Cards

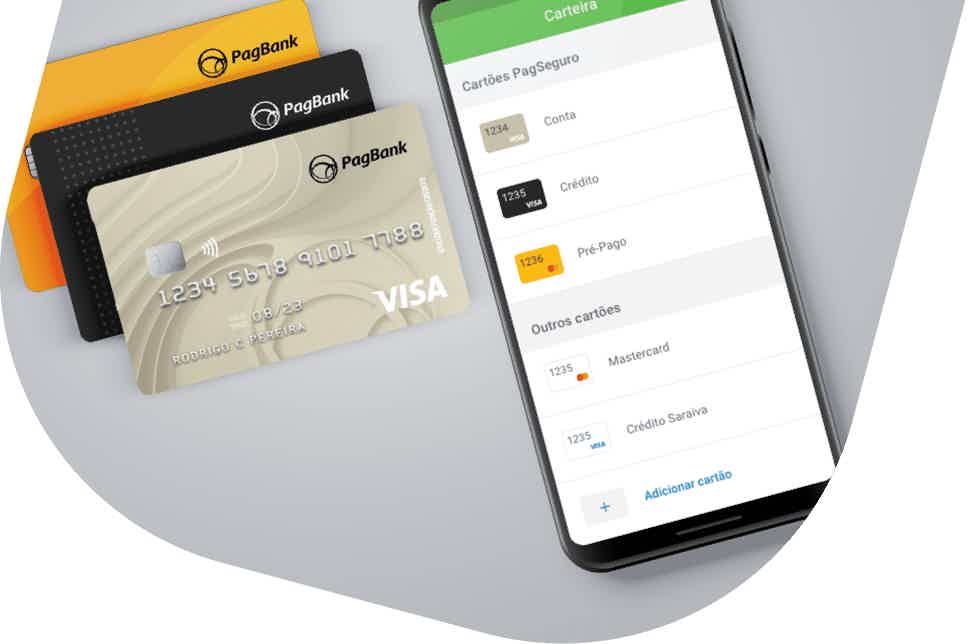

How to apply for PagBank card

Apply for your credit card with no annual fee and with a limit of 100% of your salary or up to R$ 100,000 if you have an application in the CDB. See now how to acquire your PagBank card and have your financial independence.

Advertisement

PagBank: apply for your credit card online

First, applying for the PagBank card is a great option for those starting out in financial life. Being a simple option for you to create your financial autonomy. That's because it is international with a Visa flag. That way, you can do your day-to-day shopping, as well as consume products and services abroad.

Also, do you want to know how to apply for your PagBank card? So, read on and check it out!

Order online

To apply online, just enter the official PagBank website and open an account. After that, you need to wait for the offer made available by the institution to apply. So, it is possible to speed up this process, if you port your salary to the account or make an investment in the CDB. After receiving the offer, just access the app and request the card.

Request via phone

If you prefer, you can also find out about PagBank products by phone at the numbers below, but the request process can only be done via the website or the app.

- 4003 1775 (capitals and metropolitan areas);

- 0800 882 1100 (other locations, except mobile).

Request by app

To purchase your PagBank card through the app, just download the PagBank app and open your account. Then, you must wait for the offer and go through the request process according to the step-by-step instructions given by the application itself.

Santander SX card or PagBank card: which one to choose?

Are you still in doubt if the PagBank card is right for you? So, check now the differences between PagBank and the Santander SX card. Also, compare them and choose the best option!

| Santander SX | PagBank | |

| Annuity | 12x of R$33.25 Exempt if you spend R$ 100 per month or if you join the PIX system | Exempt |

| minimum income | R$ 1,045.00 for non-account holders R$ 500.00 for account holders | not informed |

| Flag | Visa or Mastercard | Visa |

| Roof | International | International |

| Benefits | Benefits of the flag; Discounts with Esfera partners. | Vai de Visa Program; High credit limit. |

How to apply for the Santander SX card

Find out how to apply for your Santander SX card online and enjoy its advantages, such as discounts with partners, exclusive installments and much more!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

General Mills Careers: Everything You Need to Know

Being a very large company, General Mills has a lot of different careers. Let's discover them.

Keep Reading

Get to know the Mercado Pago credit card

How about getting to know the Mercado Pago credit card, which has a free digital account with many benefits? So check out the details here!

Keep Reading

How to apply for the prepaid Ourocard Card

Want a card with no annual fee and surprise fees that helps you do your shopping? Get to know the prepaid ourocard card and find out how to apply

Keep ReadingYou may also like

SIM Loan or SuperSim Loan

Many people get confused, but SIM loan and SuperSim loan are not the same product. So, check out our comparison below and find out which one is ideal for you.

Keep Reading

Bradesco ou Itaú: qual banco tem o melhor cartão?

O Banco Bradesco e o Banco Itaú Unibanco são instituições financeiras em transformação digital. Diante disso, que tal conhecer os seus principais cartões? Leia este artigo e confira tudo sobre eles.

Keep Reading

Is the SuperSIM personal loan reliable?

The SuperSIM personal loan offers a high approval rate, money in up to 30 minutes in the account and option for bad debts. But, after all, is SuperSIM reliable? We tell you here, see!

Keep Reading