Financial education

Is it worth opening a savings account?

Opening a savings account can bring security, but it is no longer so advantageous in terms of income. So is it worth it? Check it out here!

Advertisement

Find out if it's worth putting your money in Savings

You've probably heard someone older talk about how they used to put their savings in savings and it yielded a good amount. Because that was considered the safest and what most people did for a long time! But, is it still worth opening a savings account?

So if you are one of the people who still have this doubt, don't worry. For you are not the only one and much less will be the last. Incidentally, most people still have a lot of distrust about other ways to save or invest money.

In short, there are a wide variety of options that arise for you to apply or invest your money. Thus, it can end up being a little confusing to understand the best options and whether it is still advantageous to opt for savings, right?

But that is about to end. Because in our article we will explain everything you need to know if you are thinking about opening a savings account. So, just stick with us and check out all the information we've gathered for you!

Let's go?

What is the minimum amount to leave in savings?

For those who are still thinking about opening a savings account, it is interesting to have an idea of what is a good basis for making money in that portfolio. Thus, it is interesting that you have a good amount of liquidity. But what is this?

Well, liquidity refers to resources that you can quickly convert into cash if the need arises. That is, what you have reserved is at your disposal for use in case of immediate need.

Thus, thinking about liquidity, it is interesting to have a savings account, as it gives you this option of easy access to your resources when you need it. But what is the minimum amount that a person should leave in savings after all?

Because there are some factors that can influence this answer, which you should always take into account when setting aside an amount to open a savings account. In other words, the following things must be kept in mind:

- What are your fixed monthly expenses, those that you characterize as indispensable and occur every month without fail;

- Is there stability in monthly income? That is, do you have a job or primary source of income?

- Are there any possibilities of needing emergency values in the short or medium term?

- What standard of living do you want for yourself?

- Based on your current life context and your personal desires, what amount of money would you feel secure in having at your disposal?

Now, let's think about two of them in more depth.

What are your monthly fixed expenses

To know how much money you should have when opening a savings account, it is essential to understand your fixed expenses well. So, think carefully: in case of unemployment or running out of primary source of income, for how many months would you be able to maintain yourself that way?

So, it is interesting that you try to guarantee a reserve of at least six months to live comfortably without a primary source of income. In short, you save money and still have stability and security in emergency cases.

Incidentally, it is also possible to facilitate this process by reducing the cash flow demands on your household budget. That is, you settle long-term debts in advance and pay smaller amounts. Thus, the amount you put in when opening a savings account may be lower, allocating the rest to investments or expenses.

Are there any possibilities of needing emergency values in the short or medium term?

In this regard, there are those little surprises in the short and medium term, such as:

- unexpected medical expenses, procedures, hospitalization or expensive medications;

- lending money to a trusted family member or friend for emergency reasons;

- urgently settle any overdue debt, overdue bills, etc.;

- Between others.

What amount does it bring you security to have at your disposal?

As we said, to know the right amount to open a savings account, you need to think about your desires and your emotional side. That is, for you to feel financially secure, what is the amount you would like to have at your disposal in your savings account to withdraw when you need it?

But this value will vary from person to person, according to the context of each one's life. Therefore, sit down and think carefully about what would be the value that brings you security, and set that as a goal when opening your savings account.

Choose the bank that's right for you

Did you know that every savings account has the same income, regardless of which bank you have your savings in? So it is! But then, what is the importance of choosing the right bank to put your money in?

Because to know what is the ideal amount that will bring you security, it is also interesting to know well which is the ideal financial institution to keep it. So search

- Bank presence in several cities

- the quality of service

- the added services

- how many withdrawals you are entitled to without charging fees to your account.

In this way, the characteristics of the bank can also influence the amount you should leave in a savings account at the institution.

After all, how much money to leave in savings?

Well, after reflecting on all these factors that we brought up above, it is important to say that most specialists bring a general maximum value for you to be able to open a savings account with stability.

Thus, you must set a limit of 50 thousand reais for your savings. Because above that you'll start paying income tax, and with the current percentage of savings, that wouldn't be worth it at all.

So, if you are exceeding this ceiling with your savings values, the ideal thing is to start thinking about alternatives, such as government bonds and low-risk investment funds.

In short, leave up to 50 thousand reais in savings for emergencies in terms of unexpected expenses. But from there, try to vary the way you use the money you manage to save from your monthly income, and think about investments, for example.

By the way, how about we understand a little more about what your money yields like when you open a savings account? Because that's exactly what we're going to talk about next, so stay with us and check it out below!

How much does 1,000 a month earn in savings?

First, let's explain how the savings income is in 2021. Because at that moment (2021) savings are yielding 70% of the Selic Rate, as long as the rate is lower than 8.5%.

Thus, with the selic rate at 2%, the yield on savings this year is 1.4% per year and 0.11% per month. That is, if your intention is to make the money work, opening a savings account and leaving your money lying there may not be the best choice, since other Fixed Income investment assets deliver more income and are also safe.

But after all, how much would 1000 reais per month in savings? Well, if you leave 1000 reais in savings, you will have an income of 0.14%. That is, 14 reais in a year, receiving 1014 reais at the end of the period.

However, when withdrawing this amount after one month, you will still incur a monthly interest rate of 0.11%. Thus, the final value will be 1011 reais, with an income of 11 reais.

Is it good to put money in savings?

As we said, savings was once a good option and is one of the most popular ways to save money in Brazil. Incidentally, it is still highly sought after by people, especially those who are older and used to a period in which the income from opening a savings account still pays off.

However, times have changed and savings have lagged behind other investment assets and fixed income government bonds, which bring security and better yields.

That is, money in savings is no longer an advantage! Unless you're not worried about income, and just need a safe place to leave your emergency fund.

But, in any case, we know many other good options for those looking for income and security while saving money. So, we have gathered below what would be the best alternatives for those who intended to open a savings account, but want a better option.

So, just continue your reading and check what we have chosen for you. Let's go ahead!

Treasury Direct

As we said, putting your money in government bonds can be a good alternative for those who gave up on opening a savings account due to low income. Thus, when you put your money in the Direct Treasury, you are investing in a program of the National Treasury and the São Paulo Stock Exchange, the B3.

So, a good cost-benefit ratio is the exemption of administrative fees for this type of investment by most stockbrokers. Furthermore, there is only an annual fee of 0.3% on whatever you invest.

By the way, another interesting point for you to put your money in the Direct Treasury is the possibility of starting with little money: the minimum amount accepted is 30 reais! Very easy to start, isn't it?

However, the redemption of values has losses when it occurs in the short term and before the maturity date you defined when placing the money.

CDB (Bank Deposit Certificate)

This is another good alternative for those who no longer want to open a savings account. Because the CDB is a type of fixed income asset, very safe and low risk. Thus, investing in CDB is as if you lend your money to the bank for it to operate, and thus obtain remuneration.

In addition, the CDB has daily liquidity (as well as savings), and you can invest with low risk and the possibility of withdrawing amounts when needed. But there is also the CDB option with pre-determined redemption, in which the redemption can only occur when this period comes to an end, generating higher yields.

CDB PicPay: one of the best yields on the market

Do you know CDB PicPay? If not, it's time to get to know this daily liquidity yield that is considered one of the best on the market. Know more!

Real Estate Credit Letters (LCI) and Agribusiness Letters (LCA)

This type of investment is quite advantageous compared to opening a savings account. Because they are exempt from income tax. However, you will need a higher amount to start investing. In this case, the minimum in general is 5 thousand reais, with a grace period of 90 days so that you can redeem your money and income.

private pension

With a private pension you can invest in the terms you want, whether monthly or not. In addition, you have your money in fixed income investments and also in stocks, offering a good return over time.

But you need to study and choose your private pension plan well, so that you pay a lower rate on Income Tax, or even so that you are exempt when you need to redeem the amounts.

After all, open a savings account or not?

In short, savings still offer good security for those who put their money in it. Because the Credit Guarantee Fund covers the limit of 70 thousand reais in case of bankruptcy or other problems with the financial institution.

However, in terms of income, opening a savings account is no longer the best option for those who want to make the money count, and not just let it accumulate.

So, what we recommend is that the person look for investments in government bonds and fixed income, as they bring the same security as savings, but with better yields for you.

So, pay attention to the fixed income options, especially the ones we suggested above. But not only these! Well, on our Mister Panda portal we have good information for you to find the best alternative, if you've convinced yourself not to open a savings account to leave your money.

In short, we suggest that you look for these options before considering opening savings, and search for more information on our portal.

This brings us to the end of our exclusive article on saving and whether it's still worth it. But what do you think? Do you agree with our conclusion and our information?

We hope we helped and made this decision process easier! Until later!

What is CDB, CDI, SELIC, LCA, LCI, LC, FGC, COE?

These and many other acronyms form part of the financial market, and can often seem scary and complicated. In fact, they are simple. Find out everything here!

About the author / Aline Saes

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

What is error 51 on the card?

Passing the card and making an error is more common than we think. In this article, you will find out what error 51 on the card is. Check out!

Keep Reading

How to register and receive the Social Energy Tariff benefit

See how the Social Energy Tariff benefit can reduce your electricity bill by up to 65% per month and further improve your quality of life!

Keep Reading

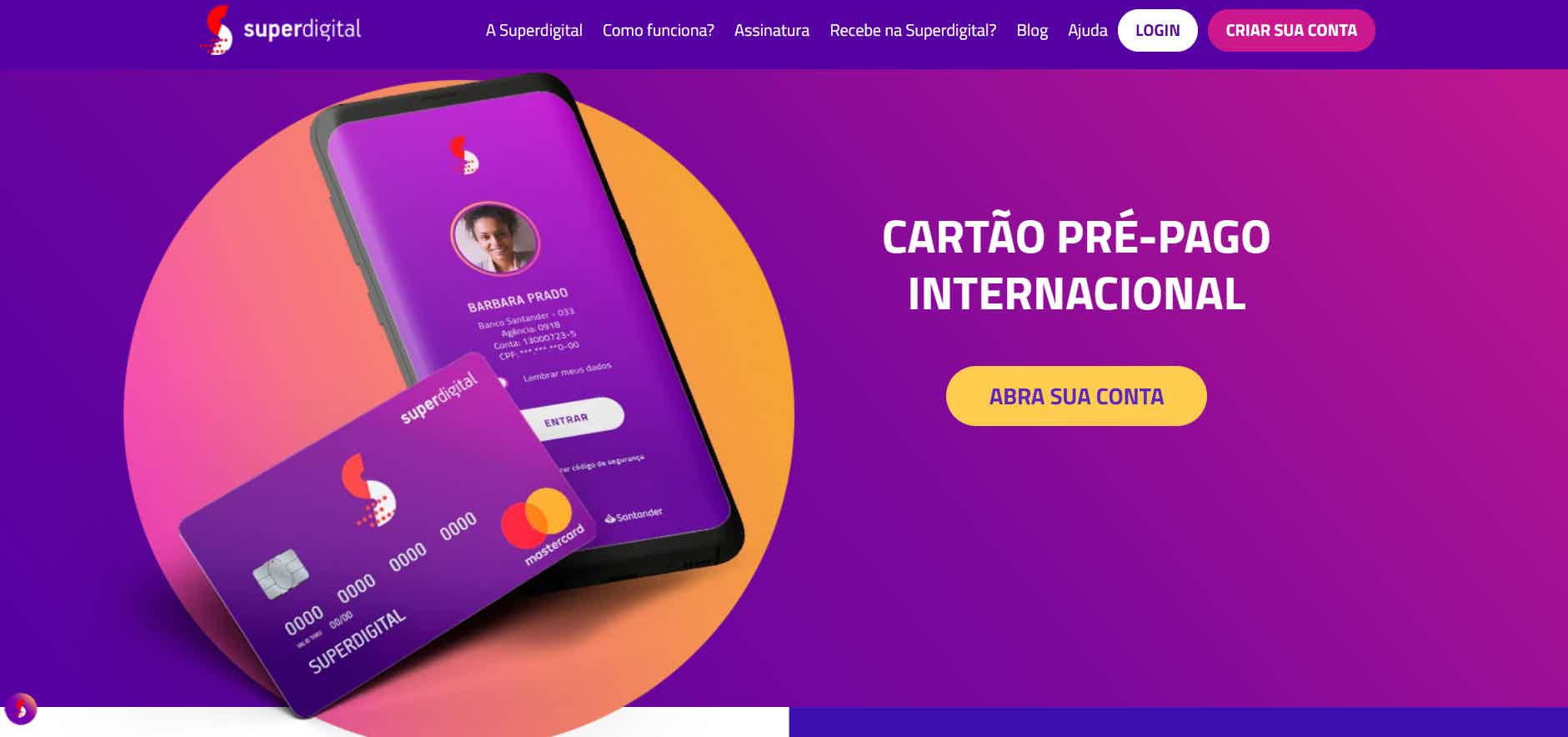

Superdigital Card Review 2021

Check out the Superdigital card review that we brought about the financial product with the Mastercard brand that accepts negative payments and also has no annual fee.

Keep ReadingYou may also like

Will Bank Card or Méliuz Card: which one is better?

A great way to decide between two cards is to compare the main features of each. This may be interesting for you to find which one matches your profile the most.

Keep Reading

What loans does Caixa offer?

Taking out a loan can help you make many dreams come true. In this sense, Caixa Econômica Federal offers several options to its customers. Come check out the best!

Keep Reading

How to apply for an Ali Credit loan

The Ali Credit loan has an interest rate of up to 3,99% per month and can be paid off in up to 96 months. Want to know how to order it? So, read this post and check out the process.

Keep Reading