Financial education

How is bank credit analysis done?

Understanding how the credit analysis is carried out can be a decisive factor in avoiding errors and possible failures in some requests. Mister Panda helps you with that. Learn more here!

Advertisement

Get ahead when it comes to bank credit analysis

It is no surprise to anyone that credit can help you a lot when buying a new appliance or even solving an emergency health problem. At these and other times it is essential to have credit. However, it's not always easy to go through bank credit analysis and guarantee this service, is it?

The truth is that you can be one of those consumers who make some mistakes and thus end up failing the credit analysis. One of the main ones is not knowing how this process works. How to pass a test without knowing what will be evaluated? Thinking of you who are having problems, we will explain everything about the analysis process in detail.

Don't leave there and come with us to understand how bank credit analysis works!

All about Positive Registration

Want to improve your score for bank credit analysis time? Get to know Serasa's Positive Register.

What is credit analysis?

Even if it is sometimes unknown, credit analysis is very present in the financial credit operations that most Brazilians carry out in their daily lives.

It happens when you ask for more credit for your card, take out a loan, financing and other operations that refer to the use of credit.

Anyway, let's focus on answering the main question: what is bank credit analysis?

This procedure consists of an analysis of your history as a consumer, that is, how you behave in relation to the payments you assume.

If you pay on time, you delay payments, easily create debt and other points. In addition, the analysis observes how your name is in the square, if it is dirty or clean, if there are debts to be paid, in negotiation, among other things.

This is so that banks and other financial institutions can have some idea that they can trust their customer's people, the more they gain confidence in that person. your payments. From these points, companies know how much credit it is possible to release, the percentage of interest and the number of installments available.

In short, credit analysis is the process in which the bank analyzes your financial profile to ensure that you will receive the amounts that were granted on credit.

In general, if you pay your bills on time and do not accumulate debts, the bank's credit analysis will not be a problem for you. See how the whole process works!

How does a credit analysis work?

In general, we have just seen that the main objective of credit analysis is to confirm that the contractor has the means to actually pay the amounts requested. For this, the institutions take into account some specific aspects.

Therefore, they are the ones you need to know to do well in the credit analysis, check it out:

personal data

First, the company needs to know you better, so it asks for basic information such as name, address, CPF, contact telephone number, marital status, education, among others.

It is important to highlight that information like this can help a lot to establish a relationship with the company. In general, the more companies know about their customers' personal lives, the more they acquire trust in that person.

In this sense, providing as much information as possible about your personal, financial and professional life will bring great benefits to banks' credit analysis.

debt problems

The institution consults the restrictions of the individual or legal entity in accordance with the credit operators. The main purpose of this part of the analysis is to identify whether there are pending payments or even debts in your name.

This part of the evaluation takes place without complications, as the company performs the entire procedure through the CPF (in the case of individuals) or CNPJ (for legal entities).

In the process of analysis of cadastral restrictions, the results are usually

- CPF/CNPJ without restrictions, that is, clean name;

- Consumer with history on alert: in this case, there is credit release, but the evaluation is more detailed.

- Consumer with registration restrictions: there are debts, delays, renegotiations or other problems with payment

- CPF/CNPJ with impediment: in this case, there are actions to block assets, the financial system or other tax actions that prevent the carrying out of credit operations.

Consumer History

At this stage of the process, the company providing the credit checks whether you pay your bills on time or delay your payments, in the latter case, the delay time is taken into account.

In addition, the company also consults its relationship time with other institutions and it is in this process that the Score appears.

The Score is the score from 0 to 1000 that indicates how good a payer you are. Depending on this score, the company can make better offers for you or reduce some benefits.

Salary proof

The receipt demonstrative papers will indicate what your financial reality is. As a rule, those interested in the credit must provide proofs such as the Income Tax, Payslip and Pro-labore so that the company understands how much credit it is possible to release for their case.

How long does a credit analysis take?

It is quite complicated to set an exact time for credit analyzes because each institution has its own specific process. Even so, it is worth mentioning that online analyzes are usually much faster, lasting a maximum of five working days.

However, there are still some cases in which the credit analysis can take up to fifteen business days, even if it is online. In addition, the processes that companies carry out physically tend to take a little longer.

The ideal way to clear up your doubts about this is to look for people who are customers of the same company to see how long the bank's credit analysis took. However, remember that this time may be private.

Especially because each CPF/CNPJ has its characteristics and particularities, that is, some cases are easier to analyze than others. The reciprocal is also true.

How is bank credit analysis done?

In general, banks' credit analysis consists of two main phases, in which banks understand what kind of customers they are dealing with in that contract.

Was it in doubt? So understand what these phases are and what happens in each of them:

- Primary analysis

This is the moment when the company requests all the necessary information to verify restrictions in the buyer's history. Therefore, the analysis of the consumption profile and other complementary information come into play at this first moment.

The company also asks for documents proving the data that the customer provided at the time of registration, such as RG, CPF, address, among other things. In addition, proof of income is sometimes required.

After this preliminary assessment, the company will proceed to analyze the profile and payment history. In this case, if the result is positive, the client is already approved in the first phase of the bank's credit analysis.

- completion phase

This is usually the phase most feared by customers, as here the company makes contact with the contractor to confirm some information or clear up doubts about their financial situation.

In the final stage, companies such as Serasa Experian, SPC, Bacen and others step in to give a better opinion on their history. Added to this, some credit operators may even get in touch with people they know who can provide better information about their nature as a consumer.

How to register with Serasa Consumer?

Monitor your CPF and credit score 24 hours a day. Get to know the Serasa Consumer service.

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

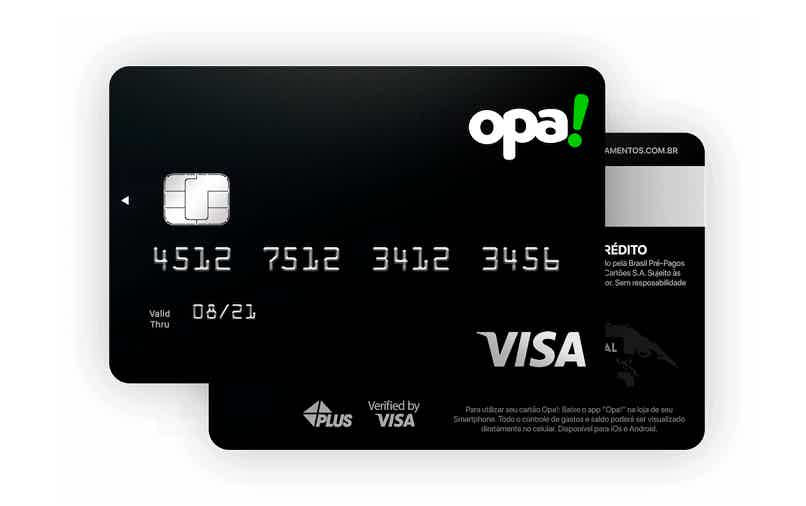

How to apply for the Opa Card! Visa

Oops Card! Visa is a good option for those who are negative, in addition to offering a digital account and exclusive benefits. Check out!

Keep Reading

5 best digital accounts for negatives

We are going to show you the 5 best digital accounts for negative accounts, and other data so that you can make the best choice.

Keep Reading

Discover the Geru Personal Loan

Get to know the Geru personal loan and understand how this loan can help you get out of the red once and for all! Check out!

Keep ReadingYou may also like

Payroll Loan Caixa or C6 Consig: which is better?

In today's article we will show the comparison between two payroll loans, Caixa and C6. By the way, each of them has its own characteristics and advantages.

Keep Reading

How to apply for Cetelem car credit

Cetelem car credit is a great option for those who want to realize their dream of owning a car, with lower rates and longer payment terms. To find out more, just continue reading.

Keep Reading

Credipronto Real Estate Financing: what is it?

Get to know real estate financing from Credipronto, a Banco Itaú company that finances up to 90% of the property online, check it out!

Keep Reading