Tips

Quite Already trusted?

The company Quite Já came to make your life easier when renegotiating debts. As a digital fintech 100%, Quite Já helps you settle your debt with a completely online process and without bureaucracy. See in this article if Quite Já is really reliable!

Advertisement

Renegotiate your debt with Quite Já

Searching for a debt renegotiation company can be difficult. That's why today we're going to show you if Quite is already reliable. This company is 100% digital and focuses on making the negotiation process less bureaucratic.

As an online company, many people wonder if it is really reliable. Even because renegotiating debt is a very important issue. In this way, it is common that there are many doubts.

With that in mind, in this article we will explain how Quite Já works. From the negotiation process to how to simulate offers from partner companies. Continue reading to find out!

What company is this Quite Já?

First of all, let's explain how this company Quite Já works. Basically, it is a fintech that offers solutions in the finance area. More specifically, a special help when negotiating debts.

Quite Já's main differential is the fact that it mediates debt negotiation completely online.

Therefore, you do not need to go to any agency or spend hours on the phone. Because the Quite Já platform is available 24 hours a day, 7 days a week.

How does Quite Already work?

In short, Quite Já works completely online. Therefore, the first step to use the platform is to access the website. There you can enter your data and view all your debts.

From this, the company analyzes your information and assists you in the best way to proceed with the renegotiation. In addition, the company also offers help to talk with the company you close the deal.

In short, Quite Já is fully responsible for the relationship with third-party companies. By the way, it is through the platform that you check which offers are available for you to renegotiate your debt.

For you to obtain your proposal is very simple. Simply access the Quite Já website with your CPF or CNPJ number. By the way, this company accepts both legal entities and individuals.

After consulting an offer and deciding on the best option, payments are made by bank slip. And Quite already works with some banks to help you settle your debts. Some of the institutions are Santander, Digio, Porto Seguro etc.

Is the Right Deal reliable?

See here if Accord Certo is a reliable platform for you to renegotiate your debts.

Reputation in Reclame Aqui

Having a good reputation on Reclame Aqui is essential for you to be able to win more customers and still offer a quality service. Therefore, whenever you meet a new company, it is important to see how it is doing on Reclame Aqui and similar platforms.

In short, Quite Já has a very positive rating on the site. Complaints are answered and even then there aren't many.

So, Is Quite Reliable Already?

Finally, Quite Já offers a quality service for those who want to finally get out of the red. In this way, if you liked this debt renegotiation option, know that Quite Já is indeed a reliable company.

Therefore, now you already know a platform that allows you to negotiate debts online without even having to leave your home. By the way, in this other article we show you several ways for you to check your debts online. Keep reading and find out more!

How to negotiate debts online

Did you know that you can negotiate your debts without leaving home? See how in this article!

About the author / Leticia Maia

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

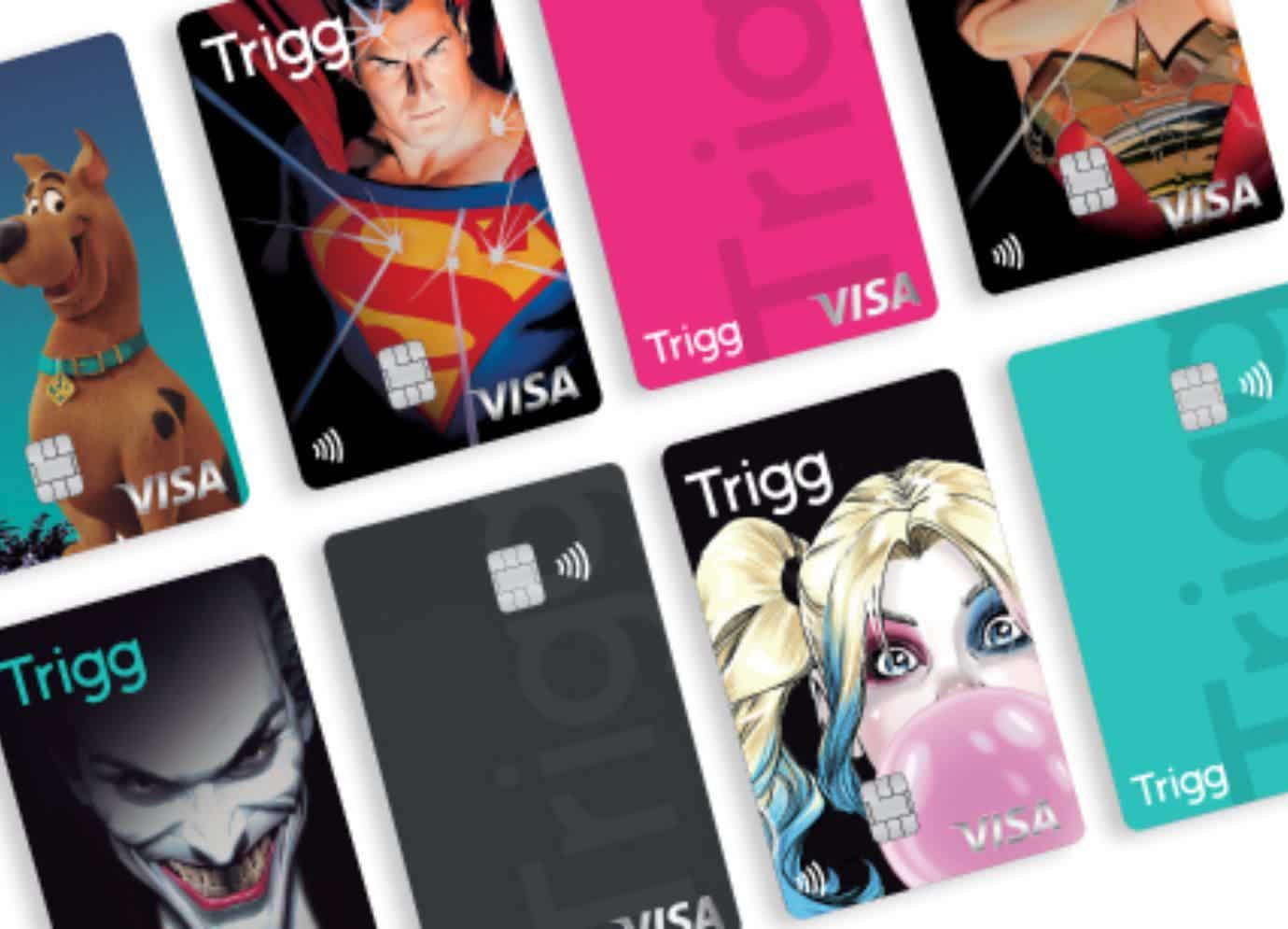

Online Trigg Card: with international coverage and cashback

Find out what the online Trigg card can offer you and how you can have a collection of fun cards with it!

Keep Reading

How to apply for a Santander card step by step

Learn how to apply for a Santander bank credit card, the step by step is simple and can be 100% online.

Keep Reading

What are the technical courses that most employ?

Do you want to know which technical courses are most employed? In today's article, we will answer this and more questions. Check out!

Keep ReadingYou may also like

How to apply for a Best Buy card

Do you want to gain even more advantages when purchasing? So, apply for the Best Buy card and see everything you can earn while taking advantage of the brand's products and special conditions.

Keep Reading

Discover the Young Apprentice Program

If you are between 14 and 24 years old, are studying Elementary or High School and want an opportunity in the job market, the Young Apprentice Program may be the solution! Read the post below and understand more about it.

Keep Reading

How to make money with digital marketing? Check out our tips

If you want to be financially independent, work from home and be able to scale your earnings, learn here how to make money with digital marketing and be surprised by this area that only grows. Continue reading and find out more!

Keep Reading