loans

How to get a bad credit loan online

Do you have a dirty name and need some quick cash? Know the types of loan available for negative online. Keep reading!

Advertisement

Loan for negative online

If you are thinking that because you are negative you are not able to get a loan online, luckily you are wrong. Nowadays, there are great opportunities to get credit in the market even with a dirty name in the market.

So if you're part of this audience, don't despair, we'll show you all the opportunities you still have to borrow money with stress-free finance companies.

In addition, we will show you how to get loans directly from your home 100% online. Because right now the best option is to stay at home and in addition to protecting yourself from the virus, you will be saving time and saving your patience by not having to face queues.

There are several ways to apply for a bad credit loan and you don't necessarily have to pay exorbitant interest rates. With that in mind, many companies lower interest rates when they offer one of their goods as collateral, for example. That's why you need to be sure you can pay.

Here we want to show you that it is very possible to take out a loan for bad credit by doing all this from home. Stay with us and check it out!

What does it mean to be negative or restricted?

Having a negative or dirty name means that the person is in default. That is, when you are late for a certain amount of time and do not pay a debt, your name will be included in the register of credit protection agencies such as Serasa, SPC, SCPC and CCF.

In the case of the restriction, it works as a negative “stamp” that the defaulting consumer receives before the market. Thus triggering many limitations directly affected by non-payment of bills or financial commitments.

In this way, any debt you make and do not pay in any financial institution can and will result in your name being denied.

How do I know if my name is dirty?

There's no shame in going through a financial crunch and getting a dirty name. So, find out how to know if your name is dirty

What is an online negative loan?

Financial loans are contracted whereby one person gives another a certain amount, which must be returned to the first within a certain market period with interest added to the monthly payment.

Basically, these are lines of credit that companies offer specifically to customers who are in default, that is, to those who have some debts or restrictions registered in the CPF.

These situations are the result of a delay in your previous payments or even non-payment of these pending items.

We know that the reasons for delay or non-payment of a bill are numerous. But in almost all cases the main driver for this is the lack of financial planning.

Therefore, before applying for any loan or credit from financial institutions, analyze your long-term financial situation, as loans can be divided into up to 60 installments. Therefore, in order not to make your situation worse, always be aware and control your expenses.

How does the online negative loan work?

With this type of negative credit you can get money to pay off debts, invest in your company and even bet on a business from scratch. Well, giving our money a purpose is very easy, but how does the loan work?

It is not because the person is negative that he is unable to afford a loan. If you have a source of income such as retirement, self-employed, CLT, or are a pensioner, you can apply.

There are several factors considered by the institutions to release the loan for negative, such as:

- age;

- minimum monthly income;

- proof of address;

- ability to pay;

- Registration notes in the CPF.

The list of documents varies according to the demands of the creditor body and according to the type of credit requested.

Taking out a loan will definitely go through some steps, get to know them all now:

Simulation

Certainly, in order to choose a good financial institution and a loan that fits your pocket, it is extremely important to carry out simulations in many different companies. This process usually does not take up much of your time, it even takes just 3 minutes to complete.

The most important thing is that to carry out this process, you won't need to make a long registration or register your information in a database of institutions that you probably won't hire.

Therefore, after carrying out the necessary simulations, you must choose the best loan that fits in your pocket and now start hiring with the availability of your personal data.

Assessment

Any loan is never available instantly, so you will have to wait for the trial period. This process consists of analyzing your profile, your salary or benefit and even your property or asset used as collateral.

This is called a credit analysis, so the company will define the amount to be released for credit, interest rates involved in the operation and the number of installments offered for payment of the amount.

This happens because the company wants to guarantee that it will get the borrowed money back. Thus, the trial period offers the best payment terms for you.

Signature

After the loan is approved, this step will guarantee your signature, in this way the documents will be provided for you to start signing the paperwork.

It is therefore worth noting that the contract includes three parties: the bank, the customer and the paying agency. This third character refers to the company or public body to which the client is linked.

If you are an employee with CLT, for example, the paying agency is the company. In the case of INSS retirees and pensioners, the INSS assumes this role. The same, therefore, applies to active and inactive civil servants and military personnel.

money released

Now it's time to celebrate, with the money released you can start your projects and allocate the money for what you plan.

Then it's time to start paying off your debts or investing in your personal projects and dreams. Even if you are negative, you may have money in your pocket.

What are the types of loan for negative online?

There are several types of loan for you who are negative to hire. Therefore, it is interesting to evaluate well how much you are willing to pay to pay off your debts. In this topic, we will present the main modalities and it is up to you to decide which one is ideal for your financial situation.

Depending on the financial institution, the loan will be carried out online or in person. However, currently with the restriction measures to combat the Covid-19 virus, it is ideal to carry out the entire process remotely via computer or cell phone. So you will only need your documents and the internet to start hiring.

It is important to highlight that the negative loan works like any other. Once approved, you will receive the money and need to pay it back within the established period. Get to know the main modalities now:

Loan with vehicle guarantee

In that case, you can use your larger assets as vehicles for securing a loan. And just like you, if the interested party does not pay the loan on time, he will lose his asset to the bank. In this case, this is a loan that focuses on vehicles, whether cars, motorcycles or other means of transport.

This property needs to be in certain conditions to be accepted by the institutions, such as, for example, being already paid and without any related legal problem. Your asset will also be disregarded if it is experiencing a serious structural problem that compromises its future value, for example.

It is important to highlight that depending on the type of guarantee. Interest rates tend to be lower than those offered on a negative personal loan, requiring greater care with the maintenance and preservation of the good.

Loan with property guarantee

This works in the same way as a secured vehicle loan. So the good is used to guarantee the payment of the loan, which if not paid, the customer loses his good to the bank.

Therefore, for you to be eligible for real estate financing and be able to place your property as collateral for the loan you need, it is necessary that this property is owned and without related debts.

Payroll loan

This is a very popular modality, along with personal credit. This type of loan has excellent conditions for negatives because its main feature is that the installments are deducted directly from the payroll.

This type of loan, like any negative loan, has some restrictions that serve to increase the chances of guaranteeing the payment of the defaulter. In the case of payroll, the only restriction is that only retirees, pensioners and employees of affiliated companies have the right to do so.

Among the benefits for you are lower interest rates than personal credit and a period of one to six years for payment to be made.

It is important to highlight that in addition to the payroll deduction, since 2018 it is possible to use the FGTS (Fundo de Garantia por Tempo de Serviços) to pay your payroll installments through Caixa Econômica Federal. The interest rates are also very low and the payment is made in up to six years.

Both for payroll deductions and for payment by FGTS, it is not allowed for the limit of each installment to exceed the 30% range of the contractor's salary or benefit.

Loan for self-employed negative

But if you work as a self-employed person and are also negative, but believe that there is no solution for your case, know that there is a type of credit that will suit you.

Nowadays, there are many credit opportunities for freelancers in the Brazilian market, as the number of people who work on their own grows every year. Especially after the start of the pandemic, many people were left without their fixed income.

If this is your case, rest assured! Because even if you work independently, institutions have ways to calculate your earnings and grant you loans.

And to begin with, there are some steps you must follow to make your credit application and have it approved. Therefore, if you find a financial institution that offers a loan for self-employed people, you must follow these steps:

- Present your bank statement, indicating the financial transactions of the last three months;

- Make the income tax return;

- Formalize your MEI or open a CNPJ.

You can also refinance your vehicle or property in order to increase the chances of having a loan approved for a higher amount. That way, you use two modalities for a single loan.

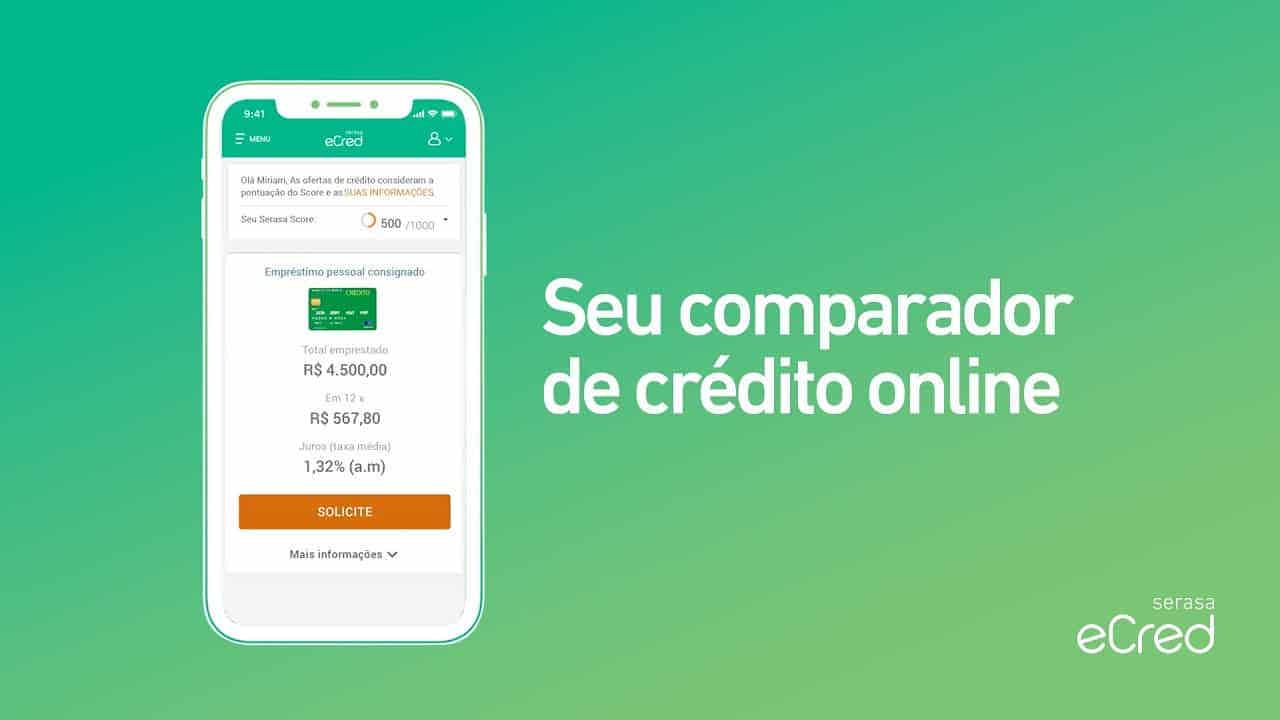

How to get your loan for negative online by Serasa E Cred?

After giving you all the most important details about online negative loan. We will teach you how to do this in practice with a reliable company that is Serasa.

With Serasa Ecred, your order is made digitally 100% and you can even simulate your loan, all through the website. Also, what's better, the simulations have no impact on your credit score. Check out some of the benefits of taking out your loan at Serasa E Cred here:

- Unlimited simulations, without impacting your Score;

- The ideal offer for your financial profile;

- Loan for negative with Serasa guarantee;

- Credit without bureaucracy;

Who has ever seen negative credit as a requirement to acquire a loan? At Serasa Ecred you can! Because the first requirement is to be negative, but each company's concession policy is different. Despite this, it is worth noting that some profiles may have different conditions when acquiring a loan. Look:

- pensioner or retiree: if this is your case, your loan is deducted by the bank directly from your benefit.

- Public agent: State, federal, and municipal employees can also enjoy the benefits of a payroll-deductible loan.

But remember that the negative loan is something to solve a momentary problem, until you organize your finances and get other types of credit available in the market.

Clean name: 8 best practices

Did you know that a clean name is important, but do you need good practices for that? See which ones guarantee the success of your finances

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Best online course for competitions: how to choose?

Get to know the best online course for competitions and prepare yourself with quality for the exams. This way, you increase your chances of getting the job.

Keep Reading

Where do you accept a card with the Cabal flag?

Find out in this post where cards with the Cabal flag are accepted and see how you can discover accredited establishments.

Keep Reading

Get to know the cell phone maintenance course

Are you looking for a career and income opportunity? So, check out more about the cell phone maintenance course and secure your place in the area!

Keep ReadingYou may also like

16 best digital accounts of 2021

In this list, we have listed the 16 best digital accounts so that you know everything they offer and have all the information before choosing the best option for your financial life! Want to know more? Check it out here!

Keep Reading

How to apply for the Bradesco Aeternum Visa Infinite

Do you want to know how to apply for the Bradesco Aeternum Visa Infinite card? If so, then know that your time has come! Read our text and learn more.

Keep Reading

How to apply for the Brasil Você card

Imagine having an international Visa-branded card that can be used without generating an invoice at the beginning of the month. It would be interesting, wouldn't it? So, how about getting to know the Brasil Você card? It has these features and also has other benefits. Let's go?

Keep Reading