loans

Simplic Loan or Credit Loan: which is better?

How about the Simplic loan or Creditas? Both options are well established in the market they serve, but their products have different profiles. Learn better in this post how loans work.

Advertisement

Simplic x Credits: find out which one to choose

Are you in doubt whether to apply for a Simplic loan or a Creditas loan? Well, don't worry, in this text you will learn everything about these loans in an exclusive comparison that will help you make a better decision.

After all, it is common to be in doubt between these two loan options. Both offer good payment terms and a very interesting credit value for you to do several things.

| Simple Loan | Credit Loan | |

| Minimum Income | not informed | not informed |

| Interest rate | From 15.80% per month | From 0.99% per month |

| Deadline to pay | Up to 12 months | Up to 240 months |

| release period | Within 1 business day | not informed |

| loan amount | Up to R$ 3,500.00 | Up to R$ 3 million |

| Do you accept negatives? | Yes | Uninformed |

| Benefits | Money in the account in 24 hours Discount when paying in advance accept negatives | High credit values low interest rate Can be used to dispose of a good |

However, they have some differences, such as interest rates and credit release, for example, which are numbers that you need to know better to decide which of the two loans is the best.

Therefore, to help you with this choice, we have prepared this post with a complete comparison between the Simplic loan or the Creditas loan, so you can make a better decision. Check out!

Simple Loan

Let's start by getting to know more about the Simplic loan. In summary, Simplic is a banking correspondent that was born in Brazil in 2014 with the proposal to offer more accessible personal credit, preferably online.

And Simplic is able to offer this because it is part of the Enova Group, which is also present in the United States and Europe offering several interesting financial solutions.

In this way, today the institution is on the market as a company that offers personal loans that everyone accepts, especially those who are negative.

From there, you can borrow up to R$ 3,500 and pay it off in up to one year with an interest rate ranging from 15.80% to 17.90% per month.

To apply for the loan, you can simply access the official website, perform a credit simulation and provide your personal data so that the company can analyze and thus approve your credit.

Namely, Simplic is one of the few companies that can release the money very quickly for you. That way, in just a few hours after being approved, the money can already be falling into your account.

For this, everything will depend on the time you received the approval email. Thus, if you receive loan approval by 1 pm, it is possible to get the money by the end of the day.

However, if the proof e-mail is received after 1:00 pm, your payment will be made by 3:00 pm on the next business day. That is, it is a loan with a very quick release.

Credit Loan

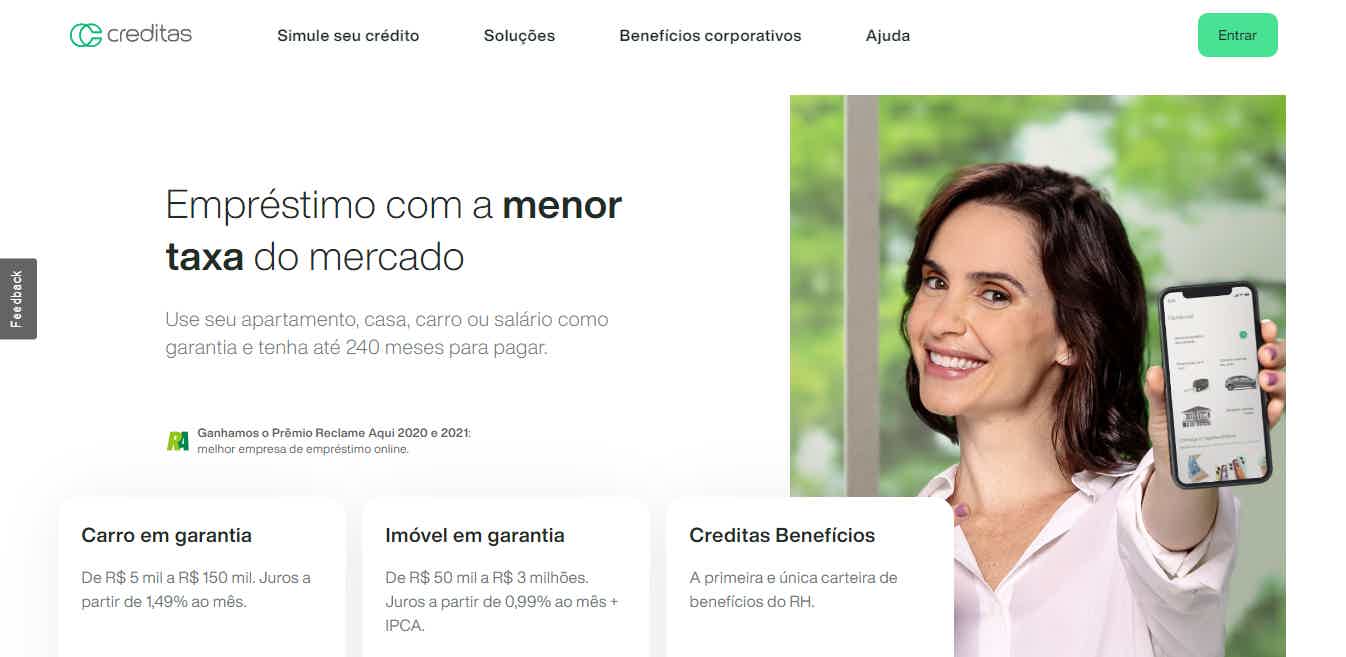

Now that we know about the Simplic loan, let's see how the Creditas loan works and what it can offer you.

Therefore, Creditas is a company that emerged in 2012 as a loan comparator. That way, in your beginning, you could access the website and compare loan offers from many financial institutions.

Due to this experience, Creditas may have the right knowledge to launch an online portal and offer its own loans to the public.

Thus, nowadays Creditas works offering three different loan options:

- Private payroll loan;

- Loan with vehicle guarantee;

- Property loan guarantee.

In this way, with the payroll loan, you can access a credit of up to R$ 70 thousand and pay it in up to 60 installments.

In the loan option with vehicle guarantee, you can access a credit of up to R$ 150 thousand and pay it in up to 60 installments with an interest rate that starts at 1,49% per month.

Finally, in the loan option with property guarantee, you can borrow up to R$ 3 million and pay it back in up to 240 months, with an interest rate starting at 0.99% per month.

In this way, Creditas manages to offer you a very high amount of credit with low interest rates and an interesting payment term.

What are the advantages of the Simplic loan?

In summary, the Simplic loan can offer several advantages to those who request it. The first one we need to highlight in this post is the fact that you get the money quickly.

That way, in up to 24 hours or less you can have the credit in your bank account and you can use it however you want.

Finally, another great advantage that the Simplic loan offers is the decrease in the interest rate when you anticipate the installments. That way, you can earn automatic discounts and make your discharge faster.

What are the advantages of the Creditas loan?

At first, the creditas loan also offers great advantages for you, starting with the super low interest rate that you can access from this credit.

In addition, the secured loan is one of the few on the market that allows you to use a property or vehicle that has not yet been paid off to access credit.

That way, you can take out the loan to finish paying off the property or vehicle you have in your name and continue paying it through Creditas, which offers lower interest rates and a longer payment term.

What are the disadvantages of the Simplic loan?

Although the Simplic loan offers great advantages for you, it also has some negative points that should be considered before applying for it.

Therefore, one of the main negative points is the interest rate applied, which is very high. In this way, from the loan you cannot access a lower rate of 10% per month, which can make the loan more expensive.

In addition, even though Simplic manages to pay the loan very quickly, this is only possible because it works in partnership with Bradesco, Itaú, Santander and Caixa Econômica banks.

Thus, if you want to take out the Simplic loan, you will need to have a bank account at one of the banks listed above to receive the money.

What are the disadvantages of the Creditas loan?

Creditas also has some negative points that you need to know before taking out a loan.

Firstly, we have the facts that Creditas only works with secured or payroll loans. That way, only CLT workers or people who have a good in their name can take out the credit.

Secondly, another disadvantage that the Creditas loan has is the fact that it is more bureaucratic.

Therefore, in your application process it is necessary to carry out an analysis of the state of your assets or contact your employer to make the loan.

These steps already make the request for it more complicated and bureaucratic, even if it can be done online.

Simplic loan or Creditas loan: which one to choose?

In summary, the Simplic loan and the Creditas loan can offer very interesting advantages depending on your profile.

Therefore, in order to know which one to choose, it is important for you to analyze your current financial life to see which of the two loans will be the best option.

Therefore, if you are a negative person and do not have assets in your name, the Simplic loan may be a good option at the moment.

On the other hand, if you are a worker under the CLT regime or have assets in your name, it may be better to take out a Creditas loan, as it offers more attractive interest rates and more interesting installments.

But, if even after knowing more about Creditas or Simplic loans you are still not sure about these two options, it may be interesting to know other loans that exist on the market.

Therefore, we recommend that you learn more about the SIM loan and the Geru loan below, which are two very interesting options that can be requested online.

About the author / Leticia Jordan

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Condor loan

Get to know the Condor loan, a secure line of credit, with digital 100% contracting and the lowest rates on the market. Learn more here.

Keep Reading

Discover the personal account ABC Personal

Discover the free and digital ABC Personal personal account! Also, invest in fixed income funds without brokerage or custody! Learn more in the post.

Keep Reading

Atacadão Card or Zencard Card: which is better?

While one card offers discounts and interest-free installments, the other is ideal for negatives. Decide between the Atacadão card or the Zencard card.

Keep ReadingYou may also like

Informal workers will now be able to apply for a loan with FGTS guarantee

In March, the Federal Government launched a series of new measures to contain the economic crisis in the country. The most recent of these is the loan for informal workers with FGTS guarantee. Learn more here!

Keep Reading

Credibom or Novo Banco car loan: which is better?

Don't worry about spending years saving money to buy your new car or motorcycle. With Credibom or Novo Banco car credit, you can enjoy life much more with your new purchase, without worrying about high interest rates. See more in the article.

Keep Reading

Montepio or Universo car loan: which is better?

You no longer have to worry about purchasing your car in cash. With Montepio or Universo car credit, you have the ideal amount for financing and can enjoy several benefits. To find out more, just continue reading.

Keep Reading