Cards

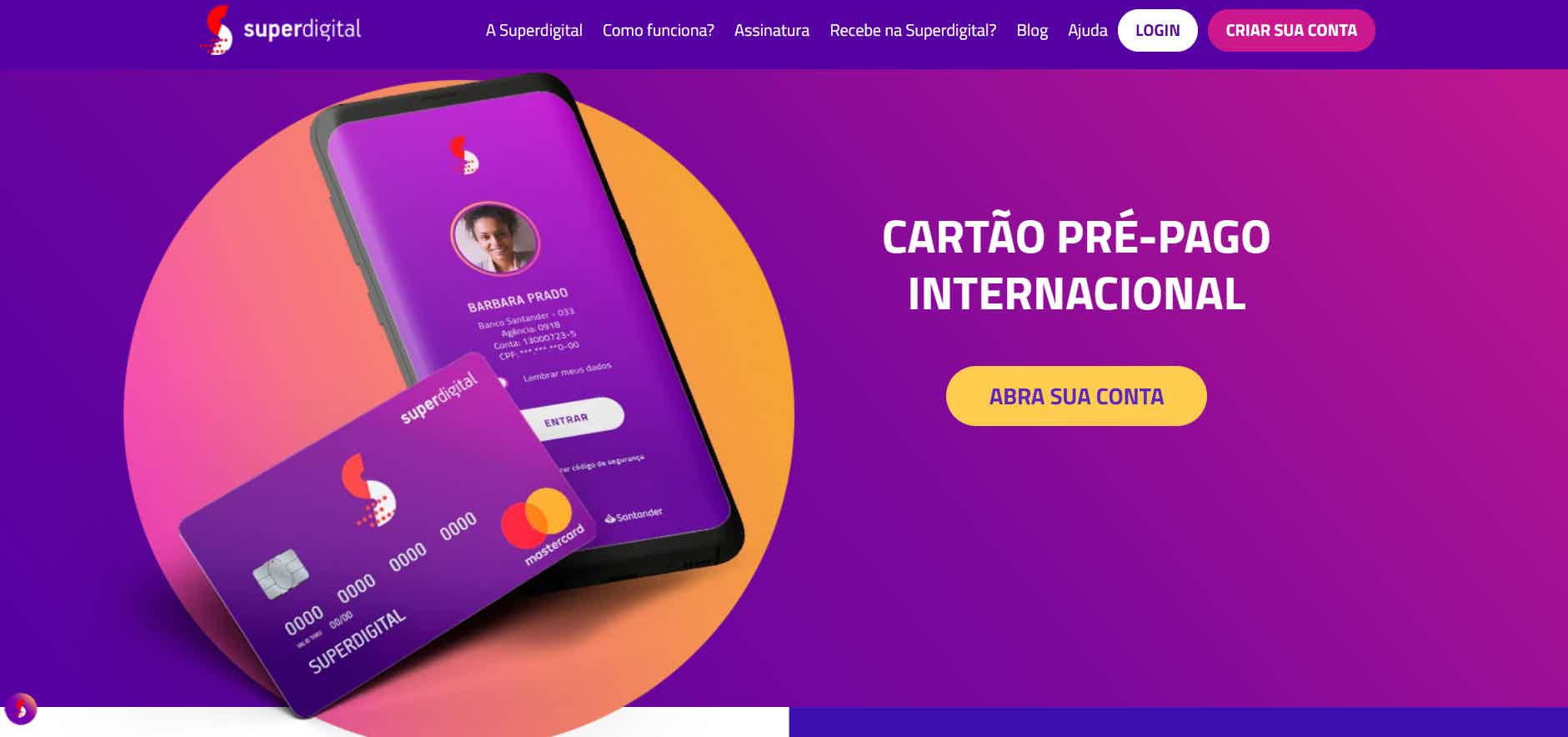

Superdigital Card Review 2021

If you are negative and need an international credit card with no annual fee and no minimum income requirement, the Superdigital Card Review will show you that it has what you need.

Advertisement

Know everything about this financial product

Being negative is a problem that affects hundreds of people all over Brazil and, therefore, the search for a credit card can become even more complicated. Therefore, the Superdigital card review will show you that you can apply for a card even with a dirty name.

That's because this card is accessible to negative people with low credit scores, so read on to find out more.

| Annuity | Exempt |

| minimum income | Exempt |

| Flag | MasterCard |

| Roof | International |

| Benefits | free transfers Payments through the Superdigital app charge cell phone Withdraw at the Banco24Horas Network ATMs |

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

Superdigital card review: everything you need to know

So, it's time to check out the Superdigital 2021 card review, below.

annuity and coverage

So, one of the first characteristics most observed in the Superdigital card is the absence of an annual fee, because you can apply for the card without having to pay anything per month.

So, being a more affordable credit card, customers won't have to worry about getting into debt, and even if you don't spend anything per month, you won't have anything to pay either.

Furthermore, the card has national and international coverage, that is, you can use it anywhere in the world to make purchases or make payments and withdrawals on the Banco24Horas Network.

rates to rates

Still on the Superdigital card review, the card charges some fees. First, in order to request a duplicate card or physical card, you will have to pay a fee of R$14.90.

And, in addition, withdrawals at ATMs in the Banco24Horas network are worth R$6.40, as well as transfers to other banks are R$5.90 (the first is free of charge).

On the other hand, issuing a statement at any bank in the Banco24Horas network is R$2.00, as well as issuing a bank slip costs R$2.90. Also, for overseas withdrawals via the Cirrus Network, you will have to pay a fee of R$19.90 per withdrawal.

So, despite being a great card, it charges some fees that can make it not a good alternative in the long run if you don't have control over spending.

flag and benefits

To use a quality card, it also needs to have a quality brand and, in this regard, you don't need to worry, as Superdigital's brand is Mastercard.

So, you can have access to all the brand's benefits such as the Mastercard Surprise Program, just go to the website and register your card and see what benefits are released for use.

Advantages of the Superdigital card

In addition to not having to worry about annuity, proof of minimum income or, even, disapproval for having a dirty name or low credit score, the Superdigital card brings other advantages.

First, it is a prepaid card, that is, to use the card you need to have a balance in your account. Thus, you use your card in the credit function, but the purchase amount is deducted from your account balance at the time, as if it were a debit.

This is a good alternative for negatives, as they reduce the chances of indebtedness, since you can only use what is in the account.

Likewise, there is the Superdigital virtual card where you can make purchases online in complete safety, depositing only the amounts you will use to make the purchase on the card, reducing defaults and card cloning.

Discover the Superdigital credit card

As the slogan would say, “like a current account, but without the headache”, the Superdigital credit card came to make life easier for many Brazilians.

Disadvantages of the Superdigital card

Continuing with the Superdigital card review, let's list the disadvantages. First, the card does not accept installments, because, as it is a prepaid card, as mentioned earlier, you can only use the balance available in your account.

So, you can't make purchases in installments, so if you like that advantage of credit cards, it's not a good alternative.

And, in addition, the card has several fees for withdrawals, issuing bank slips, issuing statements and others that we mentioned above, which is a disadvantage, since there are several options on the market that do not charge anything for these services.

card application

So, the card application is very intuitive and you can control everything that happens in your account and in the Superdigital card.

Thus, you can deposit amounts in your account all through the application to use the card in physical purchases, or in the online version. So, don't worry, because Superdigital is the world of opportunities in the palm of your hand.

application process

To apply for the Superdigital card, you need to open an account at the institution. Then, install the Superdigital application, open your account and, once opened, you will be able to apply for the card. Even if your name is dirty or your credit score is low, your application will be approved.

So, if you want to see the step-by-step process for applying for the card, click on the content below.

How to apply for the Superdigital credit card

If you are looking for a card with a digital account that accepts negative payments, the Superdigital card may be ideal. See how to order yours!

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

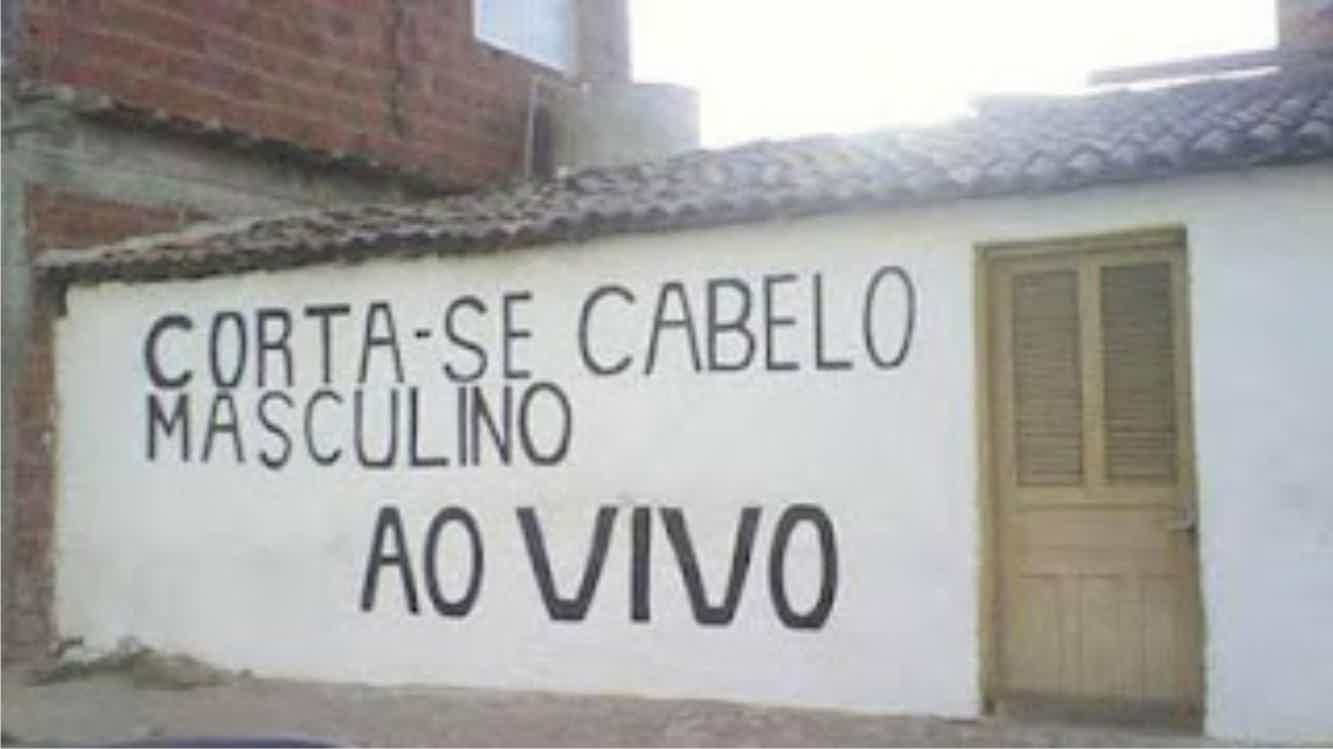

It's “serto”: the 30 funniest Portuguese mistakes you'll ever see!

Who doesn't like to see some confusion with the Portuguese language?! With that, we list the 30 funniest Portuguese mistakes for you to relax.

Keep Reading

Nubank Ultraviolet Card or BMG Card: which one is better?

There is little left for you to have access to cards with cashback and high limits. So, decide between the Nubank Ultraviolet card or the BMG card!

Keep Reading

Discover the Click Cash personal loan

The Click Cash personal loan is ideal to get your plans off the ground. With it you can get up to R$ 10 thousand to pay in up to 24 months. Learn more here!

Keep ReadingYou may also like

How to open account Next

Are you looking for a complete account to meet all your expectations? So here's the tip: opening your Next digital account is completely online and free! For more information, continue reading and find out more!

Keep Reading

Cetelem Personal Credit or Cofidis Personal Credit: which is better?

Cetelem and Cofidis have personal credit lines that help you boost dreams with high amounts and a period of up to 7 years to pay. Check out the comparison between them below and choose which is best for you.

Keep Reading

Discover the Shoptime credit card

The Shoptime credit card offers several benefits, such as the Shop+ points program and access to the Ame discount and cashback program. Were you curious? Want to know more about this card? Then continue reading the text.

Keep Reading