Cards

Discover the Dotz credit card

The Dotz credit card may be perfect for you. It is available to Banco do Brasil customers and allows purchases in Brazil and abroad. Know more.

Advertisement

dotz credit card

Do you know the Dotz credit card? It belongs to a partnership between the card points company and BB. With this, it brings facilities and benefits that call attention. Learn more about this alternative for purchases and payments today.

How to apply for the Dotz card

The Dotz card is a partnership between Banco do Brasil and Dotz to offer an exclusive product with several benefits. Check out!

How does the Dotz credit card work?

The credit card from the partnership between BB and Dotz works in the same way as other cards. That is, it allows purchases in cash and in installments, in debit and credit. In addition, it has the Visa International flag.

That alone gives access to millions of online and in-person establishments around the world. Therefore, this is a practical alternative that really finds great application power.

Likewise, the card also has its points programs. One belongs to Dotz itself while the other is from the brand, Visa. With this, you double your chances of accumulating points and exchanging them for products and discounts.

What is the Dotz credit card limit?

The limit of a card will always vary according to the client and his relationship with the financial institution. And this is no different in relation to Dotz, a card that also performs its own analyzes before granting.

For each situation there will be a limit. The better the score score before the Consumer or Positive Register, the greater the chances of having a good value as a limit. On the other hand, low scores tend to decrease these chances.

Still, the relationship with BB also causes influences. After all, this is the banking institution that grants the card in partnership with Dotz. Therefore, the better your relationship and the more complete your registration, the greater the chances of a high limit.

Transparency, in these cases, makes all the difference. In this case, anyone who is already a bank customer and a transparent relationship with the bank can get a higher limit value. Likewise, anyone who keeps up-to-date payment of all bank debts.

Is the Dotz credit card worth it?

This depends on the advantages and disadvantages that this card has. Equally, what you look for when looking for credit card services. So, check out some of the main negatives and positives of the Dotz card below.

1. Free annual fee for the first year

In the first year, there is no need to pay fees to maintain the services. That is, the annuity is free. However, from the 2nd year of use onwards, these fees will be charged. They are R$ 228 per year (12 installments of R$ 19)

2. Points programs

The BB card in partnership with Dotz offers 02 points programs. The customer has access to both the Dotz program, in which R$ 3 generate 01 point, and the brand's Vai de Visa.

3. Discounts and promotions

Customers find exclusive promotions and payment conditions with Dotz partners. With the card, then, it is possible to get offers with up to 70% off, as well as airfare promotions.

4. Earn points when migrating to this card

Also, this card offers between 5 and 10 thousand free points when you sign up for it. So don't miss it!

How to make a Dotz credit card?

To apply for the Dotz card, you must be a Banco do Brasil customer. Thus, you must first make sure that there is a link with the banking institution. If so, just follow the service channels for the request. If not, you must open the account and then ask for the card.

The application for the Dotz BB credit card occurs in several ways. First, it can take place in face-to-face agencies. Likewise, remotely, such as through the telephone service or, then, through the BB application.

For telephone service, just call one of these numbers, according to the place of origin of the call:

- 4004 0001: For capitals and the metropolitan area;

- 0800 724 0001: For other locations.

How to apply for the Dotz card

The Dotz card is a partnership between Banco do Brasil and Dotz to offer an exclusive product with several benefits. Check out!

About the author / Aline Augusto

Reviewed by / Junior Aguiar

Senior Editor

Trending Topics

Find out how to withdraw your retained FGTS

Are you wanting to withdraw your retained FGTS, but don't know how? Find out here how it is possible to carry out this process from different means!

Keep Reading

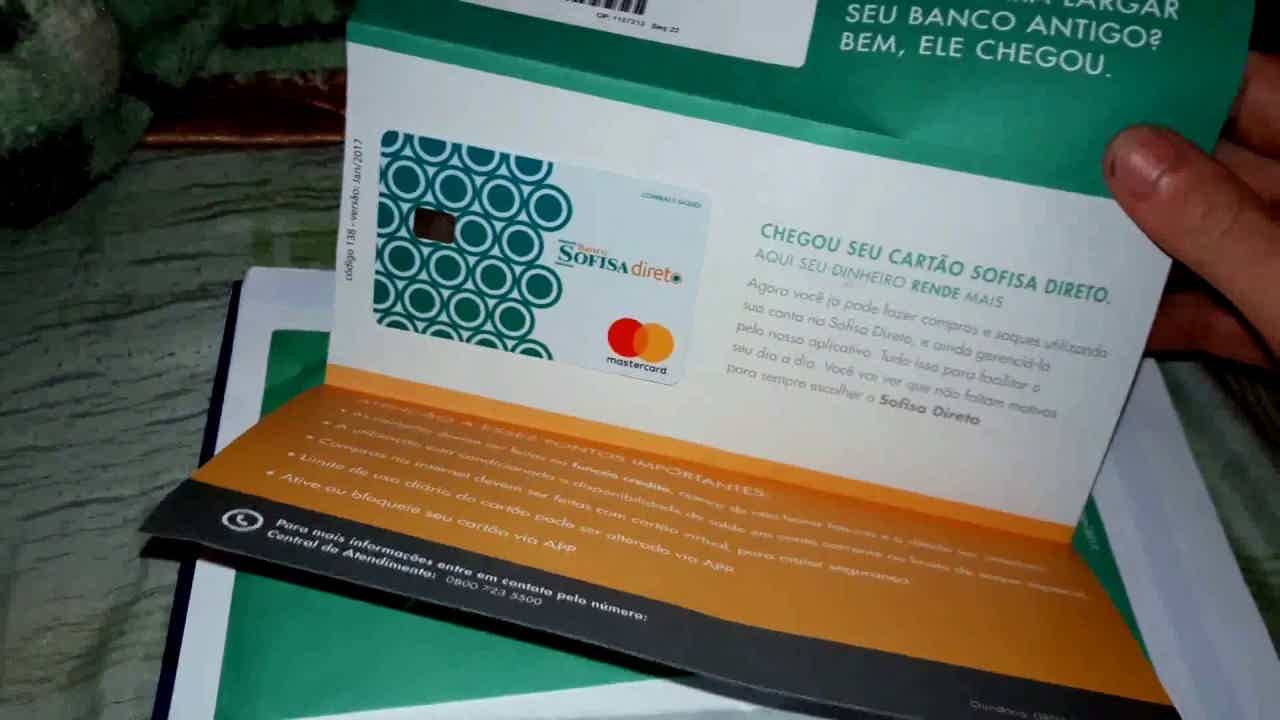

Sofisa credit card: what is Sofisa?

Get to know the Sofisa digital bank and the conditions and exclusive offers of the credit card with international coverage! Check out!

Keep Reading

FGTS 2022 birthday withdrawal: see if you can withdraw R$1 thousand reais

The FGTS birthday withdrawal benefit is granted to workers who opt for it. In this article, see how to request and receive. Read on!

Keep ReadingYou may also like

Discover the current account Abanca Currency Foreign

Do you need to send and receive money abroad in a currency other than the Euro? If so, check here how the Abanca Foreign Currency current account works and see if it is exactly what you are looking for.

Keep Reading

How to open a Novo Banco 26-31 current account

For those looking for a complete current account, with credits, investments, cards and much more, Novo Banco 26-31 may be an option. Check out, in the post below, how you can open yours.

Keep Reading

Pan Mastercard Gold credit card: how it works

Are you looking for a card that has a points and cashback program? With the Pan Mastercard Gold card you can enjoy these and many other advantages. Want to know this option better? So read this post and check it out!

Keep Reading