amount. If the refund takes a long time or does not happen, you should take legal action to assert your rights.

Contactless payment fraud: how to avoid it

Contactless payments are here to make life easier for Brazilians, but they have also been the target of fraud. Check it out!

How to protect yourself from having your credit card cloned?

Credit card companies invest in technology to prevent scams. However, we also need to adopt strategies. Check out the tips for protecting your credit card below.

- Never leave your password with your card;

- Create strong passwords without combining names, dates of birth and any other obvious combinations;

- If possible, use a virtual card to make purchases online;

- Always monitor your accounts and cards to have control over your financial life;

- Beware of sweepstakes links. Many victims click on links received via SMS and WhatsApp that promise free makeup kits, dinners at trendy restaurants, and iPhone giveaways. No company gives away products like this, so be wary;

- Do not register your card details in unknown apps. If you do, leave the information in popular apps, such as Uber and Netflix;

- Don't let store clerks walk away with your card. Bad-intentioned professionals may take advantage of this opportunity to photograph your information;

- No card operator sends motorcycle couriers to customers' homes asking for passwords, much less to collect cards;

- Do not provide card information if you receive a supposed phone call from the bank. Try to get the most out of this “call center” and notify the bank about it;

- Do not register with unknown online stores. Always choose sites that are known to the general public.

Now that you know what to do if your credit card is cloned, how about learning what to do in case of theft? So, read our recommended content and check it out!

Stolen card and undue purchase: what to do

Check out our content to find out what to do if your credit card is stolen and find out how to protect yourself from unauthorized purchases.

About the author / Sumaya Santana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Casas Bahia credit card: what is the store card?

The Casas Bahia card has a Visa flag and can be used in the chain of stores or elsewhere. Take the opportunity to know this card now!

Keep Reading

Discover the Sou Barato credit card

The Sou Barato credit card brings special discounts and exclusive benefits to its customers. Furthermore, it is easy to approve. Check out!

Keep Reading

Discover the Koerich loan

With a Koerich loan, the first installment payment takes place after 30 days and also has the lowest interest rates on the market. Look!

Keep ReadingYou may also like

Get to know Inter account

One thing is for sure, digital accounts are the best option to manage your finances, and the Inter account is ideal for anyone looking for more than a bank, but a tool to manage their money. Do you want to see it? So, learn more about it here.

Keep Reading

How to apply for the Bradesco real estate consortium

Can't you wait to have a property to call yours? So, see here what to do to apply for the Bradesco real estate consortium and make it happen!

Keep Reading

How to open a BIG Junior account

At Banco de Investimento Global, anyone under the age of 18 can start thinking about the future with an account with no maintenance fee and designed just for you. Check below how to create a Junior current account at BIG.

Keep Reading