Tips

Know the Right Agreement: negotiate your debts in 2021

Learn all about the Certo Agreement, a platform where you can negotiate your debts safely and without any bureaucracy.

Advertisement

Learn all about financial product

If you're having financial problems and you don't know how to solve them, don't worry, because Agreement Right is a platform that helps you negotiate your debts. So, read on to better understand how this platform works. Let's go!

What is the Certo Agreement platform and how does it work?

So, Accord Certo is an online debt negotiation company, recently acquired by Boa Vista.

Thus, to negotiate debts on the Agreement Right platform, simply register on the website, fill out the form with all your personal data and wait for the platform to locate your debts. Then, Agreement Right will start the negotiation process and you will be able to choose the best payment method.

In addition, everything is done without any bureaucracy with all the security and convenience you need to pay your debts.

What are the advantages of negotiating debts with the Right Agreement?

Among the advantages of negotiating debts with Agreement Right is the possibility of simulating and requesting financial loans within the site itself.

And, in addition, Accord Certo offers the best payment conditions for customers compared to other companies in the market.

How to negotiate debts online

Have you ever tried to negotiate your debts, but failed? Want some extra, quick help? So, pay attention, because we are going to teach you how to negotiate debts online.

What are the disadvantages of the platform?

Despite having several advantages, the Certo Agreement has some negative points. For example, it only makes the connection between customers and the best loan options, that is, it is not responsible for the loans or for the negotiations, but only serves as a channel for the negotiation to be carried out.

What are the Right Agreement partners?

So, the company has several partners to help you make your financial life uncomplicated, namely: Claro, Vivo, Faculdade Anhanguera, Pitágoras, Unopar, Bancos Bradesco, Itaú, Santander, Casas Bahia, Renner, Ponto Frio and several other partners that You can check it out by going to the company's website.

How to negotiate your debts on the platform?

So, to negotiate debts on the platform is very simple, just enter the website of the Right Agreement and enter your CPF. If you are already registered, just login.

Then, fill in the form with all the data, such as date of birth, telephone, e-mail and read the Terms of Use and Privacy Policies. After that, the platform will start searching all outstanding debts in the entered data.

Then, the negotiation process will start and you will be able to choose the payment method you want. That's it, just complete the negotiation.

Also, if you want more tips to get out of debt, read our recommended content below and check it out!

How to get out of debt in 2021

Are you full of debts and no longer know how to pay them? Are you unable to plan? We'll give you tips on how to get out of debt in 2021.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Zema loan or Provu loan: which is better?

In today's article, we will show you the advantages and disadvantages between Zema loan or Provu loan. Read it now and choose the best one.

Keep Reading

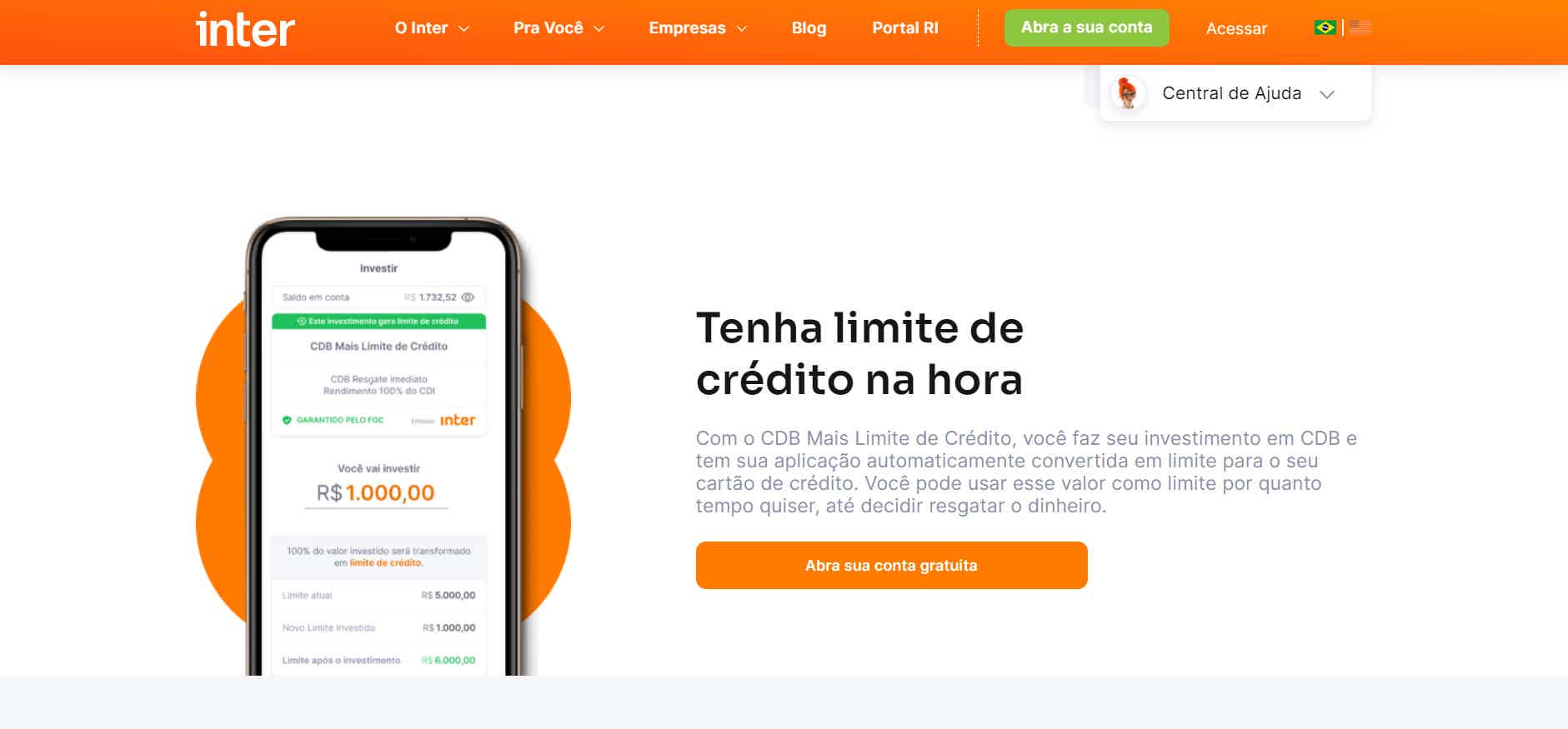

How to apply for an Inter Limite Invested card

See how to apply for the Inter Limite Invested card in the comfort of your home, with all the security, practicality and ease you need.

Keep Reading

All about the PicPay virtual card

The PicPay virtual card is a service linked to the credit card that provides even more security during the online shopping process. Look!

Keep ReadingYou may also like

Banco Inter promotion should award customers up to R$77 thousand

With Banco Inter's promotion, its customers participate in monthly sweepstakes for amazing products such as smartphones, notebooks, and cash prizes. Thus, to participate, customers only need to carry out transactions with values above R$100.00 to win lucky numbers.

Keep Reading

Discover the Banco Best Gold Plus credit card

If you live in Portugal, how about getting to know the Banco Best Gold Plus credit card? It offers many benefits such as miles program. Continue reading and check it out!

Keep Reading

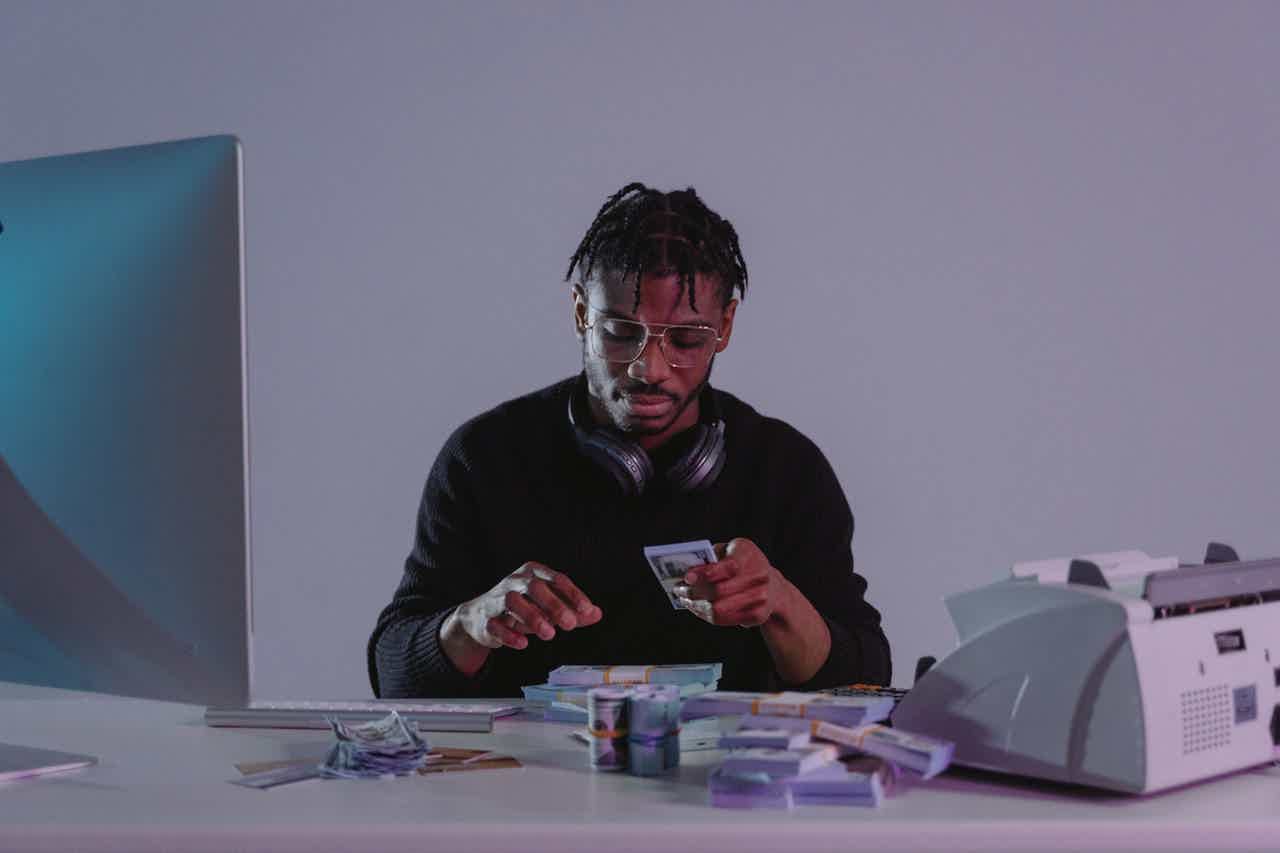

Extra income in 2020: 23 ways to earn money

You can make extra income in different ways, whether it's crafting, analyzing apps on the internet or selling food. Find out here 23 ways!

Keep Reading