Tips

Dinheirama's financial monitoring program

Do you know what Money is and how it works? Let's talk about it, and how it can help you with your finances!

Advertisement

Find out about the Financial Monitoring Program

Knowing how to control finances is something that we should all be taught since childhood, however, unfortunately this does not happen. That's why we're going to show you how the financial follow-up program at Dinheirama works.

In this program, readers learn effective methods to learn to deal with money, as well as to undertake.

So let's show you how this program works and how it can help you have a healthy financial life.

What is Dinheirama?

Dinheirama is a company specialized in financial education, which seeks, through effective methods, to improve financial knowledge for individuals and companies.

And, in addition, the platform uses simple and accessible language on subjects related to the economy, personal finance and financial education.

That is, through the dinheirama financial monitoring program, the individual is able to develop and improve skills, which aim to contribute to personal financial management.

The program seeks, above all, to simplify teaching so that lay people can understand the best opportunities for dealing with money.

In this year of 2021, Dinheirama completes 14 years of existence, which is why they created the financial follow-up program to transform even more lives.

So, check out further the services and products offered by the company.

What are the services and products of Dinheirama?

Among the services and products offered by Dinheirama, we have:

- Financial advice and personal monitoring in sessions of up to 90 minutes: In this consultancy, content on finance is transmitted, as well as achieving financial goals;

- Financial education courses: The courses offered last from 4 to 9 hours, which involve in-depth content, as well as the development of strategic thinking;

- Lectures “in loco” or “in company”: They have a workload of 2 hours a day, including 15 minutes for a snack. Also addressing financial tips;

- Business pedagogical consultancy: Consultancy aimed at organizations, aiming to develop the capacity for financial development within them.

- Specialized content creation in finance, entrepreneurship, through podcasts, videos, articles, handouts, as well as books, among other methods;

- Money website: It seeks to offer content on finance in a diversified and uncomplicated way on a daily basis, as well as methods to simplify the subject.

In addition, it also talks about:

- Entrepreneurship;

- Career;

- Sustainability, as well as other tips.

Finally, Dinheirama seeks to reach as many people as possible, proof of which is having reached 2.5 million hits on the portal.

What is the Money Monitoring Program?

Dinheirama's financial monitoring program is based on a reality show created by Fintech Grão.

In this reality, two people receive financial guidance for about 4 weeks, and from then on, their lives are directed.

In other words, the follow-up program for Dinheirama will be based on this reality, working like this:

- At first, the student will be monitored by experienced professionals in the area;

- In addition, you will receive an initial financial diagnosis to have a vision of how your financial life is going;

- You will then receive a tailor-made plan for each student;

- Finally, you will have a follow-up of the results.

Of course, the results will not appear overnight, and consistency is needed.

To do so, apply all the methods that are transmitted throughout the program.

The program will cost around R$399 up front. For more information, contact the company Dinheirama.

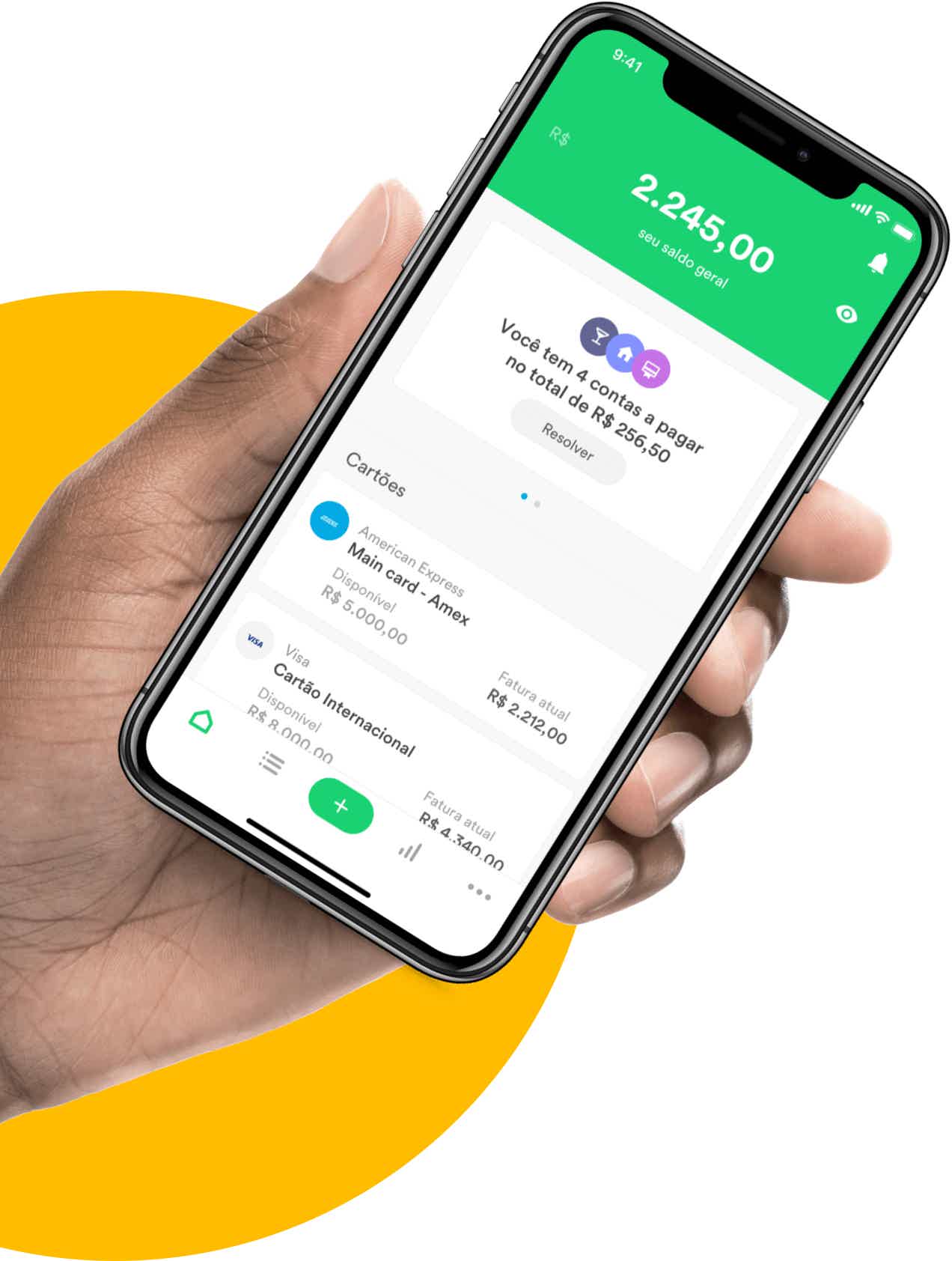

Money Online

Dinheirama online is a free 100% program, and very simple to use, making people's lives more organized.

Personal financial control software has several advantages as we will mention later.

Cash online is free

To gain access to the Moneyiama software, the interested party must:

- At first, access the company's website;

- Then, you must create an account on the platform using a personal email;

- And from that, you will take control of finances.

In addition, the software is available on the App Store and Google Play, aiming to reach a larger number of people.

All expenses are saved

In the Dinheirama program, all user expenses are saved.

This is because the program is based on teaching how to take care of finances, so it is necessary to have a vision of income and expenses.

In addition, a strong point on the platform are the graphs that record expenses, and leave a better and more organized view.

That is, the graphs also help in the interpretation of expenses with date, values, description, among other important data.

Is it possible to import the bank statement

This is one of the most interesting functions of the platform: Being able to import the bank statement.

That is, the system allows the user to upload directly from their internet banking to Dinheirama.

Then, the system will import the entire bank statement, that is, income and expenses.

To import, just access the “import statement” tab, select the bank and upload the file! Ready!

monthly calendar

Another useful function is the monthly calendar of Dinheirama. In it, the user will have all expenses broken down by color and type.

That is, it is yet another method to facilitate the interpretation and visibility of all expenses throughout each month.

credit card control

The software allows the user to control all expenses made on the credit card, no matter which bank it is.

To do this, simply add the card by clicking on the “Accounts/Cards” tab, and add all the credit card information.

reset account

If the user got lost in the cats, in the launches or wants to start the notes from scratch, just click on “reset account” in the settings menu.

Then, the system will be completely restarted, and you will be able to start the digital spreadsheet of expenses.

Financial report

In Dinheirama online, the user can export the monthly account report in the formats: Excel XLS and PDF.

To do so, just click on “Reports”, go to the bottom of the page and choose the ideal format to use.

Then, the user can accurately track all planning and financial data.

5 simple steps to organize finances

So we separate 5 simple steps so you can organize your personal finances. Check out!

financial housekeeping

This is the first tip: financial cleaner.

This tip means cleaning up all the dirt within your financial life, and it can be divided into two types: heavy dirt and light dirt.

Thus, heavy dirt is one that the person knows is present, but is too lazy to change.

Examples of heavy budget dirt: Credit card fees; bank fees; academy; and other expenses.

The lightest dirt, on the other hand, is the hidden one, which happens on a daily basis, that is, a simple financial survey is enough to know which is the dirt that has most interfered with having a healthy financial life.

Solve the easy problems first

To initiate a big change, small steps are necessary, and this also applies to finances.

So, at first, it is recommended to solve the easy problems first, such as reducing simple expenses, and then proceed with the more complicated problems, such as clearing the name.

learn to save

Tip number 3 is, according to experts, one of the most important, and even the recipe for financial success.

That's because learning to save is a safe step that will help you build solid and consistent wealth.

So at higher levels, being able to save an average of 30% of finance income will help you achieve great results.

study about economics

First of all, to start a new financial planning, you need to study about motivation, entrepreneurship, economics, as well as all related subjects.

Thus, understanding the theoretical basis of these subjects, the practice will become simpler and lighter.

goal creation

Finally, tip number five is about creating goals.

This is because it is not recommended to make promises, but to set goals to be met.

That is, promises are made not to be fulfilled, unlike goals that, when established in the short, medium and long term, tend to have good results.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for Leroy financing

Learn how to apply for Leroy construction finance and other information about it, so you can finish your construction! Check out!

Keep Reading

Mercado Pago Card or BTG+ Card: which one to choose?

Even with different profiles, these cards do not charge annuity with investment chances! Decide between the Mercado Pago card or the BTG+ card.

Keep Reading

Discover the BTG personal loan

Discover the characteristics of the BTG personal loan and find out if it's really worth it by knowing its advantages and disadvantages.

Keep ReadingYou may also like

How to apply for personal credit: see the best options

Knowing how to apply for a personal loan in Portugal is important! After all, this can be essential to achieving financial goals. Discover how to apply for personal credit intelligently in our comprehensive guide.

Keep Reading

What does it mean to be negative?

Being negative means being in default with debts, and can make it difficult to apply for credit and financial products. Know more!

Keep Reading

Blows via PIX: see what they are and how to protect yourself from the action of thugs!

Unfortunately, scams via PIX have become common in the reality of Brazilians in recent years. In order not to fall victim to fraud and data theft, it is essential to know how to identify the activity of criminals. See below for the most common scams and how to protect yourself from them.

Keep Reading