Cards

Santander SX Card or Bradesco Neo Card: which is better?

Do you want to choose between the Santander SX Card or the Bradesco Neo Card and don't know which option is the most advantageous? Then check out our post!

Advertisement

Santander SX or Bradesco Neo: find out which one to choose

To begin with, the Santander SX card or Bradesco Neo card are two card options offered by Santander and Bradesco banks with different but interesting proposals such as annuity waiver, international coverage and other exclusive offers!

So, to learn a little more about the pros and cons of these cards, we've brought you a comparison so you can do an analysis! Check out!

How to apply for the Santander SX card

Find out how to apply for the Santander SX card following the step-by-step instructions below.

How to apply for the Bradesco Neo card

Discover the step-by-step process on how to apply for the newest Bradesco bank card, the Neo credit card.

Santander SX Card

Well, the Santander SX card is a credit card model issued by the Santander bank, which has a Visa or Mastercard flag (your choice) and International coverage.

That is, you can shop at national and international stores, increasing the store options when shopping!

In this, the Santander SX card charges an annuity fee, however, it also offers means for you to zero the annuity fee. To be able to reset this fee, just register your PIX key or even have invoices above R$100, so that the registration can be completed.

And in addition, to apply for a credit card, you can go to one of the branches of Banco Santander, as well as, you can also apply for a credit card by telephone or on the official website of Banco Santander.

Another advantage of the Santander SX card is that the customer can request 5 additional cards to the holder's card, that is, everyone in his family can have access to the Santander Sx card!

Therefore, the Santander SX card is a card option that has several offers for customers, and a very interesting proposal to zero annuity!

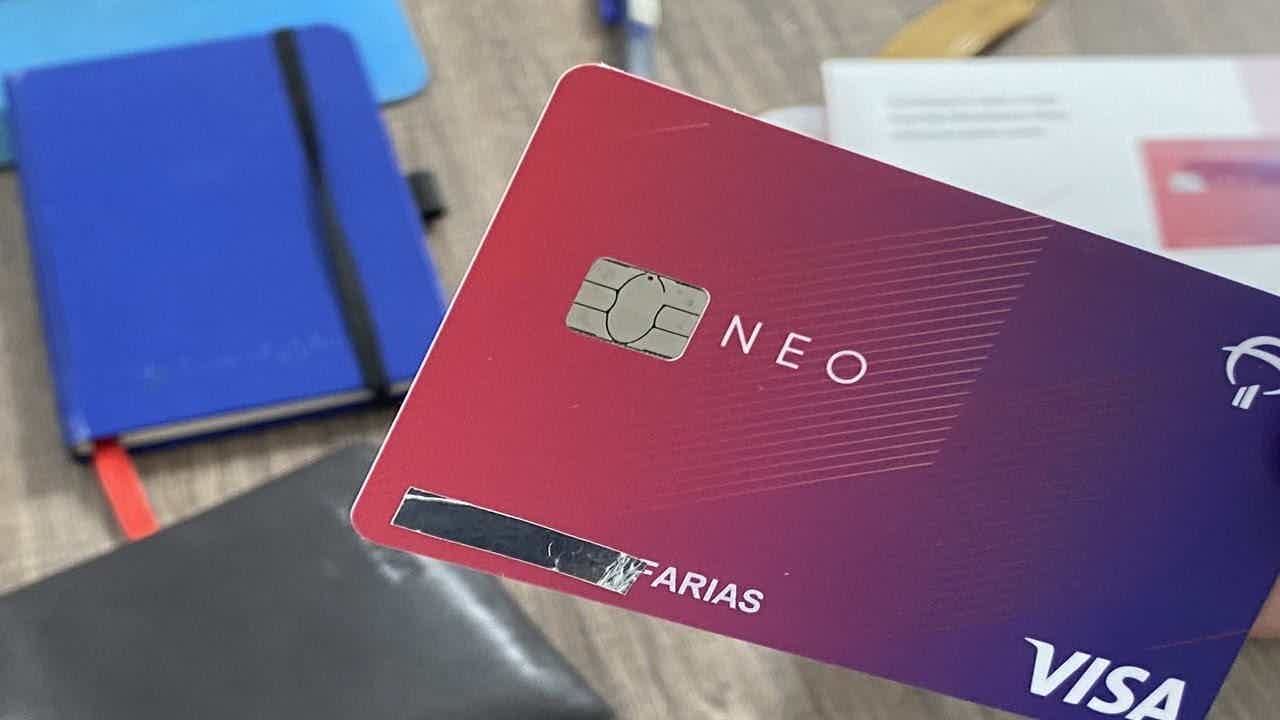

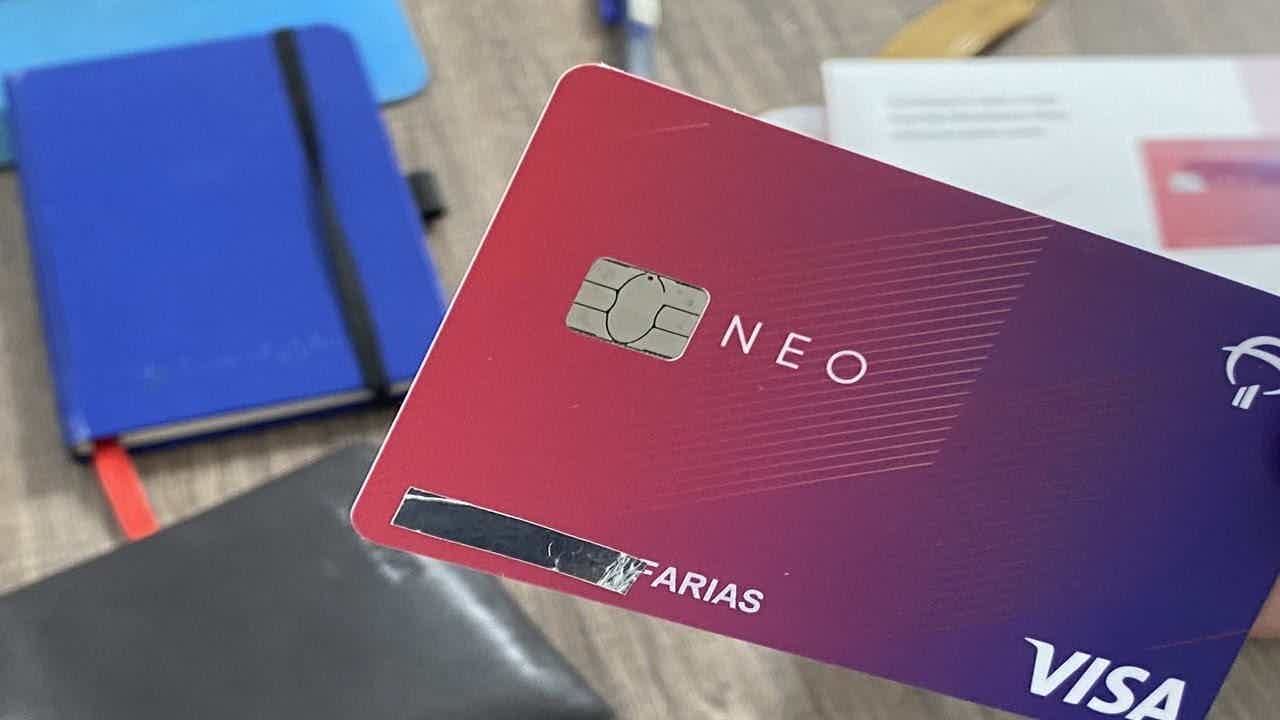

Bradesco Neo Card

So, the Bradesco Neo card is a card issued by the Bradesco bank that seeks to bring security and practicality to customers, as well as transparency and quality in the execution of the services provided!

In this, the card has the Visa flag and international coverage, that is, you can shop in almost all stores and establishments in Brazil and the world!

And besides, you don't have to pay an annual fee for the card. This is because, if you spend around R$50 reais per month using the card, the fee will not be charged!

On the other hand, if this does not happen, then an annuity of R$240.00 or 12 times of R$20 will be charged.

Also, you can pay your invoices about 40 days after purchasing the product, without interest. Too much isn't it?

Therefore, the Bradesco Neo card may be the perfect option if you are one of those people who like to shop without having to start paying the next day!

What are the advantages of the Santander SX card?

Well, the first advantage of the Santander SX card is the Visa flag. That's because, customers will be able to take advantage of all the Visa Gold program offers.

And in addition, it has international coverage, that is, you can shop in national and international stores.

Another advantage is that the card has an annuity, but you can reset it with the options offered by the bank as a Pix key record!

Also, you can request up to 5 additional cards to the main card and still have access to up to 50% of discounts at Esfera stores. Therefore, the Santander SX card seeks to offer several options to customers, mainly Santander bank account holders!

What are the advantages of the Bradesco Neo card?

So, the Bradesco Neo card, like the Santander card, has the Visa flag, offering customers various offers and Visa discount programs!

Furthermore, the Bradesco Neo card does not charge an annual fee if you spend at least R$50 per month with the card! Another advantage is that, it offers various discounts and offers for cultural events.

Another advantage that the card offers is the possibility of placing some of your goods in insurance, which is provided by the Bradesco bank itself! And because of this insurance, you have access to 24 hours of free service!

And in addition, it has several assistance services for different occasions, such as: locksmith service for residence; forwarding service; home protection and much more!

Finally, you have the card application that allows you to manage all your credit card expenses through the app! To do this, just install the application, available for the App Store and Google Play, and register! In it, you will have access to the digital card, as well as, you can request the physical card!

What are the disadvantages of the Santander SX card?

So, one of the biggest disadvantages of the Santander SX credit card is the annual fee charge. That's because there are several credit card options on the market with digital accounts that don't charge an annuity fee, so this can become a hindrance!

Therefore, the Santander SX card can be an advantageous option for customers looking for offers that offer an interesting proposal.

It is important to remember that it has the possibility of zeroing the annuity rate. To do this, just register the Pix key or spend invoices above R$100 per month!

What are the disadvantages of the Bradesco Neo card?

Unfortunately, one of the biggest disadvantages of the Bradesco Neo card is that it is not an option for negative credit cards. That's because, he does a careful credit analysis and does not accept people with dirty names, that is, who are registered in credit bureaus like SPC and SERASA!

But don't be discouraged, as there are several other card options on the market that are accessible to people with a dirty name!

Santander SX Card or Bradesco Neo Card: which one to choose?

Well, the Santander SX card or Bradesco Neo card are card options issued by Santander and Bradesco with innovative, different and very interesting proposals to bring more security, comfort and options to customers who do not want to pay an annuity!

Therefore, make an analysis of the cards that are available on the market and see which one is the best option for you! And if you still have doubts, check out a new card comparison below that we bring in recommended content:

Superdigital Card or Santander SX Card?

Either the Superdigital Card or the Santander SX Card, both are cards issued by the Santander bank and with exclusive benefits! Check out!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Know the Right Agreement: negotiate your debts in 2021

Get to know the Right Agreement, a platform where you can negotiate your debts safely and without any bureaucracy.

Keep Reading

How to apply for the Fiat consortium

Undoubtedly there is a Fiat dealership near you to request your consortium. But you can also use the call center or app. Check out!

Keep Reading

Online Iti Itaú Card: no annual fee and free account

Get to know the Iti Itaú card online and see the advantages it can offer you, such as the Vai de Visa Program and up to R$ 20,000 limit!

Keep ReadingYou may also like

How to approve vehicle financing with a low score

Find here the answers to the main questions about how to get vehicle financing with a low score. Also, find out how to improve your credit score to get the ideal score to hire this financial product.

Keep Reading

How to invest in gold on the Stock Exchange?

In today's post we will talk about investing in gold. The value of the metal has little chance of failure, being a good alternative for those who want to protect their money. Interested? Continue reading and check out how to invest in gold on the Stock Exchange.

Keep Reading

How to open a Binance account

At the Binance brokerage, you can invest in various cryptocurrencies and have the security of a double verification system. See below how to open your account and start investing.

Keep Reading