Cards

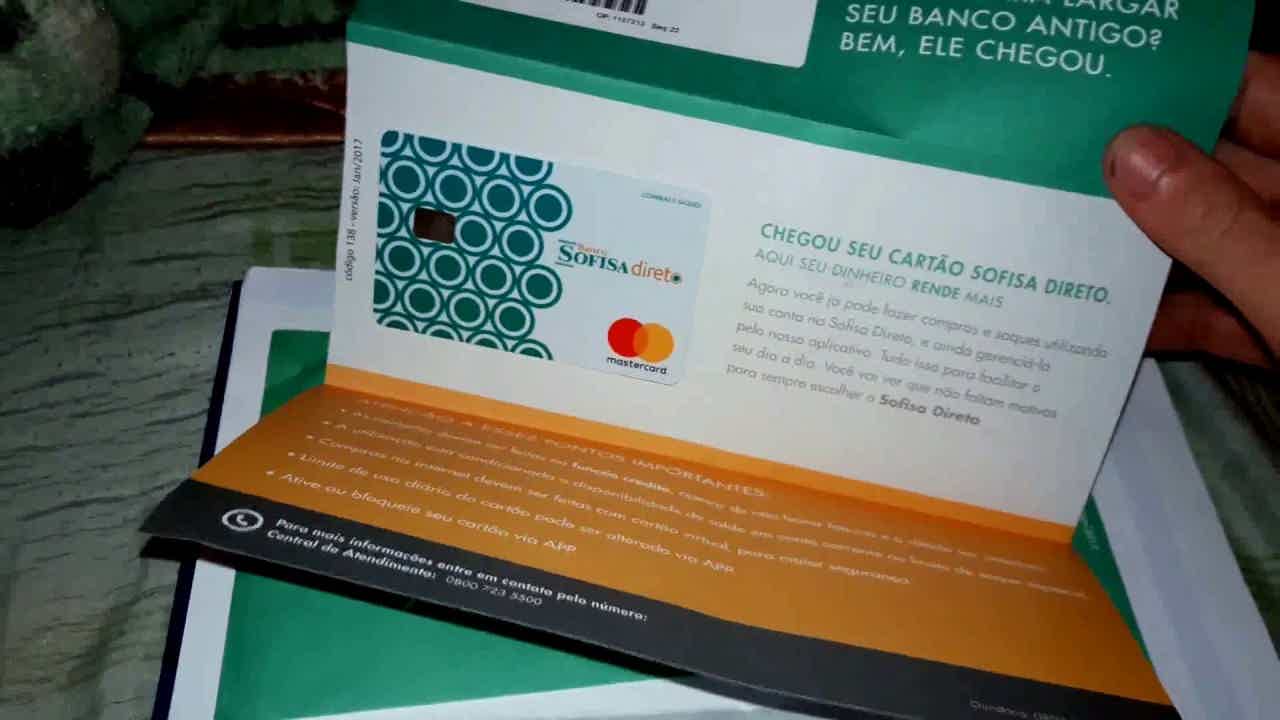

Discover the Sofisa credit card

Do you want a prepaid card with international coverage? The Sofisa credit card has these characteristics and also participates in the Mastercard Surpreenda program. Check out!

Advertisement

Sofia credit card

So, Sofisa Direto was created in 2011, it is the first digital bank and without any fees in Brazil. In this regard, it seeks to offer security, transparency, comfort and practicality in the execution of the services provided. Today, we're going to show you a little more about the Sofisa credit card!

So read on to find out more about this card! Check out!

How to apply for the Sofisa card

Do you have a dirty name? The Sofisa Direto card can be a good option. It has international coverage, is prepaid and the requested income is only one minimum wage. co

| minimum income | Minimum wage |

| Annuity | free |

| Flag | MasterCard |

| Roof | International |

| Benefits | Mastercard Surprise, exclusive discounts |

How does the Sofisa Credit Card work?

Well, the Sofisa Direto card is a prepaid card that has the Mastercard brand, and is totally free of annual fees.

This means that you do not pay any fees to keep the card services active, as well as, there are no minimum amounts to invest and your money yields more than savings! Too much isn't it?

And in addition, you make purchases using the credit function, but the amount is debited at the time of purchase, in your Sofisa Direto account.

In it, you can shop at different establishments that accept the Mastercard flag, make withdrawals, and still have access to several exclusive offers! And best of all, you can manage all your card expenses through the Sofisa app!

What is the Sofisa credit card limit?

So, the Sofisa credit card limit is up to R$5,000.00 daily, linked to the amount available in the account. And you can still change the limit through the Sofisa Direto app!

Is Sofisa credit card worth it?

So, let's get to know the advantages and disadvantages of the Sofisa credit card so that you can decide whether or not it is a good option for you! Check out:

Benefits

Well, the Sofisa card has several advantages, the first of which is one of the most important is the fact that it does not charge annuity or administrative fees, that is, it is a completely free card!

And besides, you can make purchases using the credit modality but with a prepaid card and you can even make 24-hour self-service withdrawals!

Another advantage is that the customer is entitled to four free withdrawals per month, as well as being released in several establishments throughout Brazil, both in physical stores and online.

Also, you can shop at all establishments that accept the Mastercard flag, which also has international coverage, Mastercard Surpreenda points program, and several other offers.

Disadvantages

On the other hand, the card also has some disadvantages such as not being able to make purchases in installments, because it is a credit card that works as a prepaid card.

And in addition, it does not allow recharge through a bank slip or recharge by third parties, that is, you have to recharge through the application!

How to make a Sofisa Credit Card?

So, you can apply for the Sofisa credit card through the digital bank application! In the recommended content below, we will teach you step by step so that you learn how to apply for this credit card and other information!

How to apply for the Sofisa card

Do you have a dirty name? The Sofisa Direto card can be a good option. It has international coverage, is prepaid and the requested income is only one minimum wage. co

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

How to avoid CPF fraud?

Looking for ways to avoid fraud on your CPF? Really the security of your document should be a priority. Learn more here!

Keep Reading

How to apply for the Lendico loan

Do you want to learn how to apply for the Lendico loan? It has interest rates starting at 1,99% per month, personalized service and much more!

Keep Reading

Unicred Gold Card or Zencard Card: which is better?

With exclusive benefits and unique features, the Unicred Gold card or the Zencard card give you more purchasing power! Learn more here!

Keep ReadingYou may also like

How to pay PIX with PicPay credit card: understand how it works

Nowadays, there are several ways to keep your payments up to date, even if you don't have money in your account. One of these methods is to pay PIX with a PicPay credit card. See how it works in the article!

Keep Reading

Novo Banco or Cetelem car loan: which is better?

If you want to buy your car more easily and safely, then Novo Banco or Cetelem car loans may be a good option. With them, you have more flexibility in paying installments and access to lower rates. To learn more about it, just continue reading.

Keep Reading

Payroll loan I want money: what is I want money?

Are you retired or pensioner of the INSS? So get to know the advantages of payroll loans I want money.

Keep Reading