loans

How to borrow from Caixa with a dirty name

Did you know that it is possible to borrow from Caixa with a dirty name? That's right, see right now how to apply for the loan even though it's negative.

Advertisement

Cash loan with dirty name

To do bank loan with dirty name It is a possibility that few are aware of. This is because little is said about the subject. Most people believe that negative status prevents them from doing anything.

However, this is far from the truth. Although more complicated, this label does not mean the end of your financial autonomy. Therefore, it is fundamental that this theme be more disseminated.

Therefore, this post will help you understand more about it. Here, you will learn how to make loan from Caixa with a dirty name. See how there are solutions to where you least imagine.

Caixa loan with dirty name without CPF consultation

Currently, there are around 60 million Brazilians with a dirty name in credit protection bodies. SPC and Serasa are the main examples of the latter.

To get a clearer idea, it is interesting to talk about the number of people with negative CPF. It represents around 40% of Brazilian consumers.

Undoubtedly, this very high index directly harms commerce, since the approval of purchases is more difficult. So, most people are unable to apply for credit.

This goes for both cards and loans. Thus, financial institutions consult the payment history of each consumer before approving anything.

This is a strategy to protect yourself from any losses. However, not all is lost for those who have the negative status. If you are in need of money, there are ways to get it more easily.

Thus, Caixa offers 3 forms of loan. Still, none of them makes appointments at Serasa and SPC. The next topics will describe more about each of them.

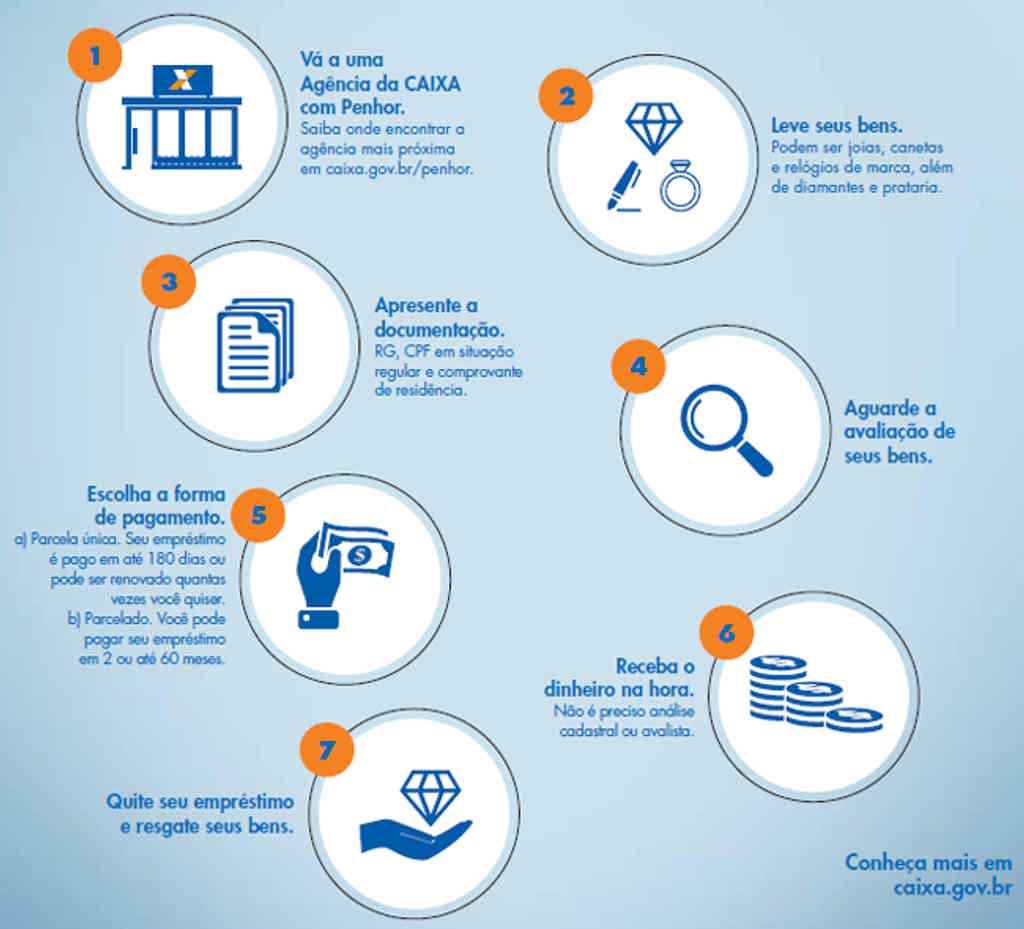

1- pledge

This is therefore one of the lowest interest rate lines of credit that exist. It is one of the most interesting alternatives to do loan from Caixa with a dirty name.

The pledge allows you to leave with your money right away. Check some important points about it.

- Negotiated objects: You can pawn different objects. Jewels, noble metals, pearls, diamonds and watches are just a few examples. Now, stay tuned, as these goods need to be original and with duly recognized value.

- Exclusions: Items made of gold with a content of less than 12 carats are not accepted as guarantees. That is, except when they have some adornment of historical or artistic value.

- Percentage: The loan amount corresponds to a certain percentage of the asset's value. In this case, it cannot be greater than 85%. However, Caixa is studying raising to 90%.

- Loan: One of the conditions of the pledge is the loan limits. So, you can only request amounts between R$ 50 and R$ 100 thousand.

- Documentation: You just need to take your asset to the bank. Also, you must present your CPF with regular status at the Federal Revenue Service. Finally, you need your identity card and proof of residence.

- Charges: The interest rate varies according to the pledge. So, the micro pledge has a monthly value of 2%. The normal rate is 2.459% per month. In addition, it is important to pay attention when hiring and renewing the attachment. This is because the following charges are charged.

- Risk fee (0.6% on top of the value of the asset);

- Evaluation and renewal fee (0.30% every 30 days on top of the loan amount);

- Insurance (0.055% per month on top of the appraised value).

FGTS payroll loan

In this modality, the portion of the amount that was borrowed is deducted from your payroll. Also, it is one of the alternatives to make loan from Caixa with a dirty name.

Here, you have much lower interest rates. After all, the risk that the bank runs here is also small. In addition, at the end of the period provided for the payment, the latter becomes cheaper.

In this way, the FGTS payroll is highly sought after when the objective is to pay off large debts. It works through automatic discount. So, your salary fell into the account and the loan payment is already made right away.

Now, it's important to know one thing. To get this line of credit, your FGTS balance needs to cover the entire amount you requested. However, this also includes the interest and fees involved in the transaction.

All of this has to be less than the amount you have in your account. Otherwise, it is better to look for another modality. In addition, the loan must bear interest of up to 3.5% per month. This is the maximum rate.

As for the portion, it cannot be greater than 30% of your salary. It is one of the ways that Caixa has to protect itself from possible financial losses. Still, you need to consider one issue.

That way, imagine you were fired for just cause. Therefore, you will not be entitled to withdraw the FGTS. So this is a risk you take. If you decide to opt for this alternative, be aware of some rules.

First, you must have an active payroll agreement with Caixa. Also, your salary must be received in a current account in this bank. Finally, if your debts are high, this option is definitely worth considering.

Payroll Loan Cash

This type of loan is available to INSS retirees and pensioners. Also, civil servants who have an employer body that has a direct agreement with Caixa can request this alternative.

Finally, employees of companies linked to the bank are eligible for this modality. Also, know that here, you don't need to be an account holder.

However, if you have a salary account at the bank, you have some special benefits. Thus, it is possible to contract personal credit with more comprehensive conditions.

For this reason, many opt for this form of loan from Caixa with a dirty name. With regard to interest rates, they are one of the most competitive on the market today. Check it out below.

- INSS payroll loan: 1.45% am or 18.89% aa;

- Private payroll loan: 1,27% am or 16,41% aa;

- Public payroll loan: 1,17% am or 14,93% pa.

One point you need to pay attention to is the payment term in this modality. Thus, federal civil servants have 96 months to settle all their debt.

Those who are beneficiaries of the INSS have a period of 84 months to resolve their disputes. Finally, employees of private companies have a shorter time, 48 months.

Now those are the deadlines. However, you can feel free to settle everything in less time. However, it is important to be careful. After all, in this case, the discounted installments will be higher.

Understand that here all payments are fixed and the installments have equal values. This pattern remains from the beginning to the end of the contract. To sign a Caixa consignment, you have 4 alternatives.

1- Through the Agora YES platform.

2- By internet banking.

3- Through correspondents Caixa AQUI or even, by authorized persons.

4- Through an agency or through the service channels.

How to apply for a loan at Caixa with a dirty name

Contrary to what many think, this is not a complicated procedure. Of course, you always need to be aware of the conditions imposed.

However, loan from Caixa with a dirty name it's simpler than it looks. So, check out some topics that are necessary to sign such an agreement.

How do I know if my name is dirty?

There's no shame in going through a financial crunch and getting a dirty name. But, many times, you may not know if this is the case for you. Find out now!

1- Establish which line of credit is most interesting for your case

This is the first thing to do after looking for a Caixa branch or affiliated store. Choosing the credit modality is a very important step.

Remember the ones mentioned above. Each has its particularities. So, spend some time reviewing them and seeing which ones suit your needs.

That way, you don't regret the future. Still, there is no risk of missing out on some interesting benefit. Having made that choice, it's time to prepare the documentation. So, separate RG, CPF, proof of residence and so on.

2- Wait for the analysis of your order

After the request, Caixa will need a period to analyze the proposal. This is independent of the type of credit you choose. Only after that time will the bank give a response, which may or may not be positive.

Also, be aware of the requirements to be able to apply for this aid. They are: being over 18 years old, not being in default and proving ability to pay.

3- Always be aware of deadlines

Imagine that your order has been approved. Then, you must go to the place to sign the agreement and receive the money. Thus, it is at this time that the slips will be delivered.

In this way, stay tuned in the due date of each installment. It's the best way to avoid getting into another debt.

What are the advantages of taking out a loan with a dirty name?

Make one loan from Caixa with a dirty name can bring some advantages. First, you have a fixed interest rate.

It will always be done based on the hiring date. Therefore, there will be no changes during payment. Another interesting point is about the IOF. It is also charged at the time the agreement is signed.

Not to mention that there is no charge for registration fee or any ticket. Within this scenario, find out below about other benefits that you can have access to.

1- Greater practicality

Such a loan can have several details. However, the biggest one will always be bureaucracy. Here, the entire request and analysis procedure is much simpler.

Still, the modalities work for anyone. All without the need to be a Caixa customer. Therefore, practicality is what defines the process of applying for a loan at this bank.

2- Convenience

This type of service can be done at any agency. In addition, accredited tourism stores are also able to do so. That way, you can go to the location closest to your residence. No need to travel far to get the necessary money.

3- Ease of payment

Everything works simply. So what you have to do is just respect the hiring limits. By making the payment on the correct dates, you shouldn't have any problems.

Is it worth asking for a loan at Caixa with a dirty name?

The answer is it depends. Indeed, you have a number of possibilities. So, if you know how to make the most of them, it is worth taking out a loan. A tip is to always analyze each modality very well.

See what each one can offer you. After all, not all of them will meet your needs. Also, seek to talk to the creditor.

Together, you can reach a more interesting agreement for both parties. Caixa is a very versatile institution. That way, you shouldn't have any problems getting some benefits.

Hence the importance of making a personal loan. In the case of the online option, it is also worth it. However, be aware that the alternatives available there are much more automatic.

So maybe you can't get discounts or anything like that. On the other hand, you don't have to move.

So, it is possible to conclude that all options are interesting. Your reality will be the determining factor in choosing the ideal one.

Conclusion

Now you are a real expert on the subject. Remember each modality mentioned here. Also, consider the benefits of making this type of arrangement.

Regardless of your ultimate goal, help like this can help you get there. This is especially true if you want to pay off your debts. There are many options and opportunities that can be taken advantage of.

Also, don't forget that here, the bureaucracy is much smaller. After all, being negative prevents you from many things. In the case of Caixa, this is not a limiting factor for getting help.

Finally, you already know how to make a loan from Caixa with a dirty name. Now it is your turn. Use this post to help you make the right choice. Don't waste any more time and go in search of your dreams.

How to apply for the Caixa Simples card

The long-awaited time has come to find out how to apply for your Caixa Simples card, a great option for those with a dirty name.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to enroll in the Progress program

Find out how to enroll in the Progredir program and take advantage of this opportunity to grow professionally with the help of specialists.

Keep Reading

How to apply for the BV More card

With the BV Mais card, you have access to cashback and discounts with partners. In addition, it can be requested through the app or website. Learn more here!

Keep Reading

Finamax personal loan: what is Finamax?

Do you already know the Finamax loan? Then read on, because we are going to tell you all about this low interest loan! Check out!

Keep ReadingYou may also like

Discover the Neon digital account

The Neon account is fully digital and offers unlimited and free transfers via PIX, credit card and international debit card with no annual fee, in addition to many other benefits! Read this post and learn more about it.

Keep Reading

What is the Itaú Click Credit Card?

Itaú Click is a card with Visa and Mastercard options, with many exclusive benefits. Know more about him here!

Keep Reading

Stock Market Guide: Start Investing in Stocks

Want to know when and how to invest money in the stock market? Continue reading to check out our tips and learn how to invest in stocks!

Keep Reading