Cards

Dotz credit card: what is Dotz?

The Dotz brand is well known for its points programs for exchanging benefits and products. However, it also has a credit card, as we will see today.

Advertisement

dotz credit card

The Dotz credit card is an option that emerged from a partnership with Banco do Brasil. In this way, it allows BB customers to make purchases using debit and credit and also earn points.

The credit card works very similarly to other cards on the market. After all, it has a credit limit. It also allows debit and credit purchases, in installments or in cash, and generates points for purchases.

And that's not all! By joining the credit card you earn 5 to 10 thousand Dotz after payment of the first invoice. Thus, you earn points that can be converted into products or airline tickets.

How to apply for the Dotz card

The Dotz card in partnership with Banco do Brasil is a great option for domestic and international purchases. See more here!

Dotz Advantages

Discover the main advantages of this credit card:

- Access exclusive offers at partners;

- Online membership;

- Free annual fee for the first year;

- Visa International Flag;

- Earn 01 Dotz for every R$ 3 spent;

- Vai de Visa Program;

- Receive up to 10,000 gift points after joining the card.

Main features of Dotz

The card is characterized by having a connection with Banco do Brasil. Therefore, it turns to the customers of that banking institution. In addition, for allowing purchases in Brazil and abroad and for generating points. In the case of this card, it has its own points that bear the same name.

Who the card is for

Since it comes from a partnership between Dotz and Banco do Brasil, this card is aimed at BB customers and account holders, as the benefits are more interesting for customers from this partnership.

For account holders, there is no age limit or specific target audience! With it, you can shop anywhere in the world and accumulate points to exchange for benefits or products.

Discover the Dotz card

The Dotz credit card may be perfect for you. It is available to Banco do Brasil customers and allows purchases in Brazil and abroad.

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Live football on FIFA+: see how to watch the championships via streaming

Make the most of FIFA+ and get unforgettable benefits for customers who love football every day!

Keep Reading

Discover the Saraiva credit card

Find out in this article exactly all the advantages of the Saraiva credit card, an international product, with no annual fee and unique benefits.

Keep Reading

Is a negative online loan safe?

Do you want to know if an online negative loan is safe? In today's article, we're going to answer this and other questions. Check out!

Keep ReadingYou may also like

How to apply for the Meu Tudo Consignado loan

Here you will find all the tips on how to apply for the Meu Tudo payroll loan with an interest rate from 1.76% per month and up to 84 months to pay. Incidentally, the institution guarantees money in the account within 10 minutes of approval. Check out!

Keep Reading

Discover the Itaú account

Banco Itaú offers several account options for you to choose the one that best suits your profile. See key information here.

Keep Reading

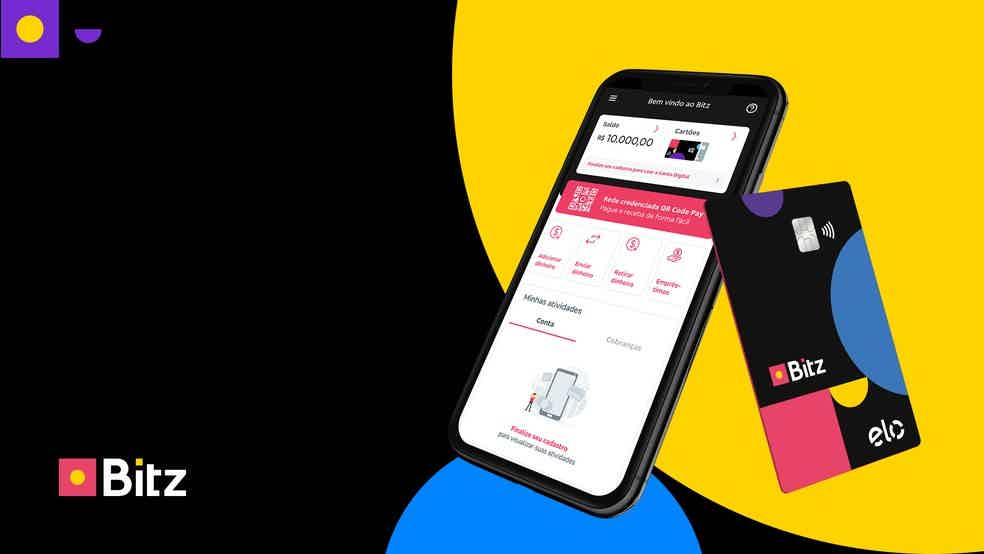

Discover the Bitz card

Currently more and more people are adhering to digital wallets. That's because they can be an alternative for those who don't like to use money. Therefore, in this post we will talk about the Bitz card. Come check!

Keep Reading