Cards

Pan Mastercard Platinum Card Review 2021

Check out the Pan Mastercard Platinum card review that we brought with all the data about this international card, with Mastercard brand, cashback program and personalized application for you to control your expenses.

Advertisement

Learn all about this financial product with many benefits

In the search for a quality credit card, it is undeniable that several questions can arise when we are faced with a huge amount of cards on the market. That is why, today, we bring you the international Pan Mastercard Platinum card review that offers many benefits to customers, such as the Pan Mais and Mastercard Surpreenda programs.

So, continue reading to check out all the information about it. Let's go!

| Annuity | 12x of R$41.66 |

| minimum income | R$5,000.00 |

| Flag | MasterCard |

| Roof | International |

| Benefits | cashback program Possibility of exemption from annuity international coverage Mastercard benefits Differentiated App |

How to apply for a Pan Mastercard Platinum card

Learn how to apply for a Pan Mastercard Platinum card. It is international, has a Mastercard flag, Club Deals, among other exclusive benefits.

Pan Mastercard Platinum Card Review: Everything You Need to Know

So, let's get to know a little about the Pan Mastercard Platinum card, next.

annuity and coverage

So, the Pan Mastercard Platinum card has an annuity in the amount of 12x R$41.66, that is, in the amount of R$499.92.

This means that, in order for you to keep the card's services active, you will need to pay the monthly fee of R$41.66.

But, if you use the card according to the Use+ Pague Menos program, you can be exempt from up to 100% of the annuity.

On the other hand, the coverage of the card is international, that is, you can make purchases at several national or foreign partner establishments.

rates to rates

Well, the Pan Mastercard Platinum card, as we mentioned, charges an annuity in the amount of 12x R$41.66.

And, in addition, you need to prove a minimum income of R$5,000.00 in order to apply for the Pan card.

In addition, the card has revolving interest of 18.24% per month, that is, it is good to be careful not to incur large debts.

Thus, to have access to the benefits of this card, you will need to make a high investment, but by using the card frequently, you will be able to accumulate points and exchange them for products and services.

Also, some Pan card services are charged, but don't worry, they are not exorbitant fees. Furthermore, if you want to spend less with the Pan card, just buy more.

flag and benefits

So, the flag of this card is Mastercard, so you can enjoy all the advantages, such as the Mastercard Surpreenda program.

To access the program, simply register the card on the official website and with each purchase you make, regardless of the purchase amount, you will earn 1 point. And every 5 points you can exchange for products.

And on top of that, you also have access to the Mastercard Global Service, which is a program that offers specialized emergency services.

So is the Mastercard auto program, which offers vehicle insurance.

Also, you can have access to travel medical emergency insurance and the free Schengen Charter, which is a statement that proves that you have international medical emergency insurance while traveling to European countries participating in the Schengen Treaty.

On the other hand, you also have access to a more extravagant benefit, such as the possibility of exemption from corkage, that is, you can go to restaurants in São Paulo and Rio de Janeiro with your own wine without having to pay a corkage fee at the first bottle.

Therefore, the Mastercard brand is one of the most used in the entire world, no wonder, as in addition to being a partner of hundreds of establishments, it also brings several benefits to customers.

Advantages of the Pan Mastercard Platinum card

Of course, the Pan Mastercard Platinum card could get even better, filling your life with advantages starting with the exclusive cashback program in which you make the purchase and receive part of the amount back on the next invoice to be able to make new purchases.

And, in addition, you also have access to the Pan bank application, to control your card limit and all your expenses, as well as access to your card bill.

In addition, depending on your expenses, you can exempt yourself from up to 100% of the annuity or part of it, because if you spend a certain amount as exemplified on the Pan bank website, part of the annuity value for that month will be deducted.

As with the Pan Mais benefit, you earn for every US$ 1 spent up to 1.8 points to spend on products or services.

And there is also the Club of Offers, in which you guarantee several discounts at partner establishments online.

Therefore, the Pan Mastercard Platinum card has several advantages to make your experience unique when using the card.

Discover the Pan Mastercard Platinum card

Find out how the international Pan Mastercard Platinum credit card works. It has a Club of Deals and the Use+ Pague Menos program, which reduces the annual fee.

Disadvantages of the Pan Mastercard Platinum Card

Unfortunately, like many other cards, the Pan bank card also has some negative points.

So, one of the biggest disadvantages of this card is the annual fee, because there are several cards on the market that do not charge this fee.

As well as the obligation to prove income in the high amount of R$5,000.00 and the stricter credit analysis process, that is, if you are negative or have a low credit score, your request may be denied.

Therefore, before choosing to apply for this card, see all the advantages and disadvantages to know if it is the best alternative for you.

card application

If you want to be able to control your card, not always contacting the bank by phone is ideal. And that's why Banco Pan offers the card application to check balance, invoice, control credit limit and expenses.

And, in addition, through the Pan bank application, you can request a duplicate card, contact the Customer Service Center, make transfers, payments and various other services.

application process

So, to apply for the card, you can enter the official website of Banco Pan, choose the card from the list of cards that appear and proceed to the application. Then, you must fill in your personal data and wait for the credit analysis. If approved, within 10 business days it will arrive at your residence.

Also, if you want to learn more about the application process, read our recommended content below.

How to apply for a Pan Mastercard Platinum card

Learn how to apply for a Pan Mastercard Platinum card. It is international, has a Mastercard flag, Club Deals, among other exclusive benefits.

About the author / Joyce Viana

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

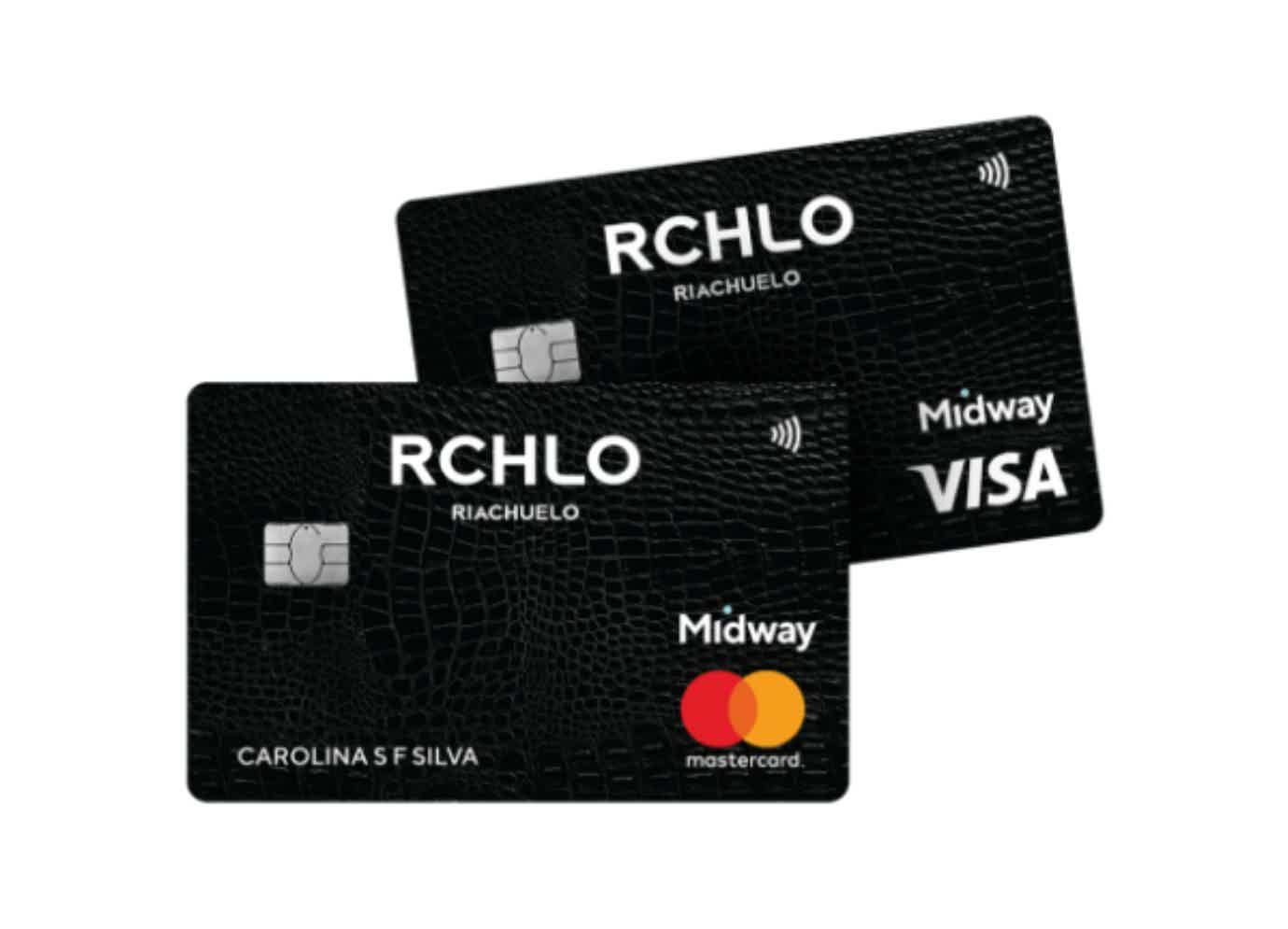

Riachuelo cards online: a world of benefits for you

Find out in this post how online Riachuelo cards work and what exclusive benefits each one of them can offer you!

Keep Reading

How to use a credit card without going into debt?

Do you know how to use your credit card without getting into debt? Let's give these and other tips on the constant use of the card.

Keep Reading

How does the prepaid card work and why apply for one?

You may have heard of the prepaid card. But, do you know how it works and who can have one? Find out all about it now

Keep ReadingYou may also like

The highest salaries in cinema: find out who are the highest paid artists in Hollywood

According to the Forbes list, some of the highest paid artists in Hollywood are those who participated in Marvel franchises. Meet the others here!

Keep Reading

How to apply for Cetelem car credit

Cetelem car credit is a great option for those who want to realize their dream of owning a car, with lower rates and longer payment terms. To find out more, just continue reading.

Keep Reading

CGD or Montepio car loan: which is better?

If you want to have more facilities when buying your vehicle, and don't have the down payment to finance it, no problem. With CGD or Montepio car credit, you can make this dream come true. To find out more, just continue reading.

Keep Reading