loans

Serasa eCred: best loan options for NEGATIVES

Did you know that it is possible to get a loan even if you are negative? That's right, get to know Serasa eCred and get out of the red.

Advertisement

Get to know Serasa eCred

It is common to believe that it is difficult to achieve loans for negatives. After all, this is fairly widespread information. However, it is not fully consistent with reality. There are indeed possible alternatives, such as the loan for negatives, Serasa eCred.

Thus, the purpose of this post is to show what they are. Here, you will find out how to get help. See how to get this can be simpler than it seems.

Serasa eCred loans for negatives

This tool is considered an extension of Serasa. It has partnerships with several banks and financial institutions. The purpose of this platform is to make life easier for people looking to find a good line of credit.

Thus, you can access loans, financing and credit cards. There are many options in one tool. Still, it is very simple and practical to handle.

That way, you don't need a lot of knowledge in technology to get what you want. The next topics will cover in more detail how to use Serasa eCred.

What is Serasa eCred?

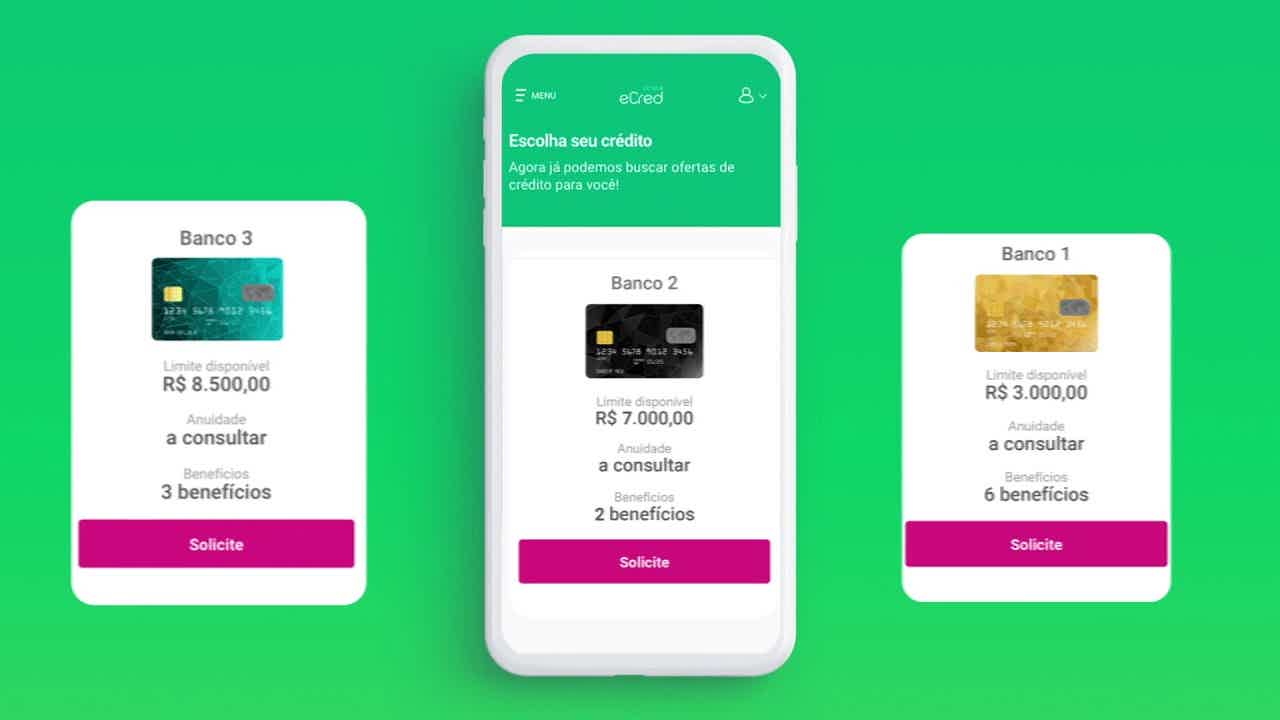

It is a great Credit Marketeplace. Many even consider it to be a kind of online shopping mall. In it, you have numerous loan and card offers at hand.

In addition, it is possible to establish partnerships with several banks, fintechs and other institutions of the kind. The coolest thing is that everything is done virtually and free of charge. After all, it makes no sense for someone who needs money to pay for this service.

The purpose of this platform is to make you have the best experience. This is when looking for a line of credit. In addition, it offers a personalized service.

That way, you can view offers that exactly fit your profile. This makes it possible to have access to a whole fee scheme and payment terms.

Still, make the necessary comparisons in search of choosing the best alternative. All this can be done without having to move and in a few minutes. Undoubtedly, practicality here is one of the biggest advantages.

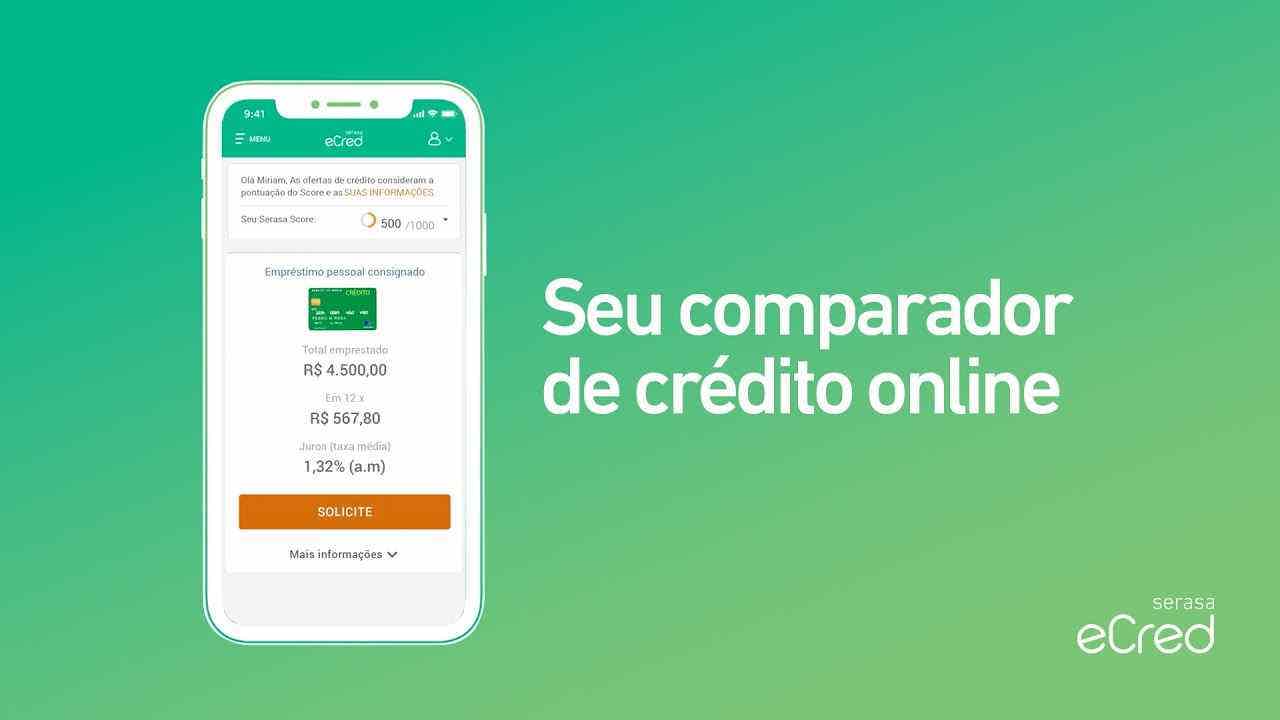

How does Serasa eCred work?

To access this platform, you just need to access the website. Then you need to answer some questions. They are the ones who will help you build your profile and select the best proposals. Therefore, answer as honestly as possible.

Also, you can check out these offers at any time. Just register on the same site. However, if you already have a Serasa record, this step will no longer be a requirement.

Once you've gone through these steps and chosen your line of credit, it's time for the second step. You need to send some documentation to the company responsible for the proposal.

Then she will evaluate everything and approve or not your request. It is important to emphasize that each company has its own credit policies. So one doesn't work the same way as the other.

If you have been rejected by an institution, this does not mean that all will give the same verdict. So it's worth every try. In addition, this tool also offers personal loans.

Another important point, it does not require any type of advance. Even when other platforms make this request, it's an indication of a coup. So beware.

However, some Serasa partner companies can make this request. This, then, is entirely their responsibility. Ideally, you should always discuss this with them before making any decision.

In summary, Serasa eCred is the safest and most reliable way to obtain benefits. It is a very simple and less bureaucratic process.

Loans for negatives

This is a possibility for you to seek to clear your name. The most interesting thing is that you can do several simulations. This without making any impact on your score.

Generally, people do not believe that there is the alternative of loans for negatives. However, this is very wrong information.

Still, numerous companies specialize in offering credit to people in this situation. However, that doesn't mean you shouldn't be very careful.

Interest rates in these cases are not always attractive. Therefore, it is necessary to do a lot of research until you find a good partnership. This can be a rather laborious activity.

However, believe me, the result is so worth it. The best way to do this search is through Serasa. In this way, your order is made completely virtual.

During this reading you will check the other advantages that this platform can offer you. Now, see what options exist for those who are negative. Understand how to achieve your goals even in this situation.

Negative self-employed loan

This is a type of credit line aimed at people who have some debt. However, they do not have a formal contract, that is, they are not CLT.

Thus, anyone who works as a freelancer knows that the end of the month can be uncertain. It is not always possible to obtain the necessary amount to confirm all payments. Therefore, a loan is always a good option.

That way, you are prepared for any emergency situation. Another important point is that freelancers are more difficult to prove income. So, credit assessment is usually more demanding.

Of course, this can complicate getting an interesting partnership. But from afar it is impossible. Once again, good research is required. There are institutions that are very open and can be excellent facilitators. The main thing is not to give up trying.

To prove your income, you have some alternatives. Thus, there is no need to present an active contract with any company. Check your options below.

- Bank transactions: presenting your bank statement;

- Income tax: helps justify the loan application amount.

How to simulate loan for negative in Serasa eCred?

The first thing you need to do is enter the website. Then just log in. For this, it is necessary to enter your previously registered CPF and password.

Then just click simulate now. You will be directed to a page where you must answer some questions. Not many, just enough to understand your profile.

Also, it is necessary to choose the desired type of credit: loan or card. Once this is done, you will be able to view your available offers. This goes for the two lines above.

Do not forget that all these proposals will have as the questionnaire. Therefore, all of them will be consistent with your final goals. So, just select the most interesting one within your needs. Don't worry, the whole process is free.

7 loan options for negatives in addition to Serasa eCred

Next, get to know the partner companies of the Serasa eCred platform with loans for bad debtors.

Credits

It provides the loan with vehicle guarantee. So, with Creditas, you have a more favorable scenario. This is how much compared to other types of loans. In addition, it has a lower interest rate.

pan bank

He is known for offering numerous credit solutions. The main one is the Pan credit card, which has 4 variations. Two of them are aimed at people earning only the minimum wage. The others are suitable for those with an income of up to 5,000 monthly.

type

It is considered a member of the new generation of financial alternatives. The Digio Card is a credit card that has no annual fee and no retroactive interest. In addition, it offers an application for easier access.

Itau

Simply one of the main banks in the country. It provides all financial modalities. So, you can choose between checking account, credit card, financing, insurance and so on.

In this case, here you would have the Itaucard Click. They also have an app so that your transactions can be carried out more easily. So, it is possible to remove the digital invoice and the points programs on the card.

legendary

Known therefore for offering fair and also personalized credit rates. That way, you have exactly what you need. It is therefore an excellent alternative for those seeking more specific goals.

Pag!

Here then, you have access to a digital account. With it, you can make payments and transfers at any time. Also, it has no annual fee and offers discounts at various stores and partner sites.

BV

It is one of the simplest and most practical alternatives to get your personal credit. With BV then, you can access all the necessary information about loans. Thus, no unwanted unforeseen events.

Some advantages of Serasa eCred

The possibilities here are immense. You have at hand a range of options to achieve your goals. Check out some of the biggest advantages available within this credit tool.

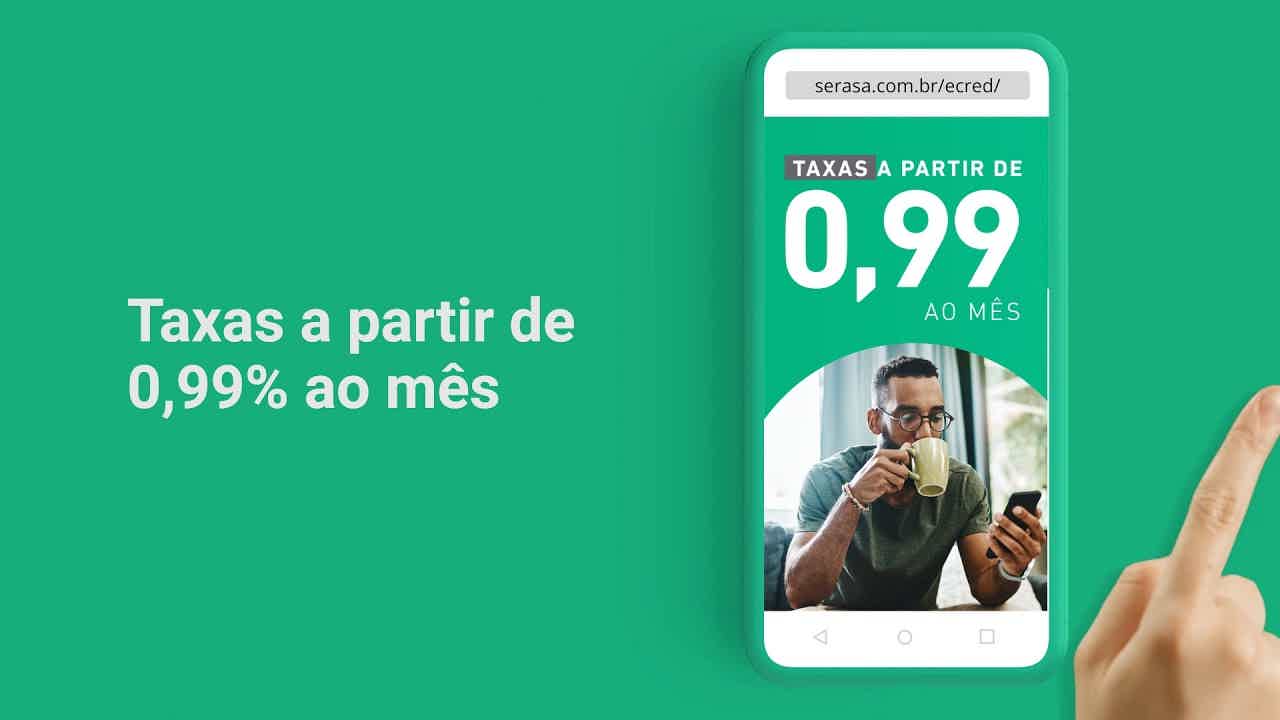

Diversity

You can choose from several cards. Each of them has a set of distinct benefits. This is to personalize the service and ensure that your needs are met. Also, the fees charged are low, starting at 0.75% am

Simulations

No need to worry about making a hasty decision. Here, you are able to simulate different scenarios without paying a penny. So, it is possible to choose the best credit alternatives with a lot of calm and planning.

Speed and practicality

Many credit schemes make you wait for the money. This tool works exactly the opposite. The amount drops into your account almost immediately. So you can start your plans as soon as possible.

Security

One point that you should always pay close attention to in any type of transaction is security. In the case of this tool, the protection of your data is guaranteed. That way, you don't have to worry about possible unpleasant unforeseen events.

Frequently asked questions about Serasa eCred

By now, you already know a lot about it. However, the purpose of this article is that there is no question left. Therefore, follow some of the most frequent questions about this loan scheme.

Payroll loan Serasa eCred

Payroll credit is one of the most popular lines of credit. That's because it's the cheapest on the market. That's why it attracts so many people's attention.

In addition, there is a group of people who can access this modality more easily. So, the criteria required for this audience are as follows.

Possess a signed portfolio, may be retired, INSS pensioner or public servant. If you fit into any of these options, know that you can take out a loan at any time.

Serasa Score x partner offer

Many people do not know that their score influences the offer of partners. This is because it is a score generated based on data present in Serasa.

Therefore, it can be used as a criterion for releasing some financial credit. The higher your score, the greater the chances of success.

If your score is low, it is possible to get a loan. Of course, as mentioned above, ideally this score should be high. Even so, this does not guarantee a credit approval.

This depends on each financial institution. Therefore, it is recommended that you contact the latter if you receive a negative response.

Interest rate and IOF

It is common for financial institutions not to include IOF in the interest rate. However, it integrates what is called “Total Effective Cost”.

This allows you to evaluate the best credit alternatives. Thus, it is recommended that it is always taken into account.

Is it worth applying for a loan online at Serasa eCred?

So, the answer is without a doubt. But there are many opportunities on one platform. It's everything you need to ensure your goals are met.

Of course, it is necessary to be careful. This goes for any and all forms of credit lines. Ideally, then, you analyze everything very calmly. Remember the importance of rationality at this time. So, you can choose something that is really interesting.

So a tip is to abuse the simulator option. The platform gives you a range of all alternatives. Also, if your proposal is rejected, don't be discouraged. There are also numerous partner companies. Therefore, surely one of them will provide you with the credit you want.

So, can you get a loan for bad credit?

Finally, you can loans for negatives. Remember that Serasa has specific modalities for this group. So it doesn't matter if you are self-employed or not. Your plans will not be disturbed by anything.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Camera Detector Apps: Find out if you're being watched

Use hidden camera detector and protect your privacy. Download now and be in charge of your security!

Keep Reading

Mercado Pago Card or Superdigital Card: which one to choose?

Either the Mercado Pago card or the Superdigital card, both have international coverage and a digital account for you to take care of your finances. Check out!

Keep ReadingYou may also like

Santander SX University Card or Superdigital Card: which one to choose?

Santander SX University Card or Superdigital Card? To find out which is the best card, read our post and check out our comparative text.

Keep Reading

Abanca Gold credit card: what is Abanca Gold?

What is the Abanca Gold card? This is a Portuguese financial product with many benefits, such as insurance and assistance. Read this post and check out everything about it.

Keep Reading

How to apply for LATAM Pass Itaucard Visa Infinite card

For those who do not yet have the LATAM Pass Itaucard Visa Infinite card, the request can be made quickly and easily, wherever you are. The card offers a points program and many benefits. See how the process works here in this article.

Keep Reading