finance

All about Positive Registration

Want a tool that helps you improve your status in the job market? So, learn all about the positive record and how to use it in your favor.

Advertisement

Find out if you should register positive

O positive record is a very interesting tool for anyone looking to improve their status in the market. With it, you can have access to more opportunities than you can imagine.

Therefore, it is essential to know more about the subject. Thus, you can understand how important it is when getting a credit option.

So this post will help you through this process. Here, you will know all the details about positive record. Learn the details of this concept and how to take advantage of it.

What is Positive Registration?

It is a very recent registration modality. Therefore, it is common for some people to get confused about how it happens. Basically, it is a kind of financial register.

Therefore, it was established by Law 12,414/2011. The latter provides something very interesting for people. Imagine that you are in need of credit and you applied to a certain company.

So, the law leaves the company in question to analyze how it behaves when paying its invoices. Thus, it is because of this striking feature that many call it a “financial curriculum”.

In addition, there is another modality known as negative registration. The difference between the two is very simple. O positive record allows the company to assess not only what you were unable to pay.

It includes the complete set. In this way, it becomes much more interesting than the first possibility. In addition, it is based on the study of this payment history that your credit score is calculated. Check out more about it below.

Credit Score: What Is It?

The word score means score in any event. Speaking of the financial market, the logic is exactly the same. So, every individual who has a CPF (Individual Taxpayer Registration) has a score.

The latter follows a scale between 0 and 1000. Imagine a situation where you understood how this type of registration works. Then start being a part of it.

Therefore, it is possible to acquire a score every time you pay your bills on time. Otherwise, your score will be reduced. So the bottom line is, being on top makes companies trust you more.

So your chances of getting a credit when you apply are much higher. After all, it has demonstrated a commitment to settle existing debts. See in practice how this analysis is done.

- 0 to 300 points: risk of default is very high;

- 301 to 700 points: the chances of you being in default are medium;

- 701 to 1000 points: there is almost no risk of you being in default.

Now, you must be wondering “What is the relationship between my score and the positive record?” Understanding the mechanism behind the latter allows you to increase your score.

Know that a high score goes beyond greater chances of getting a certain credit.

Thus, the higher your score, the lower the interest rates on financial operations. If you decide to take out a loan, your installments will be smoother as a result.

Now, if your score is low, the scenario changes. In that case, you will probably have to accept far less flexible terms and rates. That's why the positive record it's so interesting. It helps you to carry out financial operations with more practicality and benefits.

How to increase your credit score

Do you want to get back to having an active and healthy financial life? Learn how to boost your credit score right now

How does the Positive Register work?

Your transactions are recorded there. This goes for any financing, amount or value of installments. Thus, everything is in your CPF as payment for essential bills.

So, when you register, this information will help you with your credit score. Remember that your entire history will be evaluated, not just the negative parts of it.

This is a widespread concept in more than 70 countries. The law mentioned above came with the intention of including the payments in the financial history.

The term refers to payments that were made within the established limit. So, they can be electricity bills, water bills, loans and so on.

understand what was the positive record Until recently, it didn't make that much of a difference. However, today the situation is completely different.

That's because if you're up to date with your debts, your name is on the record. Of course, if the latter can bring benefits, nothing fairer than getting to know them and taking advantage of them, right?

First of all, the credit score only took into account the negative record. That's how he was calculated. So as long as your debts are up to date, that's fine. Otherwise, then your name was registered.

The most interesting thing is that it didn't matter if you only delayed a single account. So, your data went to that registry anyway. So it wasn't advantageous at all. No aspect took into account the entire user profile.

Positive Registration vs loss of privacy

Many people believe that this modality implies a loss of user privacy. After all, it includes all your financial transactions.

However, you don't have to worry about that at all. That's because credit companies don't access detailed data about it.

So everything they understand about your financial history is found in your score alone. The only visible thing will be the numbering from 0 to 1000 mentioned above in the article.

It all boils down to the level of risk an institution takes when releasing credit to you. The rest doesn't matter. In addition, no company will know which account you paid and which one is open.

Of course, this can change if you decide to authorize this query on your financial resume. That way, you are the one who chooses, regardless of the situation.

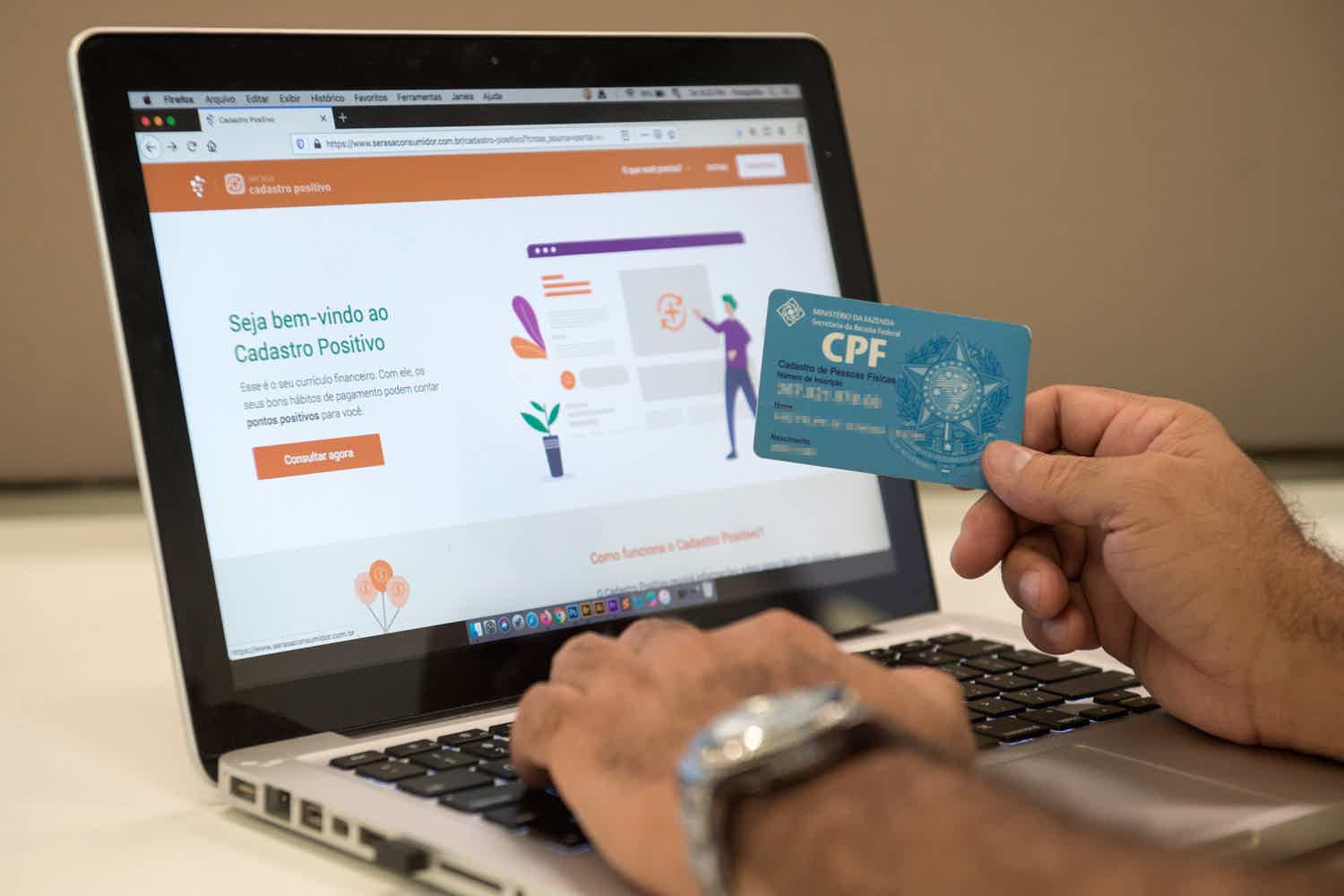

Knowing its operating scheme, it is easier to find its complete information. To consult this type of registration is very simple.

So, you just need to login to your Serasa Consumer account. Then, just go to the “Serasa Cadastro Positivo” section. That's where you'll see all of your financial history.

Now, imagine you found something that doesn't match your payments. In this situation, it is necessary to contact the Serasa team. Thus, they will analyze to correct the error. In the end, your credit score will be updated accordingly. See how simple it is?

How to register positively

It exists since 2011 and has been active since 2013. Until recently, membership was very small. In this way, a supplementary law emerged. They made the positive registration data have automatic adherence.

So, you already have this record, even without having to pass on any information. In addition, those who manage these histories are the so-called “credit bureaus”. Serasa is the best example of them.

Also, don't think that nobody is warned of anything. You should receive an SMS, letter or email informing you of this. Now, if you don't want to have that record, that's fine. It is possible to ask to be removed from the list.

However, this is not recommended in view of the advantages involved. The next topics will address more about the most important ones.

What are the benefits of registering?

By now, you already understood what this record is for. Still, you know its importance well. Therefore, it is time to delve a little deeper into the benefits that the subject of this article provides. So stay on top of 5 great advantages of positive record.

1- Loyalty in your payment history

The first point is related to the impact caused on your credit requests. With it, getting financing or a loan is much simpler.

Remember that a negative record is not good for keeping your score high. After all, any unpaid debt is going to greatly affect your score. In the record in question, this does not happen.

Of course, if you don't pay off a debt, there will be consequences. However, here they are much more relaxed. Remember that this type of registration considers your entire history and not an isolated debt.

That's why your points won't drop drastically. Therefore, realize that it is not worth disabling this option. In the end, you only have to lose if you do.

2- All your accounts are considered

Know that all your bills are part of your payment history. It doesn't matter if they are more basic or bigger. That way, the more debts you pay off, the more likely your score will increase.

Of course, this only applies when respecting the expiration date of each debt. Now, if you're wondering what's the advantage of having basic accounts on file, don't worry.

They are essential services. So they arrive every month without fail. So you have a great opportunity on your hands. By paying off these debts, your score increases. This is much faster than if they weren't included. So, there's nothing to lose.

3- Your enterprise can also be part of

Don't think that only the Individual Taxpayer Registration (CPF) is included in the positive record. Your company is also included. This is a consequence of Law 12,414/2011, cited above.

So if your venture is managing to keep up to date, excellent. His score increases as his bills are paid.

Now, if this is an advantage for an individual, imagine for a company. So, it becomes simpler to get resources for your business and make it a success. Whether to expand it or optimize it, whatever.

The important thing is that the CNPJ can also enjoy all the benefits without any problems or bureaucracy.

4- The possibility to review your history

This type of registration makes your information more accessible. Of course, all without interfering with your privacy. The point is that your financial resume can be better analyzed by interested parties.

Thus, it is possible to trace a path of all his past in the role of consumer. Furthermore, no data is error free. Remember that you can ask for correction of a certain payment.

With this, your credit score is not affected at any time. In short, your right is always respected and you can still enjoy benefits when applying for a credit or negotiation.

5- Increasing your credit score

Many financial market professionals have a common opinion about the negative record. According to them, it is very likely that this record will be left behind in a few years.

Of course, it won't go extinct. It will continue to be a useful model. However, it won't get much attention. This when compared to the positive record.

It is believed that there will be even greater encouragement for people to adhere to the latter. No wonder your credit score can increase by taking part in it.

The information present in this system is extremely relevant for all financial institutions. Still, a greater emphasis on those who work with credits and financing.

So, imagine that you want to acquire a certain asset. To do so, you need to improve your paying history. This type of registration is the perfect option to reach a good score.

Conclusion

You have reached the end of our article. Now, he's a real expert on the subject. Don't forget how easy it is to join this sign-up list. Literally, you don't have to do anything, just get on with your life as a consumer.

Also, do not hesitate to enjoy the benefits involved in this theme. Believe me, managing your finances will be much more practical. It will be possible to get an incentive without going through numerous bureaucracies.

Remember that this goes for both CPF and CNPJ. Finally, that's all you need to know about the positive record. Now it is your turn. Take all the topics covered here and invest in increasing your credit score. Turn your financial status around.

Find out how Serasa Score works

Do you want more access to credit products on the market? So you need to understand how Serasa Score works and how to increase yours. Learn more in the text below!

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to enroll in Prime Cursos courses?

Find out how to register on the Prime platform and courses, to strengthen your resume and stand out in the job market.

Keep Reading

Discover the Banrisul Universitário card

With the Barinsul Universitário card, you accumulate points in the Barinclube program and use them anywhere in the world. Find out more here!

Keep Reading

Mercado Pago Card or Neon Card: which one to choose?

Either the Mercado Pago Card or the Neon Card, both have international coverage, Visa flag and digital account to make your life easier. Check out!

Keep ReadingYou may also like

The best cards with no annual fee

The best credit cards with no annual fee, such as the Nubank and Neon cards, have points programs and more benefits. Check more here!

Keep Reading

TAP Miles&Go Credit Card: get benefits on everyday purchases while accumulating miles

Get the TAP Miles&Go Credit Card and transform your daily purchases into airline miles. Discover how you can travel economically and in style with ease. Find out more now!

Keep Reading

Exclusive details of the BBB 22 leader's room released

The most watched house in Brazil is coming for another edition, and speculation is already at full steam. The leader's room has undergone drastic changes and is now located on the second floor of the house. See all the changes!

Keep Reading