Cards

How to apply for the Zencard card

If you liked the benefits of the Zencard card, see the step-by-step guide to applying from home right now

Advertisement

Zencard

The card Zencard has been very successful in the financial market, so many people want to know how to apply. People are increasingly delighted with the possibilities it offers.

However, many still do not know how to order this product. Despite being a simple process, not everyone is familiar with technology.

So, the purpose of this post is to make things even easier. Here then, you will see step by step how to acquire a card Zencard. Don't waste any more time and get yours soon.

Step by step to apply the Zencard card

To apply for the Zencard card, the company therefore gives you some alternatives to resolve questions about the card. The next topics will talk about each one of them. Right off the bat, see how to get the product online.

Order online

The first thing to do to apply for the Zencard card is to access the company's website. No need to worry that the platform is very secure. That way, all your data will be protected.

Step 1: Apply for the Zencard card

Then drive option: ask for your card. This then, is a button that is in the upper right corner of the page. Once this is done, you will be directed to a session where the next step begins.

Step 2: Informing your data

Now, it's time to describe some things about yourself. However, rest assured, it's just some basic information. They will help the company when preparing your Zencard.

Step 3: Access the bank slip

So this is the last part. After you have entered your data to request the Zencard card, just print the slip. Still, the acquisition fee is only R$ 19.90. So, you can pay at any lottery.

Request via phone

Unfortunately, you cannot apply for this card over the phone. However, it is possible to ask questions through other channels. One of them is the email support@zencard.com.br.

In addition, it is possible to contact the company's Call Center. To do so, just call the following numbers.

- 4003-4099: for capitals and metropolitan regions;

- 0800-888-5877: for other locations.

download app

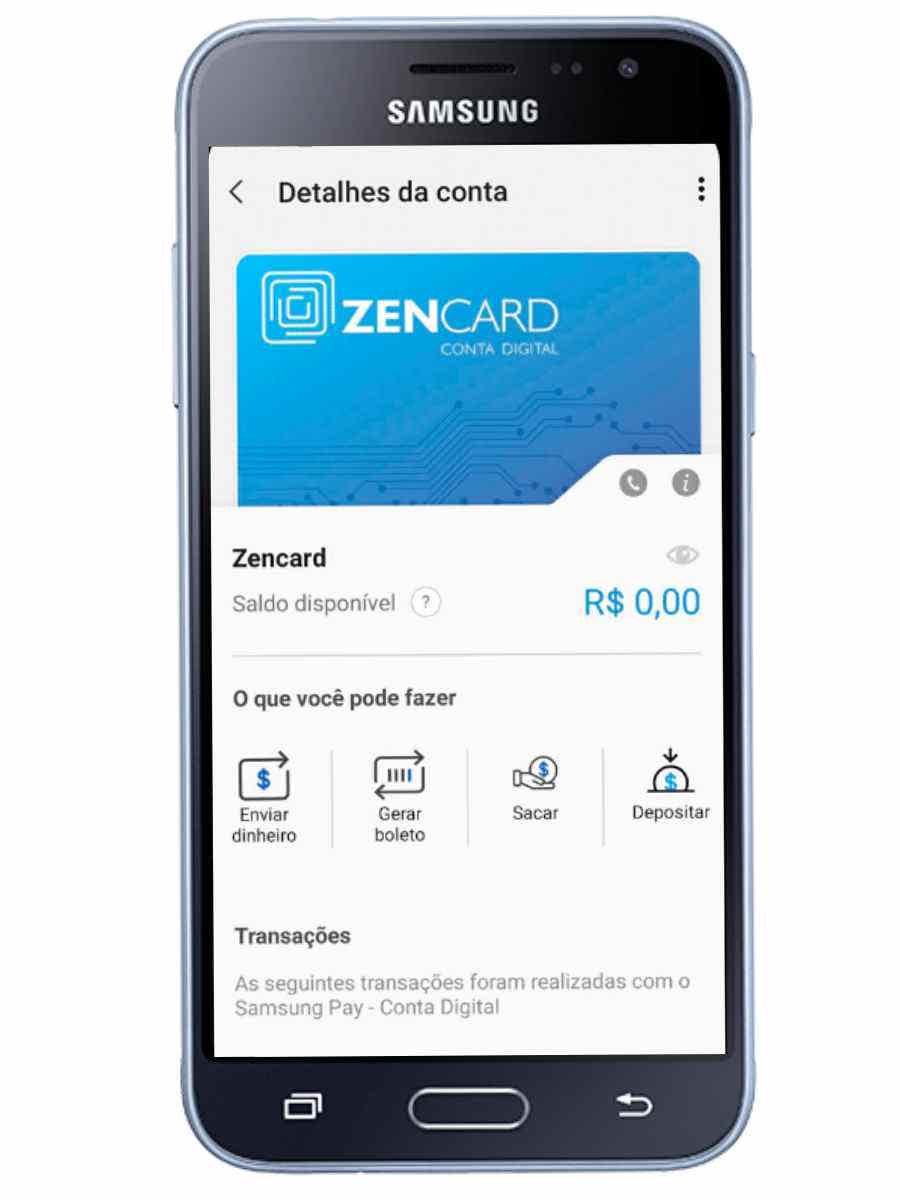

The application then allows you to manage all your expenses well after applying for the Zencard card. Thus, it is then possible to analyze the transactions made over time. Also, you can check the balance you have available.

With an application in hand, it is still possible to carry out docs and other transfers. Not to mention the ability to pay bills and bank slips.

PagBank Card or Zencard Card?

This, therefore, is a doubt that affects many people. PagBank is also a very interesting card. However, it differs from Zencard in some ways. So, to help you with that decision, we separate some important features.

| Characteristics | PagBank | Zencard |

| Minimum Income | not informed | not informed |

| Annuity | Free | Free |

| Flag | Visa | MasterCard |

| Roof | International | International |

| Benefits | Digital account, cashback, savings income | Digital account, withdrawal, recharge, bank transfers |

Now then it's up to you to apply for the Zencard card. Note that applying for the card is simple. So, be sure to conquer your financial autonomy and ask for yours now.

How to apply for PagBank Card

If you liked the options and advantages of the Pagbank prepaid card, find out right now how to apply without bureaucracy.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to increase the score with Serasa Turbo

Increasing your score with Serasa Turbo is a way to raise your score and improve your market visibility. Read this post and learn more.

Keep Reading

Can I use the Caixa digital account to deposit money?

Did you know that it is possible to deposit money into the Caixa digital account? In this article, we'll show you the options for making that deposit!

Keep Reading

How to send resume to Carrefour? Check it out here

Find out how to send your resume to Carrefour and thus be able to access jobs that pay a good salary and offer great benefits!

Keep ReadingYou may also like

Brazil Aid: see how it works and who is entitled to participate in the Program.

As a way to help the country's vulnerable population, the Government extinguished Bolsa Família and created Auxílio Brasil. With more attractive benefits, the Program came into effect this year and promises to help millions of families across the country. See more below.

Keep Reading

Discover the Cresol personal loan

With the Cresol personal loan, you can make your dreams come true and take that long-awaited trip. This is because it does not require proof of destination and also offers special credit conditions for members. Do you want to know more about him? Look here!

Keep Reading

How to apply for the Revolut Metal card

Want an uncomplicated card that helps when traveling and exchanging money? So now see how to apply for the Revolut Metal card.

Keep Reading