loans

Is the Right Deal reliable?

Do you know the Agreement Right platform? With it you can renegotiate your debts with the help of platform partners. The company offers several offers and you choose the one that fits in your pocket. All for you to clear your name. Read on and find out if the Right Deal is reliable!

Advertisement

Renegotiate your debts with the Agreement Right platform

If you have debts, you may have already wondered if the Agreement Right platform is reliable. In short, this is a company focused on debt renegotiation. That is, finding the best offer to get people's names out of the red.

In addition, the Certo Agreement is a platform that acts as a mediator between partners and indebted people. Therefore, you no longer need to stay on endless calls to negotiate your debt.

In this sense, the Certo Agreement offers an online 100% solution for you to find the best way to pay your debts. To do this, just enter some information and the platform already puts you in contact with the companies.

In this article, we'll show you more about the platform and whether the Right Agreement is reliable. Check out!

| Right Agreement Platform | |

| Minimum Income | not informed |

| Interest rate | depends on the lender |

| Deadline to pay | Varies according to debt |

| release period | Same day assessment |

| loan amount | Amount of your renegotiated debt |

| Do you accept negatives? | Yes |

| Benefits | Opportunity to negotiate debts; Process 100% online. |

How does the Agreement Right platform work?

In summary, Accord Certo is a debt renegotiation company. In that sense, its main role is to find the best way for you to pay off your debt. And the platform does just that, putting you in touch with partner companies.

Basically, you go to the website and provide some information. First, put your CPF and date of birth. Thus, the platform is already able to offer the best deals for you.

That way, just analyze the proposals and understand what works best for you. Thus, the Certo Agreement has an intuitive and easy-to-use platform. So that your renegotiation process is no longer a bureaucracy.

What are the Accord Certo partner companies?

In principle, the Right Agreement has agreements with several companies. By the way, it's not just financial institutions. The platform also establishes partnerships with stores, telephone companies and even colleges. View the full list of partners:

| Diamond | Of the House |

| safe harbor | creek |

| Unopar | Next |

| uniform | Ipanema |

| UItapevaniderp | Recovery |

| unique | Active MGW |

| Alive | Hoepers |

| tricard | Havana |

| use | Pythagoras |

| sky | Renner |

| sanequa | Atlantic |

| Hey | Pagbank |

| Itau | Fame |

| Credz | Credentials |

| credit system | Columbus |

| Clear | Bradesco |

| bradecard | BV |

| BRK Environmental | SA Assets |

| anhanguera |

How to renegotiate debt with the Right Agreement?

As we have already mentioned, debt renegotiation is only mediated by the Right Agreement. Therefore, after entering your information on the platform, just wait for the offers to simulate.

In short, it only takes a few minutes. The site already shows you the trading options for you to choose the one that best fits your financial life.

Reputation Agreement Right at Reclame Aqui

When we are researching the credibility of the company, Reclame Aqui is one of the main sources of information. This is because it is on this site that companies are evaluated by customers.

So you can see the history and reputation of each business. By the way, Right Deal has a good reputation. See the notes:

- Overall grade: 8

- Answered complaints: 99.1%

- Solution index: 85%

It is worth remembering that these numbers are just a base according to Reclame Aqui, which is one of the most famous evaluation platforms. By the way, the Certo Agreement is one of the companies recommended by Reclame Aqui.

So, is the Right Deal reliable?

But after all, is the Right Deal really reliable? The answer is yes. Well, the company has a good reputation on review platforms. In addition, they are regularized and have several trusted partners.

Therefore, doing your debt negotiation with the Right Agreement may be the way for you to get out of the negative. So, if you are still considering your options, we have another article where we talk about borrowing to pay off debt.

Read more and decide which option is best for you!

How to apply for the Right Agreement

Find out how to apply for the Certo Agreement quickly, safely and effectively. And get deals with up to 99% off debt.

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

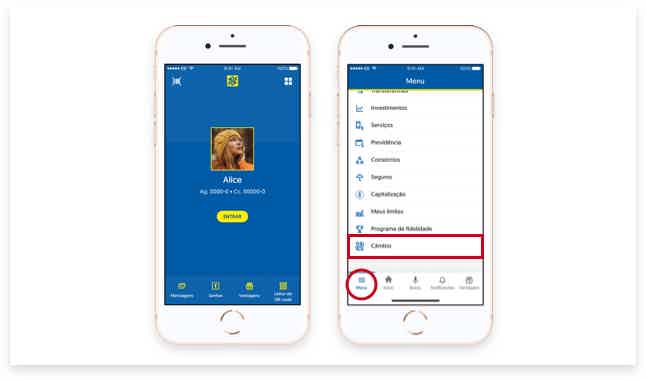

Discover the Easy account

Do you want a digital account in the US, but with the security of a Brazilian bank? Today we will show you how the Easy account works. Check out!

Keep Reading

How does Serasa eCred work?

Find out here how Serasa eCred works and how we can find the best loan and credit card options within the site. Check out!

Keep Reading

Best Sites to Watch NFL Live

Watch NFL live for instant real-time football excitement, with free and premium options available.

Keep ReadingYou may also like

Superdigital Card Review 2021

The Superdigital card is the ideal product for those with name restrictions. It also offers international coverage, does not charge an annual fee and has Mastercard benefits. Do you want to know more about him? So, read this post and check it out!

Keep Reading

How to control credit card?

Credit cards are great finance allies, as long as they are used correctly. For this, it is important to have good credit card control, have a spreadsheet to track your expenses and always keep an eye on your bill. Were you curious to learn more about credit card control, how to make a spreadsheet and more tips on using credit intelligently? Come with us!

Keep Reading

How to avoid falling into fraudulent loans?

Taking out a loan requires a lot of attention and precaution. That's because nowadays more and more people are falling into blows. Therefore, it is important to be on top of the main tips when hiring. Want to know more? Read on!

Keep Reading