Cards

How does the prepaid card work and why apply for one?

Do you want to know how a prepaid card works, who can have one and how to choose the best one? So check out all about it below!

Advertisement

Prepaid card

The prepaid card has conquered many people due to its functionality and the practicality of not having to carry cash. But have you ever heard of this type of card? Today we're going to show you how it works and why you should order one right now.

The prepaid card works as you request it. With it, you don't pay interest for delaying the invoice and much less run the risk of getting into debt with long installments that snowball. Therefore, this type of card works like a prepaid cell phone, its use is limited to the amount deposited on it.

The use of this card has been growing over the years. According to ABECS (Brazilian Association of Credit Card and Services Companies), in 2018 alone, prepaid transactions grew by 63% compared to the previous year. That is, they totaled 2.2 billion in the first quarter alone.

This all means that people are starting to see advantages in using prepaid, in addition to reducing the use of money, making room for cards. Therefore, today we want to show you each of the advantages of prepaid.

What is a prepaid card?

The prepaid card is like a credit card, but it only works according to the amount you top up. Therefore, all purchases you make on it will be automatically deducted from your balance, consuming the amount until it runs out. Therefore, you will need to recharge whenever you want to use it.

If you have or have had a prepaid cell phone, you'll know how this card works, because it's basically the same thing. You recharge with the desired amount and can use it until the balance runs out. With the prepaid card you use the “credit” function and you can make purchases in physical stores or online.

What is better is that most of these cards do not have an annuity or interest payments and, in addition, they do not consult with agencies and credit protection such as SPC or Serasa.

This happens because the company does not commit to you and does not run any risk that payment is not made by the customer. Therefore, practically anyone can have a prepaid card and also enjoy the numerous advantages it offers.

- National prepaid card: There are two main types of prepaid cards, they are national and international. As its name already indicates, the national prepaid card can only be loaded in reais and is clearly not accepted in another country.

- International prepaid card: The international prepaid card, in turn, can be loaded in foreign currency and is accepted both within the country and abroad. This is an excellent option for those who have saved money for a long time and are thinking of taking a trip to another country.

How does a prepaid card work?

A prepaid card is a fast and secure alternative, perfect for you who are entrepreneurs and want to receive the value of your sales. The prepaid card can be recharged with a payment slip, online debit and deposit into an account.

This amount you deposit becomes a balance on the card that can be used for national and/or international purchases in places that accept your card brand.

The prepaid card is always used in its credit function, as it allows you to make purchases in person, online or subscribe to streaming services, for example. This happens because, especially online, e-commerces usually do not accept debit cards.

But in practice, the prepaid card works like a debit card, since it is necessary to have a balance in order to use it. Therefore, it is important to point out that despite being used as a credit card at the time of purchase, the prepaid card does not allow for installment transactions.

To make balance inquiries, purchase statements, you must have your bank or card application or the website of the financial institution that offers the card. If the card is a means that you use frequently, it is important to always be aware of the balance, thefIn the end, it may happen that the available balance is not enough for the purchase you intend to make.

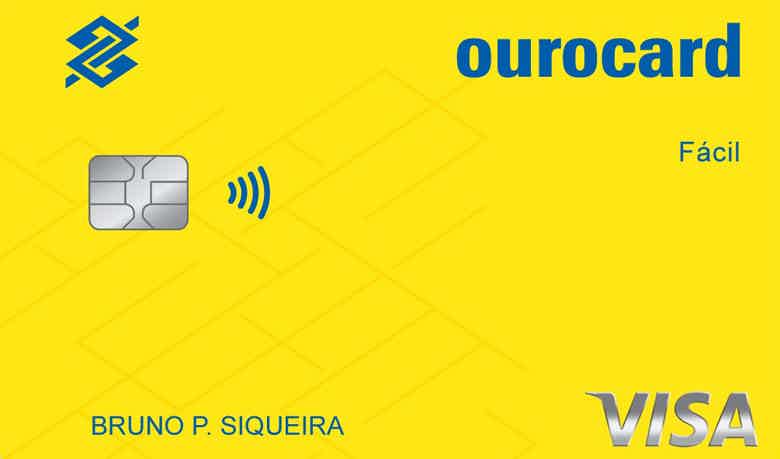

Discover the prepaid Ourocard Card

Do you want to know the prepaid card that makes your day to day easier? So now see everything about prepaid Ourocard and its benefits

How to recharge the card

Recharging your card can be done in several ways, it all depends on the financial institution you hired. But we will explain to you in a general way what are the different possibilities of loading your card

- direct debit: Some companies allow you to top up your prepaid card by debiting your account. That is, the balance you deposit on your prepaid card will be deducted from the amount you have available in your account. However, it is important to check with your institution if the account must necessarily be from the same company or if the transfer can be made from other financial institutions.

- Bank slip: This is a recharge function present in almost all prepaid cards. It is usually possible from the application to generate a slip for the amount you want, so that when the payment is made and registered, the money will automatically become a balance for your card.

The ticket can be paid at lottery outlets, bank applications or even at ATMs. However, it is worth remembering that the possibility of paying by bank slip and the places where you can pay vary from institution to institution.

- Balance: Anyone who has a prepaid card linked to an account can normally also top it up from the balance available on it. Does this look familiar?

But calm down, this function is different from online debit: in the first case, it can be recurring, programmed every month or every week, for example. But it doesn't necessarily have to be from an account linked to the card.

Everything will depend on the institution you choose to register a prepaid card, so be aware of the features that are important to you. That's why it's worth doing research and evaluating the advantages of each institution.

What are the advantages of a prepaid card?

Prepaid cards are ideal for those who want to have full control of their expenses. Because you only carry the amount you want in a practical way without having to carry money around.

It is also possible to monitor everything through the App, which guarantees greater security and monitoring of your balance. Therefore, choose to ensure more security in your daily life when shopping online or in physical stores.

Check here all the advantages of acquiring the prepaid card:

Purchases and withdrawals in Brazil and abroad

With the prepaid card you have more security and practicality in your purchases in Brazil and abroad. Having access to an international prepaid card allows you to transfer all the savings you've made to spend on that long-awaited trip abroad.

Pay your child's allowance

This is a safe and convenient way to pay and keep track of your child's allowance. Give them a prepaid card and you'll have access to all expenses directly through the App. You can contract more than one card with the same function if you have more than one child.

If your child is one of those who always ask for your card for small purchases on the internet, this is your chance to get rid of it and transfer the responsibility directly to him. By depositing the allowance on a prepaid card, your child will be able to shop online at any establishment.

do not carry money

More and more people are choosing not to carry cash in their wallets every day, as this prevents a robbery from taking away all their savings, and with money safe on a card you can immediately cancel it for theft. And if you are a person who loves practicality, the prepaid card is the ideal option that takes up less space in your wallet.

Buy online securely

You can use your prepaid card to hire services like Uber, Netflix, Spotify, or shop online. Just load and use!

negative can do

If you are negative or cannot have your card approved by any financial institution, the prepaid card is ideal for you. Because it is not necessary to consult the SPC or Serasa, in addition, you do not need to go through the credit analysis. All you have to do is request and load the card with the amount you want, that way you can already make purchases using the credit function and not miss any lightning promotion online.

And if you don't have CPF transactions or have a low credit score, this could be the reason why your card is not being approved by the finance companies. But as the prepaid does not consult the credit protection agencies, you can rest assured that your request will be approved.

How to use this type of card?

Now that you know the advantages and all the features of the prepaid card, it's time to find out how it works in practice.

- Choose the brand well: Depending on your card brand, you have access to exclusive offers that only it offers, such as discounts and cashback. Therefore, try to identify which are the most accepted credit card brands in the establishments where you usually shop.

Larger credit card companies also often offer prepaid card options to customers. Therefore, it is interesting to know if your card company already has the prepaid modality, so you can contract more quickly without having to give your information to another company.

- Choose an ideal plan for your profile: Like other services, the prepaid card offers a wide variety of facilities that can be contracted and vary according to other institutions. In this way, factors such as tariffs, maintenance fee, recharge fee, all this changes. Therefore, it is important to choose a plan that is ideal for your profile.

Other good practices

We still have other best practices for you to follow:

- Understand the limitations of prepaid: The prepaid credit card only allows the user to spend the money that has already been deposited. That is, it must be made clear that it is not possible to make purchases in installments. Therefore, if this is the consumer's expectation, his intentions will be thwarted.

- Reverse the credit card process: When we buy with a traditional credit card, even in cash, we pay the amount later and can make purchases throughout the month according to the available limit, paying all in a single invoice.

- 5. Control expenses: A fact that cannot be ignored when dealing with a prepaid card is being able to control your expenses. You who are dirty in the square and need to control what you spend there, a simple way is to deposit only the amount that you can use during a certain period, and thus control yourself not to spend it all right away.

Conclusion

In this way, you will need to acquire the habit of writing down the expenses incurred and preparing yourself so as not to lose control and run out of money. Therefore, choose to replace the use of a conventional credit card with a prepaid card and have greater control of your financial life.

We saw then that, in addition to the prepaid card representing greater security, it also avoids surprises with the dollar exchange rate. This is because in the traditional credit card modality, we pay the dollar according to the exchange rate on the day the invoice is closed, and not the day the purchase was made, which can cause some confusion.

What is the difference between protest and negation?

Discover the difference between protest and negation, and learn how to resolve each situation to clear your name.

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Artificial Intelligence App: see the trending options

Want to know how to take advantage of a good artificial intelligence app? So continue reading and understand more about the subject!

Keep Reading

5 tips to start your financial control

There are some ways to start financial planning, so we'll give you 5 tips to start your financial control.

Keep Reading

How to find the best painter jobs

We have selected the best painter vacancies and we will even show you what you need to do to get a painting job.

Keep ReadingYou may also like

How to open Bitz account

With the Bitz digital account, having total financial control from the palm of your hand is easy and safe, through a modern and easy-to-use app. In addition, the account has several incredible benefits, such as cashback and income greater than the CDI. Come with us and learn how to open your Bitz account!

Keep Reading

How to get a 240 month loan to pay

In today's post we will talk about the long-term loan. They can be a good option for those who want to buy high-value things and don't have the money. Interested? Check out!

Keep Reading

Montepio or Universo car loan: which is better?

You no longer have to worry about purchasing your car in cash. With Montepio or Universo car credit, you have the ideal amount for financing and can enjoy several benefits. To find out more, just continue reading.

Keep Reading