loans

What is the role of credit in your financial life?

Credit is a financial product that can make a difference in your life. In our article you will find out the types and how to use them in a healthy way.

Advertisement

Understand how to use the credit function

More and more people are adhering to different lines of credit available in the market, either for personal credit or another type. But it is necessary to understand well the characteristics, advantages and disadvantages of each credit option to be able to use it in the best way.

And if you're one of the people who still doesn't quite understand how to use the credit function and what role it can play in your financial life, then this article is perfect for you. Because here we will explain what are the main credit options, their characteristics, advantages and disadvantages.

In addition, of course, to what precautions you should take so you don't end up using the available credit options badly. Because credit can both make your life easier and put you in a dangerous situation of disorganized personal finances and debts.

So how about understanding better about all aspects of lines of credit? So keep reading, and check out everything we've gathered for you below!

What are the credit options on the market?

As we said, there are several credit line options available in the Brazilian financial market. And they expand more and more, just as financial institutions grow with new fintechs, digital banks and renewals of traditional institutions.

Thus, Brazilians can be faced with a huge range of loan options, which is the same as credit. And how do you know which one to choose right now? Because that is precisely what we want to help you with, presenting all the options for this type of financial product and their characteristics.

That way, it will be easier to understand which ones are and which is the best choice for you. So keep reading and follow along with us!

credit card

We know that more and more people are looking for the facilities that only a credit card option can offer. Because currently there are several options in the Brazilian market for those who want to acquire a credit card.

So, choosing your new card among all these alternatives is not a simple task. Because each financial institution offers a credit card with exclusive benefits and advantages to attract customers. So, you need to think about which type of card will be the most advantageous for you.

And what has been happening more and more is that they offer a total exemption from the annuity fee. That is, you do not pay a fixed annual or monthly amount to access a credit card.

Therefore, more and more people want access to credit and, with so many options, those who charge a fee just for you to have a card end up losing customers.

In addition, among the many advantages that a credit card can offer you are:

- Program for accumulating points, which can be reverted to discounts in virtual stores, and other partners of the financial institution;

- Accumulation of miles, which bring advantages in travel and discounts on tickets;

- Cashback, in which part of the purchase price is returned to the consumer;

- Discounts on cultural attractions and leisure options, such as cinemas, theaters, restaurants, etc.

Therefore, always keep an eye on what advantages and benefits a credit card option is offering you.

How to use a credit card without going into debt

Have you become a credit card hostage and no longer know what to do to avoid getting into debt? So keep reading, because we're going to help you use it without you having to

Overdraft

The overdraft is a type of credit, that is, it is a loan. And basically the overdraft is a loan with a pre-approved limit for when someone becomes a debtor on their checking account.

That is, if you spend more than you have in your account balance, the amount you exceed will enter the condition of loan with overdraft. Therefore, when you are negative on your checking account, that amount is what the financial institution lent you so that you could comply with the payments even without a balance.

And this type of loan is very dangerous. Because this is the line of credit with the highest interest rates in Brazil, sometimes reaching 14% per month! In addition, the longer you owe and for greater amounts, the higher the interest will consequently be.

Therefore, this is a line of credit that should only be used for emergency situations. And even then for short periods, because for long periods other types of credit can be more advantageous and less harmful to your financial life.

Personal loan

This type of credit can be considered one of the simplest. In addition, it is the most used in Brazil, with a loan contract made directly between the financial institution and the person who requested the personal loan.

Thus, the financial institution can assess the applicant's profile to find out whether it represents a high or low risk of default. And this occurs from an analysis of some data, such as CPF, RG, monthly salary, and credit score with credit protection agencies such as SPC and Serasa, in addition to other methods.

After that, the institution is free to establish its conditions for that credit to fall into the applicant's account. For example, the financial institution determines:

- monthly interest rates;

- total amount of the loan that it will release to the customer;

- term to repay the loan;

It is also possible to get better credit conditions if you apply for this loan with the financial institution where you already have your checking account. But always be aware of the Total Effective Cost of the personal loan, which will appear in the contract and encompasses all the costs you will have with this credit.

Payroll loan

Payroll loans, on the other hand, work a little differently from personal loans. In this case, the customer will have the loan installments deducted directly from their payroll or INSS benefits (pension, retirement, etc.) every month.

That way, you don't have to worry about forgetting to pay any installments. Also, the financial institution assumes a much lower risk of default, since the payment process will be automatic.

Therefore, by bringing less risk, payroll loans allow the financial institution to lend money with lower interest rates compared to personal loans. However, you can only take out this credit if your paying company has an agreement with the creditor financial institution.

In addition, there are some requirements to be fulfilled by those who want to apply for payroll loans. Are they:

- Monthly installment of a maximum of 30% of the applicant's total salary;

- Payroll discount must be authorized at the time of contracting the loan;

- Only civil servants, employees with CLT and INSS beneficiaries can apply. That is, self-employed persons, micro-entrepreneurs, etc. will not be able to apply for this type of credit.

Therefore, this credit may be more advantageous for those who meet these requirements. However, always plan well so that the loan does not destabilize your financial life and wreak havoc on your personal finances, right?

Loan with Property Collateral

Basically, this type of loan is based on the individual's desire to get a loan with better interest rate conditions and payment terms. And for that, the person puts a real estate as a way to guarantee the financial institution that the loan debt will be paid.

Because, otherwise, the financial institution has every right to take the property of the defaulting person, and sell it at auction to cover the debt. That is, you get better conditions, but your property will be sold to the creditor financial institution, so it involves greater risks for your equity.

Thus, if you take out a loan with a property guarantee but do not fulfill your part of the contract, the financial institution can simply claim ownership of your property directly at the real estate registry office. And the whole process can happen quickly, in less than a month.

That is, the loan with a property guarantee is much safer for the financial institution. And that's why the customer gets a significant reduction in interest rates and the term for paying off their loan.

But for that, you need to go through a credit analysis and register the contract in a notary. And your property is sold to the bank, but you can continue to enjoy it as before, you just cannot sell or exchange property with someone else.

In addition, your property needs to undergo an inspection for the bank to know the real value and calculate the credit that will be granted. It is also necessary to send the documentation of the property. And you will be able to use your property or that of third parties.

Loan with Vehicle Guarantee

In a basic way, making a loan request with vehicle guarantee is to get a loan amount by putting a car, motorcycle or any type of vehicle as a form of collateral.

And this type of loan is also known as vehicle refinancing, as it accepts an asset that has not yet been paid off as collateral. That is, instead of going through a more thorough credit analysis, the customer puts his asset as a guarantee that the loan will be paid in one way or another.

Thus, the customer will be selling his asset, in this case a vehicle, to the financial institution that will release the loan amounts. In this way, the customer can get the money faster and with lower interest rates. But there are always more risks in placing an asset as collateral.

When should you use credit?

Everything will depend on your context and what type of credit you are thinking of using. For example, a credit card is a type of loan that can be part of your daily routine, as long as your spending is very well controlled. And always avoiding falling into revolving credit when paying your invoice in installments.

The overdraft, on the other hand, is a form of credit that should be useful only in emergency and very short-term moments. Never get used to paying interest on a current account with a negative balance, as they are the highest interest rates in the Brazilian market.

Regarding personal loans, payroll and secured, it is interesting to understand that they can be very useful, as long as you research well before closing a contract. Because they are good options when you need higher amounts, with longer terms to pay.

That is, credit can be the solution to an emergency need for values, or when you have already made a good plan on how to use that money without harming your financial life.

How to use credit safely in your financial life?

Basically, credit should come into your life sporadically. That is, do not become dependent on loans of any kind, even those that seem harmless like credit cards.

Therefore, always look at credit as an emergency and temporary way out, which you should only use when you are in full control of your finances. Therefore, never apply for loans without having good planning and the certainty that you will be able to pay all the installments later.

Otherwise, the person may end up losing control of the installments and what they owe, thus starting to accumulate risky debts. Therefore, the result of an unsecured use of credit can be over-indebtedness and shattered financial health.

So, always be careful when using credit so as not to destabilize your financial life. And keep a lot of control over all the types of loans you apply for, those that are already open, etc. In addition, of course, to having control over what you will be paying in interest, installment amounts and deadlines to pay off your debts.

That way you will be able to use the credit in a well controlled way, without affecting the balance of your financial life. Because credit can help, and a lot, at specific times in our lives, but it should always be well planned and controlled, right?

And so we end our special article about the different lines of credit and how you can use them in your life. We hope it made it easier to understand what types are, their pros and cons.

Loan by check: how does it work?

Want to borrow a value but don't know how to do it? Know that it is possible to borrow with a check. See how it works and its advantages

About the author / Aline Saes

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

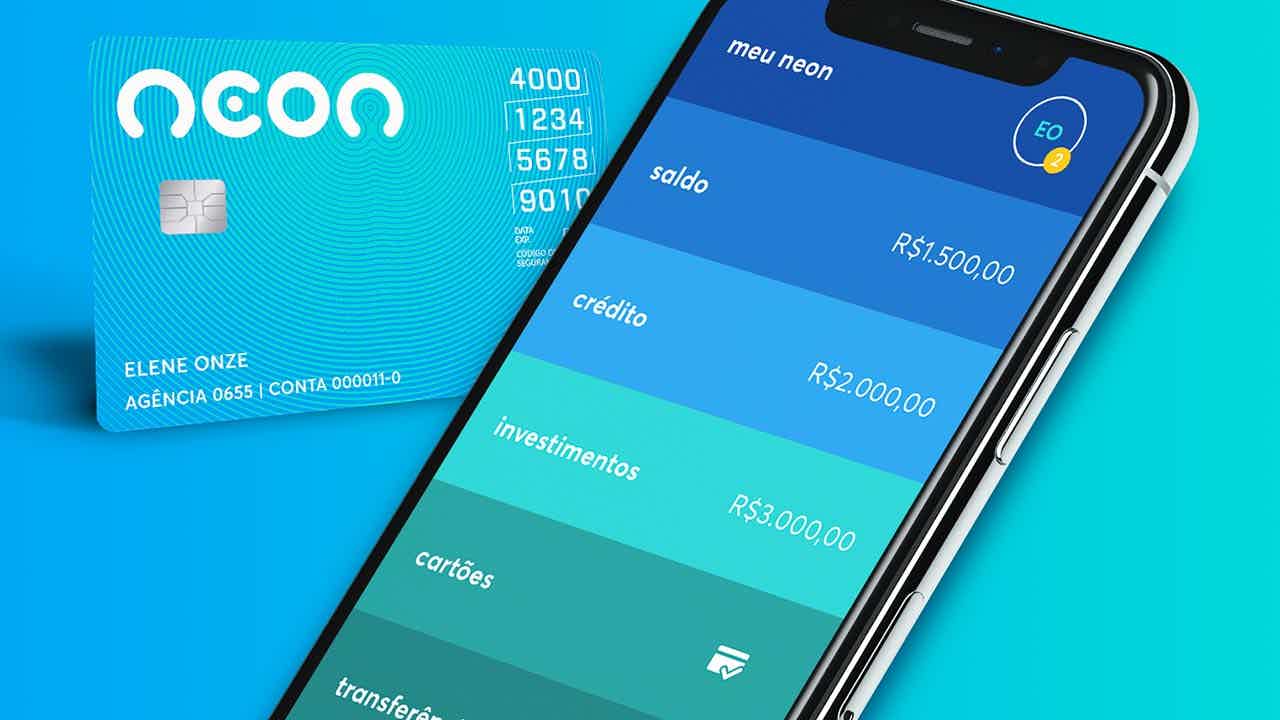

Neon Card or Pan Card: Which is Best for You?

Need to decide between the Neon Card or the Pan Card? So know that both have Visa flag discount programs! Learn more here!

Keep Reading

Discover the Cielo card machine

See how the Cielo card machine can be the ideal partner for your business and offer several resources for you to do well in sales!

Keep Reading

How to take cell phone maintenance courses

Find out how to take cell phone maintenance courses to secure your career in the service and repair industry.

Keep ReadingYou may also like

How to apply for the LiftBank card

Small entrepreneurs have more difficulty finding a credit product. Given this, how about getting to know the LiftBank credit card? It offers several advantages for those who want to undertake. So, read on and check it out!

Keep Reading

Discover the CGD current account

With subscription at the counter, CGD's current account "M" offers advantages, such as unlimited transfers, debit card, credit card and access to complete financial products. Learn more about this account right now!

Keep Reading

Entries open for the painting Who wants to be a millionaire in 2022

The painting Who wants to be a millionaire has been the subject of talk on the Domingão com Huck program. Through it, participants answer general knowledge questions and can leave with R$1 million in their pocket! Registration is now open for 2022!

Keep Reading