loans

Superdigital loan or Credits loan: which is better?

Are you in doubt between the Superdigital loan or Creditas? Both options manage to offer good credit value at low interest rates. But each of them serves different profiles. See which one to choose for you here.

Advertisement

Superdigital x Creditas: find out which one to choose

If you are looking for a loan with low interest rates, you may be in doubt between the Superdigital loan or the Creditas loan. After all, both offer good interest rates and interesting installment conditions.

However, in one option we have the personal loan offer to apply for online. While in the other, the loans are offered in the modality with guarantee or payroll.

| Superdigital loan | Credit Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | From 1,60% per month | From 0.99% per month |

| Deadline to pay | Up to 24 months | Up to 240 months |

| release period | Uninformed | Uninformed |

| loan amount | Up to R$ 25 thousand | Up to R$ 3 million |

| Do you accept negatives? | Uninformed | Uninformed |

| Benefits | quick simulation Completely online process | Higher credit amount Accept goods that are not paid |

In this sense, we see that with this small difference, the Superdigital loan or Creditas loan can work with different profiles of people.

Therefore, to help you in your choice and allow you to make a good financial decision, in the post below you will learn about the main characteristics, advantages and disadvantages of each loan to make a better decision!

Superdigital loan

First, let's check out the main characteristics of each loan, starting with the Superdigital option. By the name, you can already understand that your hiring happens online 100%.

Superdigital does this because it wants to make people's lives easier and allow them to have easy access to credit.

And the best part is that you can trust the security of the process, as this financial institution is part of the Santander Group, which is already well established in the market.

This way, she manages to work offering personal loans, where you don't need to offer your assets as collateral, and manages to have access to credit from R$ 500 to R$ 25 thousand.

Just like other loan companies, to apply you need to do a simulation that happens super quickly on the Superdigital portal!

In just 2 minutes you can already simulate your loan and proceed to hiring!

In addition, Superdigital works with very low rates, starting at 1.6% per month, and allows you to pay your loan in up to 24 installments.

Credit Loan

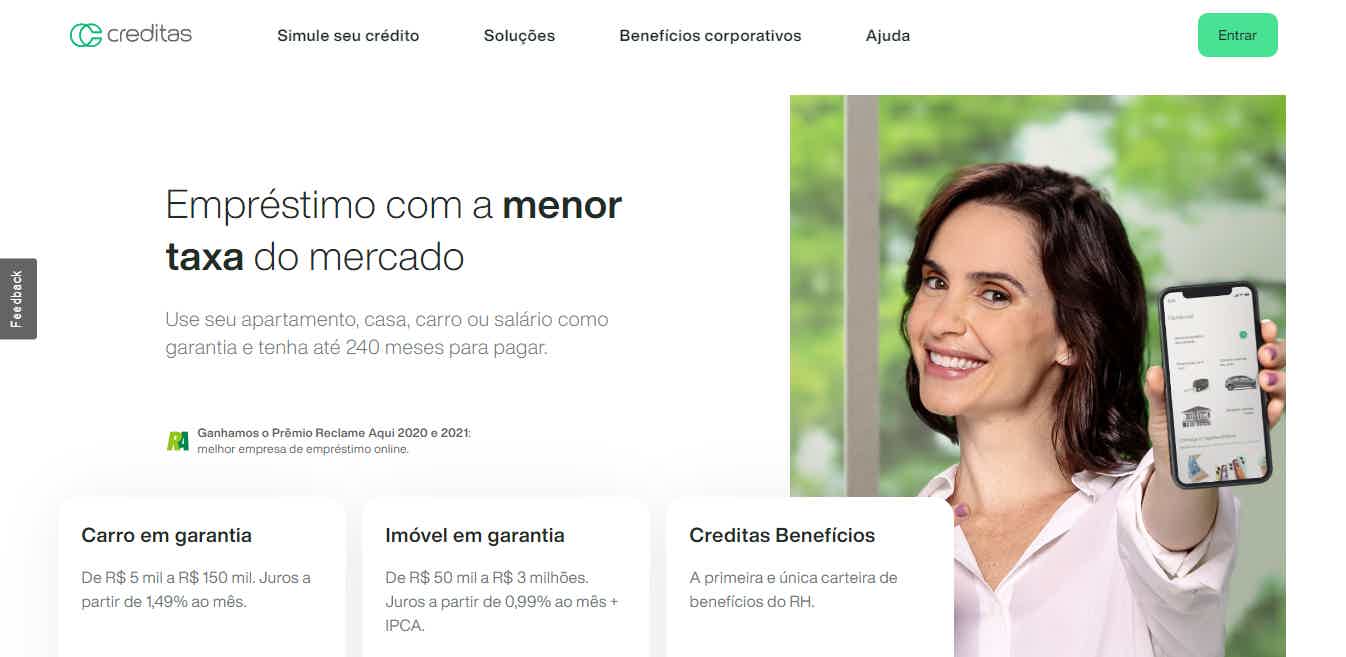

Now, let's learn more about the loan that Creditas offers to the public.

In summary, Creditas is a company that emerged as a loan comparison portal. Thus, before it only indicated the best loan offers from other banks or institutions to the public.

However, it has taken all of its market experience that it has gained since its inception in 2012 and launched its own loans.

Today, Creditas works by offering payroll loans and loans with a property or vehicle guarantee.

In the payroll loan modality, made for those who work with a formal contract, Creditas allows you to request a credit of up to R$ 70 thousand that can be paid in up to 60 months.

On the other hand, in secured loans it is possible to access even better credits. Therefore, in the loan with vehicle guarantee, you can get a credit of up to R$ 150 thousand that can be paid in up to 60 months.

As for the loan with property guarantee, you can access up to R$ 3 million credit that can be paid in up to 240 months.

In secured loan options, interest rates start from 0.99% per month, while for payroll loans, interest can start from 1.49% per month. Both rates are one of the lowest on the market.

What are the advantages of the Superdigital loan?

Now that you know the main characteristics of the two loans, it's time to check out the advantages that each one offers.

Therefore, the biggest advantage of the Superdigital loan is that it is completely online and releases credit with your financial health in mind.

The focus of the portal is to make people use credit for their own good and not get into debt with it. Because of this, they offer a very attractive monthly interest rate.

Another advantage of the loan is that it allows you to carry out the entire credit simulation very quickly. In just a few minutes, you already know the amount you can borrow and how much your installments would be.

What are the advantages of the Creditas loan?

Let's now check out the benefits that the Creditas loan has to offer. Therefore, one of the main advantages of this company is that it works with one of the lowest interest rates on the market.

This happens because secured or payroll loans offer more security to the institution, since in this modality it is more difficult to default.

In this way, the company obtains more interesting credit conditions, both in relation to the amounts that can be borrowed and the payment period, where we can find options to pay in more than 200 months.

What are the disadvantages of the Superdigital loan?

As much as the Superdigital loan has great benefits, it also has some negative points that you need to be aware of.

Therefore, the first of them is the fact that you need to open a digital account at the institution to be able to access the credit.

In addition, during the simulation, the company does not disclose the deadline for releasing the credit in your account. This can cause some distrust from the public, even if it belongs to an established financial services group.

What are the disadvantages of the Creditas loan?

Among the disadvantages of the Creditas loan, we can highlight the fact that the company only works with payroll and secured loan options.

In this way, those who do not have assets in their name or who work as a self-employed person will not be able to access the loan that the company offers.

In addition, even though the loan is online, its process can be a bit bureaucratic since it is necessary to carry out a larger analysis to verify the state of the assets or confirm the loan with your employer.

Superdigital loan or Creditas loan: which one to choose?

In summary, the Superdigital loan and the Creditas loan are two very interesting options, but which serve different audiences.

Thus, Superdigital's option fits into the financial life of the person who needs access to an interesting amount of credit with low interest rates and who cannot offer their assets as collateral.

On the other hand, those who work CLT or have assets in their name, even if they are not paid off, may see more advantage in taking out a Creditas loan, since the amount to be accessed can be higher and the interest rate is lower.

But, in this search for loans, it is always interesting to know all the options available in order to make a more objective choice that is in line with your financial life.

That way, if you want to know more about loans and their conditions, you can check the post below for another comparison of super interesting credits that can also be applied for online.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

8 tips to get out of the red

Is your dream to get out of the red for good and manage to have a stable financial life? See now the best tips to get out of the red

Keep Reading

C6 Rainbow credit card: how it works

Find out how the C6 Rainbow card works, which respects LGBTQIA+ people and supports their cause through participation in projects.

Keep Reading

C6 Consig Loan Review 2022

Check out in this C6 Consig loan review how this credit modality works and how you can apply for yours!

Keep ReadingYou may also like

American credit card: how it works

Do you like to shop at Americanas and want to enjoy exclusive benefits? So, see how the network card works, which has the Mastercard brand and you can use it both in stores and anywhere else. Learn more later.

Keep Reading

What is the best digital bank credit card option?

Digital bank cards can be very interesting for those looking for more autonomy in financial processes. Want to know what the best options are? Check it out in the post below.

Keep Reading

How to apply for personal credit for works by Novo Banco

Are you looking for a loan for small renovations and don't want to pay high interest rates for it? Then check out, below, how to sign up for personal credit for works at Novo Banco and renovate your home as you've always dreamed of.

Keep Reading