Cards

PagBank card: how it works

Not long for you to pay your bills on your own card! Discover the international PagBank credit card with no annual fee and choose the best option for your financial life.

Advertisement

PagBank Card: discover the advantages of this credit card

PagBank cards are a PagSeguro product. Cards offer several benefits and can be a good option for those who are starting their financial life. One of the main advantages is the absence of annuity, in addition to exclusive promotions for customers.

In this article, we will show you the three types of PagBank card. However, it is important to say that only one of them is actually a credit card. The other two options use the credit function but depend on an account balance. Therefore, our focus will be the credit card.

Want to know more about this card and understand if it's right for you? Read on!

| Annuity | Exempt |

| minimum income | not informed |

| Flag | Visa |

| Roof | International |

| Benefits | Vai de Visa Program; Benefits of the flag; High credit limit. |

How to apply for PagBank card

Do you dream of financial independence and don't know which card to choose? How about requesting the PagBank card without annuity? Read this post and find out how.

PagBank Advantages

One of the main advantages of PagBank cards is the ability to make international purchases. The account card and the prepaid card have similar benefits. In both, it is possible to shop online and use the credit function. It is also possible to make withdrawals, however, in this case there is a fee of R$7.50 for each withdrawal.

The credit card, on the other hand, has some extra advantages, such as not having an annuity. By the way, the card also has a virtual version for online purchases. So, if you're looking for a card to subscribe to streaming apps, this product is ideal for that.

For those who are starting in financial life, it is common to have a low score. But, this need not be a problem, it is still possible to acquire a card. This is because PagBank has the option of carrying out salary portability to release credit.

Another advantage of the credit card is Visa's Vai reward program. The benefits are many, from product discounts to education and health platforms.

Main features of PagBank

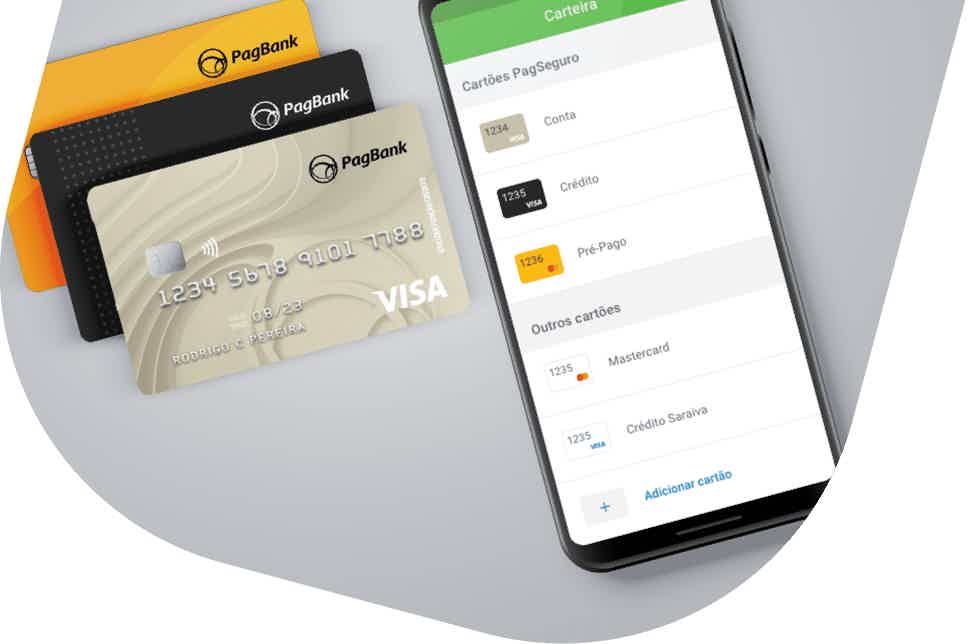

PagBank offers three card types, see below:

- Account Card: option to use the credit function with the PagBank account balance. It is a card similar to prepaid, but with no issuing fee. On this card, it is also possible to control expenses through the PagBank application;

- Credit Card: no annual fee, but depends on salary portability or investment in the bank for credit release. There is the possibility of paying in up to 18 installments and a credit limit of 100% of the salary amount;

- Prepaid Card: issuing the card for 12.90 + 19.90 monthly fee in case of inactivity. It's a good choice for anyone who needs a card for their children or employees, for example. Recharging and balance control can be done through the PagBank application.

In addition, the PagBank card has an extra limit for users who need it. Just look at the boundary conditions:

- Salary portability: the limit can reach up to 100% of the salary amount. When requesting portability, the bank performs a credit analysis. In up to 17 days, you can have 60% credit as a starting amount;

- Investment in CDB: in this modality, the credit limit can reach up to 100 thousand reais. But be aware of the conditions, the investment needs to be with a grace period of 180 days. In addition, the two options are always subject to analysis by the bank.

Who the card is for

If you want to have financial autonomy, the Pagbank card can be a good option. As it is a card without annuity (in the form of credit) it is ideal for starting out in financial life. But it is important to remember that the credit application depends on two factors:

- Portability of salary to the Pagbank account;

- Invest your money in the CBD.

After choosing the one that best fits you, the bank takes up to 17 business days to carry out the credit analysis.

Therefore, the PagBank card is a legal alternative for those seeking financial independence. However, it is always important to pay attention to the conditions of each card. So you can adjust what works best for you.

Did you like the content? So, take a look at this other post about the PagBank credit card!

Discover the PagBank credit card

Want to find the best card to start your financial life? Discover in this post the PagBank credit card and its benefits!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Review Card Submarino 2021

Check out the Submarino card review to learn about all its advantages, such as the Léguas and Vai de Visa Program. Learn more here!

Keep Reading

Magalu card with no annual fee and cash back on SuperApp

Learn about the advantages of the Magalu card with no annual fee, such as cashback, discounts and exclusive installments. Learn right now to order yours.

Keep Reading

How to buy property with real estate credit

Buying a property with real estate credit can be a great way to make your dream of home ownership come true. Read more and find out!

Keep ReadingYou may also like

Latam Pass: learn all about this points program

Anyone who travels a lot or wants to save money on buying products can benefit greatly from the Latam Pass program. It has no difficult requirements to meet and is super simple to register. To see more about it, continue reading the article.

Keep Reading

Afinz credit card: what is Afinz?

Do you know the Afinz card? We tell you here in this post what are the benefits of the newest credit card on the market. Continue reading and check it out!

Keep Reading

Credipronto Real Estate Financing: what is it?

Get to know real estate financing from Credipronto, a Banco Itaú company that finances up to 90% of the property online, check it out!

Keep Reading