Financial education

IPVA and IPTU financial planning

Carrying out good financial planning is essential to anticipate the payment of annual expenses, such as IPTU and IPVA. In addition, it will help you to have self-control of your accounts and, who knows, start a life of investment. Learn more below.

Advertisement

IPVA and IPTU: how to plan and pay taxes safely

The beginning of the year has arrived and with it some bills that are part of every family's daily life, such as IPVA and IPTU. Therefore, it is important to make your life more organized, anticipate the situation and carry out good financial planning for paying IPVA and IPTU. In this way, it will be possible to carry out the payment of annual taxes without complication.

In that sense, no magic is needed, just organization and financial planning. Therefore, we are going to give you tips to prepare properly to go through IPVA and IPTU without doing crazy things.

Anyway, despite being quite simple, good planning requires discipline and self-control to avoid unnecessary expenses. In addition, we must bear in mind that the fruit of good planning is a strong economy and financial peace of mind. That is, you do not get rich, but you are safe to achieve your goals.

Don't leave there and follow our tips!

IPVA and IPTU payment: financial planning at the beginning of the year

The payment of IPVA and IPTU is part of the annual expenses schedule of every Brazilian. Paying these bills on time avoids inconveniences such as interest charges and unnecessary fines, which will only grow every day.

For both payments there is the possibility of installments. However, it is indicated that it be carried out in sight. In this way, with financial planning in advance, this is possible. Especially because, when we pay one of these taxes in installments and we delay or do not make payments, the interest flows like water one on top of the other. So, when we stop to see, the debt is gigantic.

Therefore, it is very important, when starting a new year, to carry out good financial planning and include these certain expenses in it. In addition, determining how the payment of these taxes will be made helps not to generate any complications later.

However, if you are unsure how to do this, don't worry. We'll tell you about the financial planning of your IPVA and IPTU, and how you can start the year on the right foot and prepare to pay those taxes without worries.

But first, do you know what IPTU and IPVA refer to? Clarify with us.

IPTU

The IPTU is the Urban Property and Territorial Tax charged annually by the city hall on account of the residences and dwellings that the population owns. That is, houses, commercial establishments and buildings in general must pay a certain amount.

In this sense, the value is not fixed, as it depends on many variables. These are decisive in calculating the amount to be paid by the owner. Therefore, it is clear that one of the aspects taken into account when calculating the IPTU is the value of the property and the year of purchase. That is, the more expensive the house, the higher the tax amount.

In addition, the owner of the property is also a factor to consider. Retirees, for example, have to pay a much lower amount on the property. There are some cases where people don't even have to pay. In other words, they are exempt.

IPVA

The IPVA is like a copy of the IPTU. However, intended for vehicles. The acronym means refers to “Tax on Motor Vehicle Property”.

That is, the IPVA works with the tax collection values based on the value of the car, year of manufacture and other aspects that determine the amount to be charged.

Like IPTU, it is charged annually. In addition, it can also be paid in installments or in cash with a discount. Regarding exceptions, in each State there are different laws and norms for the tax on vehicles.

That is, there may be vehicles that do not generate as much collection and even cars that are not affected by the IPVA. However, this will depend on the place. In order to be better informed, it is necessary to follow the laws and regulations of your specific State.

How to earn extra income online?

Here are 5 reliable online extra income options that can help with your financial planning.

How to do financial planning IPVA and IPTU?

In a natural and not forced way, your financial planning should be carried out. That's because we want to save to lighten our payroll in the future. So, we cannot create debt in other areas.

That is, you need to analyze the expenses you have monthly and the funds that came in to pay for these expenses. So, put everything in a spreadsheet and have all the values in hand.

With this, it will be possible to see the expenses that you need to pay and cannot give up, such as, for example, electricity, water and food bills. However, you can also visualize certain expenses that can be avoided. In this way, it is possible to have a vision of what is fixed and variable expense, as well as what can be saved in superfluous expenses, and even saved.

By carrying out good financial planning and having control over expenses, you will be able to start the year and pay your IPTU and IPVA without much trouble or concern.

But behold, there is still a doubt: what is the best way to pay these taxes, in cash or in installments? We'll show you next.

Payment in cash or installments?

Regarding payment, it is quite understandable that many people think that the best option is to do it in installments and pay little by little so as not to spend a lot of money at once. However, when we talk about IPTU and IPVA, this is wrong.

When paid in cash, in each State the value of IPTU and IPVA has a discount. This percentage will vary from 4% to 10%. In this way, when we carry out a good financial planning for the payment of IPTU and IPVA, we can arrive at the payment dates for these charges and make the payment in cash. The rebate money should be viewed as extra income.

Following the above point of view, it will be possible to start the year saving around 10% in tax amounts. The money saved can be invested in a savings account. Therefore, a good tip from Senhor Panda for those who want to start a financial investment life.

Furthermore, taking advantage of the fact that we are talking about investments, how about knowing how much R$ 50 thousand in savings yield? So head over to our recommended content below and check it out!

How much does 50 thousand yield in Savings?

Putting money in a savings account is the first option that comes to mind for anyone who wants to start investing. But, is it an excellent option? Learn more here!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

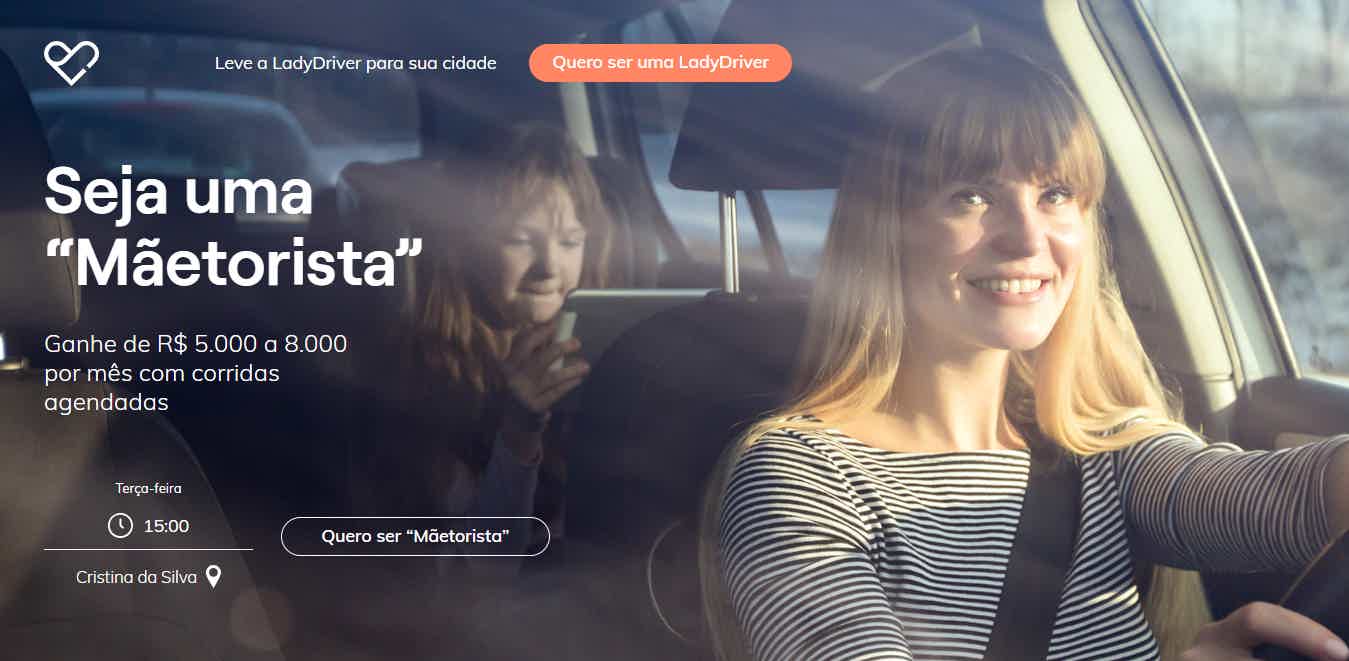

Lady Driver driver: what you need to know

Find out in this post everything about what it's like to be a Lady Driver driver and learn about the main services that the application offers!

Keep Reading

Is it worth opening a savings account?

Opening a savings account can bring security, but it is no longer so advantageous in terms of income. So is it worth it? Check it out here!

Keep Reading

Pan Mastercard Gold credit card: how it works

Find out how the Pan Mastercard Gold card works and have access to exclusive conditions, such as zeroing the annuity, cashback and the Offers Club.

Keep ReadingYou may also like

Discover the Crefaz personal loan

The Crefaz personal loan is a great alternative for those who want to catch up on their finances and have more time to pay. To learn more about credit and check how to apply for yours, just continue reading the article.

Keep Reading

Discover the Olé payroll card

Do you want to know how to have a card with more attractive rates and that is deducted directly from your INSS benefit, without a headache? Continue reading the following text!

Keep Reading

Check the new rules for granting a death benefit

Many dependents of deceased INSS insured persons were denied a death pension. However, with the new rules, many who were still in the process awaiting a response may have the benefit approved.

Keep Reading