loans

How to borrow online instantly?

Do you know how to make a loan online on time? No? So don't worry, we'll help you get money fast and safe! Look!

Advertisement

Find out where I can get an easy loan

When debts tighten, seeking quick and secure financial loan solutions is one of the best options. That's why today, we're going to teach you how to take out a loan online right away, to help you solve your financial problems!

So read on to learn how to apply! Check out!

Research before making a loan online at the time

So, first of all, the first recommendation is for you to do a search for the online loans that are available on the market!

This is because there are several options that vary according to interest rates, payment terms and the customer's profile.

Therefore, research before taking out a loan online at the time so as not to make a contract that in the long term may not be so advantageous!

Compare available institutions

Then, compare the available institutions to find out which one brings the best proposal for you according to your financial history and profile!

Therefore, compare banks, creditors and financial institutions and evaluate the security, soundness and proposals offered.

Carry out a simulation of interest rates and CET

So, do a simulation of interest rates and Total Effective Cost to find out which option is best for you!

In this regard, simulating the values of each installment, as well as interest rates and how many months you will be able to pay off this new expense is ideal, to know which of the available loans is the best option!

Therefore, before borrowing money, remember to do a cost simulation, to find out if you will be able to honor the debt commitment!

Documents required for online loan on time

After that, you must attach the necessary documents to hire on time! In this, the documents that are requested are usually CPF, RG and proof of residence such as electricity or water bills, credit card invoice or other correspondence in your name.

And in addition, they can also ask for proof of income or other guarantee as a copy of the paycheck. Then, it will be necessary to scan or scan the documents to send to the bank or finance company.

Finally, you just need to wait for the credit analysis that will be done by the creditor to then proceed to the final stage of hiring!

What are the advantages of the online loan on time?

So, there are several advantages in taking out the loan online, the first of which is the speed and practicality of taking out the loan!

This is because there is no bureaucracy and you do not need to personally go to an agency to take out the loan.

And in addition, another advantage is that you can simulate the number and value of the installments that will be paid even before closing the contract.

That is, it is much easier to be able to plan financially knowing exactly how the next months and years will be with that debt.

Another advantage of this loan is the possibility to choose when you will start paying.

This is because, when taking out the loan, you can choose the date to start paying the installments, as well as knowing how the interest rates will be.

Plus, you can pay off the debt amount or even pay it off with an automatic discount for early payment.

Finally, this way of making money online is a safe, transparent resource that brings you the comfort you need and a good alternative in the most difficult times!

What are the disadvantages of the online loan on time?

Well, the first disadvantage of the online loan is the interest rates that can be high in certain financial institutions, hence the importance of doing research before hiring.

And in addition, another disadvantage is the ease, because, as it is an easier type of loan, the chances of giving in to the hiring impulse are also greater.

How to borrow online?

Taking out a loan online is a practical and quick way to get the credit you need. Learn how to do it and discover 5 great options!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Can someone with a dirty name get a Pan card?

Can someone with a dirty name get a Pan card? Find out how this bank releases credit and see if you have a chance of being approved!

Keep Reading

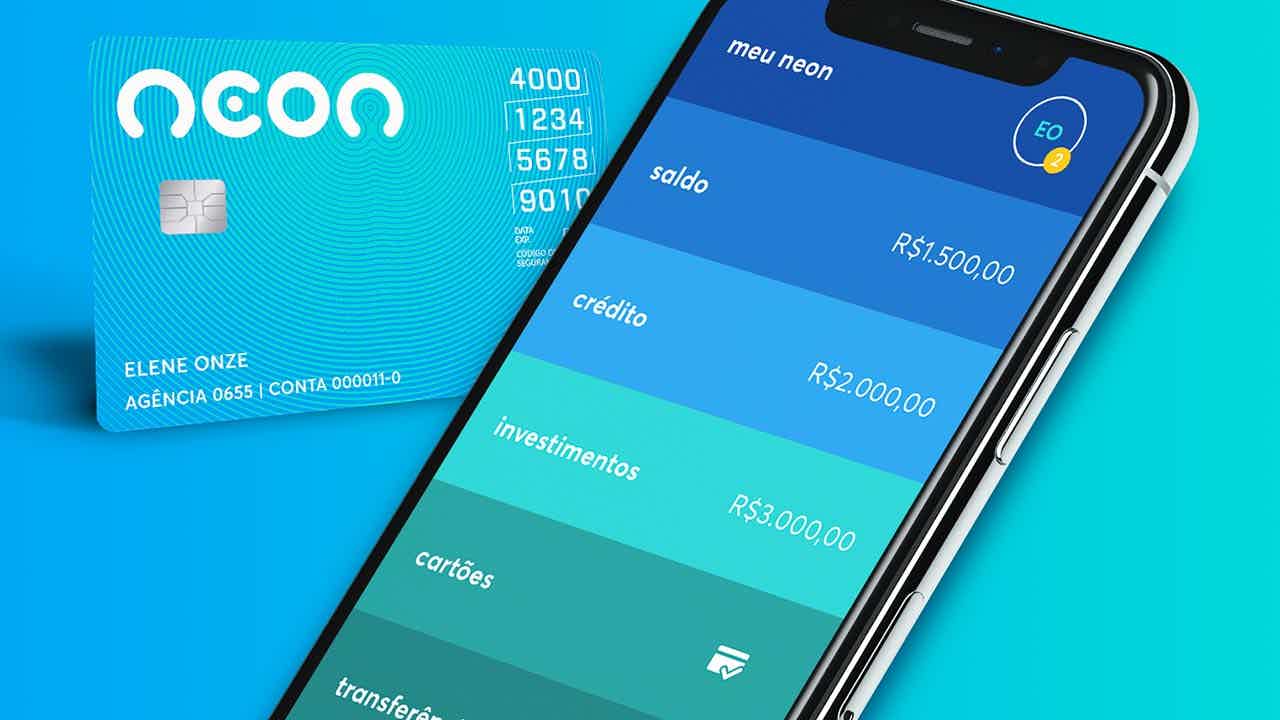

Neon Card or Pan Card: Which is Best for You?

Need to decide between the Neon Card or the Pan Card? So know that both have Visa flag discount programs! Learn more here!

Keep Reading

Superdigital loan or Jeitto loan: which one to choose?

Superdigital loan or Jeitto loan: Do you know which one is the best option when taking out a personal loan? Check out!

Keep ReadingYou may also like

How to get free stuff on Shopee: see how to redeem prizes and coupons

Discover the secrets to saving and even getting free products on Shopee. Take advantage of incredible offers and exclusive coupons!

Keep Reading

Pan Mastercard Internacional credit card: how it works

Get to know the Pan Mastercard International card and discover its advantages, such as the Pan Mais program. In addition, the card is issued by Banco Pan and has international coverage. Check out more details here!

Keep Reading

Can someone with a dirty name get a Pan card?

Anyone with a bad name knows how difficult it can be to apply for a credit card. However, at Banco Pan you have access to good plastic that does not charge annuity and has Visa benefits. Learn more right below.

Keep Reading