finance

5 tips to start your financial control

There are some ways to start financial planning, including apps that can help you with this process! Check out the unmissable tips that we separate for you.

Advertisement

Financial success depends on controlling finances

To start a simple but working financial control, we will mention 5 tips to start your financial control.

In Brazil, we don't have financial education as taught in schools, which unfortunately undermines people's understanding of this subject.

That's why it's so important to learn about financial education, and how it can help us in our personal and professional lives.

So, let's give you some tips to start a new financial life today, and other useful information.

5 tips for financial control

To start effective control, let's list 5 tips to solve and organize your financial issues:

Know all your income and expenses

To start a financial control, the first tip could not be different from this one, to understand what are the revenues and expenses within a management.

That's because, we need to know how much time of income, and what our expenses are, so that we can control expenses.

So, let's first of all clarify what are the revenues and what are the expenses.

Revenue, in a very simple way, is all the income generated by the person throughout the month, that is, all the money that enters your personal cash, so to speak.

Expenses, on the other hand, are all the pending items that you need to pay, either per month like water and electricity, or per year like IPVA of a charge.

It is necessary to take into account that they fit into the income, the salary, allowances, Christmas bonus, all the active income that enters your budget.

For this, it is necessary to separate in which ranges these revenues will enter, as one should not count on the thirteenth to pay fixed expenses, for example.

In terms of expenses, they should all be grouped by cost centers, for example, the credit card is not a cost center, but what is spent with the credit card.

So if you own a car, and you pay for gas with your credit card, the expenses will go towards the cost of the car.

Then, there will be a sum of these expenses that will total the cost of the car, as well as a house, for example.

That is, with all this data well noted, you will have financial control and you will be able to know where the income comes from, and where it is going.

set financial goals

After writing down all your income and expenses in a spreadsheet or on a simple piece of paper, you will need to start setting goals.

This is because the goals serve to make payments organized, as well as possible delays.

In this case, a goal might be: to pay a certain expense by that date.

However, unlike promises, goals are made to be fulfilled, and when not fulfilled, your control will lose meaning.

That is, try to set goals that you know you can meet, so as not to get into an even bigger snowball.

For this, we separate the goals into METONA, META, METINHA, METIZINHA. Check out!

METHONE: These are those goals that you intend to achieve in the long term, that is, at least ten years from now.

Example: retirement and financial independence.

GOAL: These are those goals that you intend to achieve in the medium term, that is, between 2 and 5 years.

Example: Marriage.

MEAT: These are those goals that you intend to achieve in the short term, that is, between 6 months and 2 years.

Example: Travel.

MEET LITTLE: These are those goals that you intend to achieve in an even shorter period, for example, in a maximum of three months.

Example: buying a cell phone.

Then, within your financial control, write down in detail each of the goals and the dates to be met.

develop the discipline

Still within financial control, for it to occur it is important to develop discipline.

This is because, without discipline, nothing within that control will happen, and thus payments will not be honored either.

So, establish punishments for yourself if necessary, for example, if you don't pay a bill on the correct date, you won't be able to go out the next day to a more expensive restaurant as you'd like.

These punishments, although silly, make the brain understand the importance of following a routine.

start saving money

This tip is one of the most important, if not the most important: saving money.

This is because, the more expenses that occur within financial management, the income also needs to be higher, so saving money is an alternative that should be followed within financial control.

A very effective money saving tip is to ask for discount on your purchases, because if you don't ask for the discount, you'll be losing money.

Another money-saving tip is avoid waste. Yeah, everything that isn't used is still money.

So, if you own, for example, clothes or stationary objects, you have stationary money, which could be in circulation.

This also applies to food you don't eat and throw in the trash, for example a snack you bought, didn't like and threw away.

Another way of wasting that prevents you from saving money is the wrong investment of that money.

An example is that investment that is yielding 5% per year, and could be yielding much more than that, it is also a waste.

Another tip is to price research. That is, when you go to buy, search in at least three different places.

Because, when doing a price research, you will have more chances to buy in the place with the lowest price, or, at least, the best product.

Including, through the internet, the chances of doing price research increased even more and made things easier.

Finally, the last tip to save money, is generate more revenue. That is, with discipline and knowing how to see new opportunities, such as teaching classes, selling used clothes.

Have a financial control tool

And, our last tip is for you to have a financial control tool that can be an app or a simple excel spreadsheet.

For beginners, an excel spreadsheet is more than enough for all planning to be done efficiently and safely.

However, there are some apps that can help you start your financial control, they are:

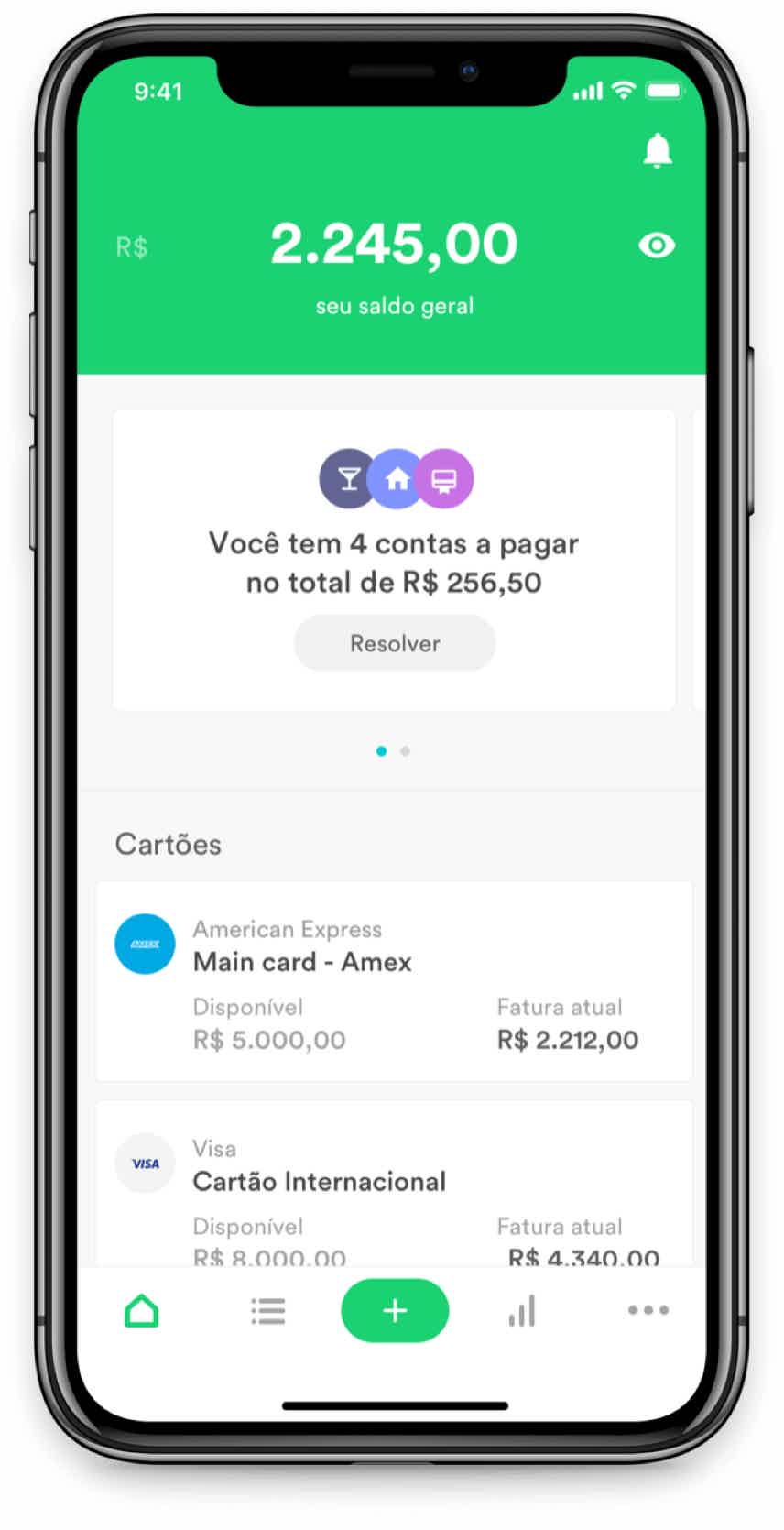

Organize

This app allows account management, definition of expense categories, generation of reports with graphs on transactions.

And in addition, the app is free and alerts you about bills to be paid and allows you to control your credit card, in a simple and intuitive way.

There is also the option to subscribe to R$10 monthly, or R$5 in the annual plan, making it possible to define goals and import bank details.

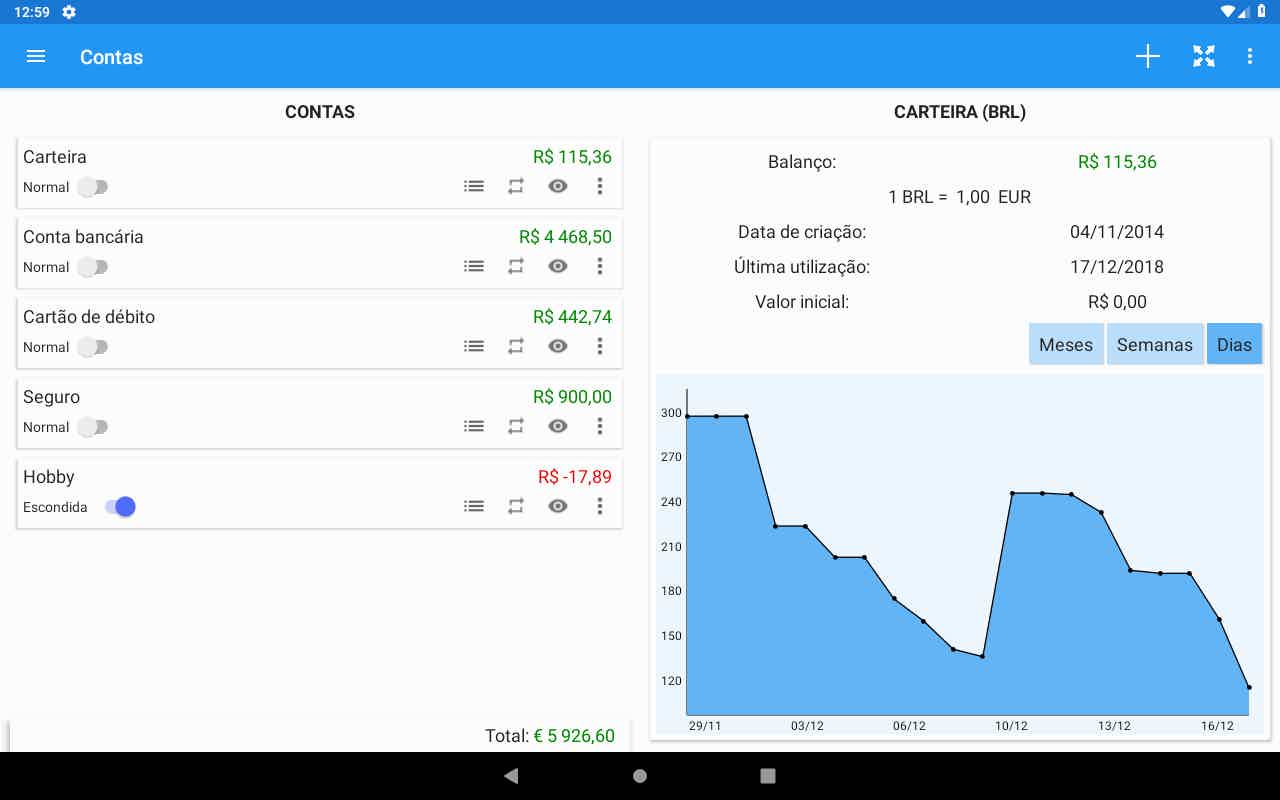

Wallet

This app is more popular, having 5 million registered users.

In it, it is possible to launch investments and expenses, analyze transaction graphs, synchronize bank accounts and even share data with the family, for example.

The app also allows data management by offering tips and categories to help your journey within the tool.

In it, there are also paid functions, however, most are free, so you can start your financial control.

easy budget

Budget Easy is an app with a very cool look that allows you to customize data within the tool.

This is because, when adding accounts, the user finds graphics available and a section dedicated to credit cards in more than ninety currencies.

The app also allows you to create financial reports in a personalized way, and thus start your financial control.

Fortune

With this tool, the user can record the monthly balance of expenses and income, including the registration of installment accounts.

This app also contains charts and reports, credit card management, setting budgets by category, custom themes.

Another very interesting function of fortuno is the fact that it reminds the user of pending financial issues, making everything much simpler, in addition to being able to export all data to a spreadsheet.

furniture

This app offers email alerts and notifications that help the user remember due dates, and thus start their financial control.

And, in addition, with the tool, it is possible to define goals and objectives for efficient planning.

Another point is that with mobills the user will always be able to have balances in the palm of his hand in a very simple tool.

Finally, mobills also offers video classes and financial planning courses in free and paid versions in R$15 monthly and R$80 annual plans.

spendee

It is an application for those who want to add virtual wallet and cryptocurrencies.

This tool lets you share data with the people you spend most time with, connect bank accounts and credit cards, accept multiple currencies, and issue alerts.

And, in addition, it features a customized interface, which allows the user to add photos to their expenses, and thus start their financial control.

Expense IQ

This tool contains a planner to make life easier for its users, to instantly identify managed accounts.

And yet, it is possible to track expenses, and configure automatic launches in the tool itself, bringing alerts and graphics.

In the tool, it also contains data to make you more informed of your planning at the end of the month and be able to start your financial control.

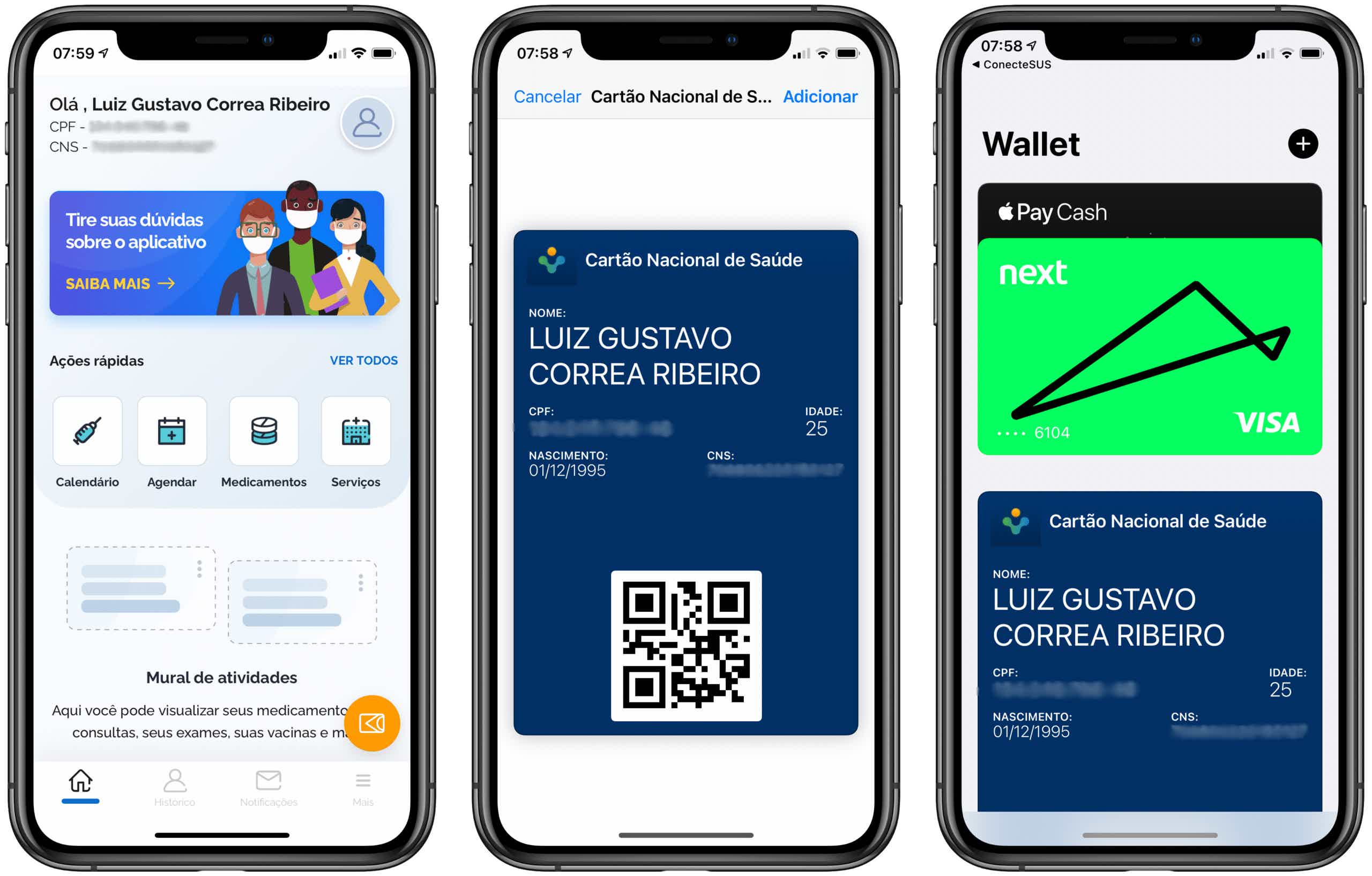

Pocket Guide

This tool is already better known and goes beyond other applications, as it has a greater number of functions.

The app allows taking out loans, providing rate comparison on its interface, and even compares financial ratios with other people of the same profile.

And, in addition, the user can also track both the CPF and the credit score, whenever they want through the application itself.

To learn more, check out our article on Money Monitoring Program (PAF).

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Zuum card

The Zuum card is offered by Vivo in Brazil to its customers, but also to people with a valid number from any other operator. Check out!

Keep Reading

Discover the free courses Prime Cursos

Get to know the options of the free Prime courses, their advantages and characteristics. And enjoy 100% classes online without leaving your home.

Keep Reading

Best TV shows to join: check out the options

Get to know the 18 best TV shows for you to be part of and check out unmissable tips to know how to choose which one to be part of!

Keep ReadingYou may also like

Discover the WiZink Rewards credit card

Do you live in Portugal and still don't have a card to call your own? So how about getting to know the WiZink Rewards credit card? It offers a great points program. Read this post and learn all about it.

Keep Reading

Is there a credit card like Nubank? Find out the answer here!

But after all, is there a credit card like Nubank? The answer is yes, and we tell you what they are here. So, read on and check out the digital and no annual fee credit card options to find out which one suits you best.

Keep Reading

The best card for you is the Inter Card

The best card for you is Inter! Come and learn more about this excellent option with ZERO annuity and cashback.

Keep Reading