loans

Do I need to plan to get a personal loan?

Getting a loan requires responsibility and planning. In today's article, we'll explain what you should consider before taking out this type of credit. Check out!

Advertisement

Learn how to plan to get a personal loan

It's common for many people to end up getting in the way financially throughout their lives. Or else the price of everything goes up all at once and ends up leaving families with no choice. At such times, the first option that comes to mind is the personal loan. Therefore, some people may end up getting even more indebted. Therefore, it is very important to plan to take out a personal loan. In today's article, we'll show you how to do this planning. Keep reading and find out!

What to do before taking out a personal loan

In short, before taking out a personal loan, see what the reason for this credit is. That is, it is due to debts or a trip or, then, medical expenses. That's because, depending on the reason, sometimes it's better to save money instead of paying interest on a loan. However, there are some situations that cannot wait. Therefore, we are going to give you some tips to think about before taking out a loan:

Financial control

First, focus on your financial control. That is, always write down all your expenses. Whether in a spreadsheet or even in an old notebook. The important thing is to actually write it down. That way, you can visualize everything you're spending, and understand if you really need that loan. In addition, it is sometimes possible to cut expenses on one side to help the other.

In this sense, it is common for some Brazilians to end up avoiding this step. Because they start to spend too much and are even afraid to look at the card statement. But this practice only tends to make the situation worse. In the end, the invoice will be there anyway. So, don't avoid it!

Finally, make it a habit to organize your finances on a weekly basis. So you don't plan yourself too far into the future. For example, you do your monthly planning. But there by the third week, a medical emergency occurs. How does the next week look, when you've already planned the whole month? Therefore, we recommend that you have a monthly plan, but follow up weekly.

Loan installment amount vs your ability to pay

In this regard, moving on to planning to take out a loan. An essential factor is calculating how much you can pay per month. Because the loan installment will not be able to exceed this amount. So, understand that if your ability to pay is too low, you will probably pay more interest.

Therefore, it is very important to evaluate all conditions. Currently, there are several platforms where you can search for credit options. By the way, research different financial institutions. That is, if you don't have a lot of payment capacity, try to focus on those loans with more flexible interest rates or with more time to pay.

How to get personal loan in 2022

Want to get rid of debt? Find out here how to get your personal loan in 2022 and also get to know some market options.

Installment amount and total loan cost

In continuation, the value of the installment can deceive you into thinking that the value is low. Therefore, always be aware of the total cost of the loan. Because the installment can be, for example, R$200, but you have more than R$1,000 in interest. Also, if you already have other debts, don't create a new one. Seek to gather all the debt in one place, preferably in a more flexible institution.

That way, you organize your payments to be made and manage to focus all your efforts on a single debt. In that sense, remember to always check the CET, or total effective cost. In short, this is the rate that encompasses all your loan fees. That is, institutions with a high CET will have much more expensive interest rates.

Therefore, prioritize companies with an average CET, and also see the conditions in case of delay. Typically, fines are even more expensive than interest. Therefore, always be aware of this before taking out your personal loan.

Plan for payment of the contracted personal loan

In this sense, if you already have a personal loan taken out, but you are having problems paying it off, let us help you. First, follow our first tip: write down all your expenses. Really, do a detailed analysis of every expense you make during the month. Therefore, this practice will help you plan better to finish paying off the debt.

Also, write down the expenses for the loan itself. See how much is missing and how much interest you can deduct. By the way, there are companies that offer a discount if you anticipate installments. That way, you can start collecting the money to anticipate several installments at once.

Beware of default

Finally, no one wants to have a dirty name. Unfortunately, in some situations it ends up being necessary to borrow money. And everything is fine! The important thing is to focus on planning. That way, now you have an idea of how to plan to take out a personal loan.

That is, when you hire yours, you will not be in default. Incidentally, default can generate several other restrictions on your behalf. In this sense, you cannot contract other credits and even buy certain goods, such as houses and vehicles.

In addition, a final tip is: always prioritize the payments to be made. That is, remove all unnecessary expenses from your day to day. At first it can be very difficult to be without that weekend outing, but think that it is temporary. In that sense, a few days of planning can save you a big headache down the road.

So now you know a little more about planning to get a loan. So, you can also know some credit options available in the market. See in this other article, which is the best personal loan!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Discover the Atacadão card

Check out how the Atacadão card works and what are the exclusive benefits for those who use the service on the network. See how to order yours!

Keep Reading

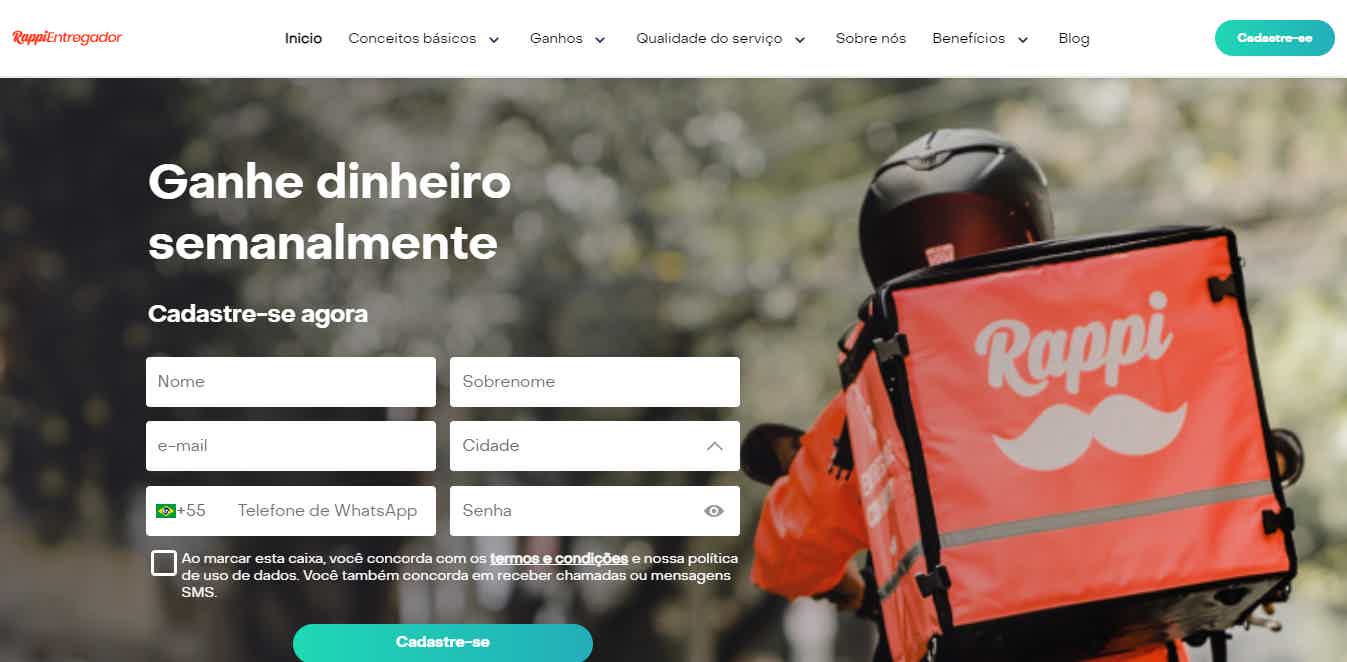

Rappi delivery man: what you need to know

Discover in this post everything about what it's like to be a Rappi delivery man and learn more about the routine and advantages of working with the app!

Keep Reading

What is the difference between protest and negation?

We often know that the name is dirty, but we don't know exactly how. Know the difference between protest and negation to know how to solve it

Keep ReadingYou may also like

Discover the TD Double Up credit card

The TD Double Up credit card is a financial product that has a very advantageous cashback program. Being able to profit twice as much, customers count on this and many other advantages that it offers. Find out all about him here.

Keep Reading

Stone Card Machine: what it is and how it works

How about boosting your sales with a card machine that accepts several brands and even vouchers (food and meal vouchers)? So, take the opportunity to get to know Stone and get personalized service when you join. Learn more later.

Keep Reading

Creditas Reforma loan or Bradesco Reforma loan: which is better?

Creditas Reforma or Bradesco Reforma? These two types of renovation loans stand out when it comes to security and practicality. But after all, which one to choose? Find out here.

Keep Reading