Cards

What is the Marisa card limit?

If you have one of the Marisa cards, you're probably wondering: what is the card limit? Or, how do I unlock it? So, read this post and find out the answers to these and other questions about this financial product.

Advertisement

Find out all about the limit and see how this card can make your purchases on the brand's network easier

If you buy clothes frequently, you've probably already visited Marisa stores. One of the largest clothing chains in Brazil, it has hundreds of stores spread throughout the country, as well as an e-commerce site. Thinking about making shopping easier for its customers, it created a credit card with discounts and special conditions. But what is the limit on the Marisa card?

Today, you will learn more about this card and its purchase limit. Check it out!

How to apply for the Marisa credit card?

In this article you will understand the exact step by step to order the traditional Marisa card and the Marisa Itaucard, all 100% online.

How does the Marisa card work?

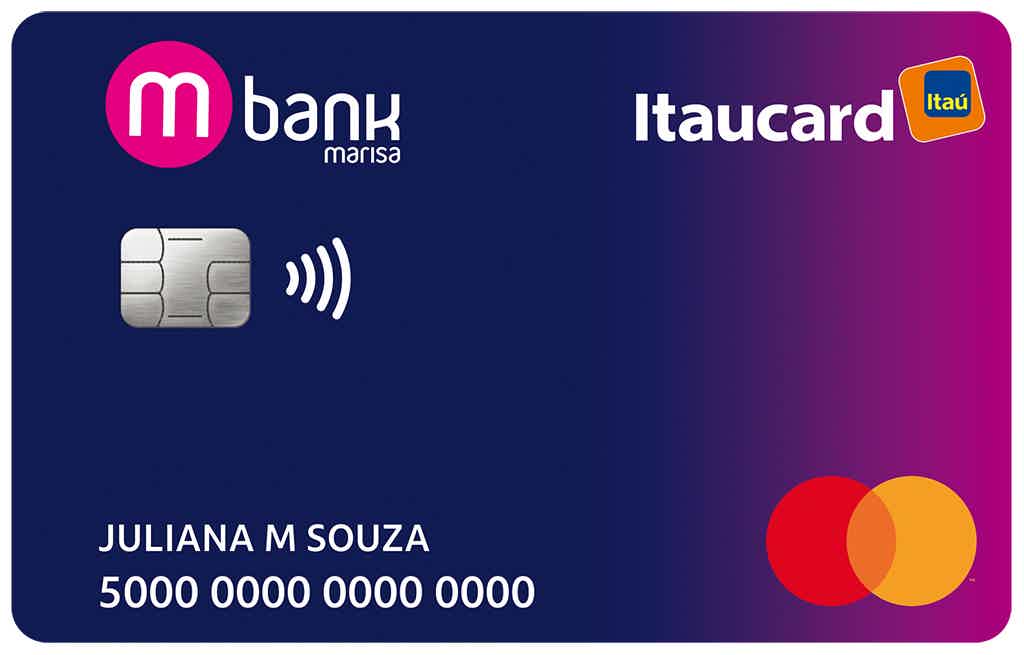

So, the Marisa credit card has two versions, the traditional Marisa card and the Marisa Itaucard. The first can only be used in the chain's stores, while the second is accepted in several establishments in Brazil and other countries, as it has international coverage. In addition, both cards can be used in the Marisa chain and come with exclusive discounts and conditions.

Furthermore, the Marisa Itaucard is a good alternative for those who also want to shop at other establishments without losing out on discounts at Marisa stores. However, it is worth noting that it charges an annual fee of R$10.90 per month, has a Mastercard brand and requires a minimum income of R$800.00. It is worth noting that there is a possibility of exemption from the annual fee if you spend at least R$1,500.00 per month on your bill.

On the other hand, the traditional Marisa card can only be used in Marisa stores, does not require a minimum income and has nationwide coverage. It also has no brand and the annual fee is R$$3.90 per month. In this case, the annual fee is different, meaning you only pay when there is an outstanding invoice.

However, for both Marisa Itaucard and traditional Marisa, bill payments can be made by bank slip or at Marisa stores, as well as at other banks. Therefore, go to the website and choose the best Marisa card option for you.

How do I unlock my Marisa card?

So, to unlock your Marisa card, you can go in person to one of the chain's physical stores with your card and personal documents in hand and request that your card be unlocked.

Remembering that there are several Marisa stores spread throughout Brazil, just choose the store closest to your home.

You can also contact the Marisa Customer Service Center and request the card to be unblocked using the following numbers:

- (11) 4004 2211 (capital);

- 0800 728 1122 (other locations).

Know everything about the Marisa credit card

Discover now all the characteristics of the Marisa card and the Marisa Itaucard card, two options offered by the store.

How does the Marisa card limit work?

Well, there is no defined limit, as the amount will depend on the credit analysis carried out at the time of requesting the card.

Furthermore, we recommend that when you apply for the card you have a high credit score, as the chances of the limit being high are also greater in these cases.

How do I increase my Marisa card limit?

So, after using the Marisa card for 90 days, you can request an increase in your card limit. To do so, you can contact the Customer Service Center directly or through the Marisa app itself.

We recommend that you have a good credit score when requesting an increase in your credit limit. You should also have a good financial history, i.e., you should have made several purchases at Marisa stores and paid your bills in full on the due date. This will increase your chances of approval for an increase in your credit limit.

How do I apply for the Marisa card?

To request the traditional Marisa card, you can go to a physical store with your personal documents or download the brand's app and place the order.

To apply for the Marisa Itaucard, go to the Itaú card page and find the financial product. Then click on “Apply now” and fill out the form.

In both cases, you must wait for the credit analysis. Then, if approved, you will receive the card at your address.

Do you have any questions about the application process? Then read our recommended content below and learn all about it.

How to apply for the Marisa credit card?

In this article you will understand the exact step by step to order the traditional Marisa card and the Marisa Itaucard, all 100% online.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Where can I apply for a prepaid card online?

If you have questions about how to apply for a prepaid card online or how to recharge it. So, read our post and learn all about it.

Keep Reading

How to negotiate debts with BB: check the options

Learn in this post the complete step-by-step for you to negotiate debts with BB and thus clear your name easily and without leaving home!

Keep Reading

Credits personal loan: what is it and how does it work

The Creditas loan offers three types of credit and the application is 100% online, without bureaucracy. Discover more benefits here!

Keep ReadingYou may also like

Discover the Single Portal – website launched by MEC to unify Prouni, Sisu and Fies registrations

It is now possible to enroll in the selective processes of Prouni, Fies and Sisu through a single registration on the Portal Único platform! Check here how it works and what content is offered by the new website of the Ministry of Education.

Keep Reading

What to sell to have extra income?

Are you out of ideas on how to make extra income? Don't worry! We list some ideas of what to sell to have a second source of income.

Keep Reading

Check out the rules and how to apply for the INSS death pension

As hard as it is to lose a loved one, dealing with the bureaucracy related to the death is necessary to guarantee support for dependents. So, find out how the INSS death pension works, and how to apply for it.

Keep Reading