Cards

Zencard card or Santander SX card: which is better?

There are several similarities between the Zencard and the Santander SX card, such as international coverage, discounts from partners and special conditions for customers. But do you know what the differences are? Read this post and find out!

Advertisement

Zencard x Santander SX: find out which one to choose

So, the Zencard or Santander SX card are two credit card options with international coverage and many benefits, such as a rewards program, discounts with partners and an application for controlling expenses that provides more security and autonomy.

So, stay tuned in this article, as we will show you the advantages and disadvantages of these cards, so that you can compare them and make the best decision. Check out!

How to apply for the Zencard card

The Zencard card offers many benefits, such as the Mastercard Surpreenda program and the discount club. See the step-by-step guide to applying for yours from home right now.

How to apply for the Santander SX card

The Santander SX card offers discounts at Esfera partners and the possibility of waiving the annuity. Learn how to request it by following the post step by step.

| Zencard card | Santander S CardX | |

| Minimum Income | not informed | R$ 500.00 for account holders R$ 1,045.00 for non-account holders |

| Annuity | 12x of R$ 7.90 | 12x of R$ 33.25 Exempt if you join the PIX system Exempt with a minimum spend of R$100.00 per month |

| Flag | MasterCard | Mastercard or Visa |

| Roof | International | International |

| Benefits | Digital account; Mastercard Surprise Program; Discount club. | Discounts at Esfera partner stores; Possibility of exemption from the annuity; Two flag options. |

Zencard card

Firstly, the Zencard is a prepaid financial product, so it basically works like a conventional credit card, however, payment is made as if it were a debit card, that is, the amounts are immediately deducted from the digital account.

So, you should top up your card constantly, as you can only use it if you have a balance available on it. Therefore, it is a great alternative for controlling your spending, as you cannot pay for purchases in installments. Furthermore, this card can also be purchased by people with bad credit.

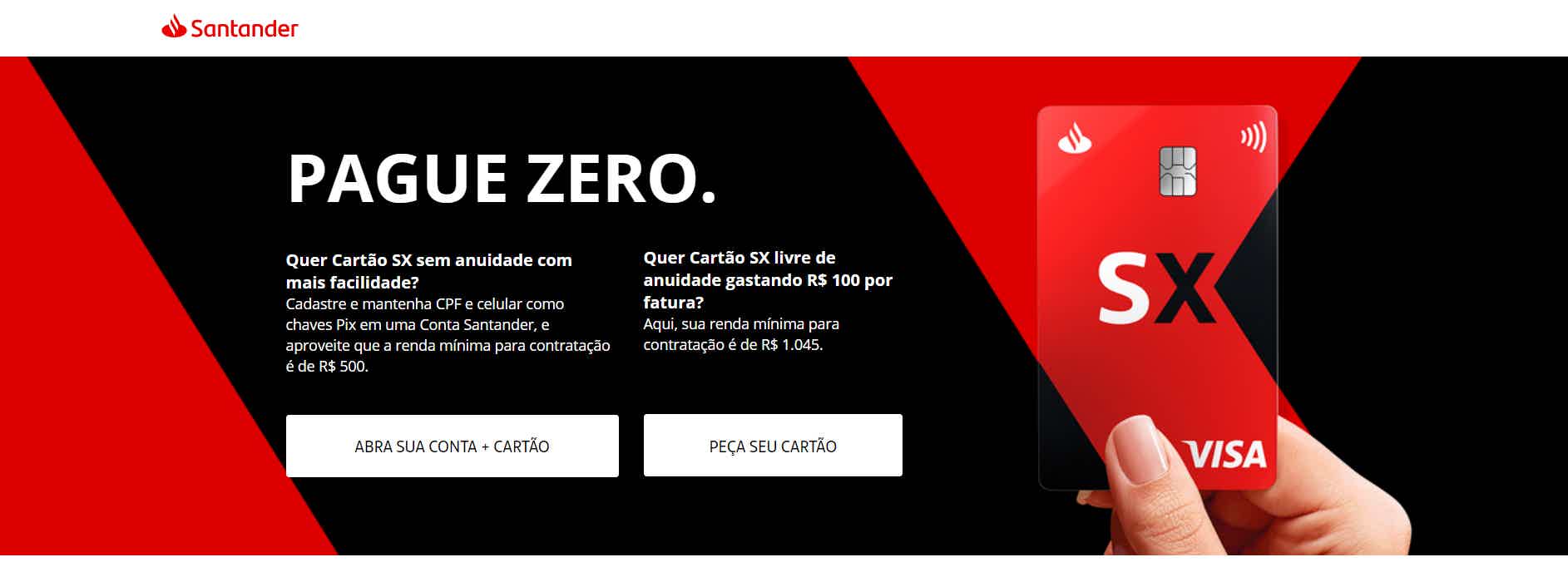

Santander SX Card

So, the Santander SX card is one of the financial products created by Banco Santander. It can be issued under the Mastercard or Visa banner and, therefore, you can have access to programs such as Mastercard Surpreenda or Vai de Visa.

Furthermore, to apply for Santander SX, simply go to a Santander branch or apply through the bank's homepage. You must also have a minimum income of R$1,045.00 if you are not a current account holder or R$500.00 if you are a current account holder.

And, if you spend at least R$100 on your monthly bill or join the Pix system at Santander, you can waive the annual fee. Otherwise, the annual fee is charged at R$399.00 or 12x R$33.25. In addition, you can request up to 5 additional cards and have access to very attractive conditions for customers.

What are the advantages of the Zencard card?

Firstly, the Zencard is international, so you can use it in national and international stores, as well as make purchases in physical or online stores.

Furthermore, the card has a digital account and through it you can check all your card transactions, it is important to mention that it does not have an invoice as it is a prepaid card.

We cannot fail to mention that you can join the Discount Club. In this case, you can earn vouchers to buy at lower prices from partners.

Furthermore, the card has a Mastercard logo, so you can have access to benefits, such as the Mastercard Surpreenda Program, where you can accumulate points and exchange them for products or services, in addition to being accepted in millions of establishments.

What are the advantages of the Santander SX card?

Among the advantages of the Santander SX card are its international coverage and two card options. So, you can choose the card of your choice, which can be Visa to take advantage of the Vai de Visa program that offers discounts at partner establishments. Or, you can choose the Mastercard card with the Mastercard Surpreenda program that offers points that you can exchange for products and services.

In addition, you can request up to 5 additional cards, pay your bill in up to 24 installments, and enjoy up to R$50% in discounts from Esfera partners. You can also eliminate the annual fee by spending at least R$$100.00 on your monthly bill or register your Pix key in your Santander account.

What are the disadvantages of the Zencard card?

Among the disadvantages of the Zencard card are the charging of fees for card acquisition, top-ups and transfers, as well as the generation of payment slips, second copies of the card and a monthly fee of R$7.90. Check out the full list below.

- To purchase the card: R$ 21.90;

- Recharge at lottery shop: R$ 4.00;

- Top-up via bank slip: R$ 3.00;

- Withdrawals: R$ 6.90;

- Monthly fee: R$ 7.90;

- Transfers between prepaid cards: R$ 1.50;

- Transfers between cards via internet banking: completely free;

- Withdrawal of second card: R$ 21.90;

- DOC and TED transfers: R$ 8.90.

So, before opting for this card, pay attention to all the fees charged.

What are the disadvantages of the Santander SX card?

So, the biggest disadvantage of the Santander SX card is the annual fee and the mandatory minimum income of R$1,045.00 for non-account holders and R$500.00 for account holders. Therefore, if you are not in a position to open an account with Santander, it may not be a good alternative.

Zencard Card or Santander SX Card: which one to choose?

So, the Zencard or Santander SX card are two options with several advantages, such as international coverage and benefits associated with the brands. So, see which of these cards best meets your expectations.

However, if you are still unsure about which credit card is best for you, don't panic, because below we have another comparison between cards. So, click on the recommended content below and check it out!

Santander SX card or Pan card: which one to choose?

The Santander SX card or Pan Card are credit card options for those looking for practicality, security and autonomy in using their credit card! Check it out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Who can be a minor apprentice?

Do you know who can be a minor apprentice? Basically there are some rules to exercise this position. Find out what they are in this article!

Keep Reading

How to apply for the Itaú Construshop loan

If you want to renovate or decorate your property, Itaú Construshop may be the ideal line of credit for you! Check here how to apply.

Keep Reading

Discover the Meu Tudo personal loan

The Meu Tudo personal loan does not require consultation with the SPC or Serasa and has reduced interest rates starting at 1.70% per month. Meet here!

Keep ReadingYou may also like

8 best cards to earn miles

Cards to earn miles can be an excellent way to enjoy benefits and travel at a discount and comfort. Learn 8 best cards

Keep Reading

How to pay Itaú bill in installments?

Do you have a credit card and are in doubt about how to pay Itaú bills in installments? So, check with us the step by step and pay your invoice with more peace of mind!

Keep Reading

Dragon Pass Visa: what is it and how does this benefit work?

If you travel a lot and want to be more comfortable when waiting for your flights, then the Dragon Pass Visa is a great alternative for you. To learn more about this benefit program, just continue reading and check out more information.

Keep Reading