Financial education

Do you know your financial profile?

Financial profile is an essential factor to understand how you relate to money and define goals and objectives. Click and learn more!

Advertisement

Find out your financial profile

Many times you must have heard how important it is to have good planning of your personal finances, right? And surely you must have read before that it is essential to understand what your financial profile is. But do you really know what a financial profile is and how to find yours?

Well, if you answered no, this article is perfect for you! Because here we have gathered all the necessary information so that you know everything about the financial profile and how it can make all the difference in your financial organization.

Thus, those who discover their own financial profile can create strategies to control expenses, investments, plan better trips or save money. So, did you just see how important it is for you to discover your financial profile?

So, be sure to read everything we've gathered about it in this article. Check it out below!

What is financial profile?

Basically, your financial profile is based on how you relate to money. And surely you must have even done an analysis of the profile of close people like friends and family, identifying who is more spender or more closed-minded, right?

So this is what we call a financial profile. But, of course, in a less simplified way to be able to understand specifically what your relationships are with what enters and leaves your account every month and year.

That is, to draw your financial profile, you will need to reflect to understand some of your personal characteristics in relation to money. For example:

- How do you use your money once you receive it?

- Do you spend more on essentials or non-essentials?

- Do you tend to use many different personal lines of credit, such as credit cards, overdrafts, loans, etc.?

- Do you usually have money left over at the end of the month?

- Do you save a portion of your income every month?

- Do you make investments of any kind?

- Do you have debts and/or are you negative?

- What are the main types of expenses you have every month?

- Do you have more than one credit card? Or do you just use debit?

And so on. So, you already have an idea of what types of attitudes and financial decisions make up your financial profile, right? But to help you, you can count on several types of online tests to define which one is yours.

For example, Serasa itself offers a free online test on its official website so that you know your financial profile. Very interesting. it is not? And know that there are different types of profiles. Find out what they are below!

Financial profile types

Generally speaking, a person's financial profile can fit into five different types. So, when you go to take a profile test, you will fit into one of the following types:

- Debtor;

- Spender;

- Off;

- saver;

- Investor.

But to make it even clearer what these types of financial profiles are, let's explain each one. So keep reading and check it out!

Debtor

This financial profile, as the name implies, is that of people who lose balance in their expenses in such a chaotic way that they always end up in debt. Thus, this type of profile is more likely to fall into risky debt and become over-indebted.

And this is because that person's expenses always exceed their income, making them need to apply for loans or be in debt for their credit card and overdraft. In this way, their debts also end up being greater than the total amount that this person has in equity.

That is, those with this financial profile end up thinking more about the now and less about the later, forgetting that emergencies may occur in life that require an immediate cash reserve. But as this profile is incapable of planning the future, it always ends up in debt and suffering a lot from stress due to the lack of money in times of need.

Spender

It can be a profile that is very similar to the Debtor, since he also thinks more about now than about future planning. However, the essential difference between these 2 profiles lies in the fact that the Spender does not exceed the value of what he earns.

That is, this financial profile basically spends everything it receives every month. Thus, it does not create debts, but it also does not manage to save money for emergency situations in which it may be needed.

Therefore, when you get to a situation where you need immediate cash, the Spender profile can easily end up becoming a Debtor financial profile.

But while this does not occur, the Spender does not accumulate debts, but he is also unable to create his own equity. Because in general it spends a lot on superfluous goods that do not add equity value.

Off

This financial profile is the most moderate, not spending everything you earn and not accumulating debts. However, he is a person who is not aware of the need to save money or invest part of his income.

Thus, what is left over at the end of the month is often forgotten in the checking account, without any planning on how to save or invest that income. And there may also be a lack of money at the end of the month, then the Disconnected profile can pay invoices and bills in installments, but balance their accounts again with the surplus for the next month.

However, the person with this financial profile ends up not thinking about the need to understand and plan their personal finances. Thus, despite being more moderate and without debt, those with this profile are unable to accumulate capital and make their assets grow in the long term.

saver

This financial profile is the one that thinks most about the future, thinking about saving money for unforeseen events. In addition, they know they need to invest, but prefer to have the security of a fixed income, with investments that have guaranteed profitability.

Thus, they are people who plan for the future and do not like to risk their money. But they end up not studying more about the investment world, resigning themselves to safer financial assets such as savings, CDB and Direct Treasury.

Investor

And the last financial profile is that of the Investor. As the name suggests, those with this profile like to study how the financial market works and how capital flows. In addition, they know how to make money go well and strive for it.

Thus, they seek to grow more and more in their applications, without fear of higher risk investments. Therefore, they are people who plan and prepare themselves in order to be able to risk losing some of their money, without being greatly harmed.

And then, those with this financial profile manage to have more assets, stability and even retire earlier. In addition, you live without the stress of debt and not having money for emergencies or big expenses.

Did you just see how many differences between the financial profiles? So how about finding out which one is yours?

How to discover your financial profile?

We know that the financial profile is an essential factor for you to understand what your financial planning strategy should be, right? But how can you discover yours?

Basically, you need to understand yourself and analyze well what your attitudes and decisions are in relation to your money. That is, record expenses, income, debts, etc. That way, you can see which financial profile you are most like, and understand how to get to the profile you want.

In this way, you will be able to have better financial planning and increase your knowledge in financial education. And to help you, there are many financial profile tests that are completely online and free, like on the Serasa platform.

So be sure to find out what your financial profile is. Because this is the first step towards identifying where you should change habits and improve strategies, to have a different relationship with money.

So now it's time to go back and find out what your profile is!

What affects your financial profile?

Now that you know that there are different types of financial profile, and why it is important to know which one is yours, how about understanding what factors shape this profile?

So keep in mind that the main factors that affect your financial profile are your beliefs and values regarding money. And to better understand what we are talking about, ask yourself the following questions:

- Can you identify what you think about it?

- What is your idea of financial success?

- What does money mean to you?

- What are your consumer desires?

- And what do you expect from your financial life in the future?

Because these questions are usually things that don't cross our minds, but that reflect the way we relate to money. And so they form our financial profile.

In addition, the way his family raised him was his first example of a relationship with money. So thinking about how you grew up watching your family deal with spending, debt, etc makes all the difference.

And even friends and celebrities that we idolize influence our way of relating to money. Also, think about your spending habits, your spending patterns, and what you prioritize when spending your money.

Financial psychology: understand how it affects you

Did you know that financial psychology can affect your pocket? Then learn how to use it positively to improve your finances.

Why should you know your financial profile?

As we've already said, the financial profile represents everything you think and do about your money. From your spending pattern to how you live your life and think about the future. Therefore, understanding what your profile is can facilitate the process of reflection and change.

That is, a person who perceives himself in the debt profile may notice attitudes towards money that are highly dangerous for him. And so you can commit to improving your habits, managing to pay off your debts and/or stop being negative.

Therefore, by knowing your financial profile you can do essential things such as:

- Better organize finances and obtain more efficient results;

- Also conquer more quality of life;

- And do more with the money you earn.

Did you just see how many benefits you can have in your life simply by better understanding your financial profile?

Now discover yours and change your attitude towards money!

So, now that you know how important it is to know your financial profile and all the improvements it can bring to your life, it's time to discover yours.

And for that, just look for a financial profile test that is reliable, such as the online test available on the Serasa platform. After that, sit down and do an analysis of your finances, trying to identify the habits there that confirm the result of your financial profile.

That way, it will be easier to understand where you need to improve, which habits to change and which ones to keep. In addition to making better strategic decisions to make your money go further, have a reserve amount for emergencies, etc. So, you will be able to live better with less stress related to money, right?

Therefore, discover your financial profile and start changing your attitude towards your money now. Because now you already know that this can only bring you benefits and peace of mind!

And so we come to the end of our exclusive article with everything you need to know about the profile. So hopefully now it's easier to identify your profile and make the necessary changes to improve your overall financial health.

Therefore, do not underestimate the importance of good financial planning, and studying more about financial education. Because, in the end, the biggest beneficiary will always be yourself, right?

So we want you to discover your profile and make good changes for a more stable and peaceful financial future. And who doesn't want financial security and see their money yielding, isn't it! So put our tips into practice.

How to improve your relationship with money?

Improving your relationship with money can seem complicated and difficult. But it is not! Then check out our tips to make your life easier.

About the author / Aline Saes

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Natura Pay digital account

Check out in this post the main advantages of being a Natura Pay account, how to get paid for your sales safely.

Keep Reading

Ourocard Universitário Card or Santander Universitário Card: which one to choose?

Need a reasonable limit and no proof of income? So, choose between the Ourocard Universitário card or the Santander Universitário card.

Keep Reading

Bradesco loan or Superdigital loan: which one to choose?

Bradesco loan or Superdigital loan: do you know which one is the best option when taking out a personal loan? Check out!

Keep ReadingYou may also like

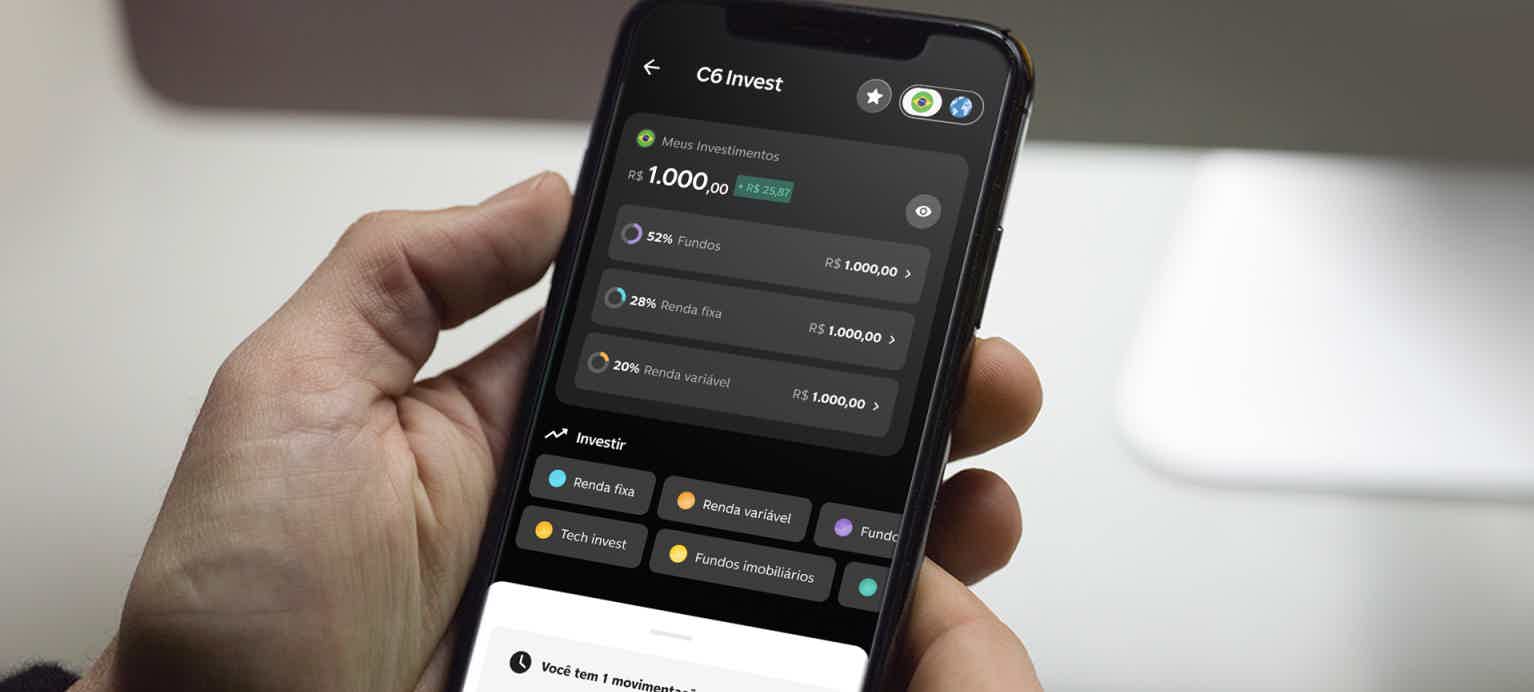

Investments in real estate funds by C6 Bank guarantee up to R$1,200.00 per month in passive income!

Thanks to advances in technology and the creation of investment platforms by digital banks, today it is possible to safely apply your savings to guarantee short-term or long-term profitability. With C6 Invest, you can earn passive income through real estate funds and earn up to R$1,200.00 per month for life. See more here!

Keep Reading

What is Serasa Score 2.0?

Serasa underwent an update and now, with Serasa Score 2.0, it is even easier and more accurate to obtain a score that matches your financial transactions. See more on the subject here.

Keep Reading

INSS table: see how the calculation turned out

The INSS Table changed with the 2019 Pension Reform. Now, the calculation is progressive and has some rules. Do you want to know how to calculate your rate and how much you can contribute? So, check out more information below.

Keep Reading