Financial education

Is it safe to pay to increase the score?

Paying to increase the score may not be feasible, but there are some strategies that are worthwhile. Learn more in our post and understand how to increase your score once and for all.

Advertisement

Know what to do when the company offers the service to increase the score

Browsing the internet it is possible to find several advertisements of companies that carry out the process of increasing the score. But the main question for many is: is it really safe to pay to increase your score?

The truth is, everyone is looking for an easy alternative to change their score and easily pass credit checks. Sometimes this is possible, but in some cases it gets more complicated.

We produced this article thinking about you who are about to pay to increase your score. So before hiring this service, be aware of how everything really works!

Is it safe to pay to increase the score?

In the foreground, it is necessary to be aware that Serasa itself informs that there are no methods that increase your score instantly.

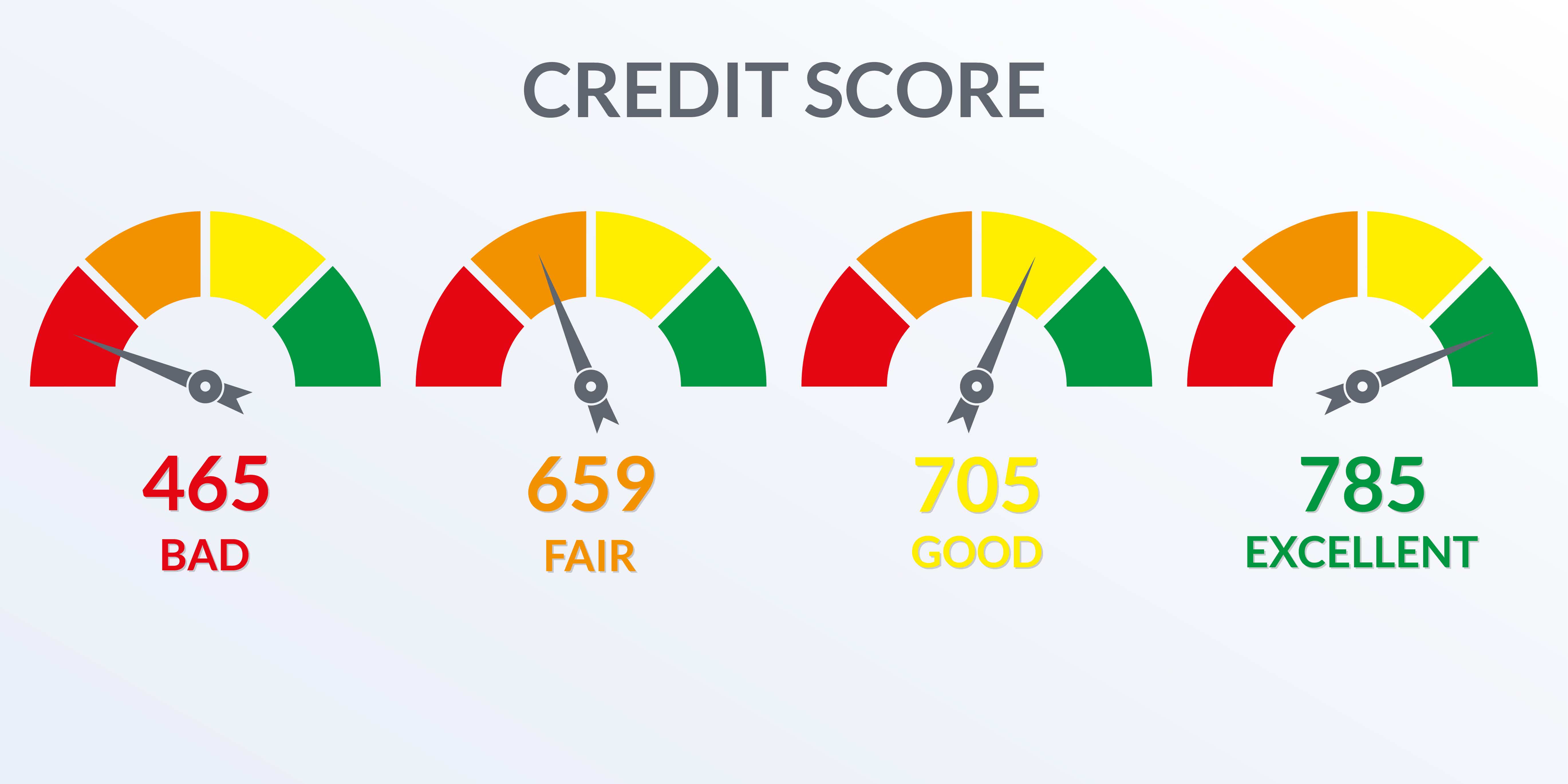

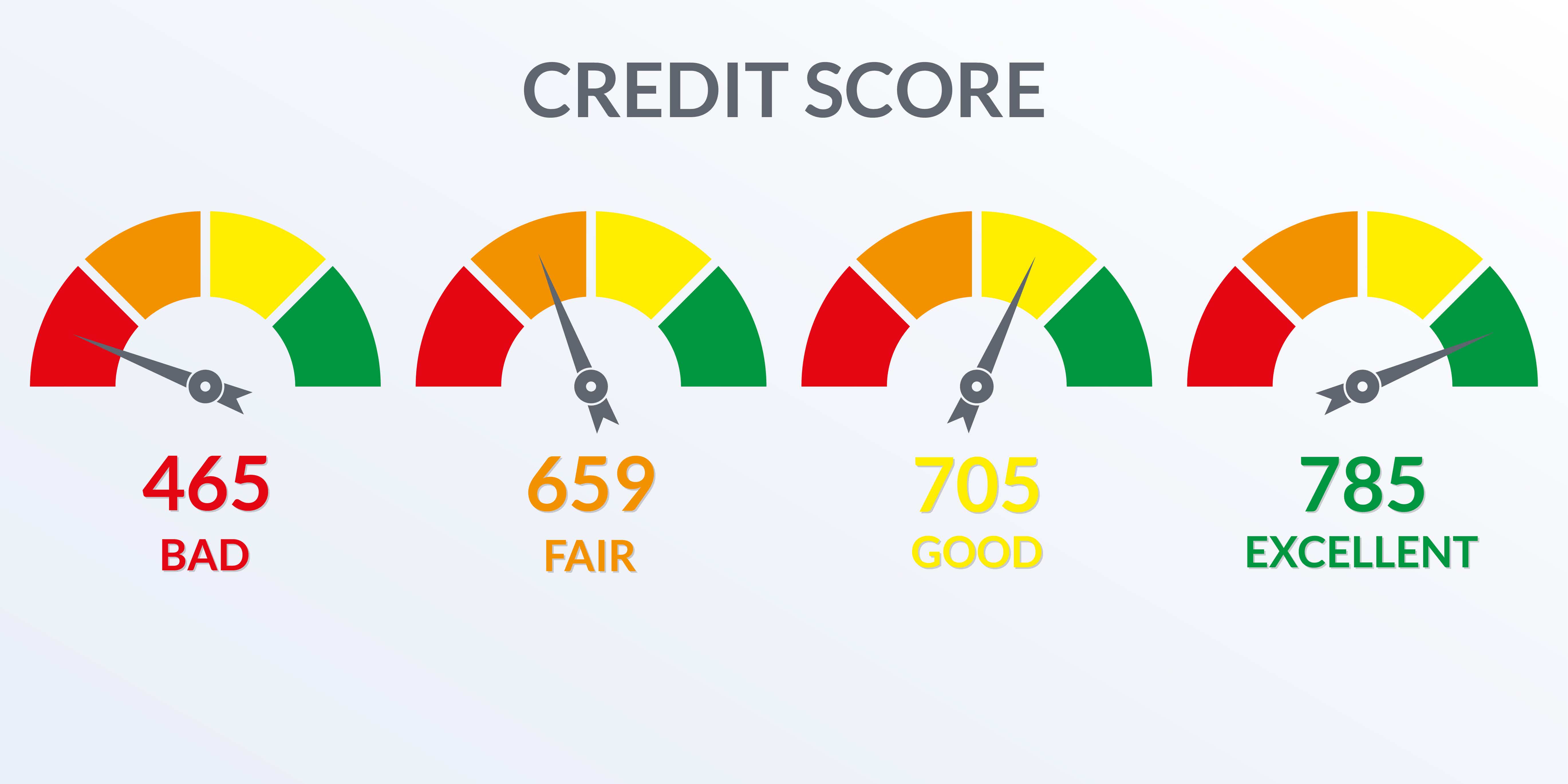

The score is the score that measures the quality of your financial behavior over a relevant period. So it takes some time for the score to change.

Therefore, be aware that any proposal to increase the score in up to 24 hours or things like that is nothing but a farce. Escape the blow!

In general, the pay to increase score process works as well as companies usually advertise. For we have already seen that this is a process that requires patience.

The institutions that work with this type of service are usually, in fact, financial credit operators that negotiate their debts.

But how does it work? Well, the whole process is actually quite simple and sometimes even advantageous. Just look at the example below:

João has accumulated debts and cannot negotiate them or show any attempt to clear his name. Therefore, your score is below 300 points.

Company X offered this gentleman a score increase service and he was really interested, as he needed a good score to finance his new car.

To increase João's score, the company will offer him a new credit service in the total amount of his debts and with lower interest or more interesting payment terms.

Therefore, João will be able to pay off his oldest debts and pay only that credit from company X that charges lower interest rates.

Returning to the topic, even with the hiring of this service, realize that the company will not literally increase your score. However, with the payment of outstanding debts, your score tends to improve.

How to increase score fast

Your score will no longer be a problem. Understand how to increase your score by reading our recommended content.

How to increase the score fast?

If you are drowning in debt and your Score score is very low, know that there is a great solution to pay back debts and even increase your score very quickly.

This scoring modality is a great novelty so that people can pay the bills and already raise their score a little. It is worth remembering that this is the only case that raises the score quickly.

People with debts can earn Turbo points when they participate in Serasa Limpa Nome and start negotiating their debts.

According to Serasa, each negotiated debt generates a number of instantaneous points for your financial behavior. That's because you're showing interest in clearing your name in the square.

With this, consumers have access to the natural growth of points more quickly. That is, without the need to wait months and months to pass a credit analysis.

There is no secret to accessing Serasa Limpa nome turbo points, just follow the step by step:

- Join the Serasa Limpa Nome program;

- Enter your login information. If you don't have it yet, you'll need to register;

- Consult the existence of agreements for your debts;

- Confirm the agreement and make the payment of the debt.

The more debts you pay off, the more points you earn. Thus, your score grows quickly and naturally.

What makes score drop?

Even with the recent update to the Serasa Score 2.0 version, the average score remains the same as before. This means that the score continues to be used to analyze the default risk that consumers accumulate.

Therefore, he is continually analyzing his behavior in relation to the financial responsibilities he assumes.

Have you ever stopped to think about what makes your Score drop? Amazing as it sounds, many people don't know what causes this type of behavior in stitches.

Some people even report that the score suddenly dropped without anything unusual happening.

So let's now detail the main harmful points for your Score score, i.e. what makes your score lower.

Serasa update for Score 2.0

We've talked briefly about this update before, and it hasn't changed the overall goal of scoring. However, Serasa 2.0 comes with a new method of calculating and valuing your financial performance.

Therefore, some aspects of your behavior are worth more, while others are worth less. Check it out:

- Consultations at the CPF account for 1.5% of the score;

- Queries for contracting services and credit count as 17.8%;

- Credit contracts are worth 7.9%;

- The debt history represents 13.7%;

- Your credit payments amount to 43.6%;

- For debt settlement we have 5.5%;

- Lastly, the usage time is worth 10.1% of points.

Keep an eye on all these points and realize that paying on time is what most influences a good score.

Therefore, if you fail in any of them, even without intending to, Serasa's artificial intelligence tends to reduce your Score score.

Does not have a positive record or is out of date

The positive record became more important for the score in this last update. Therefore, if your score is lower, try to register or even update your old one.

Stop paying the bills

We have just seen that the payment of credit installments on time is what most impacts the score. So if you stop paying any bills even if you don't want to, the score tends to go down.

Did you like it? Access our recommended content and learn more about how to increase your score using Serasa Turbo.

How to increase the score with Serasa Turbo

With Serasa Turbo, you can leave your score ideal and have good credit opportunities. Understand!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Pan Mastercard Internacional credit card: how it works

Find out how the Pan Mastercard Internacional card works. With it, you can zero the annuity and also take advantage of several benefits, such as PAN MAIS.

Keep Reading

How to unlock hidden categories on Netflix?

If you want to watch a specific title, you need to know the hidden categories on Netflix to make your search easier. Learn more here.

Keep Reading

Loan on electricity bill: how does it work?

Did you know that it is possible to borrow money from your electricity bill easily and quickly? See right now how this modality works.

Keep ReadingYou may also like

PagBank Card or Pan Card: which one to choose?

PagBank card or Pan card? They have many benefits, but which is the best financial product? Read this post and know the answer.

Keep ReadingGet to know Inter account

One thing is for sure, digital accounts are the best option to manage your finances, and the Inter account is ideal for anyone looking for more than a bank, but a tool to manage their money. Do you want to see it? So, learn more about it here.

Keep Reading

Can any pregnant woman apply for the new Pregnant Composition Benefit?

The government's new social benefit for pregnant women should begin to be paid later this month. However, not all pregnant women are entitled to monthly payments. See more here!

Keep Reading