loans

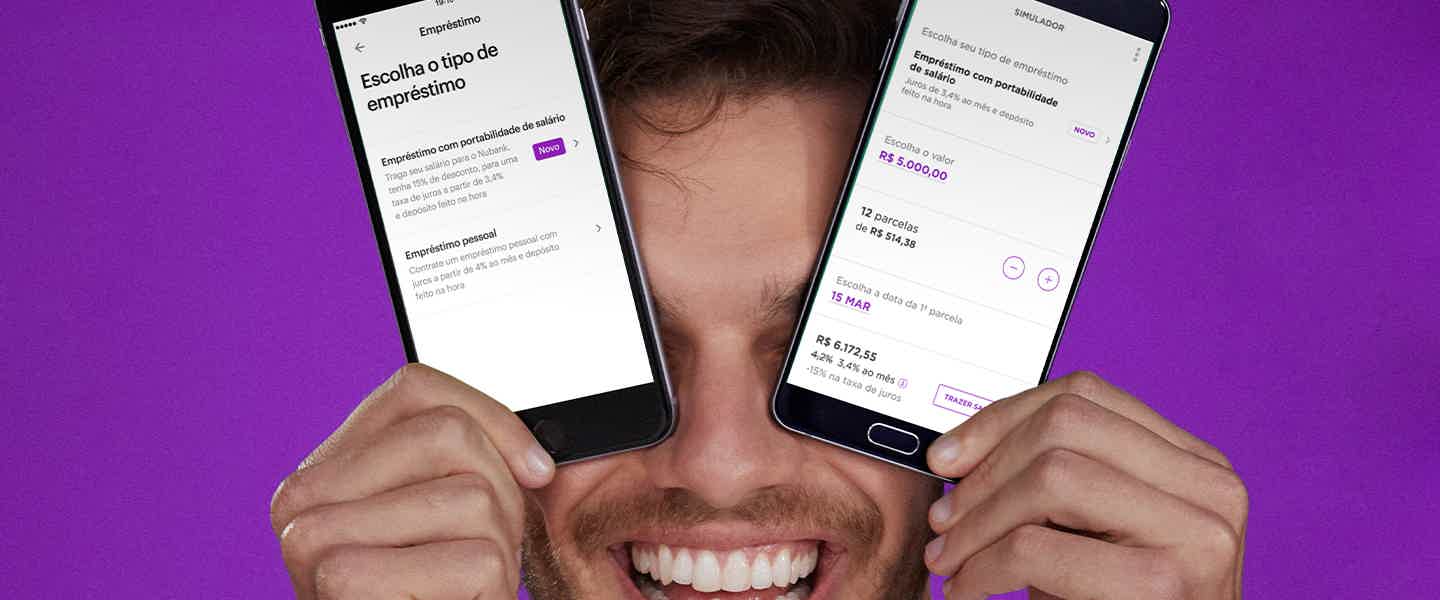

Discover the Nubank personal loan

With the Nubank personal loan, you can consult all the information directly through the application and have up to 24 months to pay. Know more!

Advertisement

Nubank: online hiring without bureaucracy

Well, the Nubank personal loan is a great option for those who are looking for extra money and want to do it quickly and easily.

So, in addition to having lower interest rates than the market average, you have up to 90 days from the date of signing the contract to start paying.

So, if you are interested and want to know even more about credit, continue reading and find out if it is the best option for you!

How to apply for a bank loan

The Nubank loan has fixed installments of up to 24 months and low interest rates. Check out how to order yours today!

How does the Nubank personal loan work?

Well, the credit is available to customers of the digital bank. Therefore, you must have an account with Nubank to be able to make the request.

So, the loan has reduced interest rates and you have up to 24 months to pay, which is equivalent to 2 years. Furthermore, you can start paying only after 90 days after signing the contract.

In addition, the installments are charged via automatic debit from your digital account. However, if you do not have a balance, the amount will not be discounted. Therefore, you do not need to worry about having a negative balance.

In this case, Nubank will send you a message asking you to regularize the situation. However, it is important to know that other interest rates are charged if you miss the payment date. Therefore, always plan to avoid this type of extra charge.

What is the limit for a Nubank personal loan?

Therefore, the credit limit will vary for each customer. Therefore, to find out what conditions are available, you must run a simulation using the app.

This way, you will know what the interest rates are, the number of installments and also the approved limit.

Is a Nubank personal loan worth it?

Therefore, credit is a good option, as it offers personalized conditions for each person and you can consult all the information before making your request. This way, you can make a good plan to pay off the debt without worries.

However, not all customers have access to it yet. So, to find out if you can request yours, you must check the app and see if the option is available.

But if you don't have this option yet, don't worry! This is because the bank makes daily updates and wants to release the service to all customers as soon as possible.

How to get a Nubank personal loan?

Therefore, requesting your loan is very simple and easy. To do so, simply access your digital account in the Nubank app and simulate the loan.

If everything is ok with the bank's analysis, the money will be deposited directly into your Nubank account. Easy, right?

So, if you want to know more details about how to apply for your loan today, check out our recommended content below.

How to apply for a bank loan

The Nubank loan has fixed installments of up to 24 months and low interest rates. Check out how to order yours today!

Trending Topics

How to apply for Leroy financing

Learn how to apply for Leroy construction finance and other information about it, so you can finish your construction! Check out!

Keep Reading

Good Loan for Credit or BMG loan: which is better?

Check out the main features, advantages and disadvantages. And find out if a Good for Credit loan or a BMG loan is right for you!

Keep Reading

Dotz card or Inter card: which is better?

The Dotz card or Inter card has an international flag and offers several benefits in addition to reward programs! Find out more here!

Keep ReadingYou may also like

See how to declare rents paid in 2021 in this year's Income Tax

Taxpayers who paid rent during the 2021 period and will declare income tax this year need to report the amount when filling out the document. Check out more information here!

Keep Reading

Who can apply for a payroll loan?

The payroll loan is a line of credit especially aimed at INSS beneficiaries and public servants. However, some institutions offer the opportunity to hire workers under the CLT regime. Check more here!

Keep Reading

Wise Card or BPI Gold Card: which is better?

You know that moment when we're looking for a good card to organize our finances, but we can't find it? Your problem is over. Get to know the Wise card or BPI Gold card today, what was missing for you to improve your financial life. Want to know more about these two options and their features? Come with us!

Keep Reading