Cards

Unicred Gold Card or Zencard Card: which is better?

If you are looking for a new credit card, how about checking out two very different options. So, read our comparison and see the main features of the Unicred Gold and Zencard cards. After that, choose yours and enjoy amazing rewards programs.

Advertisement

Unicred Gold x Zencard: find out which one to choose

Firstly, choosing between the Unicred Gold card or Zencard card will give you the chance you need to access a credit card with an international brand, low fees and application functionality.

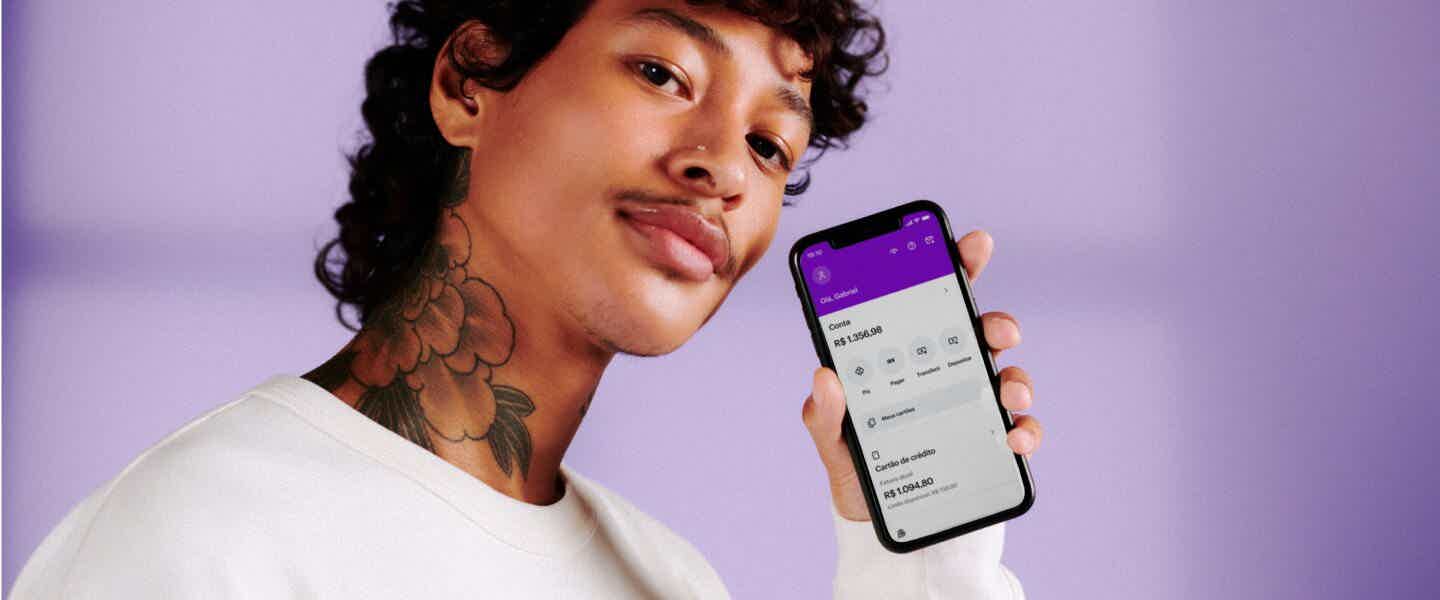

In short, the Zencard card is for negative customers who need an option to pay via credit. In other words, there are no consultations at SPC and Serasa to request this card. In fact, use it for online purchases and in stores outside Brazil.

On the other hand, the Unicred Gold card has the benefits of the Mastercard brand, such as a points and accumulation program that generates exchanges for products or airline miles. In addition, there is movement and monitoring via application.

Furthermore, both cards are ideal for those looking for immediate approval and little bureaucracy. Therefore, follow the comparison and ask any questions related to the options. Let's go!

How to apply for the Zencard card

Negative, it's time to buy on credit! The Zencard card does not perform credit analysis and also offers loans to those with a bad name. Request!

How to apply for Unicred Gold card

The Unicred Gold card is a great option for an international credit card with several advantages for customers. See here how to order yours!

| Unicred Gold Card | Zencard card | |

| Minimum Income | not informed | not required |

| Annuity | not informed | 12x of R$ 7.90 |

| Flag | Mastercard or Visa | MasterCard |

| Roof | International | International |

| Benefits | 40 days for payment; Withdrawals at Unicred terminals; Unique Rewards Program. | No proof of income or consultations at bureaus; Make international purchases with a credit card; Prepaid without monthly bill. |

Unicred Gold Card

The Unicred Gold card was created by the Unicred cooperative, which has existed for 32 years. So, in this version the customer has the advantages of a Gold customer and benefits of the chosen brand. In other words, decide on Mastercard or Visa.

Furthermore, this card is an option for international purchases or installments in any physical store, as well as online. On the other hand, you need to open an account and wait for a credit analysis to get the Gold card. In fact, Gold versions usually require a higher income.

However, Unicred does not provide this information to the customer. Furthermore, after approval, operate the account via the application and make inquiries or withdrawals at Unicred terminals. Therefore, whenever you have problems with your accounts, you can resolve them in person!

The most important thing is that this option gives you more time to pay. In other words, while most invoices must be paid within 30 days, this one allows 40 days for payment. Additionally, have additional cards to share expenses with whoever you want.

Finally, take advantage of the Mastercard Surpreenda or Vai de Visa programs, which guarantee discounts at thousands of partners. On the other hand, take advantage of the Unique Rewards Program to accumulate points and exchange them for miles or products.

Zencard card

Firstly, this is a pay-as-you-go option. In other words, there is no way to pay in installments. However, you can pay via credit for national and international purchases. Furthermore, it is the ideal card for negative customers who need the modality, mainly to pay for Netflix or Spotify, for example.

So, even if you have restrictions, you can use the card, as it does not carry out credit analysis. Therefore, load your card with the amount to be spent and make purchases in cash. Furthermore, this card can help you obtain personal credit.

Recently, the company entered into a partnership with Credluz, which provides credit to negative people. Therefore, once the money is released, use it as a credit limit. So, take advantage of this card and also monitor your digital account through an app.

It is possible to request this option without leaving home. In other words, go to the Zencard website and wait for the card to arrive. After that, release it through the app and enjoy. Finally, it is possible to withdraw the money inserted into the digital account.

In conclusion, this option is ideal for negative individuals who need credit, which is so essential for various transactions. Plus, get Mastercard benefits and much more!

What are the advantages of the Unicred Gold card?

Among the main advantages of Unicred Gold is technology. In other words, the card has contactless payment, has a complete application in which you control your finances and also receives a digital invoice.

Additionally, take the opportunity to make international purchases and enjoy the cooperative's rewards program. In fact, with this program you accumulate points and exchange them for cashback, services or products, in addition to airline tickets.

On the other hand, also take advantage of one of the points programs offered by the brand, such as Vai de Visa or Mastercard Surpreenda. Additionally, have emergency withdrawals and cards, as well as extended warranty insurance, purchase and price protection.

What are the advantages of the Zencard card?

The most important thing is that this card gives negative access to purchases with a credit card. Furthermore, it is ideal for trying to borrow, even with restrictions, through Credluz, a Zencard partner company.

What stands out is that this loan does not disrupt your financial life, another advantage. In fact, the installments are deducted from the electricity bill, and you pay with peace of mind.

Additionally, enjoy the brand's benefits, such as the Mastercard Surpreenda program, for example. Furthermore, take advantage of discount clubs and secure coupons to purchase at a reduced price from partners.

What are the disadvantages of the Unicred Gold card?

We highlight that only those who open a bank account with the cooperative will be able to take advantage of this Gold version. Furthermore, most Gold cards require an income above the minimum wage, so be careful when applying.

Another disadvantage is that only people with a clean name can apply for a credit card. In other words, there is credit analysis and presentation of documents. Finally, it is also not advantageous to have to go to the branch to request this card, which is required by the cooperative.

What are the disadvantages of the Zencard card?

As it is a prepaid card, Zencard customers cannot pay in installments, unfortunately. Additionally, there are some fees that can be heavy on this card, for example.

If you need to withdraw from the limit, there is a fee of R$ 6.90. On the other hand, there are also charges for refills. So, pay three to four reais to insert money via deposit or at the lottery. Finally, there is a monthly expense of R$7.90 for using the card. Finally, pay R$1.50 each time you transfer between prepaid cards.

Unicred Gold Card or Zencard Card: which one to choose?

By the way, was it difficult to choose between the Unicred Gold card or the Zencard card? Certainly, they are cards full of advantages and that fit different financial profiles.

In short, the Unicred Gold card is for members who need a credit card with a high limit, as well as advantages related to rewards programs and available brands. However, the client must have a clean name and a high score.

On the other hand, the Zencard card is the solution for negative people. Certainly, many missed the chance to purchase credit with a bad name. So, this prepaid option comes as an easy way to pay for Netflix, Spotify and other applications, for example.

Therefore, before deciding, look at your financial situation, in addition to your CPF status. Only then will you know which option is ideal. Also, evaluate your priorities: do you want to pay for small purchases every month or do you want a high limit for travel and courses?

Finally, don't worry if the decision is still difficult. In fact, there is other recommended content below to make your choice easier. So stay with us!

Afinz card or BMG card

Are you in doubt between the Afinz card or the BMG card? Both have international coverage and great rewards programs. Learn more here!

Trending Topics

How to apply for a bank loan

The Nubank loan has fixed installments of up to 24 months and low interest rates. Check out how to order yours today!

Keep Reading

How to work in big companies? Check the options

Want to learn how to work in big companies? Discover in this post 18 large Brazilian companies that are hiring!

Keep Reading

7 cards for negative public servants 2021

Meet 7 cards for negative public servants to make your financial life easier and insert you into the market in a very easy way!

Keep ReadingYou may also like

How to open a BitcoinToYou brokerage account

Open your BitcoinToYou brokerage account through the website, make the initial deposit and invest in the main digital currencies. Learn how to have your account and make deposits in the post below.

Keep Reading

Discover the Bradesco Marvel card

Do you want to live a unique experience inspired by Marvel movies and also enjoy unique benefits? Discover the Bradesco Marvel card here.

Keep Reading

What is the difference between the Brazil Aid and the Permanent Aid, and who can receive the benefits?

The Chamber of Deputies advanced in discussions on the creation of specific aid to support single mothers in a state of economic vulnerability in the country. However, beneficiaries of Auxílio Brasil want to know if they are also entitled to the allowance. Check out!

Keep Reading