loans

How to apply for a bank loan

The Nubank loan has fixed installments of up to 24 months and low interest rates. Check out how to order yours today!

Advertisement

Nubank: payment within 90 days after hiring

If you are looking for credit without bureaucracy and a quick application, the Nubank loan can be a good option.

So, in addition to having reduced interest and installments in up to 2 years, you can also do the entire process online. So, check out how to apply for your loan today!

Order online

Well, the request is made online 100%, directly through the Nubank digital account.

First, you must access your account and check if the option is enabled. If so, click to run the simulation and discover all the conditions available to you.

So, just check the information and check if the values are in order. If you agree with the conditions, you can confirm. After that, if everything is correct with your analysis, the money goes directly into Nubank's digital account. Simple, isn't it?

Request via phone

Although it is not possible to make the request by phone, you can ask all your questions about the process at the following number: 0800 608 6236.

Also, if you prefer, send an email to [email protected].

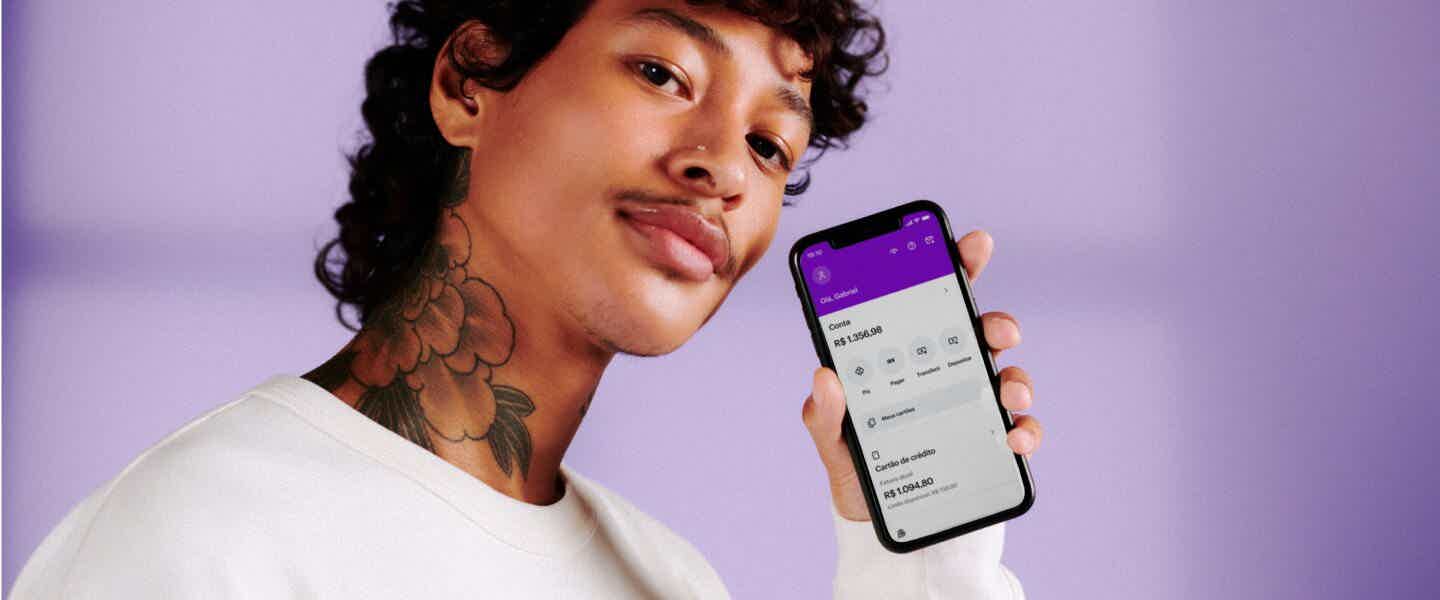

Request by app

So, the request is made directly through your digital account in the Nubank app.

So all you have to do is download the app, which is available on Google Play and the App Store. Then, carry out the simulation step by step and confirm the loan.

Agibank loan or Nubank loan: which one to choose?

But if you've come this far and are still in doubt about the best loan choice for your financial life, don't worry!

Therefore, we have prepared a special comparison between the Nubank loan and the Agibank loan. Thus, you have one more option to make the best decision according to your needs. So, check it out below!

| Agibank | Nubank | |

| Minimum Income | On request | On request |

| Interest rate | Variable | Variable |

| Deadline to pay | Up to 84 months | Up to 24 months |

| Where to use the credit | Renovating the house, financial unforeseen | Take a trip, start a business |

| Benefits | No SPC or Serasa consultation, payroll deduction | Online hiring, reduced interest rates |

How to apply for the Agibank loan

If you already understood what the Agibank loan for negatives is and you were delighted with its advantages, the time has come to find out how to apply for it. So check it out here!

About the author / Amanda Laet

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pan Bank loan online: 4 credit offers for you

Get to know the 4 types of Banco Pan loan online and find out the amount of credit you can access with them!

Keep Reading

How to check PIS 2021 balance

Have you worked more than 30 days with a formal contract and want to know the amount of your benefit? So, here's how to check your PIS 2021 balance.

Keep Reading

What is the best digital account to receive assistance in Brazil?

Do you want to know which is the best digital account to receive Brazil Aid? See in this article the 10 options for you to receive the benefit.

Keep ReadingYou may also like

Nubank Emergency Aid: clear your doubts now!

Find out now how to apply for emergency aid. Comment at the end if you got yours, and if you didn't, our team will get in touch.

Keep Reading

BPI Bank Personal Credit: what is it?

Do you want a customizable loan for yourself in which you choose the term, amount and value of installments? So, check out these and other advantages of Banco BPI Personal Credit.

Keep Reading