Financial education

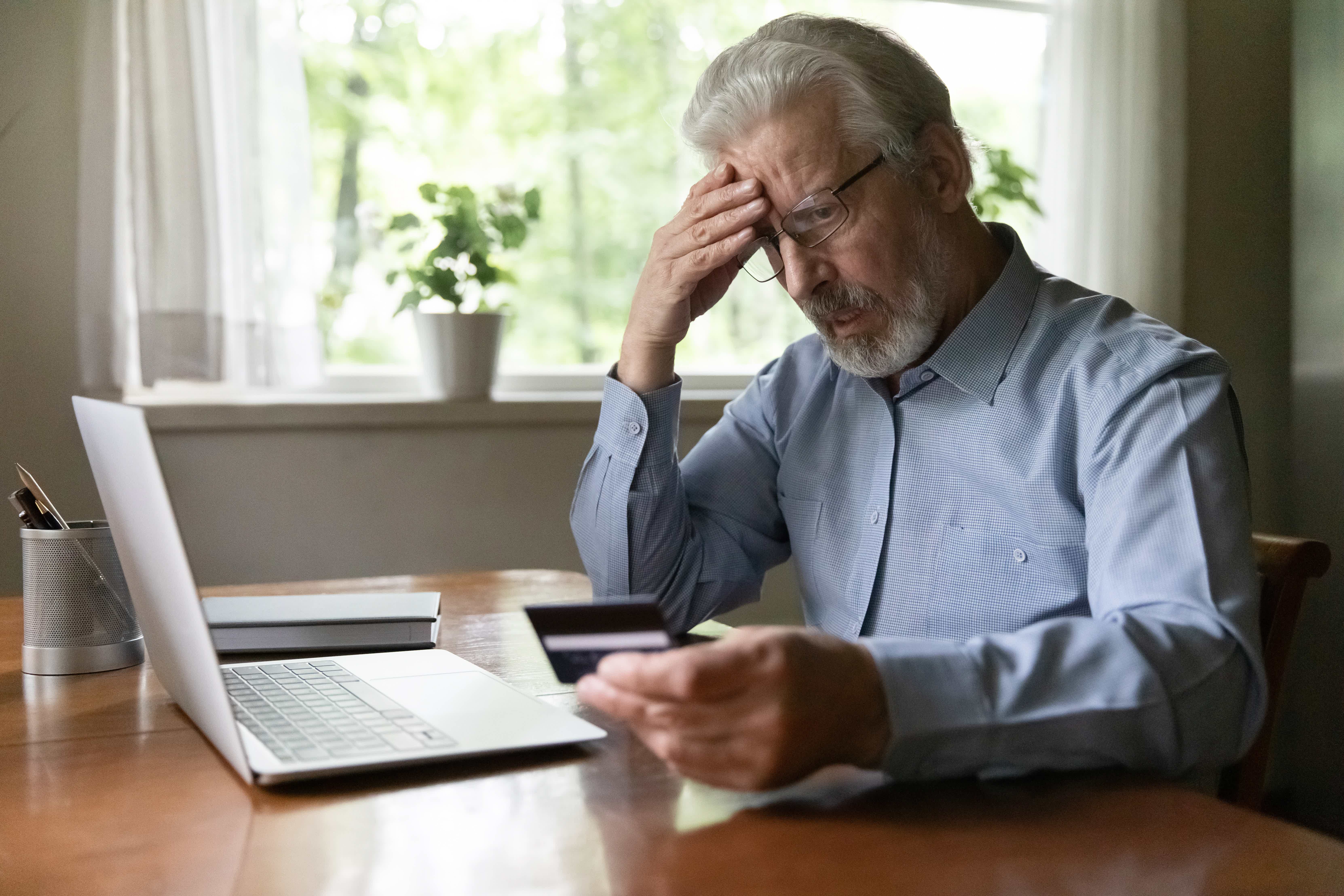

How to avoid CPF fraud?

CPF frauds have become increasingly frequent. That's why we've separated 5 infallible tips that will help you avoid this inconvenience. So, learn here how to avoid fraud with your CPF.

Advertisement

CPF fraud: 5 infallible tips to avoid

Knowing how to avoid CPF fraud is a way to prevent unpleasant surprises such as loans improperly requested in our name or telephone lines.

However, fortunately today there are ways to prevent these scams that are increasingly frequent. Serasa, for example, has developed an exclusive platform that helps you monitor your CPF. We'll talk about it and how it works later.

Therefore, with technological advances and the numerous opportunities in the market, it is important to be aware. A very important tip is not to go around entering your document number on the internet on unknown sites. In addition, Mister Panda will show you other infallible tips to avoid fraud in your CPF.

Continue reading and find out more!

How to avoid fraud with my CPF?

It is true that there is no way to guarantee 100% security against current scams or fraud. However, there are ways to minimize these chances as much as possible.

So, follow this list of tips and avoid being the target of fraud on your CPF!

Beware of online shopping

First, beware of online purchases. Therefore, this is one of the main ways to avoid CPF fraud.

Therefore, you need to be careful when shopping online, especially on unknown sites that do not have much recognition and reliability.

In other words, technology advances so much over the years that it becomes increasingly simple to create online stores and sell products from different segments. However, this also increases the number of scams and fraud.

That's because many scammers create fake stores to collect user's personal information, such as CPF, credit card number and more.

Therefore, avoid making purchases on unreliable sites and always try to analyze whether the site is known and whether someone has already made purchases on it.

How to know if my CPF was misused

There are ways to find out if your CPF has been misused and you can learn all about it in our content. Access!

monitor your CPF

Monitoring the CPF is essential in the security of our document, as it helps people to pay attention to any movement carried out. Therefore, the recommendation is that you use tools such as Serasa Antifraude, for example. Which, in turn, works in a simple way and anyone can have access to your plans.

It works as follows: register on the platform and subscribe to one of the plans. With this, the tool will notify directly by cell phone about any movement in the CPF.

Therefore, it is possible to quickly know what is happening and if you are suffering from scams and fraud. Finally, here are some of the notifications you will receive:

- When someone consults at the time of a purchase in commerce or loans from banks;

- The moment a company is opened in your name;

- When you are about to be negative;

- In case your name is removed from the default register.

Therefore, follow the plans and values that Serasa Antifraude makes available. The monthly plans are:

- Basic – R$25.90/month;

- Premium – R$29.90/month.

For annual plans, they are:

- Basic – R$119.90 in cash or R$9.99/month on your credit card;

- Premium – R$169.90 in cash or R$14.16/month by credit card.

Have your personal documents close at hand

This tip is especially for people who perform many face-to-face procedures, in which it is necessary to use the CPF or other documents.

Beforehand, we recommend that you always keep your documents close at hand. Therefore, avoid giving it to third parties, especially in places where it is not possible to view the document.

Even if it is at your bank branch and an attendant asks for your document, always stay close and check what procedure the individual will perform. Either with your CPF or any other document.

Be careful when disposing of credit cards and documents

Another important tip is regarding the disposal of documents. It may seem unnecessary, but many people still do this process the wrong way and don't care about it.

Therefore, a simple mistake can give the scammer the opportunity he needs. Therefore, it is recommended that when discarding any document it be destroyed.

For example, when discarding expired cards, it is recommended that you tear up the entire card. If you are one of those people who accumulates copies of personal documents, when discarding, remember to tear all the sheets well.

Beware of online surveys

And last but not least, beware of online surveys. They are common today in the virtual world, so many scammers take the opportunity to collect your personal information.

Therefore, review any research that is unknown or claimed to be from a large company. If this survey asks for any of your personal data, it is essential that you do not provide it.

What to do in case of CPF fraud?

If even with all these tips on how to avoid CPF fraud, you or someone you know ends up falling into scams, there are measures we can take

In this sense, the essential thing in the case of a cloned CPF, for example, is to file a police report to inform the authorities that your documents have been violated.

On the other hand, in the case of robbery or theft, we must notify the SPC Brasil system that our documents have been compromised. Within this, we will use the SPC document alert platform.

With that, when the scammer tries to impersonate you using your document, the shopkeeper, when checking the veracity of the documents, will see that it is stolen documentation and will take legal action.

Finally, now that you know how to avoid CPF fraud, access our recommended content and understand why it is important to invest in protecting your CPF.

Protected CPF: why invest in it?

Protect your CPF by investing in monitoring platforms and receive periodic reports. Know more!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to apply for the Itaú Business Loan

The Itaú business loan offers special payment conditions! Want to know how to apply? Read this post and check it out!

Keep Reading

Neon Card or Sicredi Gold Card: which is better?

Are you in doubt between the Neon card or the Sicredi Gold card? We will show you the advantages and disadvantages of each of them. Read the post and check it out!

Keep Reading

How to apply for Higa's card

Learn how to apply for the Higa's card and get access to the DMCARD application, a period of up to 45 days to pay the invoice and exclusive prices.

Keep ReadingYou may also like

Órama brokerage: what it is and how it works

With Órama, you can invest in fixed income and variable income without paying a custody or brokerage fee. See how this brokerage works next and find out if it's for you.

Keep Reading

Visa Gold Card or Visa Platinum Card: Which is Better?

Are you looking for a versatile credit card full of exclusive premium benefits? Then Visa Gold Card or Visa Platinum Card is a great alternative for you. To learn more about the cards and find out about their main advantages, just continue reading and check them out!

Keep Reading

Everything you need to know about qualified investing

Being a qualified investor even seems like a compliment for those who make good profits from investing. However, that's not quite what it means. After all, an investor of this type needs to have at least R$1 million in investments or else have their own certification. See how it works below!

Keep Reading