loans

Loan by check: how does it work?

Want to borrow a value but don't know how to do it? Know that it is possible to borrow with a check. See how it works and its advantages

Advertisement

Find out if a check loan is a good option

The check loan is a good credit option for those looking for it. But, it is still not as popular as other options on the market, so it still has the lowest popular searches.

However, due to the increase in debt and reduction in income, many people need to seek credit with finance companies. At this moment, knowing new and advantageous options is very important.

To fulfill this request, we have prepared this article for you. Here you will understand how this modality works, its advantages and how to apply. Follow until the end!

What is a check loan?

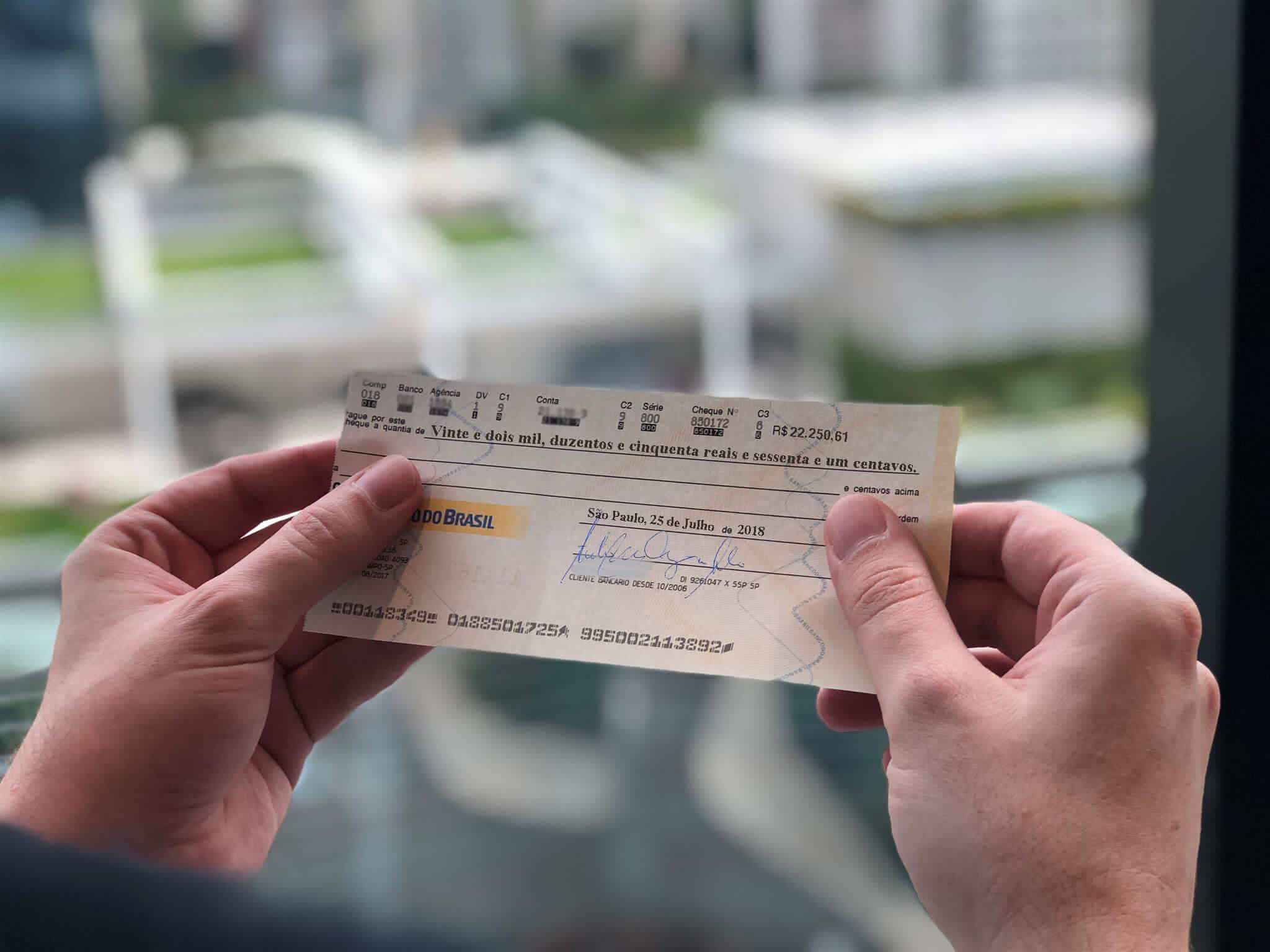

This type of credit is a personal modality that uses your nominal check sheets, already with pre-defined discount dates to pay the installments.

To hire this service, you will need to present personal documents such as RG, CPF, proof of income and residence. It is also necessary to take your checkbook with the amount of sheets referring to the total installments.

Thus, you agree with the company 12 installments for payment, for example. Then, the same amount of checks you will write, sign and deliver for storage by the lender until the date of your deposit.

For your safety and that of the company, you must complete the check. This measure is essential so that the day that has already been signed in the contract is not changed.

To apply for the credit, it will be necessary to have a current account, proof of income and, obviously, check sheets in the required amount. The applicant's account must have been operational for at least 6 months prior to the application.

How does the check loan work?

Like any other type of credit, this loan is based on collateral. The customer guarantees with the sheets the payment of the amount borrowed together with the stipulated interest rate.

Therefore, you deliver the sheets in the amount of installments, filled with the values and discount dates. The sheets are stored at the credit company and each month one is deducted.

This format ensures that the bank that made the loan then receives the amounts on time.

Therefore, before approval, a credit analysis step is carried out so that the financial institution can assess your documents and financial history.

If you are approved, you will sign the check sheets and deliver them to the creditor. The deadline for releasing the money into the checking account is usually 24 hours, but it may vary according to the institution's policies.

It is worth remembering that, as the checks have defined dates, you need to have money available in the account on the day of the discount. If not, your name may be denied.

What are the benefits of a check loan?

We always like to know the advantages before performing a procedure. So, it is worth saying that you will get several advantages with this type of offer, especially if you compare it to others.

This type of credit line offers the possibility for the customer to obtain credit with lower interest rates in a short period of time, thus making it feasible even when the consumer needs money for an emergency.

As with secured loans, the interest rates applied are lower than those applied to other types of loans. In addition, the checks you deliver are proof of payment and bring security to the financial institution. So approval is easy and fast.

The check loan has little or no bureaucracy, both in the progress of negotiations and in the availability of the amount. There is no type of intermediation involved in depositing the money, which can be in the applicant's checking account in just 24 hours.

What are the disadvantages of a check loan?

Of course, even such a loan also has disadvantages. If it is done with a company without reference in the market, it may act in bad faith and deposit before the date, in which case it may harm your bank account.

In addition, there is also the downside of the credit limit. It is restricted and lies between the minimum of R$200.00 and the maximum of R3000.00.

For consumers who need a larger amount, they should look for other types of credit. However, among the options, the one that allows larger amounts is the loan with property guarantee.

Advantages of the Itaú Real Estate Loan

If you are interested in learning about the benefits of Itaú Real Estate Loan, then you are in the right place. Read our text and understand more

Another disadvantage is the possibility of protesting your name if you do not close the account for the current month. This in itself already shows the financial institution that the credit card is unable to pay off the loan.

If the customer does not have enough money in the account when the institution makes the deposit, the consumer is automatically considered in default, getting a dirty name. Having a dirty name can bring difficulties when acquiring a good, such as a property or vehicle, or even when you want to take out other loans.

Who can apply for a check loan?

There is no restriction on who can or cannot borrow by check, it is only necessary that the person has an active checking account at a financial institution and can also prove their income.

With the condition of becoming guarantor or guarantor of the loan, some institutions may accept to work with third party checks.

So it's not common. This is because the applicant with a negative name, even with a guarantor, can lead to the disapproval of his credit.

To apply for a loan, the consumer must meet the following requirements:

- To be the current account holder issuing the check sheets;

- Have your name clean;

- Have proof of income. Some institutions require a minimum income for approval.

To apply for a loan, as in any financial operation, you need your RG, CPF and proof of address, in addition to a checkbook, specific to this type of credit line.

What happens if the check loan applicant has a negative name?

There is a specific line of credit for those who are negative. The best option is to resort to these specific ones. However, you can also apply for a loan with a negative check.

So this happens, but the checks cannot be in the name of the consumer with the negative name, since a simple credit analysis would disapprove them and make the continuity of the process unfeasible. Therefore, in this case, you just need to present a guarantor or guarantor, as the checks and current account of that guarantor or guarantor will be analyzed in order to enter into the negotiation.

As with any type of loan, it is necessary for the client to look carefully at his financial situation, to confirm that he will be able to pay the entire amount of the loan installments, until it is paid off.

Planning is important so that the loan does not compromise the consumer's budget, as a financial operation can only compromise 30% of the applicant's fixed monthly income.

Even though it is rare due to the fact that the check is already post-dated and in the possession of the then financial institution, it is not impossible for the customer to have his name negatived.

This happens if the check is deposited and the money is not in your account. This cannot happen with other types of credit lines, such as secured loans, for example. This could make this type of loan a potential risk.

Is it safe to use a check to make a bank transaction?

Contrary to popular belief, checks are still used in the country as a form of payment. According to a data survey carried out by the Credit Protection Service (SPC) and the National Confederation of Shopkeepers (CNDL), the pre-date modality is still used by 8% of Brazilians.

Therefore, it has been increasingly disused over the years. According to the Brazilian Federation of Banks (Febraban), the number of checks cleared in Brazil fell by 85% in the last 22 years. In 2017, 494 million checks were cleared. In 1995, the value rose to 3.3 billion checks cleared.

Even with the drastic drop in use due to electronic means such as credit and debit cards, the check is not close to being extinct. Therefore, market experts say that its use works well, especially in several large operations that need a more formal record of payment.

The main reason for the migration of check users to other means was their security. However, we can use it calmly following some requirements for the correct completion of the document.

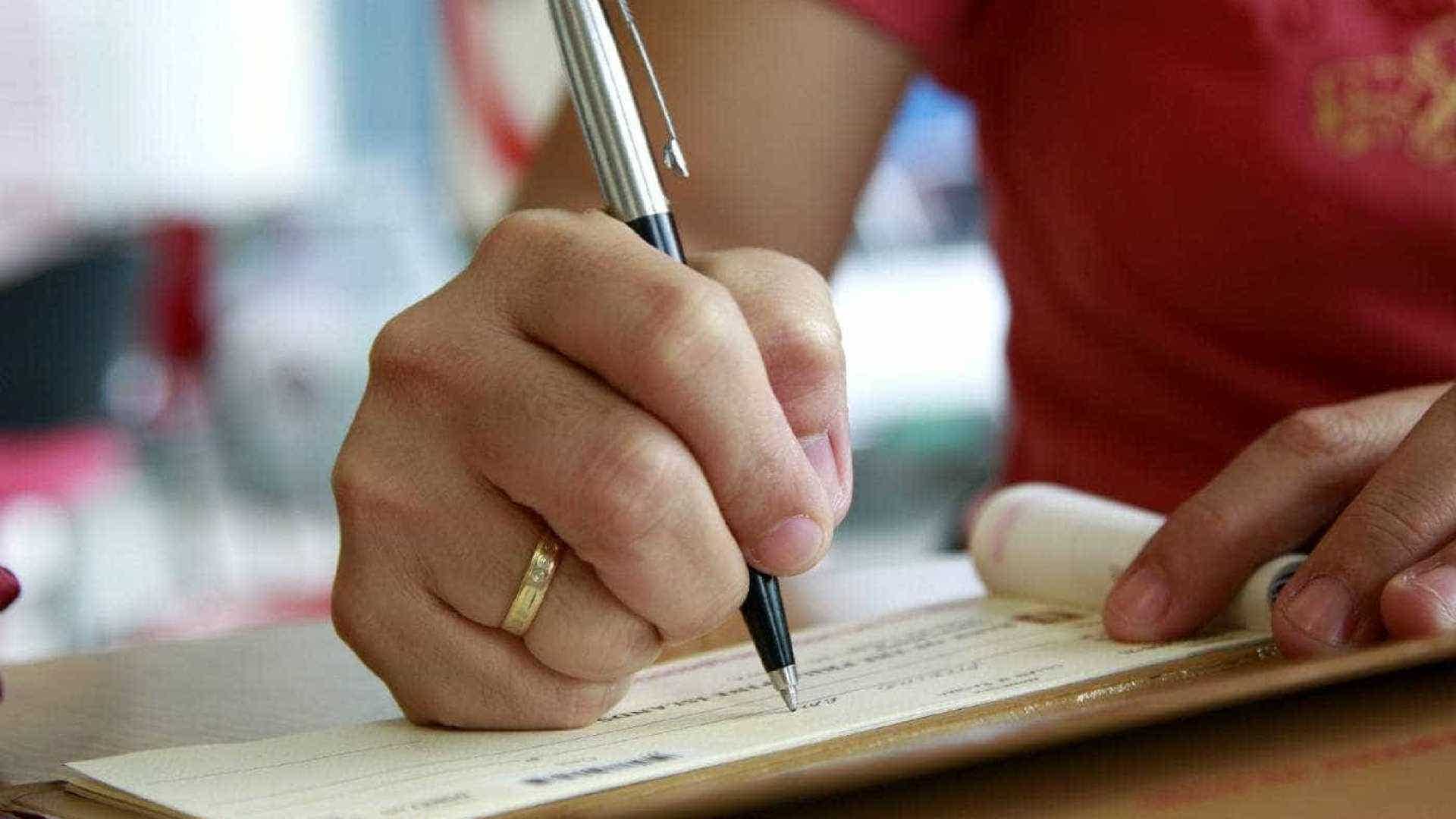

Check below some practices recommended by the Brazilian Federation of Banks (FEBRABAN)

- Always issue nominal and crossed checks;

- Eliminate empty spaces and avoid erasures;

- Do not use a pen with ink that is easy to erase or smudge;

- Use only your own pen, refusing those offered by strangers;

- Write down all the information about who will receive the check, its value and its issue date on the stub of the receipt.

Still according to the institute, it is not recommended to walk around with many checkbooks in your pocket, since this can be dangerous for the financial security of the consumer. The ideal is to take only the amount of sheets that will be used on the day.

If the applicant wishes to take out a secured loan, it might be better to go for other ways than using the post-dated check as loan guarantee. One option is the real estate secured loan, which is safer and brings many advantages.

Is check credit worth it?

It is important to emphasize that a loan is not the best option for those who want to have a good financial life. Economists always advise that this feature should be last on the list.

So, you need to understand your financial situation first and foremost. Check your monthly expenses, your income and if you are not going into debt, apply for the loan.

So, carrying out a good financial planning to not get into debt, it is worth choosing this type of credit. That's because it's safe, fast and will help you resolve emergency demand.

In addition, it is on the list of lowest interest rates, which makes it even more advantageous. In short, the best option is not a loan, but if you need it, this option is among the most worthwhile!

Conclusion

The check loan is among the modalities that offer ease, agility and security in the application. That's because the check generates a certain guarantee to the company that lends you money.

Still you saw that there are drawbacks and precautions to be taken that need to be taken into consideration. Pay attention to all the points so as not to make a mistake in the request.

That's nice you got here. Remember to carry out financial planning so you don't get into even more debt. Enjoy and see our content that will help you get organizediazar!

How to organize your finances step by step

Organizing your finances may even seem like a simple task, however, it is a very important task, since the lack of organization of this can lead to very serious problems.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the AFEAM personal loan

Find out how the AFEAM personal loan works and see how it can help your company get out of the crisis. Pay in advance and get discounts!

Keep Reading

Cold in the belly that speaks? See which are the scariest airports in the world

Even those who aren't afraid of flying would be terrified to face one of the scariest airports in the world. Know more!

Keep Reading

How to clear name Serasa?

Want to clear Serasa name and don't know how to start? Have you ever thought about getting it for just R$ 100? See here how it works and take advantage of the offers.

Keep ReadingYou may also like

Banrisul payroll loan or C6 Consig loan: which is better?

In today's post we will compare Banrisul payroll loans and C6 Consig. Each of them has its own characteristics and advantages. Interested? Come check!

Keep Reading

Porto Seguro Card or Itaú Card: which one is better?

Deciding between two credit cards is not a simple task. In general, it is necessary to evaluate several aspects and characteristics. That is why, in this post, we are going to show you the comparison between the Porto Seguro and Itaú cards. Interested? Continue reading and check it out!

Keep Reading

How to apply for BV university credit

Having BV university credit for students means keeping your finances safe while fulfilling your undergraduate, graduate or MBA dream. To find out how to order yours, read on!

Keep Reading