Cards

Unicred Black Card or Sicredi Black Card: which is better?

If you are in doubt between the Unicred Black card and the Sicredi Black card, check out all the main features of the products here, as well as their numerous advantages. After all, Black cards are the best cards on the market. Check out our comparison and find out!

Advertisement

Unicred Black x Sicredi Black: find out which one to choose

Firstly, Black cards emerged with the aim of serving special customers, with high purchasing power. In this sense, they have personalized service and exclusive benefits. Therefore, we brought this comparative content for you to choose between 2 Black cards, the Unicred Black card or the Sicredi Black card.

Thus, the cards are issued by the Unicred and Sicredi cooperatives, respectively. And they offer incredible benefits to their customers. Therefore, follow our content below and discover which of these cards best meets your financial needs. Check out!

| Unicred Black Card | Sicredi Black Card | |

| Minimum Income | not informed | not informed |

| Annuity | not informed | not informed |

| Flag | MasterCard | MasterCard |

| Roof | International | International |

| Benefits | points program; Mastercard Surprise Program; VIP lounge at airports; Cork Exemption; Car Insurance; Theft insurance. | Mastercard Surprise Program; Sicredi rewards program; Travel insurance; Car Insurance; Contactless technology; Access to VIP lounges. |

Unicred Black Card

Well, Unicred is a credit cooperative that currently operates in 14 Brazilian states. Furthermore, the financial institution has existed for over 32 years and offers different types of cards to its members.

In this sense, the Unicred Black card is a differentiated card, issued under the Mastercard brand. Furthermore, it has international coverage. In other words, you can use it for purchases in Brazil and abroad. However, customers must pay an annual fee, the amount of which is not stated on the official website.

Furthermore, the Unicred Black card offers two types of credit limits, one for cash purchases and the other for installment purchases. Thus, you can also request additional cards, in addition to having access to exclusive benefits, such as travel insurance and concierge, for example.

Therefore, continue following our content about the Unicred Black card or the Sicredi Black card and see all the main features of both before making your choice.

Sicredi Black Card

First of all, Sicredi, or Cooperative Credit System, is a Brazilian cooperative with more than 5 million members. By the way, do you know how a credit union works?

So, the cooperative is nothing more than a financial institution that takes the place of a traditional bank. This way, its members do not need to depend on other banks, as the cooperative can carry out all necessary transactions.

Furthermore, when you become an associate, you will be able to divide the profits proportionally according to the partner's movement rate. However, in the case of dividends, its members must also share the amount.

Therefore, Sicredi offers various services and credit cards to its customers, including the Sicredi Black card. Furthermore, the Black card is the premium financial product on the market, aimed at special customers with high purchasing power. Therefore, if you want personalized service, as well as exclusive benefits, this card is for you.

Furthermore, the Sicredi Black card has the Mastercard brand and its coverage is international. This way, you will be able to use your Black card both in Brazil and abroad. There is also an annual fee, but the amount is not stated on the official website.

However, if you are still in doubt between the Unicred Black card or the Sicredi Black card, check out the advantages and disadvantages of each one below.

What are the advantages of the Unicred Black card?

Well, the Unicred Black card is a Mastercard Black card and, therefore, offers several benefits to its customers. Check out some of them below.

Firstly, with the Unicred Black card you will be entitled to Travel Insurance, with medical assistance for both you and your family members. Furthermore, the financial product also offers protection for your luggage, in case it is lost or stolen. This way, you can request a refund in case of any mishaps.

Furthermore, you also have access to a concierge who provides personalized service 24 hours a day. Or, you have access to the Mastercard Global Service, with free telephone assistance at any time worldwide.

Therefore, Black cards also give you access to VIP lounges at airports, as well as Car Insurance if you choose to rent a vehicle. Finally, you can also participate in the Mastercard Surpreenda rewards program, as well as the Unicred points program. This way, you can accumulate points and exchange them for discounts and offers on products and services.

What are the advantages of the Sicredi Black card?

First of all, as it is a Black card, the Sicredi Black card has numerous benefits offered to its customers. Thus, the card provides a personalized experience with 24-hour service through Mastercard assistance. In addition, you also have a concierge, which is nothing more than an assistant available to you at any time of the day.

Furthermore, the Sicredi Black card is also an excellent choice for those who travel frequently as it offers Travel Insurance for you and your family. In addition, you also have your luggage protected against theft and loss, as well as access to VIP lounges at airports.

In fact, if you decide to rent a vehicle during your trip, Sicredi Black also offers Car Insurance. With it, you are protected from any damage to the rented vehicle, and are reimbursed for any extra expenses in this regard.

Therefore, you can still participate in the Mastercard Surpreenda program, where you accumulate points that you can exchange for discounts and offers on products or services. In this sense, Sicredi also offers its own rewards program that works in a similar way.

This way, you also accumulate points with each purchase and can exchange them for household appliances, electronics, as well as cashback and airline miles. There are many benefits, right?

What are the disadvantages of the Unicred Black card?

So, although it is a card with numerous advantages, the Unicred Black card also has some negative points that need to be taken into consideration before signing up. Firstly, the Unicred Black card charges an annual fee that is considered high.

Furthermore, not everyone is approved to have a Black credit card. Prerequisites tend to vary depending on the financial institution. Furthermore, to check the possibility of obtaining a Unicred Black card, you need to be a member of the Unicred cooperative. Therefore, it is more bureaucracy to sign up for the card.

What are the disadvantages of the Sicredi Black card?

Although the Black card offers many benefits to its customers, to obtain it you need to pass the prerequisites. In this sense, each financial institution or bank carries out a different analysis of your financial profile before approving your Black card application.

In fact, you can only request the Sicredi Black card if you are a member of the Sicredi cooperative. Therefore, you must become a Sicredi member before applying for this cooperative's Black card.

Furthermore, it is important to remember that this card charges an annual fee from its users. In this sense, annual fees for Black cards tend to be the highest on the market.

Unicred Black Card or Sicredi Black Card: which one to choose?

Finally, if you followed our comparative content between the Unicred Black card and the Sicredi Black card, you will already know that both are a Mastercard Black card. This way, you can analyze some details that each cooperative offers to make your choice.

In this sense, remember that the cards charge an annual fee, with different amounts for each of the cooperatives. Furthermore, check the cost of membership to Unicred and Sicredi, as well as see which one can best serve you, as you must become a member before signing up for the card.

So, are you still in doubt and want to see other card options? Well, access our content below and discover more!

Nubank Ultraviolet card or Vooz card

Find out details to decide between the Nubank Ultraviolet card or the Vooz card. Both have a digital account and benefits associated with the brand. Check out!

About the author / Aline Barbosa

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Check out how to earn 1400 reais and have the opportunity to work with machines

Machine operator: check out how it works and where to find a job, and more, how much he earns and what he does in his work routine. Look!

Keep Reading

Itaú loan without consultation with Serasa: did you know it existed?

Do you know the Itaú loan without consulting Serasa? If not, it's time to get to know this bank service that is little known to us.

Keep Reading

5 cards that don't require a high Serasa Score

Do you have a dirty name, low score and need a negative credit card? You can count on options like Next and more. Check out!

Keep ReadingYou may also like

Cielo Zip Card Machine: what it is and how it works

The Cielo ZIP card machine helps you sell more, because it's with you anywhere. In addition, it has its own chip and Wi-Fi connection so you don't depend on your cell phone to sell. Want to know more? So, read the post below.

Keep Reading

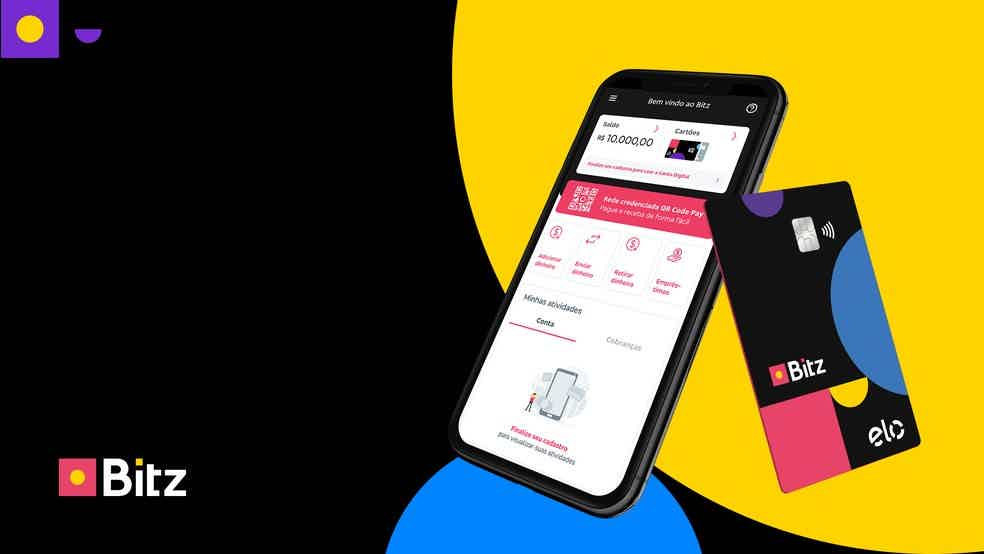

How to apply for the Bitz card

The Bitz card is ideal for those looking to spend little on maintenance. That's because it's an international card with free annuity. In this sense, in this post we will teach you how to request it. Come check!

Keep Reading

How to avoid accumulating credit card debt

The accumulation of credit card debt can be easily avoided with planning and greater control of your expenses and installments. Check out!

Keep Reading