Government Aid

IR 2022 refund: payment of rectifications

The Revenue has already started paying the lots of those who declared the IR. But how is the payment of those who needed to send the IR refund in 2022? Learn more about it in this post!

Advertisement

Know when the payment happens for those who rectify

Did you need to refund IR 2022? Now that the deadline for delivering the document has ended, many people who sent it with some information error need to make a correction.

That way, they can edit the submitted income tax return and thus correct errors so they don't cause problems later.

But, a very common doubt that can happen at that moment is how the payment of this refund will be for those who are entitled.

Therefore, in this post, we are going to talk more about this part of the 2022 IR refund and check the deadlines for the payment batches. As well as how you can consult your rectifying statement. Follow!

What is the deadline to rectify the Income Tax 2022?

Just as sending the income tax return has deadlines well determined by the Federal Revenue Service, sending the rectification also has its delivery dates.

In the case of rectification, it is possible to change it and send it to the revenue within 5 years after sending the original declaration. But, it is necessary not to have any pendency with the Federal Revenue so that the rectification can be sent within that period.

Therefore, it is possible to make the correction after the income tax delivery deadline without having to pay any type of fine for this submission.

IR 2022 refund for those who made the rectification

In short, taxpayers who are entitled to receive the IR refund will be able to be paid through the batches organized by the Federal Revenue Service. Each year, the revenue creates a schedule of batches to determine the refund payment deadline.

To organize the batches, the Revenue uses the date of submission of the original declaration. Therefore, if the taxpayer sent it in the first days of the deadline, it is possible that he will be in one of the first batches to receive the payment.

But when the taxpayer makes the refund, that payment can be postponed to one of the last batches of payment. This happens because the rectifying statement replaces the first one that was sent.

Thus, the date on which the rectifying statement is sent becomes the new date on which the payment will be made.

Lots from the Federal Revenue

This year, the Federal Revenue has already paid the first and second batches, and the third will be paid on July 29th. To check the other dates, just see the list below.

- 1st batch: 05/31/2022;

- 2nd batch: 06/30/2022;

- 3rd batch: 07/29/2022;

- 4th batch: 08/31/2022;

- 5th batch: 09/30/2022.

In addition to the date, another factor that influences the time to pay the refund is the condition of the taxpayer. Therefore, those who have some legal priority can receive earlier. For this, the taxpayer needs:

- be over 80 years of age;

- be between 60 and 79 years old;

- have a mental or physical disability;

- have teaching as their main source of income.

After these groups receive payment, the rest will receive based on the IR submission date.

How to consult your rectifying statement?

Therefore, if you want to consult your rectifying statement, you can simply access the Federal Revenue page or its application, which is available for Android and iOS devices.

This way, when accessing the portal, you can consult your rectifying statement and check the added information.

By now you already know that payment for the statement will depend on the date it was sent. So the sooner it's done, the better it will be for your financial life.

But, there are also cases where after sending the declaration, the taxpayer needs to pay some tax due. This situation can take people by surprise as it represents an unexpected expense and we don't always have the amount to make the payment.

In these cases, what is left for us is to try to arrange the value in other ways. For this, having an extra income can be the best solution to have the amount.

Therefore, in the following article, we separate some valuable tips to help you earn some extra money and thus be able to cover your expenses!

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

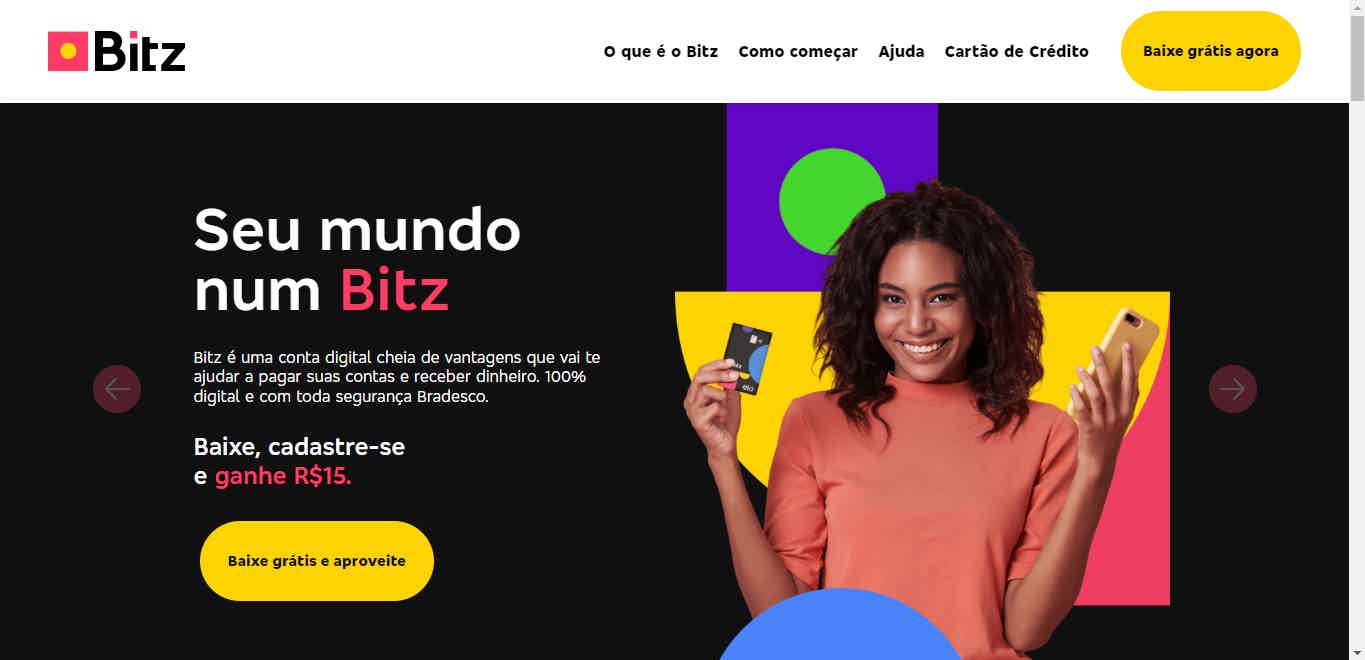

Discover the Bitz digital account

The Bitz digital account is an application managed by Bradesco that offers you many facilities. Learn all about her in this post!

Keep Reading

Ton Card or Access Card: which is better?

Why not opt for cheap cards, with purchases in the form of credit and order without bureaucracy? So, decide between the Ton card or the Access card!

Keep Reading

How to apply for Cashme loan

Want to know how to apply for the Cashme loan? Take advantage of credit from R$ 50 thousand to pay in up to 240 months with interest rates below the market.

Keep ReadingYou may also like

Discover the Digio account

Taking care of our money has never been as easy as it is today, as we have several digital account options that can be used directly from your cell phone. However, not all of them are suitable for our needs, so we must choose carefully. With that in mind, we present you the Digio account, 100% online and free, with all the features you need for your day to day. Check it out below.

Keep Reading

Discover the PicPay digital account

Practicality and financial security in the palm of your hand? With the PicPay digital account, this is possible. Continue reading the article and learn all the main features, advantages and disadvantages of the account. Check out!

Keep Reading

Discover the Sicoob Gold credit card

With the Sicoob Gold card, you have international coverage and participate in the Sicoobcard Prêmios and Mastercard Surpreenda or Vai de Visa programs. Want to know more? Read on to find out all about it!

Keep Reading