digital account

7 best digital wallets 2022

Digital wallets are great ways to make payments. With them, your purchases are much more practical and safe. Therefore, in today's article we will show you which are the best options for digital wallets. Continue reading to find out!

Advertisement

Discover how to make your payments with these digital wallets

The best digital wallets can help you make your day to day even more practical. That's because, with them, you register your cards and manage to make your online payments faster.

In short, it really is like a physical wallet, but only with your virtual cards. Therefore, it is also possible to change the cards at any time. And some wallets allow mobile payments, such as Apple Pay and Samsung Pay.

Continue reading and discover the best digital wallets in 2022!

What are the best digital wallets?

To understand the best digital wallet, you need to know which one will work best for your everyday life. For example, if your phone is from Apple, maybe Apple Pay is a better option.

It is worth remembering that it is also possible to use more than one digital wallet. How to use Samsung Pay on your cell phone and Google Pay on your computer or notebook, in Google Chrome. So, keep reading and see some types of online wallets.

1. Google Pay

Google Pay is Google's digital wallet. By the way, it is exclusive to the Android operating system. In addition, you can also use it on your computer. In this case, you need to browse through Google Chrome.

Therefore, Google Pay allows you to pay either by credit or debit card. It accepts several banks, such as Nubank, Bradesco and Banco do Brasil. In addition, Google Pay also has integration with the PayPal platform.

2. PicPay

PicPay has become one of the most famous digital wallets among users. This is because it is extremely easy to create and also has several advantages. Besides being completely free.

Therefore, PicPay is a payment application that you use your wallet to make purchases in the app itself. For example, if you need to pay a ticket or install a Pix. All this is possible by PicPay.

In addition, when leaving money in your PicPay digital wallet, your money yields up to 105% of the CDI. That is, much more than savings. Therefore, it is very worthwhile, in addition to registering your cards, to also leave some money there.

3. Apple Pay

As already mentioned, it is also possible to use digital wallets directly on your cell phone. In this way, for those who have IOS, Apple Pay is already integrated into the devices. In that sense, it is very simple to use.

Also, with Apple's digital wallet you can pay with just a few clicks. And security is up to Touch ID or Face ID. This way it is really very simple to pay and use.

In addition, it is worth remembering that Apple Pay is not compatible with all banks and flags. Some that you can register are, for example, Banco do Brasil, Itaú and Bradesco.

4. Samsung Pay

Following the line of electronics companies, Samsung also has its digital wallet. By the way, Samsung Pay is already integrated into the brand's devices. Therefore, payment is made by approximation.

When we talk about releasing the use of the card, Samsung Pay needs to be released at ATMs. This is due to security when using an approximation payment. In addition, the digital wallet also offers free transfers and the issuance of bank slips.

5. Love Digital

Ame Digital is a great digital wallet option, mainly because it has cashback on specific purchases. Therefore, you register your specific cards in the application and make your purchases normally.

In this way, Ame has partnered with stores such as Americanas and Submarino, to earn cashback on almost all purchases. It is a great solution to combine digital wallet with cash back.

In addition, Ame Digital also offers an international credit card with no annual fee for those who use the digital wallet.

6. Iti Itaú

Banco Itaú has been modernizing more and more, and created Iti. Although the advertisement is for a digital account, in practice it works more like a digital wallet. That's because you insert your credit or debit cards and you can make your purchases.

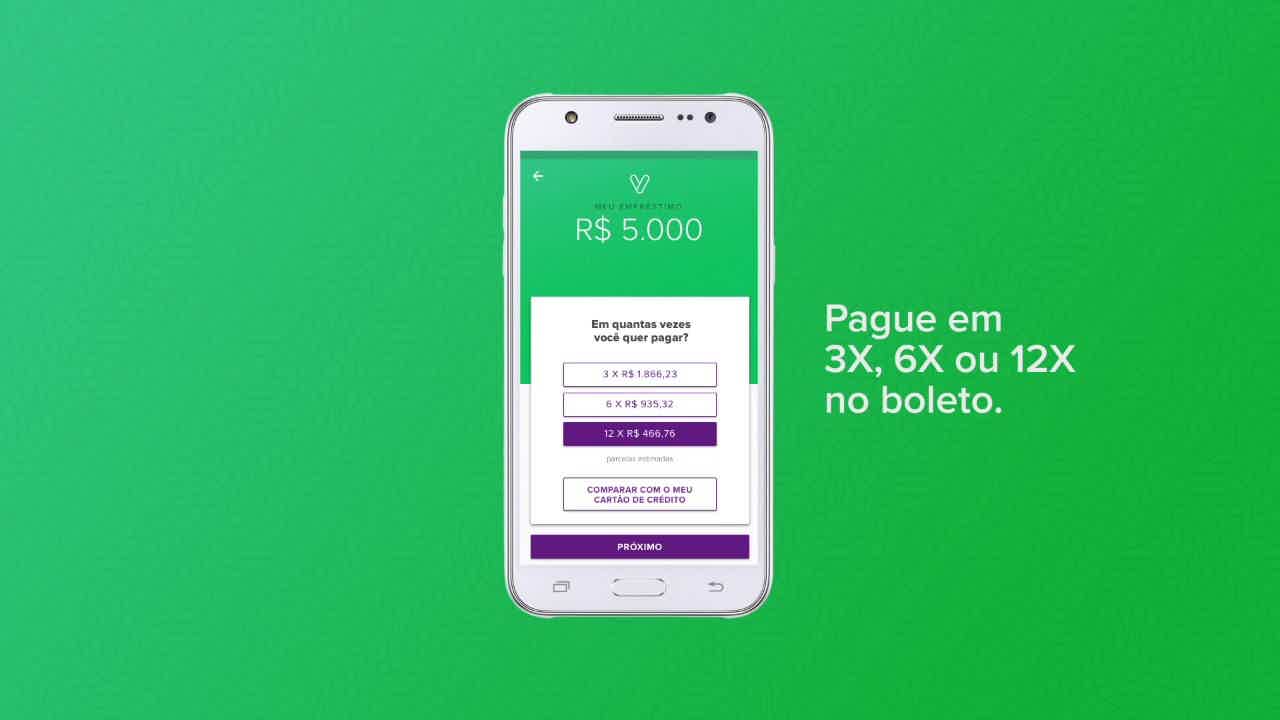

In addition, with Iti it is also possible to carry out transfers, such as a digital account format. Together, you can withdraw money from ATMs 24 hours a day and apply for personal loans.

7. BanQi

Finally, we have BanQi. This digital wallet was created by Via Varejo and works similarly to most digital wallets. But, in the case of BanQi, you can also create a checking account.

Therefore, it is also possible to make payments and transfers through the same digital wallet application.

Therefore, now you have learned a little more in detail about the best digital wallets in 2022. With the wallets, you can make your payments much more safely and conveniently.

To choose the best option for you, consider which device you use. In addition, also think about the issue that some wallets have cashback. By the way, nothing prevents you from using more than one wallet.

In addition, with this form of payment, you must be very attentive to possible scams. Mainly because most payments are made through NFC technology. That is, only approximation.

In the recommended article below, we give you some tips to avoid fraud in contactless payments. Continue reading through it and find out how to prevent yourself.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Magalu vacancies: how to check the options?

Check out in this post the main Magalu vacancies currently open and learn about the benefits that this company offers.

Keep Reading

How to apply for a car loan with BV Financeira

Find out how to apply for a loan with a BV Financeira car guarantee and take advantage of the credit to put your finances in order, check it out!

Keep Reading

How to apply for the Digimais card

We will show you how you can apply for the digital card and other tips on how this card works. Check out!

Keep ReadingYou may also like

How to apply for a loan online Noverde

Need to pay off a debt? The Noverde loan grants you up to R$4 thousand reais and installments in up to 12 months. Find out how to apply in the text below.

Keep Reading

Even if you have lost your Auxílio Brasil card, you can withdraw the benefit!

Even with the loss of the Auxílio Brasil benefit card, it is still possible to use the value of the benefit. In fact, you only need to have the CaixaTEM application installed on your cell phone to make payments, transfers and even ATM withdrawals.

Keep Reading

Ibovespa has a drop of 1.18% in the trading session on Wednesday before the announcement of the increase in the Selic rate

Amidst market expectations regarding the Monetary Policy Committee meeting on the Selic rate, Ibovespa fell by 1.18% and ended last Wednesday's session at 111,894 points.

Keep Reading