Cards

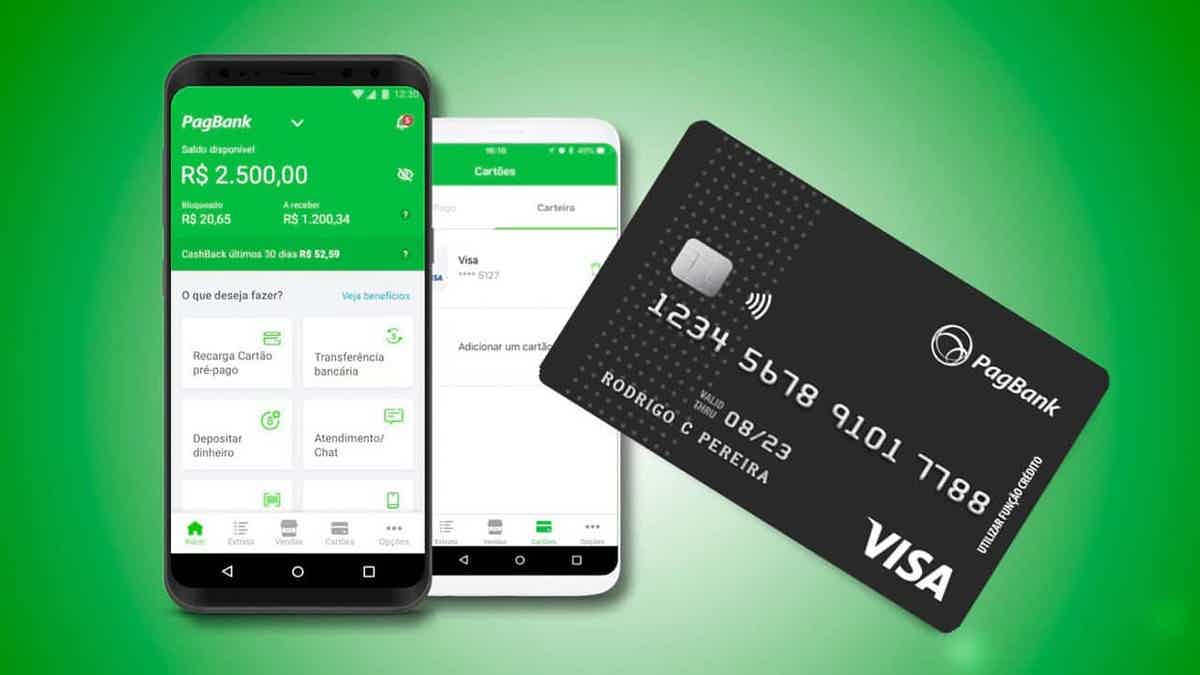

Discover the PagSeguro Card

The PagSeguro prepaid card has become popular due to the facilities and advantages it offers. See all about it now.

Advertisement

PagSeguro Card

O PagSeguro card has been one of today's preferred credit tools. Many people were interested in this product due to its series of advantages.

Even so, it is still common to find consumers who have never heard of it. Therefore, it is essential that this subject be further discussed. Thus, it is possible to highlight all the elements and benefits that involve it.

The purpose of this post is exactly that. Here, we will tell you absolutely everything about the PagSeguro card. See how it can contribute to your financial autonomy.

| PagSeguro | |

| Minimum Income | not required |

| Annuity | Free |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise |

Request Prepaid Pagseguro

Also find out how to request your Pagseguro prepaid now without leaving home.

How does the PagSeguro Card work?

It closely resembles a traditional card. So, it is possible to pay your purchases in installments, use a special limit and so on. Also, as it has a Visa flag, you can use it in virtually any establishment.

Also, this credit tool guarantees you greater convenience in your payments. Depending on the type of card chosen, you have access to an invoice with all the details of your purchases.

In summary, there is no hassle of understanding your card details. The company makes everything very clear. This is before you even have the product in your hands.

What are the advantages of the PagSeguro credit card?

Now, it's time to learn about the main benefits that you are entitled to when choosing this tool. Realize how important they are in the consumer's daily life.

international reach

Most of the cards only work in locations within Brazil. With PagSeguro there is no such limitation. So, you can enjoy your international trip and buy a lot.

In addition, foreign sites are also available for you to make the most of.

Purchases at millions of establishments

There are so many stores that you get lost. O PagSeguro card It is accepted at millions of establishments. After all, its flag is one of the most popular on the market. Still, this goes for both physical and online businesses.

digital services

With this card, you can pay for all your virtual services. This includes streaming platforms like Amazon Prime, Netflix and HBO.

Withdrawals

You can make withdrawals from any 24-hour bank network. Of course, within the national territory. So, if you are out of the country, just look for the Plus network.

credit function

Your card automatically assumes the credit function. So this goes for when you want to shop or make withdrawals.

exclusive discounts

The company offers exclusive discounts and benefits to its card users. There are many opportunities to take advantage of.

Those are the advantages of all 3 types of cards. Also, the credit card gives you the chance to pay your purchases in installments. Also, it has a monthly invoice for payment. Later on, you will get to know these card versions.

Types of PagSeguro cards

The company was not content to offer just one version of the product. So, she offers 3 types of cards. This was a company strategy to reach more consumer profiles.

No doubt it is a benefit for both parties. In this way, the institution grows and you have access to a personalized product. Find out what your options are PagSeguro card.

account card

With it, you can use the entire balance of your PagBank account. Its acquisition is free. In addition, the card has no annual fee or monthly fee.

Even here, there is not even an invoice. To request it, just access the company's application.

credit card

This version is not available to everyone. The company offers the credit card only to a few previously selected customers. Thus, it is also free and has no annual fee.

With this product, you can install all your purchases in the blink of an eye. You can also use your PagBank account balance to settle your bill. In short, it's a combination of practicality and efficiency in a single tool.

Prepaid card

A simpler card version. Prepaid works through a top-up scheme. Therefore, it is ideal for those who do not want to get lost in shopping. After all, you only spend as much as you put in balance.

So you can get your card for just R$ 12.90. Top up can be done via PagBank account, bank slip, deposit or online debit.

Also, many people use this version to give to their children or company employees. That's because you can track the balance through the app.

What are the disadvantages of these cards?

Like every product, there are pros and cons. In the case of this one, the disadvantages are directly linked to the fees charged. Check it out.

account card

Cost of R$ 7.50 per national or international withdrawal;

International use 5.00% + IOF on currency conversion rate.

credit card PagSeguro card

- Late fee: 2%;

- Revolving interest: 10.99% per month;

- Invoice installment interest: 10.99% per month;

- Compulsory installment payment interest: 9.99% per month;

- Issuing installment interest rate: 3% per month;

- Domestic withdrawal interest: 9,99% per month;

- International withdrawal interest rate: 9.99% per month;

- Late interest: 10.99%;

- Interest on arrears: 1% per month;

- Withdrawal: R$ 29.99;

- Second copy of the card: R$ 19.90;

- Overlimit: 19.90;

- IOF – international transactions/withdrawals: 6.38%;

- IOF rate – rotating journal: 0.01% per day;

- IOF – additional: 0.38%;

- Dollar Conversion: PTAX + 5.00%.

Many people are not familiar with that term, overlimit. However, he is very important. In this way, it refers to the special limit that the customer uses when he exceeds the limit of his card.

Therefore, whenever it happens, a fee of R$ 19.90 is charged. Also, it is worth remembering that this does not depend on the amount that is exceeded. The latter is capped at 10% of the cap value.

Prepaid card PagSeguro card

- Cost for each national or international withdrawal R$ 7.50;

- Card issue/reissue cost R$ 12.90;

- Card maintenance: R$ 19.90;

- International use 5.00% + IOF on currency conversion rate.

Now, stay tuned. The monthly fee is free. However, only for customers using the PagSeguro card prepaid version.

Otherwise, after 180 days, you will be charged R$ 19.90 per month. This is, of course, limited to the balance available on your card.

Is the PagSeguro credit card worth it?

For sure. O PagSeguro card it's one of those products that has too many benefits to ignore. So it's really worth buying one of these. The most interesting thing is undoubtedly the versatility of this card.

So many people can have it. Even if your financial needs are different. The 3 versions mentioned above allow for this type of event.

Therefore, the ideal is that you think about which one is the most suitable. This card may be exactly what you need to give your financial autonomy a boost.

How to make the PagSeguro Card?

To order your card is very simple. Just access the PagSeguro website. Then click on the version that interests you most. Thus, you will be directed to a page where you must login.

If you are not yet registered, you will need to provide some personal data. However, do not worry that just like your product, the platform is very secure.

After creating your account, just request the card. Everything works simply and without bureaucracy.

Okay, now you know everything about the PagSeguro card. So it's your turn to act. Don't waste another second and order yours now. Go in search of improving your financial life.

Request Prepaid Pagseguro

Also find out how to request your Pagseguro prepaid now without leaving home.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Get to know the Bradesco Elo Internacional Consigned Card

Get to know everything about the Bradesco Elo Internacional Consignado Card, how it works, how it is and also what is needed to have it.

Keep Reading

How to avoid CPF fraud?

Looking for ways to avoid fraud on your CPF? Really the security of your document should be a priority. Learn more here!

Keep Reading

Guide: how to use the PicsArt App to edit your photos

With this app, any photo can become the canvas for your creative expression. Download the PicsArt app and start transforming your images!

Keep ReadingYou may also like

How much is the limit on the Nubank card?

If you want to know how the Nubank card limit works, we can help you! Here you will understand how the bank increases the limit of customers and even learn tips on how to improve your profile to have more chances of getting your increase. Know more!

Keep Reading

Best Buy Credit Card: How It Works

If you know Best Buy stores, you certainly know the amount of products they offer to their customers. Do you know what else it offers? A credit card with no annual fee. Do you want to know the Best Buy card? Follow!

Keep Reading

How to apply for the C&C card

Learn how to apply for your C&C card in a practical way with this step-by-step guide!

Keep Reading