Cards

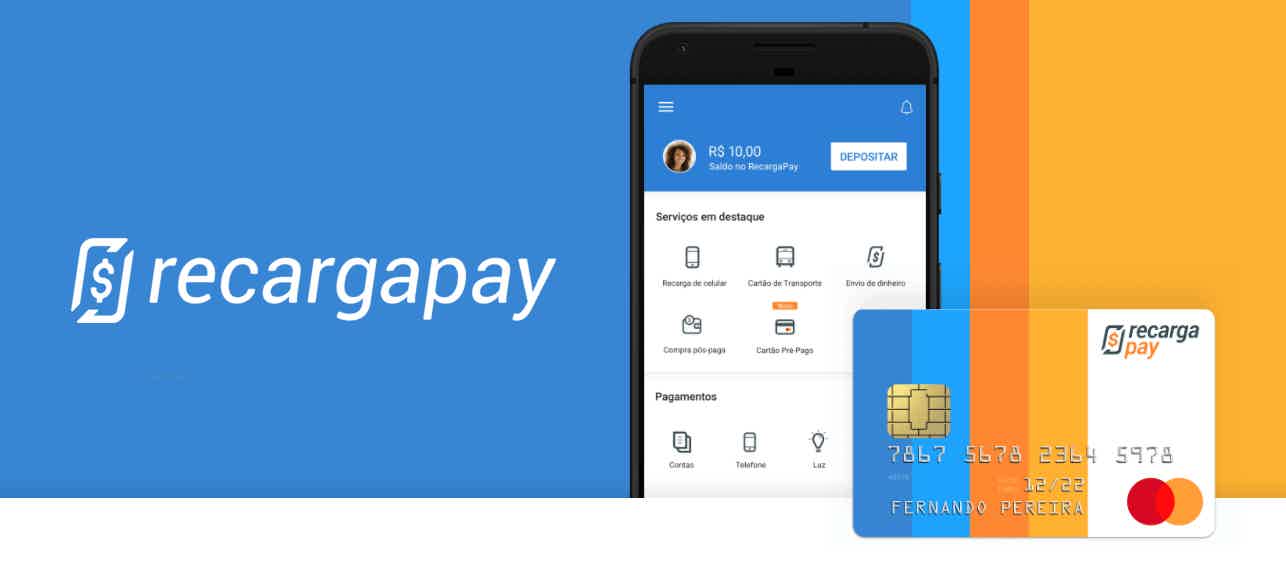

Discover the Recharge Pay Card

Do you already know the modality of card via recharge that doesn't scare you at the end of the month? So get to know the Recarga Pay card and its advantages.

Advertisement

How does the Recharge Pay Card?

The card Pay top up has been gaining a lot of space in the financial market. Users are really enjoying the proposal of this product. The advantages and its method of operation are responsible for this popularity.

Therefore, it is interesting that this tool is further discussed. In this way, you can visualize all the elements that are part of it.

This post will act as a complete guide on the Recharge Pay card. Here, you will learn about the benefits of prepaid and how this product stands out. So follow through to the end.

| Pay top up | |

| minimum income | does not require |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | All card flag related |

Request Recharge Pay card

With so many advantages, Pay recharge has become a very attractive card. So, see how to apply right now!

What is a prepaid card?

First of all, you must understand the scheme of a prepaid card well. Basically, his goal is to help you have a good relationship with your money. That's when it comes to control.

So, this tool follows the logic of recharges. With that, you only use what you have. So let's say your card has R$ 350.00. However, he decided to make a purchase with twice the value.

In that case, you will have a problem because the transaction will not be authorized. Therefore, notice that there is no option to exceed this limit. One of its main differences when compared to a traditional credit card.

Also, no installments. Everything must be paid at the time of purchase. So that's why you have more control over your income. This is the philosophy of Recharge Pay card.

Another important point of this product is that it does not work with unnecessary fees. That way, you won't have to worry about annuity or anything like that.

Also, it lets you shop at thousands of stores. The most interesting thing is that this card has international coverage. So you have freedom and control in one product.

After all, he prevents you from being in the red. At the same time, it lets you spend what you have almost anywhere. Okay, now you know how a prepaid scheme works. Now, learn more about the company that founded this card.

Pay Recharge

This is the name of a Brazilian Fintech. It is a mobile payments wallet. Currently, the company is one of the leaders in its field. Founded in 2009, the company is focused on digitizing microtransactions.

Thus, from the beginning it seeks to democratize this type of service. So anyone can become a user. The idea of the institution when creating the Recharge Pay card was to unite the physical and virtual world.

So you have access to the plastic card. However, it is fully linked with the application on your mobile phone. Including, it is not possible to order the product without using the app.

With it, you become capable of recharging cell phones and transport tickets. In addition, you can make payments in general without any problems.

That's why card and app are the perfect combination. The entire application process is very simple. Still, this company comes with a very interesting novelty. It does not require consultation with the SPC or Serasa.

So if you have a dirty name, that's fine. This will not hinder you from getting this prepaid.

Now, if you think that's the only benefit of this card, you couldn't be more wrong. The next topic will talk more about the advantages of this product.

What are the advantages of Recharge Pay credit card?

You may have already noticed that the company does not like bureaucracy very much. Therefore, everything becomes simpler and faster. Find out now what are the benefits you can enjoy with this Recharge Pay card.

- Control of expenses: As mentioned above, this type of product helps you with your financial control. Remember that it works with refills. That way, you can only use what you actually have available. This makes your monthly budget more secure.

- No credit analysis: Not everyone has the profile that allows applying for a traditional credit card. However, here this is far from a problem. The company does not charge a financial status from its users. Plus, you don't have to worry about incurring outrageous interest rates or a bad name.

How do I know if my name is dirty?

There's no shame in going through a financial crunch and getting a dirty name. See how to check if your name has suffered a negative

- fraud protection: One of the biggest advantages of this card is directly related to its security. So, it has a system with SSL protocol and PCI certificate. Therefore, all your data is properly protected. There is no risk when carrying out banking operations.

- Brazil is not the limit: As you already know this is an international card. That way, you have complete freedom to buy wherever you want. In addition, there are about 30 million stores to choose from. Of course, that number also includes online establishments.

- Payments: This tool lets you pay virtually any type of bill. Water, gas, electricity, internet, telephone and so on. So, this versatility helps to settle all your debts. Still, the coolest, without having to leave the house. Also, there are no limits on operations. So, you can kiss the crowded queues goodbye.

What are the downsides?

Basically, the Recharge Pay card it has only one disadvantage. However, it weighs a lot. So, you should never neglect it. It has already been said that this product has two versions: online and physical.

The first is completely free. However, the second does not follow the same pattern. So, if you want the plastic card, you will have to pay an amount for it. A fee of R$ 9.99 per month is charged.

Thus, when choosing the physical version, you need to become a prime member. Hence the reason for this kind of “monthly fee”. Many people still don't handle technology very well.

Therefore, they end up preferring this alternative. So, despite being a small amount, it is monthly. This can weigh heavily on your pocket. Of course, everything will depend on your financial situation. The important thing is that you don't overlook this issue.

Is the Pay recharge card a reliable product?

The answer is yes. As far as reliability goes, you have nothing to worry about. This product follows all the legal norms to work. In addition, the company has an excellent reputation in the market, among Fintechs.

Certainly, it would not make sense to make available a tool that is not of high quality. The card can be used without problems and your data will be protected.

Remember that we talked more about security protocols above. So, an investment of this type demonstrates that the company behind this product cares about the user.

Recharge Pay credit card it is worth it?

Overall, without a doubt. It is a very useful tool in everyday life. After all, the card together with the application helps you solve everything without setting foot outside the house.

So, in that sense, it's really worth buying the product. The only impasse is regarding the physical version. The monthly fee charged does not please some consumer profiles.

So this needs to be evaluated. One tip is to put everything on the scale and see if this card will actually meet two needs. Most of the time, the answer is positive.

how to do Pay Recharge Card?

To apply for the card, you must first open a digital account. She will help you with the monthly control. After that, the card can be applied for. You can check out a complete step-by-step on the website to help you!

Request Recharge Pay card

With so many advantages, Pay recharge has become a very attractive card. So, see how to apply right now!

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Fiat consortium

With the Fiat consortium, you can purchase your zero vehicle with interest-free payment in up to 100 months. Find out how it works here!

Keep Reading

BTG+ credit card: how it works

Enjoy exclusive benefits such as zero annuity for three months, CPF monitoring and investment opportunities. Find out how the BTG+ card works!

Keep Reading

How to apply for Unicred Gold card

The Unicred Gold card is a great option for an international credit card with several advantages for customers. See here how to order yours!

Keep ReadingYou may also like

How to do a free postgraduate course?

Are you looking for a postgraduate course? What if we tell you that it is possible to do it for free? Check it out in the post below and learn how!

Keep Reading

Payroll loan BMG or C6 Consig: which is better?

In today's article we will compare the BMG payroll loan and the C6 Consig. Both have their own advantages and conditions. Interested? Read on!

Keep Reading

Discover the Millennium BCP Platinum credit card

The Millennium BCP Platinum credit card offers the Millennium Rewards Program. Through it, your purchases become points that can be exchanged for exclusive products. Want to know more about card? So read this post and check it out!

Keep Reading