finance

How to get out of over-indebtedness?

In Brazil, the number of over-indebted Brazilians grows more each year and that's why we're going to bring you some tips on how to get out of that state and keep your name clean again and without debt.

Advertisement

Pay off your debts in 2021

In 2020, indebtedness reached around 67.5% of Brazilians, according to data released by the National Confederation of Trade in Goods, Services and Tourism. In this scenario, in the midst of financial chaos, how to get out of over-indebtedness?

In the midst of a pandemic scenario that has reached alarming levels around the world, one of the first decisions to be taken is to understand what we are experiencing, in order to then start a debt settlement process in 2021.

That is, we need to understand what it represents, its causes, and know which paths can be taken to improve this situation.

So let's talk about debt, its origins, and we'll also bring you some tips so you can get out of debt.

What is over-indebtedness?

Over-indebtedness can be defined as the overall impossibility of the debtor, who will be an individual, lay consumer and in good faith, to pay all his current and future consumer debts.

First, let's warn about some criteria about this concept of over-indebtedness.

In summary, only an individual can be over-indebted, that is, MEI, legal entity, and any other person do not fit this concept, as they will not suffer the effects of over-indebtedness.

That's because, these companies can file for judicial recovery, bankruptcy law, and other ways to recover their assets.

Over-indebtedness is divided into two aspects: active It is passive.

Active over-indebtedness is one in which the consumer spends more than he or she earns.

In other words, it is that consumer who uses all the credit on the card, and already starts spending the next month's credit as well, accumulating invoices.

There is the active unconscious, which is the consumer who acted impulsively, but had no intention of defaulting on anyone.

That is, at the time of purchase, the consumer had assets to pay his debts.

There is also the conscious active, which is the consumer who acts in bad faith, that is, he incurs debts knowing that he will not be able to pay them off.

This is important, because the conscious asset, for not having acted in good faith, does not deserve the protection of the state.

Another over-indebtedness is the passive, which is the one in which the consumer acquires debt due to external or unpredictable factors, without bad faith.

That is, the consumer makes purchases even knowing that he will not be able to pay for them.

In the country's current scenario, we can see that over-indebtedness has reached hundreds of people, amid the pandemic.

Over-indebtedness x Indebtedness

It is indisputable that credit has become essential for the economy, expanding and inserting consumers into the consumer market.

On the other hand, this same credit expanded and also included these consumers in the list of over-indebted or indebted.

Thus, the indebted consumer is the one who has overdue, unpaid debts, and therefore, their names are entered in the SPC or SERASA.

Although this happens, there will still be an expectation of payment for these debtors, even in the long term.

Already the over-indebted is that consumer without expectation of payment, without compromising their subsistence.

That is, with the minimum necessary for survival, including, some do not even have the minimum necessary.

In Brazil, as we mentioned, hundreds of people are heavily indebted, so let's better understand how they can pay off their debts.

PL 3515/15

Under the terms of article 54 of this bill, over-indebtedness means:

"The manifest impossibility of the consumer, a natural person, in good faith, paying all of his consumer debts, payable and overdue, without compromising his existential minimum, under the terms of the regulation."

This project exemplifies why it is necessary to divide indebted from over-indebted consumers.

This is because the project brings solutions and alternatives for these over-indebted consumers as support, prevention and treatment.

That is, the treatment of over-indebted consumers becomes differentiated, due to the vulnerability of this consumer.

In 2020, one of the alternatives to over-indebtedness was emergency aid given by the Federal Government to consumers.

What are the causes of over-indebtedness?

As we mentioned above, over-indebtedness occurs due to several factors, both internal and conscious.

Or also by unpredictable external factors, for example:

- Unemployment;

- Divorce;

- Maternity;

- Uninsured car accident or some other supervening fact that becomes obstacles for the consumer to settle their debts.

Thus, these facts are called "accidents of life”, because they are unpredictable.

So, consumers who are targets of these accidents end up going into over-indebtedness, commonly called a “snowball”.

An example of this is the consumer who owes his credit card, and takes out a loan to pay off the card.

In that context, here are some tips that might help you get out of that snowball.

7 tips to get out of debt

We separate 07 tips among the most indicated by researchers and economists for a super-indebted person to get out and restructure his financial life. Check out!

make a list

This is the first tip to start your new financial life.

That is, at first, make a list of all your debts, with a payment date, to also have an idea of the delays.

Still on this list, make a comparison of interest rates, as well as possible negotiations in each of them.

This is because, when comparing debts, you can have a better view of which one to start negotiations.

When making the list, opt for paper and pen, as economists recommend that when writing, the debtor will be able to visualize even more clearly and thus organize the debts in the mind.

Write down fixed expenses

To get a healthy financial life, you also need to remember that there are fixed expenses.

That is, in addition to the payment of old debts, there are also new expenses that, if not paid, become new pending items.

Then, write down fixed expenses such as electricity, water, telephone, internet on another list, so that you have an idea of how your finances are going.

In this context, all income left over from fixed expenses should be directed towards paying off unpaid expenses.

Know how to prioritize expenses

Another tip is that after making both lists, keep in mind what your priorities are.

This is because not all unpaid expenses must be paid immediately, prioritize those with a longer delay period or more interest.

That is, choose to prioritize expenses such as credit cards and financing that usually have higher interest rates.

Renegotiate debts

So, we arrived at the stage of starting the debt renegotiation process.

At this stage, you should start contacting creditors, following the priority list we mentioned above.

So, call to propose proposals and also receive proposals, being ready for negotiations.

However, still in order of priority, try to get in touch with the creditors, one at a time, to be able to settle the debts.

That is, it is recommended that there be a strategy for making payments, and thus finding the best solutions.

Cancel the overdraft and credit card

This tip is for those consumers who entered the overdraft, and who do not know how to control themselves when using the credit card.

That's because, we already know how much of a villain he can be amid debts, being recommended to be cancelled.

Another tip is also to be able to recover bad checks.

In other words, get in touch with the stores where the checks were issued, and take them to the respective financial institution, so that the negative checks can be written off.

honor the payments

This tip is paramount. That's because, there's no point in doing all the negotiations and not honoring the debt payments.

So, before doing any business with creditors, find out if you can honor it, because duty already brings problems, but lying that you will pay will be new problems.

Have a new financial life

After managing to settle all your debts, you will find yourself facing a new financial scenario, which must be cultivated.

This is because, if new expenses are incurred and not paid, that scenario may return, and you will become frowned upon in the market.

So, restructure your financial life, cultivating good habits, and paying off expenses on due dates.

Bonus Tip: Look for public agencies to get free help

A bonus tip is for you to look for public bodies for help in the midst of this debt snowball.

One of these bodies is the Public Defender's Office, which offers support to people who are unable to pay their debts.

Another body is PROCON, where the consumer will be faced with financial guidelines, as well as negotiations that the body will intermediate between the consumer and creditors.

So, if you are over-indebted, get in touch with these bodies to be guided on what can be done.

Attention: your debt does not expire after 5 years

This is a necessary alert for all over-indebted consumers: your debt does not expire after 5 years.

What actually happens is that credit protection bodies can only keep the name of consumers for about 5 years.

After that, the consumer's name will be withdrawn, however, the debt is not forgiven, that is, the pendency with that respective creditor prevails.

This means that the consumer's name is removed only from the system of credit protection bodies, but the debts continue even after that period.

That is, the debt will continue to be registered not only with the bank of origin, but also with the Central Bank, in the SCS – Credit Information System.

If, after the five-year period, the consumer tries to apply for loans or credit cards from other banks, the request may be denied.

Well, these institutions can consult the SCR through the authorization of that debtor, and, when realizing that outstanding debt, they will be able to deny the request.

So consumers who want to pay off their debts will need time, and above all, patience.

And, remembering that to negotiate the debts, it is enough to go personally to the Public Defender's Office or Procon, or even to the fairs that take place every year of debt renegotiation.

How do I know if I'm overindebted?

We'll ask you nine questions, and if you answer YES to all of them, or most of them, it's because you're over-indebted:

- Do your debts amount to more than 50% of your income? Or still spend all of your income?

- Do you need to work, including working overtime to pay your expenses? Or sometimes you can't even quit?

- Does your salary end at the beginning of the month?

- Are your debts causing family rifts?

- Are you unable to pay your fixed expenses such as telephone, internet, electricity and water on time?

- Do you suffer from depression because of debt?

- Is your name dirty because of debts?

- Do you always delay monthly bills?

- Have you ever borrowed money from friends and family to pay off debt? Or you can't even ask anymore because you already owe them too?

If you found yourself in these questions, then you are among the hundreds of over-indebted people, and you need to follow our tips right away.

For today, start by making a list of all your debts, and little by little, follow the other tips. Good luck!

Want more tips? Check our step by complete step that how to get out of debt.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Online Iti Itaú Card: no annual fee and free account

Get to know the Iti Itaú card online and see the advantages it can offer you, such as the Vai de Visa Program and up to R$ 20,000 limit!

Keep Reading

Discover the BV Único card

With the BV Único card, you have cashback, residential and vehicle assistance, as well as other exclusive benefits. Learn more here!

Keep Reading

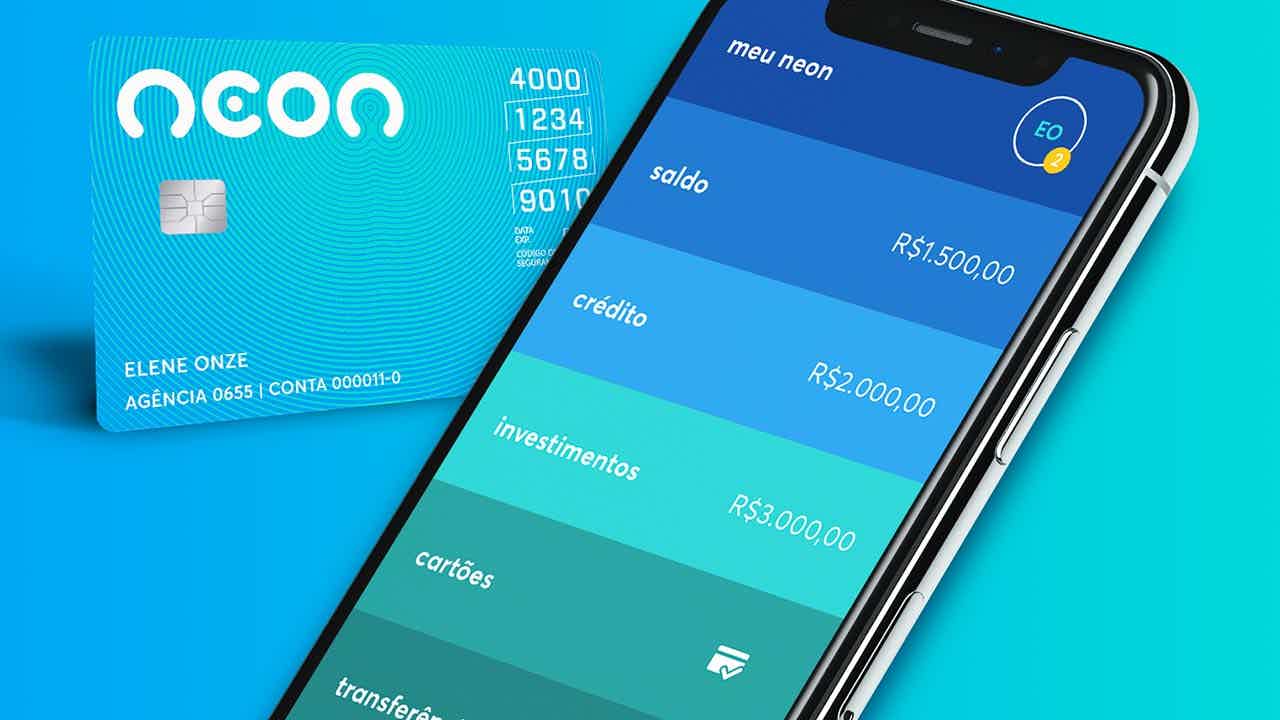

Neon Card or Pan Card: Which is Best for You?

Need to decide between the Neon Card or the Pan Card? So know that both have Visa flag discount programs! Learn more here!

Keep ReadingYou may also like

How to apply for Porto Seguro Visa

Discover now how to apply for the Porto Seguro Visa credit card. Follow the instructions below to get yours!

Keep Reading

Discover the Juno card

Juno is a prepaid card that can be used in places that accept Visa, including delivery and streaming apps. Want to know more? Then see the post below.

Keep Reading

Find out about the BPI Serviços Mínimos current account

The BPI Serviços Mínimos account has the main resources to keep your finances up to date, as it has an affordable maintenance fee and does not charge an opening fee. Learn more about this complete current account option here.

Keep Reading