Financial education

What is Serasa Score 2.0?

With Serasa Score 2.0, you can check your score points, check financial issues and negotiate. Understand here how it works and how to use Serasa Score 2.0!

Advertisement

Discover the benefits that a good score brings

Before talking about what Serasa Score 2.0 is, we should mention that it is not news that the vast majority of Brazilian citizens tend to use credit frequently in their financial operations. This modality is very useful to make that emergency purchase or even a product with the highest value.

However, the fact is that if you don't have a good Serasa Score 2.0, you might not get the credit card you've dreamed of. That's because this is one of the most relevant scores when the company performs the credit analysis.

Therefore, we prepared all this content thinking about you who need to know Serasa Score 2.0 and use this score in your favor when shopping and credit analysis. For this, do not miss any of the following information.

Follow us to the end and have a great read!

What is Serasa Score 2.0?

In the foreground, you need to understand what Serasa itself is and then understand how the score score works in its new version 2.0.

In short, Serasa is a company that acts as a credit bureau. It brings together a variety of data that comes from financial institutions, such as banks, to provide a certain type of help to other companies.

But after all, what help is this? Well, Serasa gathers some data on outstanding debts, renegotiations, bad checks and other operations that are bad for the consumer's profile.

The main objective of this is to create a way to assess a person's financial capacity by looking at just one score, which is the Score 2.0.

The points system is basically what will indicate whether you are a good or bad payer. That is, it measures how much a credit operator company can trust you.

When we talk about Serasa Score 2.0, this is a new, more improved score that will classify you according to your financial behaviors. The biggest new feature in version 2.0 is the score calculation methods.

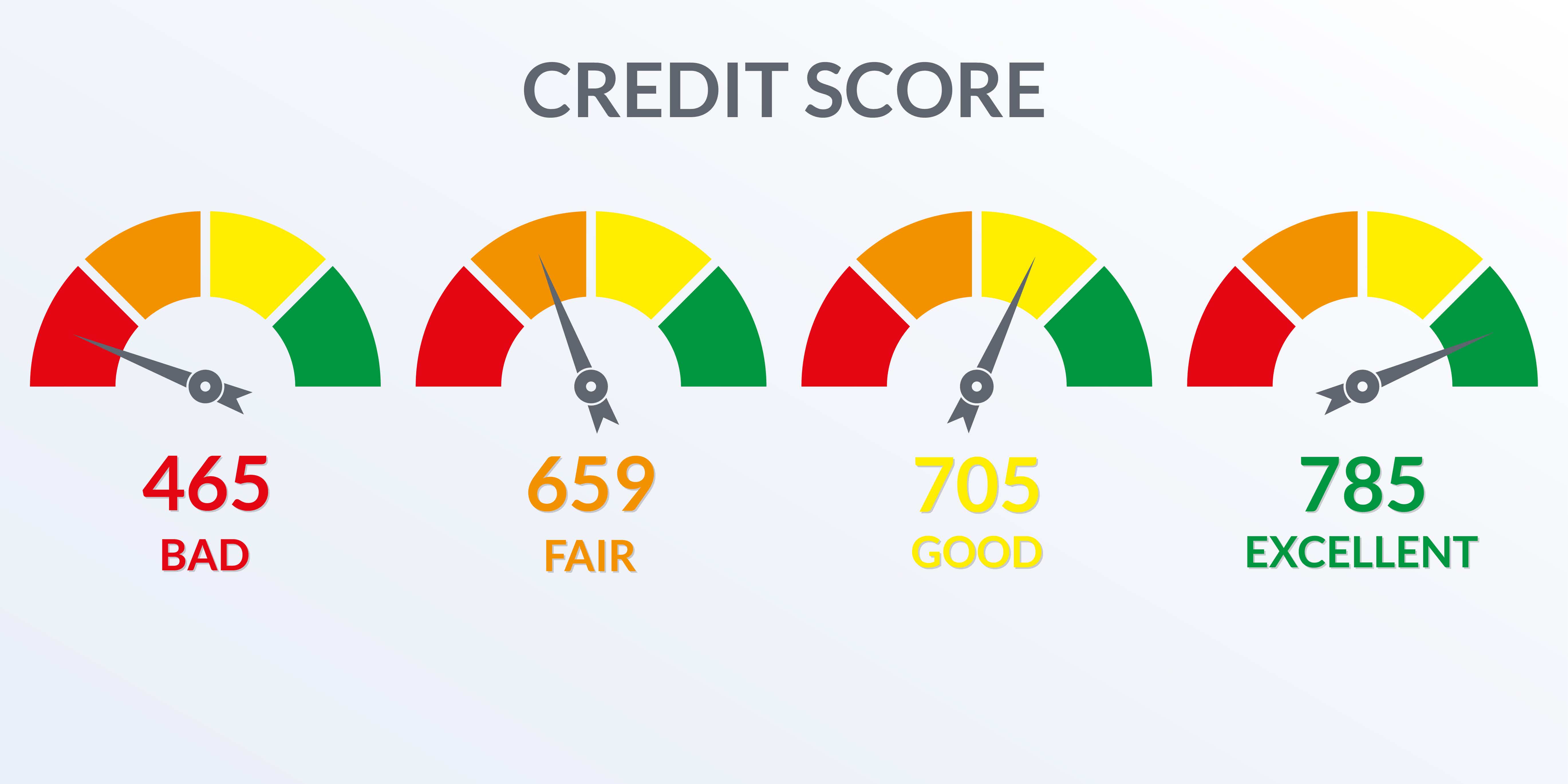

Otherwise, the points continue on a scale of 0 to 1000, in which the higher your level, the companies will perceive that you pay your bills on time. That is, more chance of being approved on credit.

How to increase score fast

Check out our content on how to increase your score quickly and get credit opportunities.

How does Serasa Score 2.0 work?

With the reformulation of the calculation methods, Serasa Score 2.0 started to care even more about the bills that customers pay on time. Therefore, these operations have more weight for a good score.

Added to this, the company also informs that the new calculation tool allows for more coherent and realistic analyzes of the consumer profile. Be aware, as this does not mean that the score will be nice and leave you with high values.

In the new scoring system, you can consult the entire pending schedule and a single digital environment: the Serasa website.

The new Serasa Score 2.0 system uses the following information to generate your score:

- Behavior and history of queries for service and credit: 19.3% of relevance;

- History of credit contracts: 7.9%;

- Default history: 13.7%;

- Payment of credit installments: 43.6%;

- Debt payments: 5.5;

- Length of relationship with credit operators: 10.1%.

Note that each of these topics has a different influence on building your final score.

How to use Serasa Score 2.0?

We have already seen that in general, the main objective of Serasa Score 2.0 is to show companies whether you have good financial behavior or not.

Therefore, you will use the score mainly when hiring a credit service, such as loans, financing, card applications, among others.

But what guarantees you that your score is good enough to be able to perform this type of operation above? In general, Serasa itself offers an overall ranking of good and bad scores.

Below, we will explain how this classification works and what is its impact on the use of the score. Check it out:

Low risk of default

People who score in the range between 701 and 1000 are unlikely to be excluded from any credit opportunity, as they have good financial behavior. That is, the credit provider company can trust this consumer more.

Medium risk of default

In the range between 301 and 700, it is also not so bad and usually releases a good amount of credit-related services. However, the analysis of this consumer is usually a little more rigorous due to its score.

High risk of default

Finally, in the range between 0 and 300, regardless of what happened to the score in this red zone, the opportunities for consumers with this score range are usually very scarce. I don't even need to explain why, do I? In that case you must acquire new financial habits to increase that score.

How to consult your Serasa 2.0?

If you are determined to improve your image and clear your name in the market, the first step is to consult the score. This is also a tip for anyone planning to hire a credit operation, check it out beforehand to make sure everything is ok.

Follow the step by step below to consult the Serasa Score 2.0:

- Step 1: Enter the Serasa website to make the first consultation;

- Step 2: Log in with your personal information. If it is the first access, it will be necessary to register. To do this, just enter all your personal information that the system requests;

- Step 3: All ok! Your Serasa Score 2.0 score will appear on the screen.

Always try to maintain good financial behavior and understand what needs to be done to improve it, as this will make your financial life much easier.

Therefore, every time you seek financing or a loan for any purpose, Serasa Score 2.0 will be your strong point and not your point of concern.

Did you like it? Access our recommended content and see how to increase your score using Serasa Turbo.

How to increase the score with Serasa Turbo

Leave your ideal score with Serasa Turbo. Learn more by accessing our content!

About the author / Marina Poncio

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Havan Card or Neon Card: which is better?

Find out about credit options that appeal to different audiences. So, read this post choose between Havan card or Neon card.

Keep Reading

PIS: how to calculate?

Do you know how to calculate PIS? In today's article we will show you how to know the amount you will receive. Read it now and see how to calculate!

Keep Reading

5 loan options for commissioned servers

Discover in this post the best loan options for commissioned servants and learn how you can apply for yours!

Keep ReadingYou may also like

What is unemployment benefit?

If you are unemployed and have already used up unemployment benefits or have just been fired and need financial help, see how the unemployment benefit works. We will show you how you can apply for this benefit and receive at least €351.05 per month.

Keep Reading

How to calculate percentage quickly

In today's post we will teach you what percentage means. In addition, we will also show ways to calculate, check it out!

Keep Reading

Porto Seguro Card or Bradesco Card: which one is better?

Deciding on the best credit card is not always an easy task. That's because there are many options available on the market today. Therefore, observing the comparisons can be a good way. Interested? Come check!

Keep Reading