loans

Cash loan or BMG loan: which is better?

Do you know the best loan between Caixa and BMG? No? Remember that each has its characteristics and advantages. So, keep reading and see the analysis we did! Check out!

Advertisement

Caixa x BMG: find out which one to choose

Initially, the Cash Loan or BMG Loan are two loan options that are among the best on the market! In this, they have very interesting proposals with various facilities and everything you need to uncomplicate your financial life!

So, to learn a little more about the pros and cons of these loans, we have brought a comparison for you to do an analysis! Check out!

How to get a cash loan

Did you know that it is possible to borrow from Caixa with a dirty name? That's right, see right now how to apply for the loan even though it's negative.

How to apply for the BMG Emergency Loan

Applying for your BMG Emergency Loan is much easier than you might think! Read our text and understand more about this request process.

| cash loan | BMG loan | |

| Minimum Income | Uninformed | INSS salary or benefit |

| Interest rate | Uninformed | 1.80% per month |

| Deadline to pay | 48 months | 84 months |

| release period | In a few hours | 24 hours |

| loan amount | R$300.00 to R$50,000.00 | It will depend on the salary or INSS benefit |

| Do you accept negatives? | Yes | Yes |

| Benefits | Security Request can be digital 100% It is not necessary to be a Caixa customer. | accept negatives Security |

cash loan

So, Caixa Loan is a type of loan that can be used the way you need it!

This is because there are several options for you to choose from according to your need and payment capacity, that is, the installments can be paid in one go or in monthly installments with a pre- or post-fixed rate.

And in addition, interest rates vary according to the chosen option, as well as the payment term can reach up to 48 installments!

Therefore, Caixa seeks different forms of loan to offer customers a type of credit that suits the financial situation of each one!

BMG loan

Well, the BMG loan appeared in November 2020 and is part of the Super Conta BMG offer package, being an emergency credit modality with payment in up to 12 months and amounts released into the account in up to 24 hours!

And in addition, the BMG loan is ideal for negatives, because it does not consult with credit protection agencies such as SPC and SERASA.

Just as it has lower interest rates than other loans on the market, it does not charge fees and guarantees access to several other services!

Unfortunately, the accessibility of the BMG loan is reduced, because only retirees or pensioners from the INSS - National Institute of Social Security, public servants or employees of private companies associated with Banco BMG can access the loan!

This is because, in the payroll loan modality, the discount is made directly on the payroll or on the INSS benefit.

What are the advantages of Cash Loan?

So, the first big advantage of the Caixa loan is its practicality, because Caixa offers the opportunity to apply for a loan without any bureaucracy.

Furthermore, the types of loans available at Caixa can be accessed by anyone, with no need to be a Caixa customer!

Another great advantage is that you can apply for the loan at any of Caixa's agencies, as well as at accredited tourism stores.

And yet, you can apply for the loan even if you are negative, being a great option for people with a dirty name!

Therefore, Caixa Econômica Federal brings a great opportunity for people with a dirty name and, with debts, to settle their financial pending!

What are the advantages of the BMG Loan?

Well, the BMG loan has several advantages, the first of which is the fact that it is the loan with the lowest interest rates on the market, being around 1.80% per month!

And besides, you have up to 84 months to pay your debt, that is, you can take out the credit with the term that fits in your pocket!

Likewise, the BMG bank also offers its customers the BMG Card, the best payroll credit card in Brazil!

In other words, it's a great opportunity for people with negative credit to be able to have a credit card to use when shopping!

Therefore, BMG bank has several advantages for you to apply for the loan with all the security, transparency and special conditions that only BMG offers!

What are the disadvantages of Cash Loan?

So, one of the disadvantages of the Caixa loan is the interest rates. That's because if you're not careful, you might not be able to pay off the loan in the long term due to high interest rates!

Therefore, before applying for a Caixa loan, analyze other options on the market to find out if this is the best option for you!

What are the disadvantages of the BMG Loan?

Well, one of the big disadvantages of the BMG loan is the affordability.

This is because, as we mentioned, only retirees or pensioners from the INSS – National Institute of Social Security, public servants or employees of private companies associated with Banco BMG can access the loan.

Therefore, before opting for this loan, see if you fit this list of people who can apply.

Cash loan or BMG loan: which one to choose?

Well, the Caixa Loan or BMG Loan are two loan options that have all the credibility, security, ease and accessibility that Caixa Econômica Federal and the BMG bank offer to their customers.

Therefore, make an analysis of the loans that are available to you in the market and see which one is the best option for you! And if you still have doubts, see the recommended content below about personal loans that we have brought.

Loan Sim: the Credit Solution

Have you ever thought about getting a simple, fast and 100% credit online? Of course not? But with Loan Sim, this is fully possible. Know more!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

4 apps for pregnant women you should know about in 2023

3D images of the baby, gestational timeline and list of doubts are just a few functions of apps for pregnant women. Check more here!

Keep Reading

Ali Credit personal loan: what is Ali Credit?

Do you already know the Ali Credit personal loan? No? Then read on, as we are going to tell you all about this loan! Check out!

Keep Reading

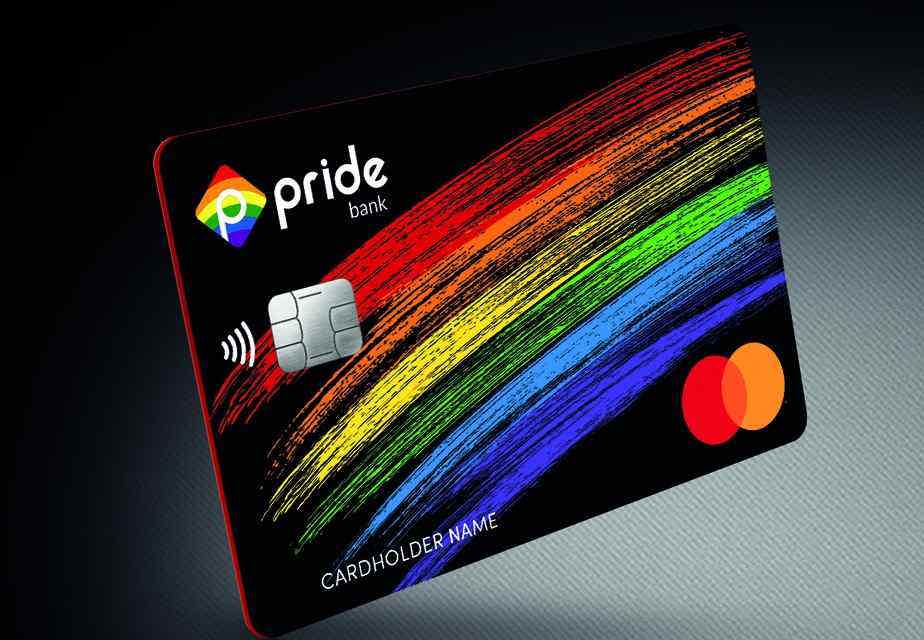

BMG card or Pride card: which is better?

Are you in doubt between the BMG Card or the Pride Card? Both are great credit card options with international coverage. Check out!

Keep ReadingYou may also like

Do I need to declare life insurance on Income Tax 2022?

The deadline for submitting the IR 2022 declaration has been extended to May 31, and many people still have doubts about what should or should not be included in the document. Check out the requirements for life insurance below.

Keep Reading

Discover the Best Trading current account

If you are looking for a complete current account to take care of your finances, Best Trading is a great option. It is free and includes Visa credit and debit cards, as well as free intrabank transfers. Learn more about her below.

Keep Reading

Midway Personal Loan: Right for You

The Midway personal loan is offered to customers who have Riachuelo cards. Want to know more? So, read on and check it out!

Keep Reading