loans

Geru loan online: personal credit without bureaucracy

Geru's loan is completely online and offers customized conditions for your profile to access the best credit in less time. Check out all the details about this financial product in the post below.

Advertisement

Credit of up to R$ 50 thousand for you to receive in just 24 hours

For those looking to access a high amount of credit, but can only do it in personal mode, it might be a good idea to learn more about the Geru loan online!

From this institution, you can access a high loan amount without having to offer any asset as collateral.

| Minimum Income | not informed |

| Interest rate | As of 1,90% am |

| Deadline to pay | From 12 to 36 months |

| release period | Within 1 business day |

| loan amount | Up to R$ 50 thousand |

| Do you accept negatives? | Uninformed |

| Benefits | Fast and online approval Money drops within 24 hours Do not use your assets as collateral |

In addition, hiring is completely online and without bureaucracy, which allows you to receive the money in your account within 24 hours.

In the post below, you will learn more about the Geru loan online, the conditions you can access and how you can apply for your credit.

How does the online Geru loan work?

In summary, the online Geru loan is a personal credit option that can be accessed from the official website of that financial institution.

Thus, when accessing it, you can carry out a quick registration that already shows the approved credit amount, the payment term and the monthly interest that will be applied.

That way, in a few minutes you can already know the loan conditions that Geru makes available.

With this information in hand, you can accept the proposal and finalize the loan contract from the same website, where Geru will issue the loan agreement and, after it is signed, the money will fall into your account.

And since Geru is focused on bringing you more convenience and making your financial life easier, they manage to release the credit amount in up to 1 business day.

That way, if you need extra money to cover an emergency, the Geru loan online can be a good choice!

How to apply for a Geru loan

Get to know the main digital channels that the finance company makes available for you to take out credit!

What are the credit terms of the Geru loan?

Knowing the conditions of an online loan is a very important step in the search for your personal credit!

Therefore, when taking out a loan with Geru, you can access the term of up to 36 months to pay. That way, you have a total of 3 years to pay off your loan.

In addition, Geru works applying a very low interest rate compared to other personal loans offered by banks. That way, with it you can access rates from 1.90% per month.

But, to know exactly the amounts your personal loan will have, you need to register on the Geru website so that it can carry out the credit analysis and, thus, release the conditions of your personal loan.

As this registration is quick and does not bind you to the loan, it might be a good idea to do it to know the amounts you can access.

What is the Geru loan limit online?

Another important piece of information to know about a loan is the total amount you get with it.

After all, there's no use taking out a loan to cover a big project or emergency if it doesn't offer all the value you need, right?

Therefore, when making the Geru loan online, you can access a credit of R$ 1 thousand up to R$ 50 thousand to enjoy as you wish!

And the best part is that you don't have to pledge any of your assets as collateral for the loan.

This way you guarantee that you will be contracting a high loan amount without harming any of your assets.

Is it worth applying for the Geru loan online?

So far you have seen how the online Geru loan works and what conditions it can offer you. But is it really worth taking out this credit?

This is a very common question when looking for any type of loan, as it will compromise your monthly income for several months.

Therefore, to help you understand if Geru's loan is the ideal option for you, we have separated below the main advantages and disadvantages of this solution.

Benefits

The first big advantage that the online Geru loan offers is its speed. With this financial institution, you can be approved quickly and receive your money in a matter of hours.

In addition to speed, Geru's loan is also highlighted by offering high credit that does not compromise your assets. Nowadays, having a credit of up to R$ 50 thousand on a personal loan is not something you see in any bank.

Finally, the Geru loan also has the advantage of being completely online and with little bureaucracy so that you can quickly access the credit you need!

Disadvantages

The advantages of the Geru loan are great, but we must not forget that the financial institution also has a negative point.

Although it offers a high loan amount, its repayment term is still very low. This can make the loan installments too high to pay every month.

Therefore, you need to be careful when taking out your credit and consider whether the high amount received at the beginning will really be worth it later.

How to make a loan at Geru?

In summary, taking out the Geru loan online is done completely online and very quickly.

To do this, you just need to access the financial institution's website and do a credit simulation to understand how the value of the installments would look.

Once this is done, you can continue on the website and register to access the proposal approved for you.

That way, if the proposal values please you, you can proceed with the loan contract and receive it in your account in a few hours.

If you want to know more details about this contract, check the post below with the step-by-step guide for you to apply for the Geru loan online!

How to apply for a Geru loan

Check out the complete step-by-step to apply for your credit of up to R$ 50 thousand!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the loan with Creditas car guarantee

Find out here about the loan with Creditas car guarantee that allows you to have a high-value loan at the lowest interest rates on the market!

Keep Reading

How to make money with Fiverr in 2021

Discover how to earn money with Fiverr, the platform that connects you and your services with companies internationally. Check out!

Keep Reading

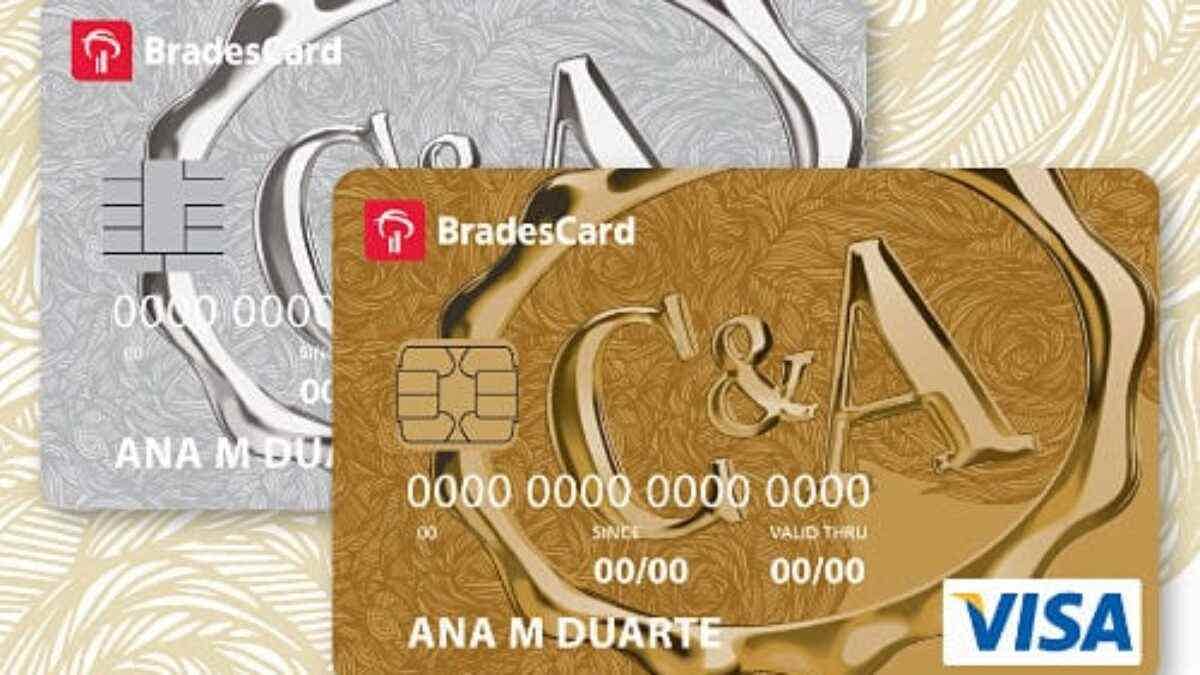

CEA 2021 Card Review

Check out our CEA card review and discover its facilities, exclusive discounts, as well as how to apply for one. Check out!

Keep ReadingYou may also like

How to Apply for the Bahamas Card

Do you want to know how to apply for the Bahamas card and enjoy all the benefits of Clube Up? Read the article in full.

Keep Reading

GBarbosa credit card: how it works

The GBarbosa card offers discounts and special offers at the supermarket chain, in addition to international coverage and Visa benefits! Do you want to know more about him? Look here!

Keep Reading

ActivoBank or Banco CTT car loan: which is better?

If you want to buy your car more safely, with less fees and longer payment terms, two incredible options are ActivoBank or Banco CTT car credit. To learn more about them, just continue reading the article and check it out!

Keep Reading