Cards

Verdecard credit card: what it is and how it works

Verdecard credit cards bring exclusive benefits and special discounts at accredited stores. Check out!

Advertisement

Verdecard Card: exclusive benefits and discounts at Quero-Quero stores

First, Verde Gestora de Cartão de Crédito SA is the financial institution responsible for Verdecard cards. In fact, she only owned the Quero-Quero card. But, with the success of the financial product, the company launched the Verdecard credit card, which has exclusive benefits and discounts.

So, are you interested and want to know more? Also, just keep reading!

| Annuity | 12x of R$8.99 |

| minimum income | not informed |

| Flag | Own |

| Roof | Regional (RS, SC, PR) |

| Benefits | Discount at Quero-Quero stores; Different forms of payment in associated stores. |

How to apply for a Verdecard

The Verdecard credit card can increase your purchasing power, in addition to giving you exclusive discounts. See how to apply!

Verdecard advantages

First, it is important to mention that the Verdecard card is widely accepted in the southern regions of the country. Therefore, before joining, check the official website to see the list of accredited stores.

Some card benefits include exclusive discounts at Quero-Quero stores. In addition, it also offers different forms of payment in its affiliated stores.

In addition, he still has a period of 40 days to pay invoices and you can request additional cards.

You still have access to your invoice, limit, statement and other features online and without leaving home.

Main features of Verdecard

The Verdecard card has exclusive differentials, such as discounts and super special payment conditions when buying at Quero-Quero stores. In addition, it is also accepted in thousands of other establishments.

In addition, it also works on Vero and GetNet machines.

But attention! It is important to inform that this card is not yet accepted in all regions of Brazil. It is a good option for people who live in Rio Grande do Sul, Santa Catarina and Paraná, where it is accepted without complications.

Who the card is for

Furthermore, this card is ideal if you want to increase your purchasing power, as it offers different payment terms at accredited stores.

By the way, are you interested and want to know more about the Verdecard card? So, read the recommended content and check it out!

Discover the Verdecard credit card

The Verdecard credit card is accepted in more than 200,000 stores with exclusive discounts! Come find out more about it!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Lanistar credit card

The Lanistar credit card was created for a group of consumers who seek security and frequently make international purchases.

Keep Reading

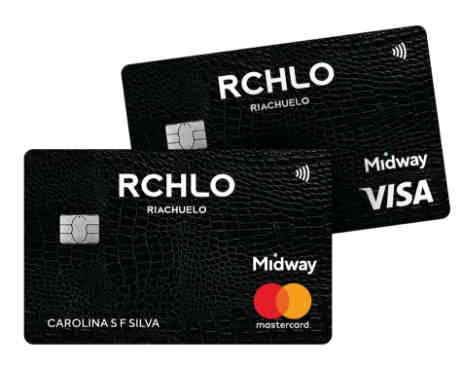

All the benefits of the Riachuelo card

The Riachuelo card has been growing more and more in the country, but are its advantages really good?

Keep Reading

Believe Who Wants: check out how to participate in this framework

Find out in this post how the Believe in Who Wants framework works in practice and check out the main advantages of participating in it!

Keep ReadingYou may also like

Discover the LATAM Pass Internacional card: 1.3 points for every dollar spent!

Travel with exclusive benefits! The LATAM Pass Internacional Card offers free annual fees, discounts on tickets and the accumulation of points to make your financial experiences even more rewarding. Request now and transform the way you explore the world!

Keep Reading

How to open a current account Banco Best Digital +

The Banco Best Digital + current account is a great opportunity to manage finances with peace of mind and security, taking advantage of all the benefits of the Visa network. To find out how to open an account, just continue reading with us!

Keep Reading

How to get miles with the Porto Seguro card? Check the process

If you travel a lot and want to save on your airline tickets, knowing how to get miles with the Porto Seguro card is a great alternative. Continue reading and learn all about the points program that offers miles.

Keep Reading