digital account

Discover the personal account ABC Personal

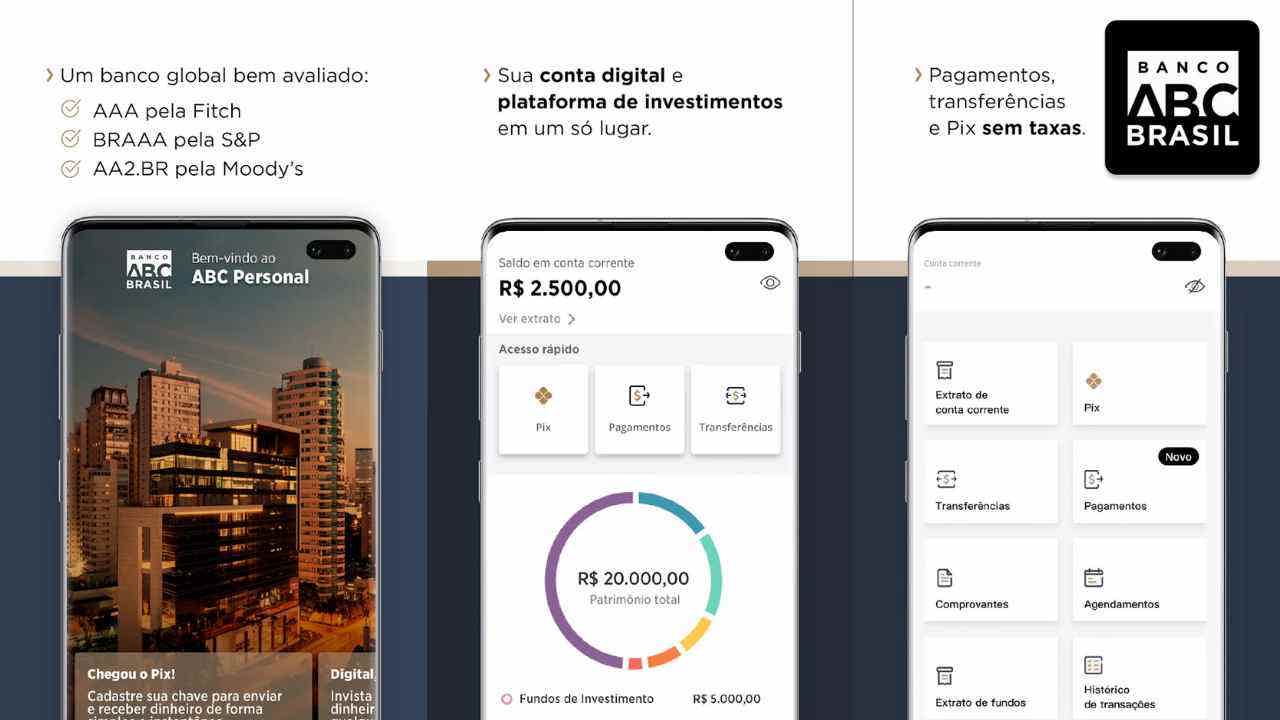

How about getting to know the free ABC Personal personal account and digital 100%? In addition, the client learns to invest in fixed income funds and does not pay brokerage fees. So, find out more in the post below.

Advertisement

ABC Personal: free digital account without brokerage for new investors

The ABC Personal personal account curates investments, is digital and 100% free. That is, it is ideal for individuals who want to start investing in fixed income.

More importantly, this account also has the traditional functionality. However, there is a service that teaches you how to invest in fixed income funds. That is, move your money and also ensure that it has income.

So how about learning more about this option? Just stay with us to find out how interesting this digital account is. Let's go!

How to open an ABC Personal account

Learn how to open your ABC Personal account without leaving home. As well as take advantage of the opportunity to invest in fixed income funds without paying fees.

How does the ABC Personal personal account work?

The initial idea of bank ABC Brasil was to serve companies, however, it decided to invest in opportunities for individuals to develop financially. Therefore, he created the personal account ABC Personal.

At no cost, the bank's digital account is much more than just a financial transaction application. That is, in the palm of his hand, the client will have curation for fixed income investments.

With money to invest, learn how the most accessible financial investments on the market work, such as LCAs, CDBs, Direct Treasury and LCIs, for example.

Also have access to transfers, deposits, Pix and even invest without paying brokerage or custody fees.

What is the limit of the ABC Personal personal account?

Unfortunately, Banco ABC Brasil does not inform the account limit, but you will know the amount as soon as you finish contracting this financial product. To do this, access the internet banking or bank app.

Is ABC Personal account worth it?

Also, did you realize that with the digital account you will have financial transactions? Also, are you going to enter the financial market?

But, after all, is the digital account worth it? Check out the advantages and disadvantages and find out.

Benefits

Firstly, you will not pay any fees while using the digital account. In addition, receive information about investments, operate with them without paying brokerage, a fee charged by brokers for you to enter the financial market.

In addition, you have a secure digital account, with transactions such as TED, DOC and fee-free payments. Finally, take advantage of the DDA (Authorized Right Debit). With it, you receive your slips online and pay with one click, without entering codes.

Disadvantages

Among the main disadvantages is the lack of a credit card for installment purchases. So, know that there are not many disadvantages to this option. Since it remains the most suitable for beginner investors.

How to make an ABC Personal account?

Finally, know how easy it is to have your ABC Personal digital account. First, access the website, locate the account and fill in the form with all the requested information.

On the other hand, there is also an account opening through the application, which must be downloaded in virtual stores. But, if you want to know the step by step to open the account, just click on the link below and follow the topics!

How to open an ABC Personal account

Learn how to open your ABC Personal account without leaving home. As well as take advantage of the opportunity to invest in fixed income funds without paying fees.

Trending Topics

Find out about the Finamax personal loan

Get to know the Finamax personal loan, and see if this loan is what you need right now! Ah, he is ideal for negatives! Check out!

Keep Reading

How does the bank approve the customer?

Knowing how the bank approves the customer is essential to use the information in your favor and increase the chances of credit approval. Look!

Keep Reading

How to enroll in Prime Cursos courses?

Find out how to register on the Prime platform and courses, to strengthen your resume and stand out in the job market.

Keep ReadingYou may also like

Méliuz Card or PagBank Card: which one to choose?

So, Méliuz card or PagBank card? Which financial product is the best? Continue reading and check out our comparative text!

Keep Reading

Check out how to get a work visa in Canada

If you want to have a professional experience abroad, it is essential to understand how to get a work visa in Canada. To find out about the document and how to get it, just continue reading the article!

Keep Reading

Discover the Santander consortium

With the Santander consortium, you acquire or renovate your property for payment in up to 180 months, interest free! See more on the subject here.

Keep Reading